撰文:Duo Nine

编译:Saoirse,Foresight News

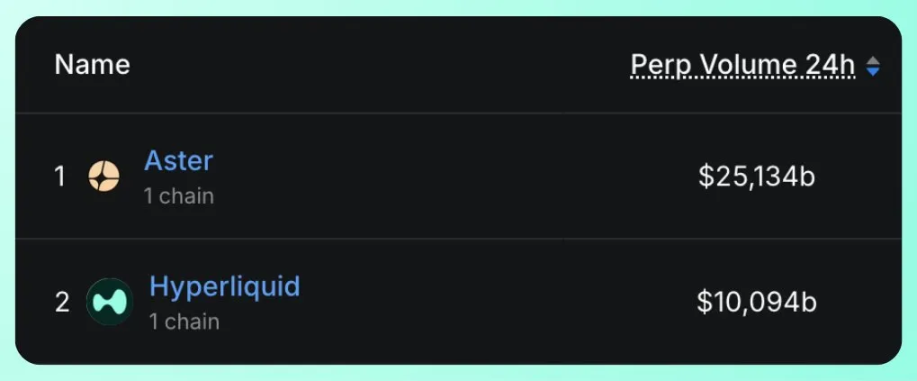

自 Aster 上线以来,HYPE 代币在短短五天内暴跌 27%。更糟糕的是,鉴于大规模 HYPE 代币解锁在即,其后续走势仍不被看好。

无巧不成书。

币安创始人赵长鹏(CZ)数月来一直推进 Aster 项目,且早已选定对 Hyperliquid 发起攻势的战略时机。本文将解析他为何选择此刻出手。

首先,让我们来看看此次事件造成的影响。正如图表所示,在 Aster 代币推出之前,Hyperliquid 的价格不断创下新高。但当赵长鹏发布关于 Aster 的推文后,这种上涨势头突然戛然而止。

结果如何?HYPE 代币在五天内下跌了 27%。

与此同时,Aster 的表现却截然相反。自从我在社群发布入场信号后,其价格直接翻了三倍。正如图表所示,我已落袋部分收益 —— 从 0.06 美元一路持仓至 2.1 美元,相当于短短五天就实现了 3 倍盈利。

正如上周日所提及的,数月来,Hyperliquid 一直是币安的「眼中钉」,对其构成了系统性威胁。Hyperliquid 的崛起速度过快,已对币安的市场地位造成了冲击。

赵长鹏刚出狱,便立即着手解决这个「问题」。他们的计划早在今年 6 月就已曝光,大家可以看看以下这条 X 平台帖子的发布时间。

显然,问题的关键不在于币安是否会采取行动,而在于何时行动。过去,他们曾试图通过清算 Hyperliquid 的协议金库来摧毁该平台,但以失败告终。于是,他们转而实施了 B 计划:推出 Aster。

为何选择现在动手?

赵长鹏在加密货币领域绝非新手,而时机的把握至关重要。此前,他仅凭一条推文就重创了 FTX,当时的时机选择堪称完美。此次 Aster 的推出同样并非偶然 —— 它恰好定在 Hyperliquid 大规模 HYPE 代币解锁前两个月。

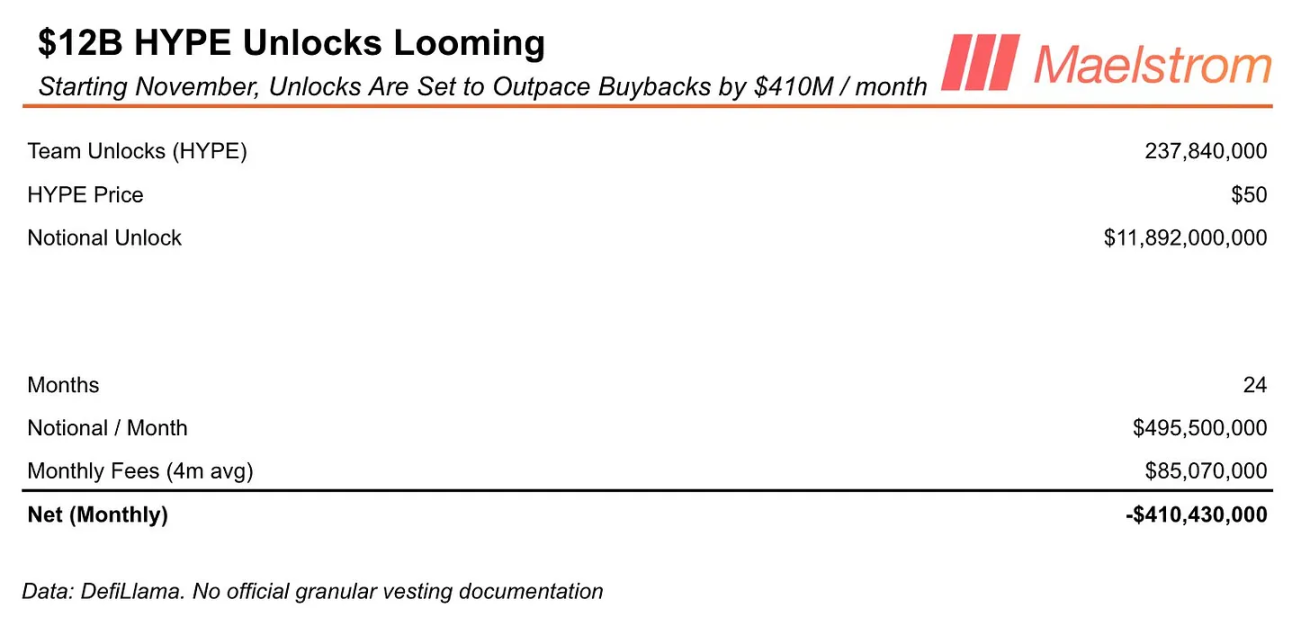

2025 年 11 月下旬,Hyperliquid 将开始在 24 个月内以线性方式解锁 2.378 亿枚 HYPE 代币。若按每枚代币 50 美元计算,这意味着团队解锁的代币总价值高达 119 亿美元,相当于每月将有近 5 亿美元的名义价值流入市场。目前,没有任何回购机制能够消化如此庞大的抛售压力。

上述数据由 Maelstrom 提供。Maelstrom 的负责人是 Arthur Hayes,而他同时也是 Ethena/ENA/USDe 项目的重要参与者 —— 币安正是该项目的关键合作伙伴。

巧合的是,Arthur 本周抛售了自己持有的 HYPE 代币,并且对此事直言不讳。他解释称,受上述解锁计划影响,HYPE 代币价格很可能会崩盘。与此同时,Aster 的价格却在持续上涨。

这真的是巧合吗?不太可能。

赵长鹏(CZ)、币安及其关联方眼下的操作,本质是在利用 HYPE 当前的弱势局面。即便 Hyperliquid 团队选择暂不出售已归属的代币,赵长鹏也根本不在意这一点。

他要做的,不过是营造出「HYPE 实力疲软」的假象,同时推出一个更具吸引力的替代选择 —— 通过将 Aster 价格推至新高来稳住散户情绪。凭借对 Aster 代币供应的严密把控,再加上雄厚的资金储备(数十亿美金),截至目前,他的这一策略执行得相当成功。

拿下这一局后,市场势头已明显向 Aster 倾斜。现在的问题是,这种势头能否站稳脚跟并持续下去?有赵长鹏(CZ)及其关联方在背后支撑,答案大概率是肯定的。

综合上述情况来看,Hyperliquid 未来数月很难实现市场主导 —— 尤其需要注意的是,Aster 并非唯一一家试图蚕食其市场份额的交易所。另一个强劲对手是 Lighter。

Lighter 对散户实行零手续费政策,而 Aster 背后则站着币安系的行业巨头。无论从哪方面看,这都足以说明 Hyperliquid 已跻身行业顶级赛道 —— 毕竟它现在的竞争对手,都是业内最顶尖的玩家。眼下处境虽艰难,但也为日后反弹冲高埋下了契机。

Hyperliquid 的出现同样并非偶然,在某种程度上,它是 FTX 崩盘后的直接产物 —— 为用户提供了中心化交易所以外的另一种选择。从这个角度而言,赵长鹏当年摧毁 FTX 的行为,间接催生了 Hyperliquid 的诞生。这无疑形成了一个颇具戏剧性的循环。

在加密货币领域,只要有平台能提供更优质的服务,市场流动性和用户关注度就会在瞬间转移。Hyperliquid 目前正因此遭受冲击,但到 2026 年,当这场去中心化交易所(DEX)市场份额之争平息后,我相信 HYPE 代币将重新占据主导地位。除非发生黑天鹅事件,否则它的发展轨迹不太可能大幅偏离。

HYPE 虽不是 FTX(加密交易所破产事件)、Luna(算法稳定币崩盘项目)那样的暴雷级项目,但存在「反身性循环」(价格与市场行为相互影响的闭环),循环逻辑如下:

HYPE 价格下跌 → 未来空投价值缩水 → 交易者在 Hyperliquid(HL,推测是发行 $HYPE 的平台 )交易动力下降 → 交易者撤离、抽离资金 → 未平仓合约(OI)和交易量减少,用于回购的手续费随之降低 → $HYPE 价格进一步下跌。

如果未来几个月 HYPE 代币持续表现不佳,那将是大举买入、建仓持仓的绝佳机会。HYPE 代币过去曾经历过一次大幅回调(跌幅达 72%),此次或许会重现类似行情,为投资者提供理想的入场时机。

无论如何,加密货币市场始终充满机遇与意外转折,短期内实现资金翻倍、三倍甚至十倍增长的情况并非个例 —— 就像此次 Aster 的表现一样。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。