撰文:arndxt

编译:Luffy,Foresight News

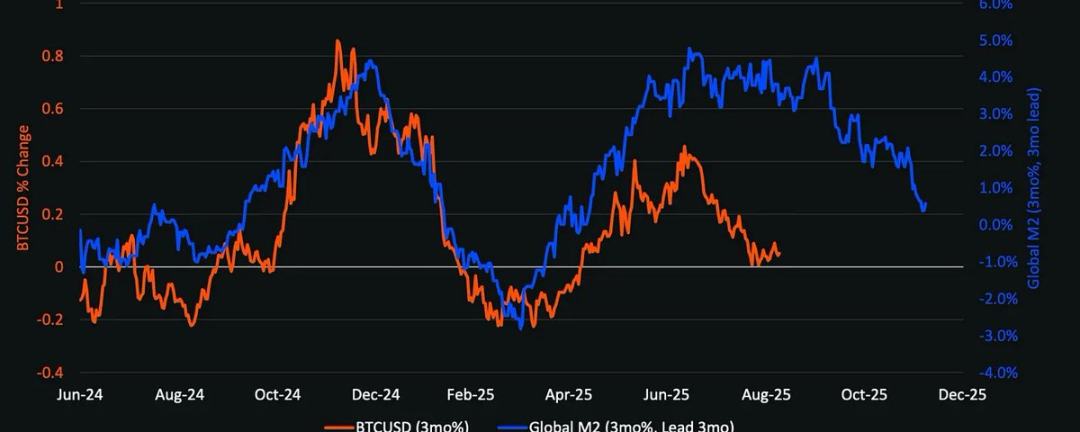

全球 M2 与比特币价格图表

最关键的结构性结论是:加密货币不会与宏观经济脱钩。流动性轮换的时机与规模、美联储的利率轨迹以及机构采用模式,将决定加密周期的演变路径。

与 2021 年不同,即将到来的山寨币季节(如果有)将会更加缓慢、更具选择性并且更加注重机构。

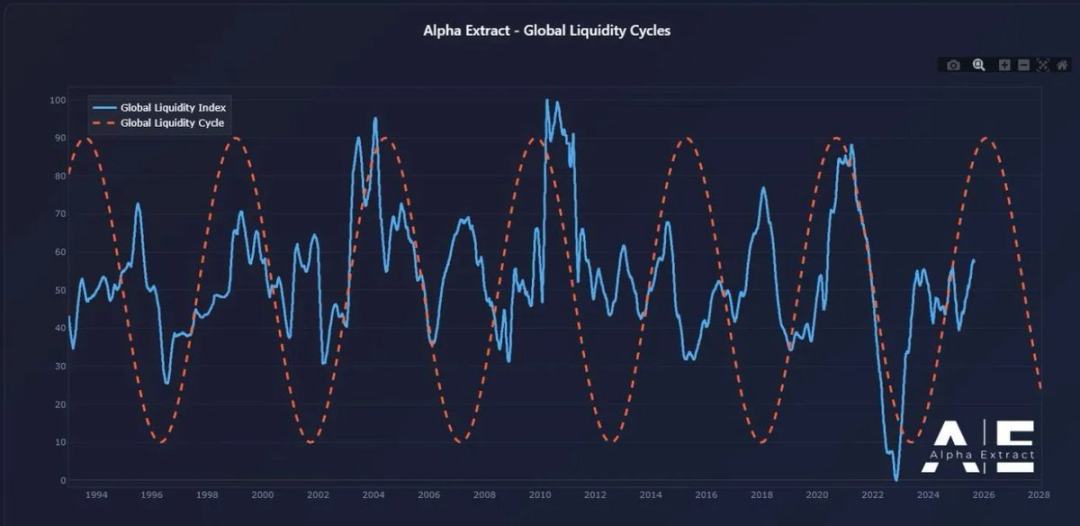

如果美联储通过降息和债券发行释放流动性,同时机构采用率持续提升,2026 年可能成为自 1999-2000 年以来最重大的风险资产周期。加密货币有望从中受益,但其表现将更具规范性,而非呈现爆发式增长。

美联储政策分化与市场流动性

1999 年,美联储加息 175 个基点,而股市却一路上涨至 2000 年的峰值。如今,远期市场的预期则截然相反:预计到 2026 年底将降息 150 个基点。若该预期兑现,市场将进入流动性增加而非收紧的环境。从风险偏好角度看,2026 年的市场背景可能与 1999-2000 年相似,但利率走势完全相反。若果真如此,2026 年或许会成为 「更猛烈的 1999-2000 年」。

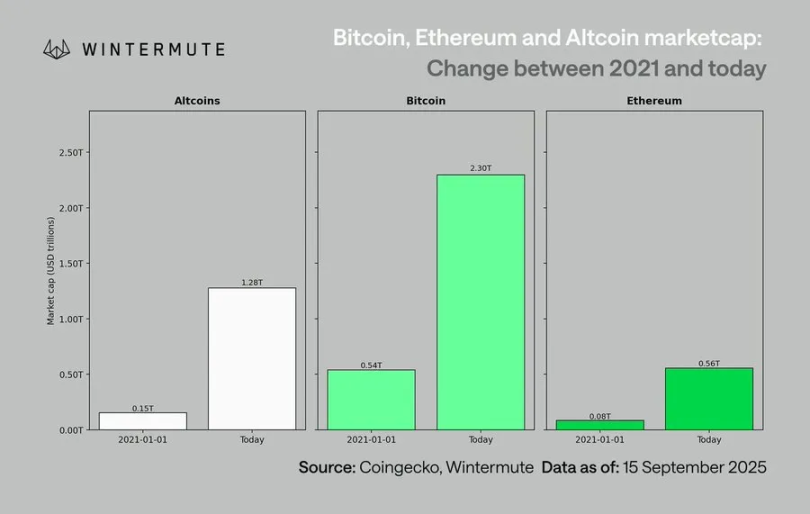

加密货币市场的新背景(与 2021 年对比)

将当前市场与上一轮主要周期对比,差异显著:

-

资本纪律更严格:高利率与持续的通胀迫使投资者更谨慎地选择风险标的;

-

无新冠级流动性激增:缺乏广义货币供应量(M2)的飙升,行业增长必须依赖采用率提升与资金配置;

-

市场规模扩大 10 倍:更大的市值基数意味着更深的流动性,但 50-100 倍的超额回报可能性更低;

-

机构资金流入:主流机构的采用已根深蒂固,资金流入更趋平缓,推动市场缓慢轮换与整合,而非资产间的爆发式轮动。

比特币的滞后性与流动性传导链

比特币的表现与流动性环境存在滞后性,原因在于新增流动性被困在 「上游」 的短期国债和货币市场中。作为风险曲线最末端的资产,加密货币只有在流动性向下传导后才能受益。

加密货币表现优异的催化剂包括:

-

银行信贷扩张(ISM 制造业指数>50);

-

降息后资金从货币市场基金流出;

-

财政部发行长期债券,压低长期利率;

-

美元走弱,缓解全球融资压力。

历史规律显示,当这些条件满足时,加密货币通常在周期后期上涨,晚于股票和黄金。

基准情景面临的风险

尽管流动性框架呈现看涨态势,但仍存在多项潜在风险:

-

长期收益率上升(由地缘政治紧张引发);

-

美元走强,收紧全球流动性;

-

银行信贷疲软或信贷环境收紧;

-

流动性滞留于货币市场基金,未流入风险资产。

下一轮周期的核心特征将不再是 「投机性流动性冲击」,而是加密货币与全球资本市场的结构性融合。随着机构资金流入、审慎的风险承担以及政策驱动的流动性转变相叠加,2026 年可能标志着加密货币从 「暴涨暴跌」 模式向 「具备系统相关性性」 的转型。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。