原文作者:Dylan Bane,Messari 分析师

原文编译:深潮 TechFlow

预测市场的应用已超越选举领域,展现了市场契合度(PMF)。

投注量正在激增,投资者蜂拥而至,从信息永续合约(information perps)到 Telegram 机器人等新方法正在进入市场。

那么,究竟哪些方法能够真正奏效,并最大化交易量的增长呢?

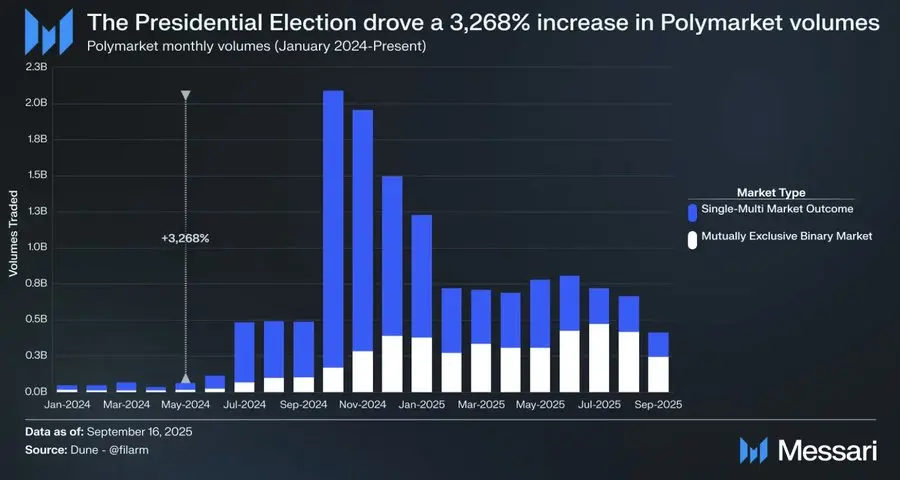

2024 年选举使得 Polymarket 的交易量从 5 月的 6200 万美元飙升至 10 月的 21 亿美元,增长了 3268%。

主流媒体如 CNN 和 Bloomberg 在直播中引用了 Polymarket 的赔率,与传统民意调查数据一同呈现。

事实上,预测市场最终在预测选举结果方面打败了民意调查。

选举结束后,预测市场的交易量虽有所下降,但仍稳定在每月超过 10 亿美元的水平。

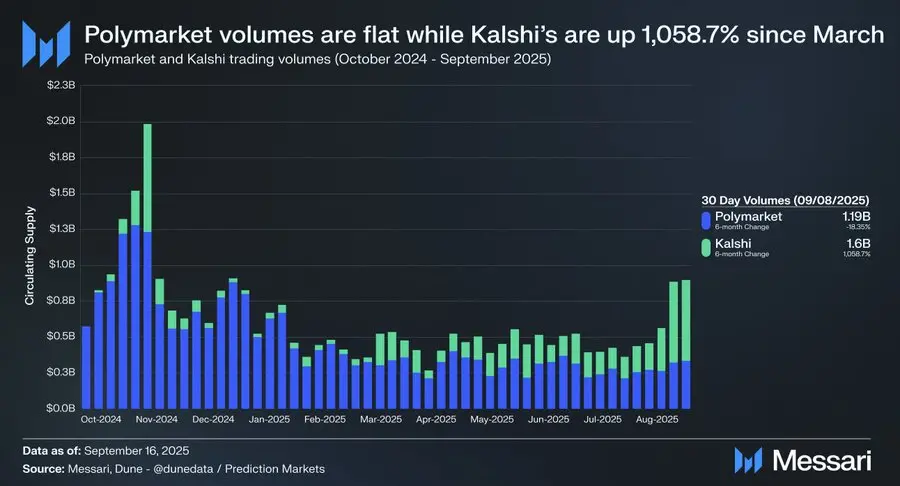

结合 Kalshi 最近交易量的激增,投资者认为预测市场已经验证了需求,并为进一步增长做好了准备。

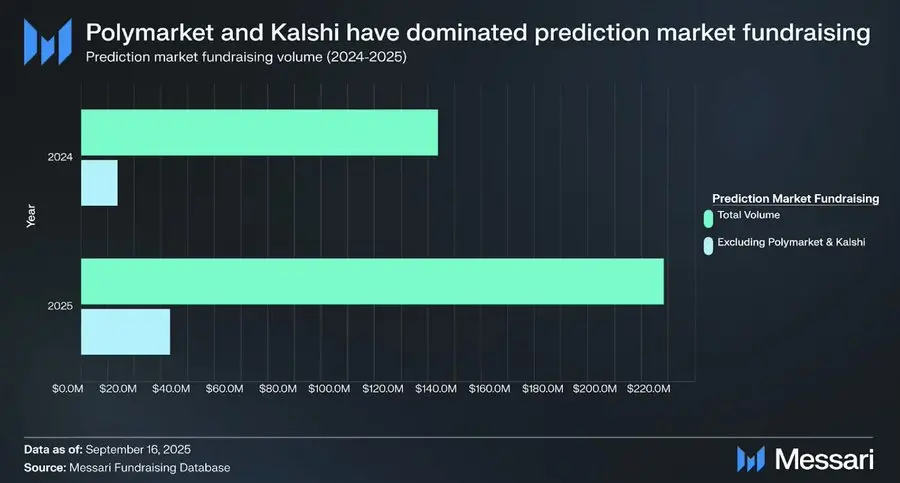

约 90% 的资金集中在 Polymarket 和 Kalshi 两个平台,估值已接近十位数(即数十亿美元)。

这些行业领先者已经建立了流动性,现在正专注于扩大交易量和增强市场防御能力,因为像 Hyperliquid 和 Coinbase 这样的大型交易所正在关注这一领域。

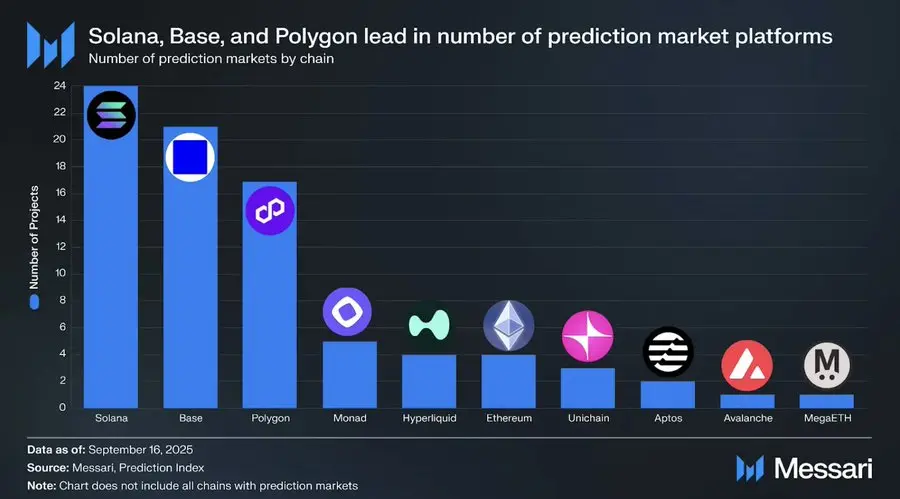

然而,预测市场项目数量超过 100 个,且还在不断增加,其中蕴藏着大量机会。

问题在于,投资者应该如何在这个日益复杂和嘈杂的领域中寻找最佳机会?

我们认为,解决流动性问题和增加交易量的最佳方法是吸引散户投机者。

预测市场可以通过关注可访问性、趣味性、用户体验和高潜在财务收益来吸引这一细分市场。

信息永续合约的持续流动

由于永续合约不断波动,它们克服了二元结果市场(binary outcome markets)中因结算速度慢而阻碍投机者的问题。

此类永续合约还可以追踪有趣且易于理解的主题,而这些主题目前尚无现有市场。

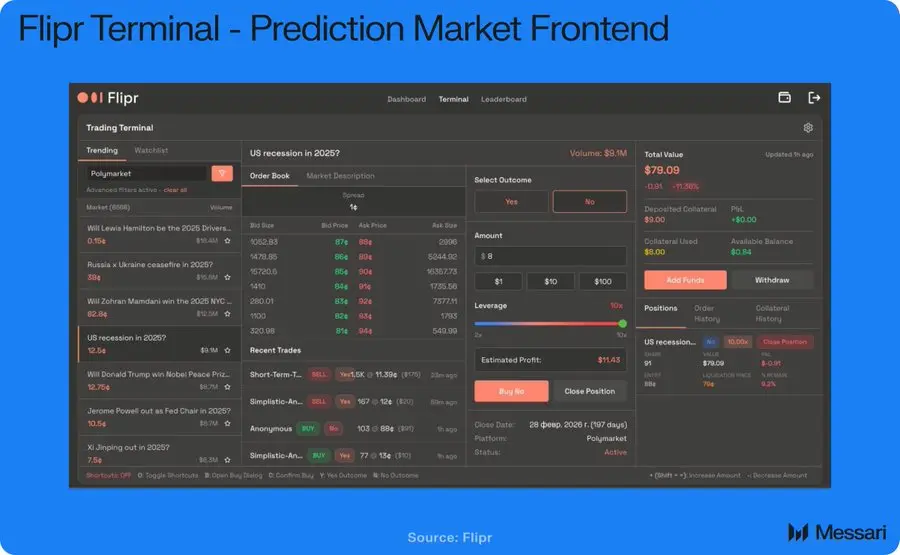

前端平台

与其构建原生流动性,初创公司可以从现有行业领导者处获取供应,并为用户提供更高质量的交易体验。

例如,Flipr 提供一个交易终端、X 平台上的交易机器人,以及利用现有流动性实现高达 10 倍杠杆。

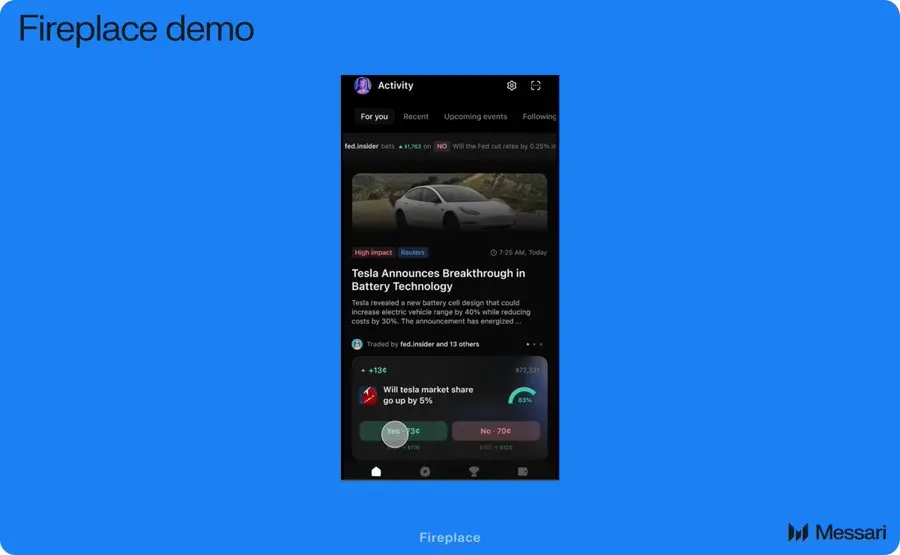

社交应用

游戏化的应用或社交体验可以让预测变得更加有趣。

就像体育博彩本质上是一种社交体验一样,预测市场也可以培养类似的互动体验。

在预测市场采用的早期阶段,设计空间非常广阔。

篮子交易、管理型指数、名人跟单交易、复式投注(parlays)以及更多创新形式都值得探索。

推荐阅读:

DeFi 标志性符号 MKR 与 DAI 正式落幕,SKY 如何重新承载市场期望?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。