The original text is from Odaily Planet Daily Azuma

Arthur Hayes, known as "Little Black Brother," may not be trustworthy in his calls, but his actual operations are truly worth learning from for retail traders.

As one of the most well-known market prophets in the industry, although Arthur Hayes is always bullish in the long run, he is ruthless when it comes to selling or wanting to sell, even disregarding the reputation of industry bigwigs, simultaneously pumping and dumping — see "When Arthur Hayes suddenly pumps the coin you bought, you should be cautious."

Hasu, the strategic director of Flashbots, once commented on Arthur Hayes, saying: “If you got any long-term signals from Arthur Hayes, I really don’t know what to say to you. He is one of the purest traders in this market.”

HYPE — “Although I see 126 times, I’m fine with 15%”

The recent Hyperliquid (HYPE) is a perfect example.

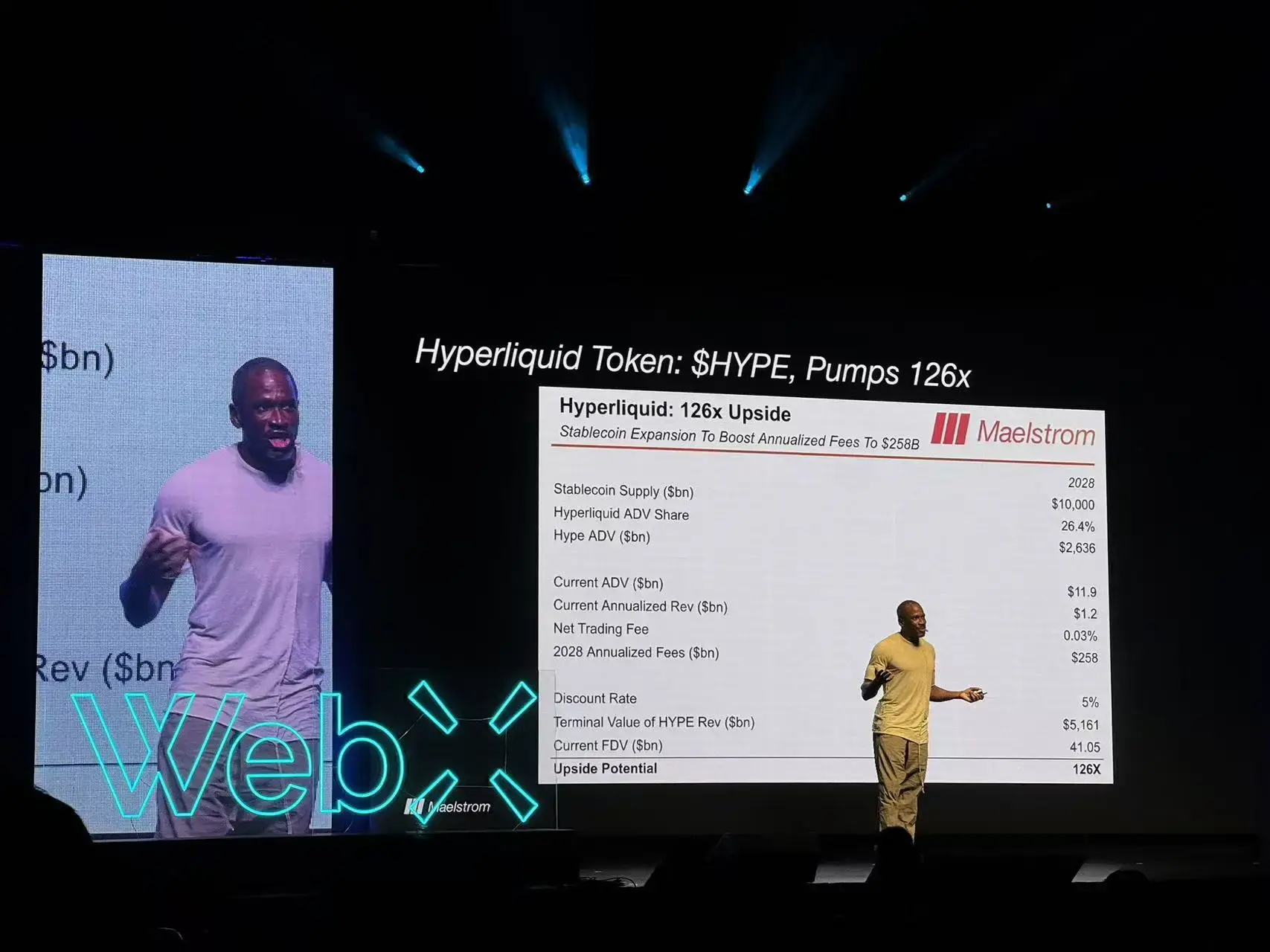

On August 25, Arthur Hayes gave a speech at Japan's WebX, pumping HYPE, claiming the token still had a potential increase of up to 126 times — by the end of that day, HYPE's price was about $45.9.

Who would have thought that less than a month later, on the day after HYPE set a strong historical high (September 21), Arthur Hayes sold off 96,600 HYPE, cashing out about $5.1 million — the average selling price was about $52.8, only a 15% increase from the price when Arthur Hayes called for a 126 times expectation…

Afterwards, Arthur Hayes's family investment office, Maelstrom, released the logic behind the HYPE sell-off: HYPE is about to face its real test. Starting from November 29, 2025, 237.8 million HYPE tokens will begin to unlock linearly over 24 months. At a price of $50 per token, this amounts to $11.9 billion in team unlocks, with nearly $500 million worth of tokens entering the market each month. Analysis indicates that the current buyback capacity can only absorb about 17% of the unlocked tokens, leaving about $410 million/month in excess token supply. The token unlock is a potential "sword of Damocles."

Arthur Hayes jokingly stated, “The dump is to pay the deposit for the luxury car Rari 849 Testarossa,” and “126 times is still possible, but 2028 is still far away”…

It’s hard not to be shocked by Arthur Hayes's thick skin, but it’s also hard not to agree with his timing in escaping the peak.

On the day Arthur Hayes sold, not only had HYPE just set a historical high, but the popularity of the Perp DEX track was also continuously rising, becoming the main narrative of the industry at this stage. However, since Arthur Hayes's sell-off, HYPE has rapidly declined along with the overall market weakness, currently reported at $44.18, even lower than the price when Arthur Hayes called for a 126 times expectation.

ETHFI — “This is true value capture, oh how did it suddenly go on Upbit…”

Similar examples are not limited to the recent HYPE.

Just two days before Arthur Hayes sold HYPE, he also engaged in a similar operation with ether.fi (ETHFI).

Around 3:00 PM on September 18, Arthur Hayes was enthusiastically interacting with his investment project ether.fi, praising its economic model for allowing value to flow back to ETHFI holders.

Around 11:00 AM on September 19, the South Korean exchange Upbit suddenly announced the listing of ETHFI, which surged to a high of $1.695 that day, setting a new high for nearly six months. Arthur Hayes showed no hesitation, immediately turning around to dump, selling 1.216 million ETHFI worth about $1.89 million that day.

Afterwards, ETHFI's price fell back to around $1.2 as the market declined, and Arthur Hayes successfully escaped the peak again.

ENA — A classic case, let’s look at it again

When it comes to Arthur Hayes's classic peak escape case, ENA is definitely worth mentioning.

Around December last year, ENA had just completed its first round of washing after going live, with the price back above $1, showing signs of continuing to rise after the wash. At that time, Arthur Hayes claimed ENA was likely to break through $10. However, while pumping, Arthur Hayes was quickly selling through exchanges like Binance and Bybit.

Later, everyone became familiar with ENA, after Arthur Hayes's dump, ENA's trend weakened rapidly, dropping to a low of $0.22, while Arthur Hayes began to calmly rebuild his position at the bottom, potentially pocketing tens of millions of dollars with his entry and exit.

Recently, perhaps having rebuilt a sufficiently substantial ENA position, Arthur Hayes has started to frequently pump ENA again — if there are any market fluctuations, please be cautious.

Little Black has also missed before: after dumping ETH, he had to buy back

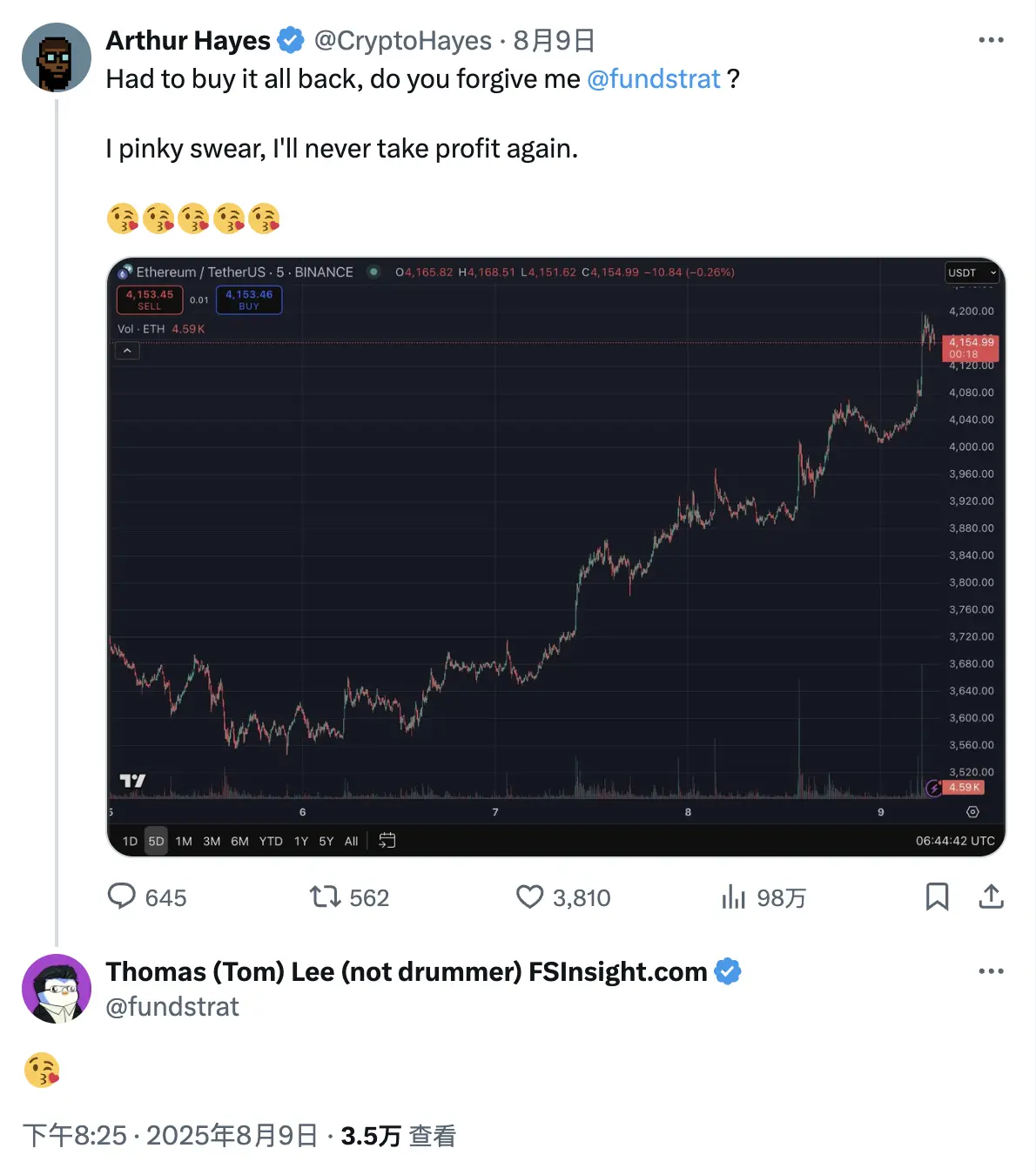

Although Arthur Hayes's peak escape record is excellent, it seems limited to the altcoin market where he has more influence; in the case of ETH, Arthur Hayes has had multiple failures this year.

During this round of ETH's strong surge, Arthur Hayes attempted to escape the peak several times but was ultimately "conquered by the rise" and was forced to raise prices to buy back his entire position.

When discussing his buyback operation, Arthur Hayes even swore, “I will never take profits again”… but given his innate trader nature, few people really believe what he says.

Recent movements, selling ONDO

This morning, Arthur Hayes had new operational moves — last night, his address received 26.28 million ONDO (worth about $24.7 million) from the Ondo project party address, which has since been transferred in batches to Coinbase, Bybit, Binance, and OKX, suspected to be in the process of selling.

Considering ONDO's current price position, while it may not be at a peak, it is also at a relatively high level. Combined with Arthur Hayes's past operational cases, ONDO holders may need to pay closer attention to price movements.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。