撰文:David,深潮 TechFlow

最近,在 Perp DEX 的热潮中,各路新项目如雨后春笋般冒出来,不断挑战着 Hyperliquid 的老大哥地位。

大家的目光都集中在新玩家的创新上,以至于似乎忽略了 $HYPE 这个龙头代币的价格会如何变化。而和代币价格变化最直接相关的,则是 $HYPE 的供应量。

影响供应量的,一是持续的回购,等于不断地在存量市场上买买买来减少流通,减少水池里的水;而另一个则是整体供应机制的调整,等于关掉水龙头。

仔细看 $HYPE 当前的供应量设计,其实是有问题的:

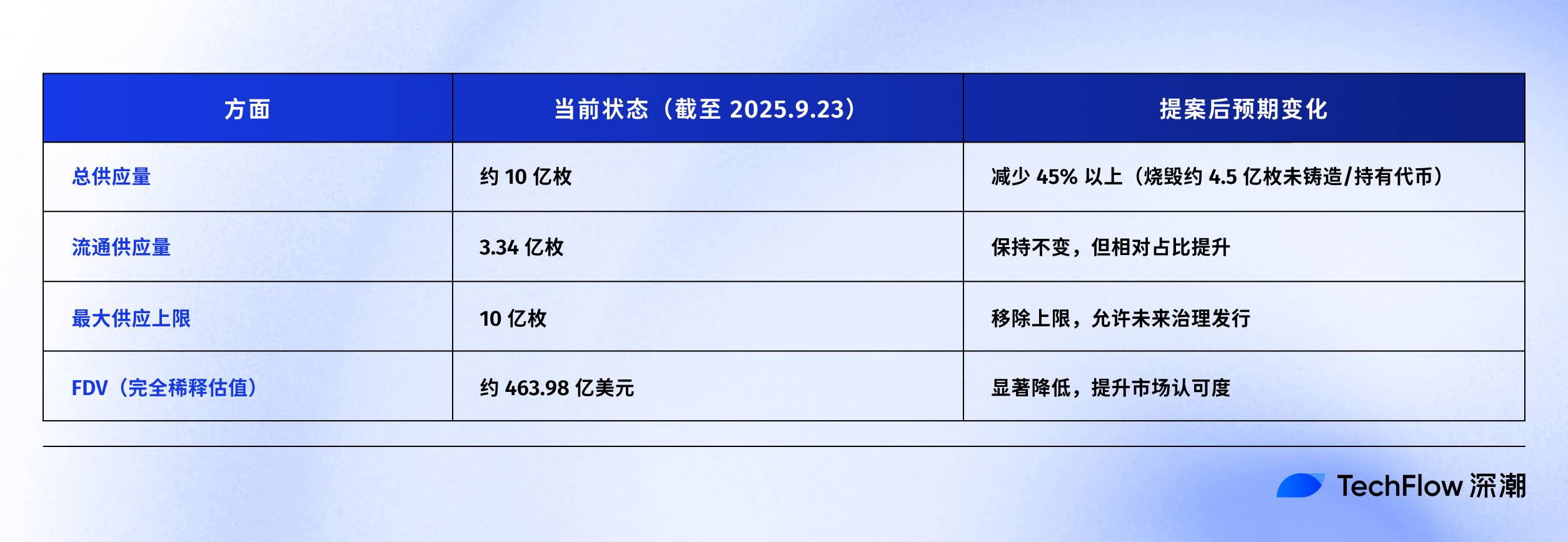

流通供应量约3.39亿枚,市值154亿美元左右;但总供应量接近10亿枚,FDV高达460亿美元。

MC和FDV这将近三倍的差距主要来自两部分。一部分是4.21亿枚分配给“未来排放与社区奖励”(FECR),以及3126万枚在援助基金(AF)手里。

援助基金是Hyperliquid用协议收入回购HYPE的账户,每天买入但不销毁,而是持有。问题在于,投资者看到460亿的FDV往往还是会觉得估值过高,即使实际流通的只有三分之一。

在这个背景下,投资经理 Jon Charbonneau(DBA Asset Management,持有大量HYPE仓位)和独立研究员Hasu在9月22日发布了一份关于$HYPE 的非官方提案,内容十分激进;省流版本是:

烧掉目前 $HYPE 总供应量的45%,让FDV更接近实际流通价值。

这个提案发出后迅速引爆社区讨论,截至发稿时该帖子已有41万浏览量。

为什么反响这么大?如果提案真的被采纳,那么烧掉45%的 HYPE 供应量,意味着 HYPE 每个代币代表的价值几乎翻倍。更低的FDV也可能吸引之前观望的投资者入场。

我们也快速总结了这份提案的原贴内容,将其整理如下。

减少 FDV, 让 HYPE 看起来不那么贵

Jon和Hasu的提案看起来简单,烧掉45%的供应量,但实际操作却比较复杂。

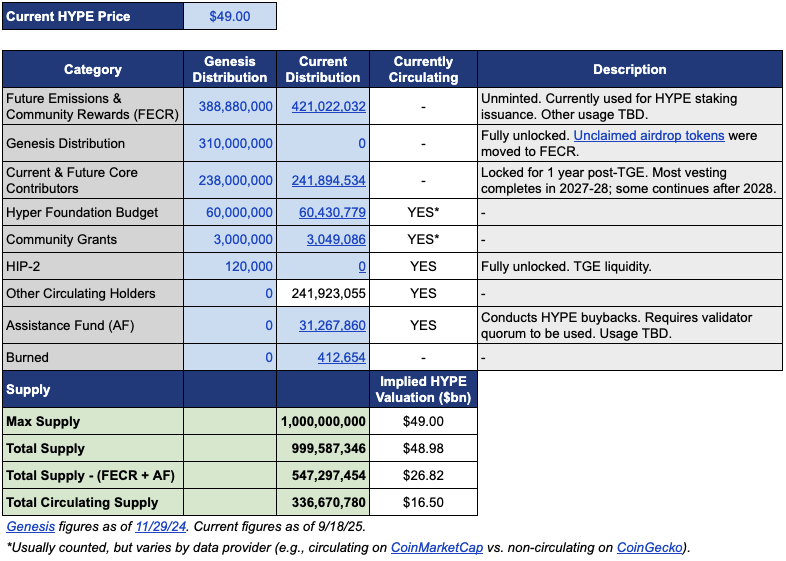

要理解这个提案,先得看清HYPE当前的供应结构。根据Jon提供的数据表,在49美元(他们提案时的HYPE价格)的价格下,HYPE总共10亿枚的盘子里,实际流通的只有3.37亿枚,对应165亿美元市值。

但剩下的6.6亿枚去哪了?

最大的两块是:4.21亿枚被分配给"未来排放与社区奖励"(FECR),相当于一个巨大的储备池,但没人知道什么时候、怎么用;另外3126万枚在援助基金(AF)手里,这个基金每天买入HYPE但不卖出,就这么囤着。

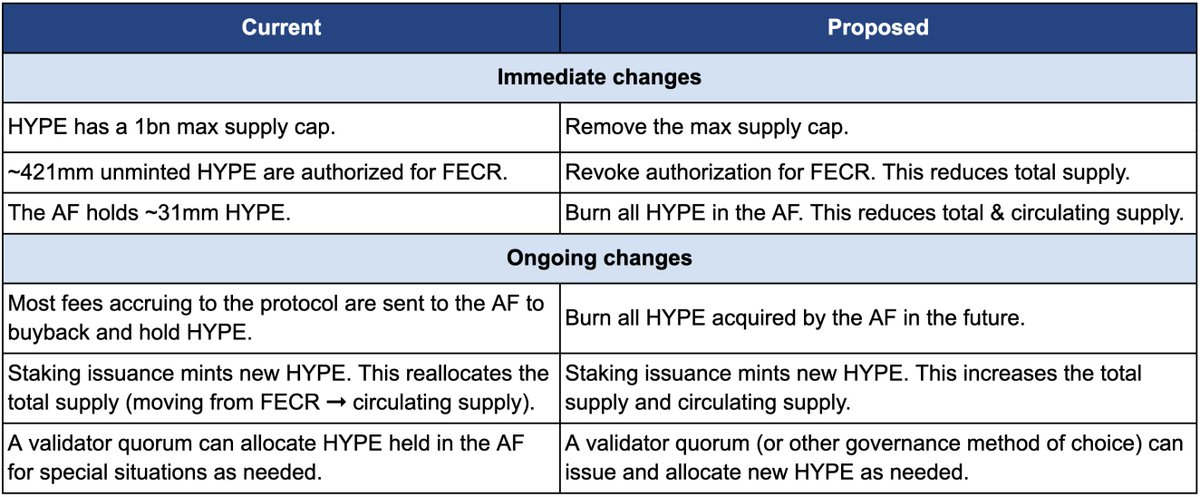

先说怎么烧。提案包含三个核心动作:

第一,撤销FECR(未来排放与社区奖励)的4.21亿枚授权。这些代币原本计划用于未来的质押奖励和社区激励,但一直没有明确的发行时间表。Jon认为,与其让这些代币像达摩克利斯之剑一样悬在市场头上,不如直接撤销授权。需要的时候,可以通过治理投票重新批准发行。

第二,销毁援助基金(AF)持有的3126万枚HYPE,并且未来AF买入的所有HYPE也直接销毁。目前AF每天用协议收入(主要是交易手续费的99%)回购HYPE,日均买入量约100万美元。按Jon的方案,这些买入的代币不再持有,而是立即烧掉。

第三,移除10亿枚的供应上限。这听起来反直觉,既然要减少供应,为什么还要取消上限?

Jon解释说,固定上限是比特币2100万枚模式的遗留,对大多数项目来说没有实际意义。取消上限后,未来如果需要发行新币(比如质押奖励),可以通过治理决定具体数量,而不是从预留的池子里分配。

下面这张对比表清晰展示了提案前后的变化:左边是现状,右边是提案后的情况。

为什么要这么激进?Jon和Hasu给出的核心理由是:HYPE 的代币供应设计是一个会计问题,不是经济问题。

问题出在 CoinmarketCap 等各大数据平台的计算方式上。

已烧毁的代币、FECR储备、AF持有量,在计算FDV、总供应和流通供应时,各平台的处理完全不同。比如CoinMarketCap 始终用10亿最大供应量算FDV,即使代币被烧毁也不调整。

结果就是,无论HYPE怎么回购、怎么烧毁,显示的FDV都降不下来。

可以看到,提案最大的变化是FECR的4.21亿枚和AF的3100万枚都会消失,同时10亿的硬顶也会取消,改为根据需要通过治理发行。

Jon在提案中写道:“许多投资者,包括一些最大、最成熟的基金,都只看表面的FDV数字。”460亿美元的FDV,让HYPE看起来比以太坊还贵,谁还敢买?

不过,大多数提案都有屁股决定脑袋的意味。Jon明确说明,他管理的DBA基金持有"material position"(重大仓位)的HYPE,他个人也持有,如果有投票,他们都会投赞成票。

提案最后强调,这些改变不会影响现有持有者的相对份额,不会影响Hyperliquid资助项目的能力,也不改变决策机制。用Jon的话说,

“这只是让账本更诚实。”

当“分配给社区”成为一种潜规则

但这个提案社区会买账吗?原贴评论区已经炸开了锅。

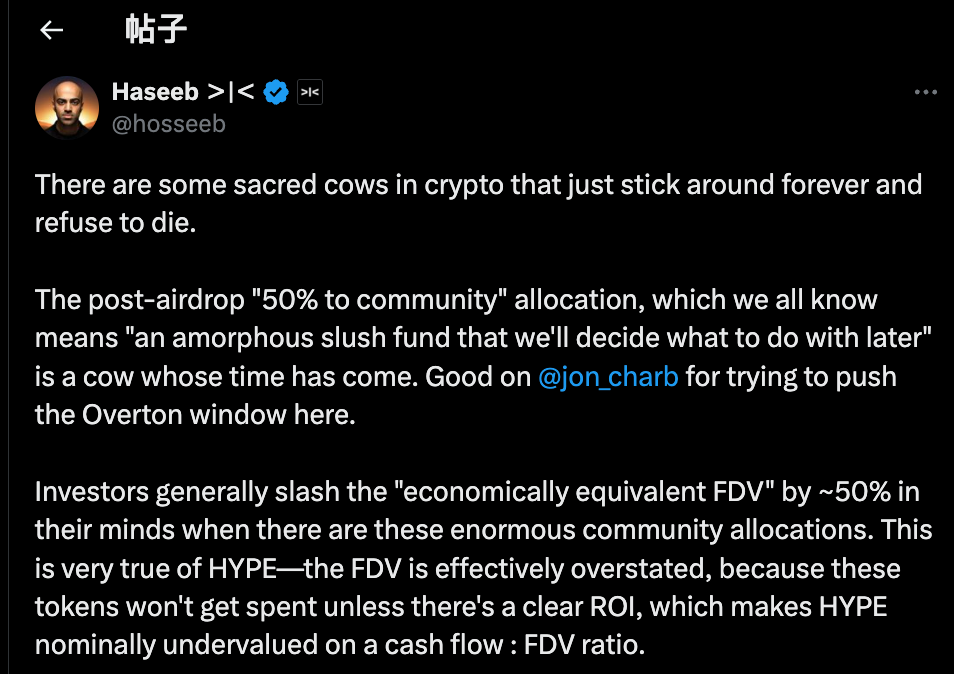

其中,Dragonfly Capital 合伙人 Haseeb Qureshi 的评论,把这个提案放到了更大的行业普遍现象里:

“加密行业有些'神圣奶牛'(sacred cows) 就是死不了,是时候宰掉了。”

他指的是整个加密行业的一个潜规则: 项目方在代币生成后,总要预留所谓 40-50% 的代币份额给“社区”。这听起来很去中心化很Web3,但实际上是一种表演艺术。

2021年时正值牛市巅峰,每个项目都在比谁更“去中心化”。于是代币经济里写到社区分配50%、60%甚至70%,数字越大越政治正确。

但这些代币到底怎么用?没人说得清。

从更大的恶意出发,某些项目方在分配给社区的代币这一块,更现实的情况是想什么时候用就什么时候用,想怎么用就怎么用,美其名曰“为了社区”。

问题是,市场不傻。

Haseeb 也透露了一个公开的秘密,专业投资者在评估项目时,会对这些“社区储备”自动打五折。

一个FDV 500亿但有50%“社区分配”的项目,在他们眼里实际估值只有250亿。除非有明确的ROI,否则这些代币就是画饼。

这也正是HYPE面临的问题。HYPE 490亿的FDV中,超过40%是“未来排放与社区奖励”的储备。投资者看到这个数字就望而却步。

不是因为HYPE不好,而是因为账面数字太虚。Haseeb 认为,Jon的提案是有推动作用的,把原本不能公开讨论的激进想法逐步变成可以接受的主流观点;我们需要质疑把代币分配给“社区储备”这个加密行业的惯例。

总结一下,支持者的观点很简单:

要用代币就走治理,说清楚为什么要发、发多少、预期回报是什么。透明、可问责,而不是一个黑箱。

同时,因为这个帖子由于过于激进,评论区也有一些反对声音。我们总结了一下大概可以分成三个部分:

第一,有些HYPE必须拿来当做风险储备。

从风险管理的角度出发,一些人认为 援助基金AF 里的3100万HYPE不只是库存,更是应急资金。如果遇到监管罚款或黑客攻击需要赔偿怎么办?烧掉所有储备,等于失去了危机时的缓冲。

第二,HYPE 在技术上已经有完备的销毁机制。

Hyperliquid已经有三个自然的销毁机制:现货交易费销毁、HyperEVM gas费销毁、代币拍卖费销毁。

这些机制根据平台使用情况自动调节供应,为什么要人为干预?基于使用的销毁比一次性销毁更健康。

第三,大额销毁不利于激励。

未来排放是Hyperliquid最重要的增长工具,用来激励用户、奖励贡献者。烧掉就等于自断手脚。而且大额质押者会被锁定。如果没有新的代币奖励,谁还愿意质押?

代币服务于谁?

表面上看,这是一场关于烧不烧币的技术讨论。但如果仔细分析各方立场,会发现分歧其实是屁股问题。

Jon和Haseeb代表的观点很明确:机构投资者是增量资金的主要来源。

这些基金管理着数十亿美元,他们的买入能真正推动价格。但问题是,他们看到490亿的FDV就不敢进场。所以要修正这个数字,让HYPE对机构更有吸引力。

社区的看法完全不同。在他们眼里,每天在平台上开仓平仓的散户交易者才是根基。Hyperliquid 能有今天,靠的不是VC的钱,而是9.4万个空投用户的支持。为了迎合机构而改变经济模型,是本末倒置。

这个分歧不是第一次出现了。

回看DeFi历史,几乎每个成功项目都经历过类似的十字路口。Uniswap发币时,社区和投资人为了金库控制权吵得不可开交。

每次的核心其实都一样:一个链上的项目到底是为大资金服务,还是为草根加密原住民服务?

这个提案看起来是服务前者的,“许多最大、最成熟的基金只看FDV。”言下之意很清楚,要让这些大钱进来,就得按他们的规则玩。

提案者 Jon 自己就是机构投资者,他的DBA基金持有大量HYPE。如果提案通过,受益最大的恰恰是他这样的大户。供应量减少,币价可能上涨,持仓价值水涨船高。

结合前几天 Arthur Hayes 刚卖了80万美元的 HYPE 戏称去买法拉利,能感受到一种时机上的微妙。最早的支持者都在套现,而现在有人提案又要烧币推高价格,到底是在给谁抬轿子?

截至发稿,Hyperliquid官方还未表态。但不管最终决定如何,这场辩论已经撕开了大家不愿面对的真相:

利字当头,我们可能从来就没那么在乎去中心化,只是在假装而已。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。