本文深度解读美联储 9 月 FOMC 决议核心内容与市场影响,此次会议以 11:1 票决通过降息 25BP,基准利率降至 4.00%~4.25%,释放 “预防性降息” 与潜在连续降息信号。从政策细节看,利率点阵图显示 2025 年预计降息 3 码,季度经济预测(SEP)上调 GDP 增速、维持失业率稳定,缩表节奏不变且流动性担忧缓解。

市场层面,加密货币市场呈现 “山寨领涨、主流稳” 格局,稳定币单周增发 36.57 亿美元,BTC ETF 净流入 13.06 亿美元,但 11.7 万美元处存筹码压制。山寨币市值达 1.15 万亿美元,情绪指数升至 52,不过需警惕高位回调风险。后续需重点关注美国国会拨款、非农就业数据,以及 BTC 突破关键价位与 ETH ETF 资金补量情况。

一、深度解读美联储9月FOMC决议:数据、路径与市场风向

美联储9月FOMC会议尘埃落定,11:1的票决通过降息1码(0.25%),基准利率下调至4.00%~4.25%区间。这份被市场解读为“鸽派”的决议,究竟透露了哪些关键数据信号和未来路径?让我们一起深入分析!

1.1 降息启动:数据驱动的“预防性”策略

投票结果: 11位票委赞成降息1码,仅特朗普新提名的Stephen I. Miran支持降息2码。这表明美联储内部对本次温和降息达成了广泛共识。

声明稿措辞变化: 显著新增“失业率有所回升”、“就业市场下行风险已经上升”等表述。虽然今年失业率预估仍维持4.5%,但这些措辞反映了美联储对劳动力市场潜在疲软的警惕性。Powell在会后也明确指出,本次降息是风险管理措施,而非应对已经发生的危机,旨在平衡就业与通胀双重使命。

连续降息信号: 声明稿删除了“更审慎的评估幅度与时机”的措辞,暗示美联储可能开启连续降息的窗口,而非单次行动。

1.2 利率点阵图:更清晰的降息路径展望

- 2025年: 点阵图显示,委员们的分布明显下移。中位数预测落在年内降息3码(前次为2码)区间,即基准利率3.50%~3.75%。值得注意的是,支持降息3码的委员有9位,但未过半,仍有6位委员支持仅降息1码,这为未来政策调整留下了弹性空间。

- 2026年与2027年: 中位数均显示将各再降息1码,分别降至3.25%~3.50%和3.00%~3.25%区间。

长期利率: 保持3%不变,意味着美联储认为通胀预期和关税政策是短期影响,长期仍有随通胀放缓而进一步降息的空间。

结论: 尽管2025年降息幅度扩大,但2026年、2027年维持1码的降息幅度,表明美联储仍倾向于**“预防性降息”**,在就业和通胀之间寻求谨慎的平衡。

1.3 季度经济预测(SEP):乐观的增长预期与通胀判断

GDP增速上调: 美联储上调了2025年(至1.6%)、2026年(至1.8%)、2027年(至1.9%)的经济预测。这传递出美联储对降息后经济的强劲信心,认为预防性降息能有效对冲就业下行风险并支撑经济。

失业率预估: 2025年失业率保持4.5%不变,明后年甚至小幅下降(2026年4.4%,2027年4.3%)。这进一步强化了美联储对劳动力市场“软着陆”的预期。

通胀预估: 仅2026年PCE和核心PCE通胀小幅上修至2.6%(前2.4%),但整体通胀路径变化不大。Powell指出,关税对核心PCE的贡献约0.3%~0.4%,低于预期且传导更慢,显示美联储认为关税通胀是一次性冲击,不会长期影响降息路径。

核心观点: SEP数据整体传递了美联储对未来经济增长、就业市场稳定和通胀可控的乐观预期。

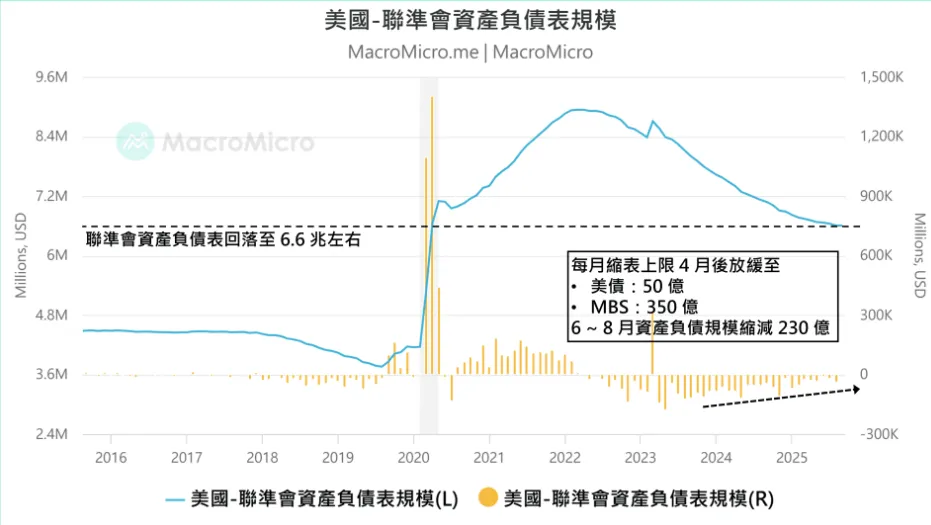

1.4 缩表与流动性:低速推进,担忧缓解

缩表速度不变: 美联储仍以每月美债50亿、MBS 350亿(总计400亿)的速度缩表。

流动性状况:

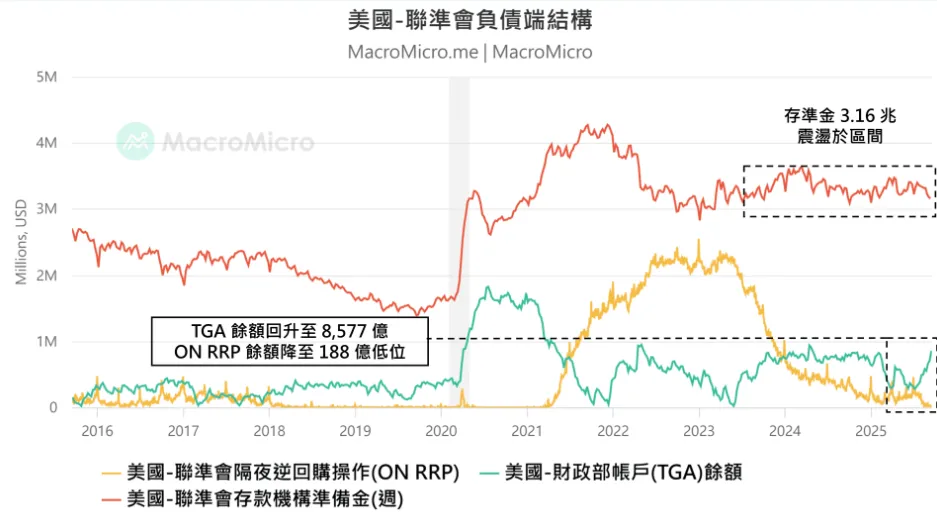

ON RRP(隔夜逆回购)已降至188亿的超低水位。

财政部TGA(财政部普通账户)在9月税收入账后回升至8500亿的季底目标。

银行存准金持稳在3.16万亿。

未来展望: 随着国会拨款,TGA账户资金将转向挹注市场流动性,抵消ON RRP下降的影响。这表明市场流动性疑虑正在逐步消散。Powell强调缩表对宏观经济影响微小,目标是准备金达到“略高于充足”的水平。

1.5 市场展望与关键关注点

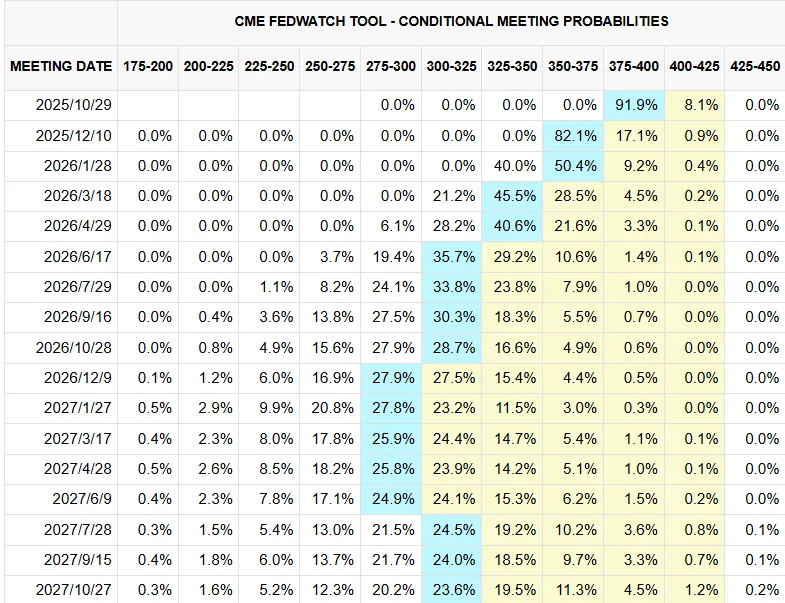

降息路径基本锁定: FedWatch数据显示,10月和12月降息概率分别高达87.7%和80.0%,年内降息3码几成定局。

焦点回归经济基本面: 市场将转向检视降息后的经济数据,如非农就业(近期已连续4个月低于10万)、个人消费支出(服务项目年增回落至1.68%)等。若数据能稳住,将有望延续市场行情。

政治风险不容忽视:国会拨款: 密切关注9月30日美国国会通过政府拨款的进度,避免政府关门危机。

财政扩张: 特朗普潜在的财政扩张计划(国防支出、基建投资、企业减税)将是美联储降息后,能否支持经济如SEP预期回升至1.8%~2%长线平均的关键因素。

二. 行情分析

2.1 本周的行情回顾

上周我们提到过周三周四是杀不动震荡上行的走势,在周五周六的时候,市场震荡上行转为了一波小流畅的上涨,我们之前提到过,这里的上涨属于跌不动的反弹,后面的上涨的技术面的不确定性比较强,所以也可以看到后面BTC、ETH的技术走势并不相同,BTC走了一个横盘,但是ETH走了多波段的震荡回落,ETH跌回了上涨的一半的走势,其实有技术面破坏性的可能。另外一点是本周18号的凌晨两点美联储的议息会议,在这之前市场的横盘,其实也有市场在等消息的逻辑,在18号降息之后,山寨市场出现明显上冲,不过ETH和BTC变动的相对幅度并不大(SOL出现单日6%的幅度)。

2.2本周影响行情的中短期行情数据变化

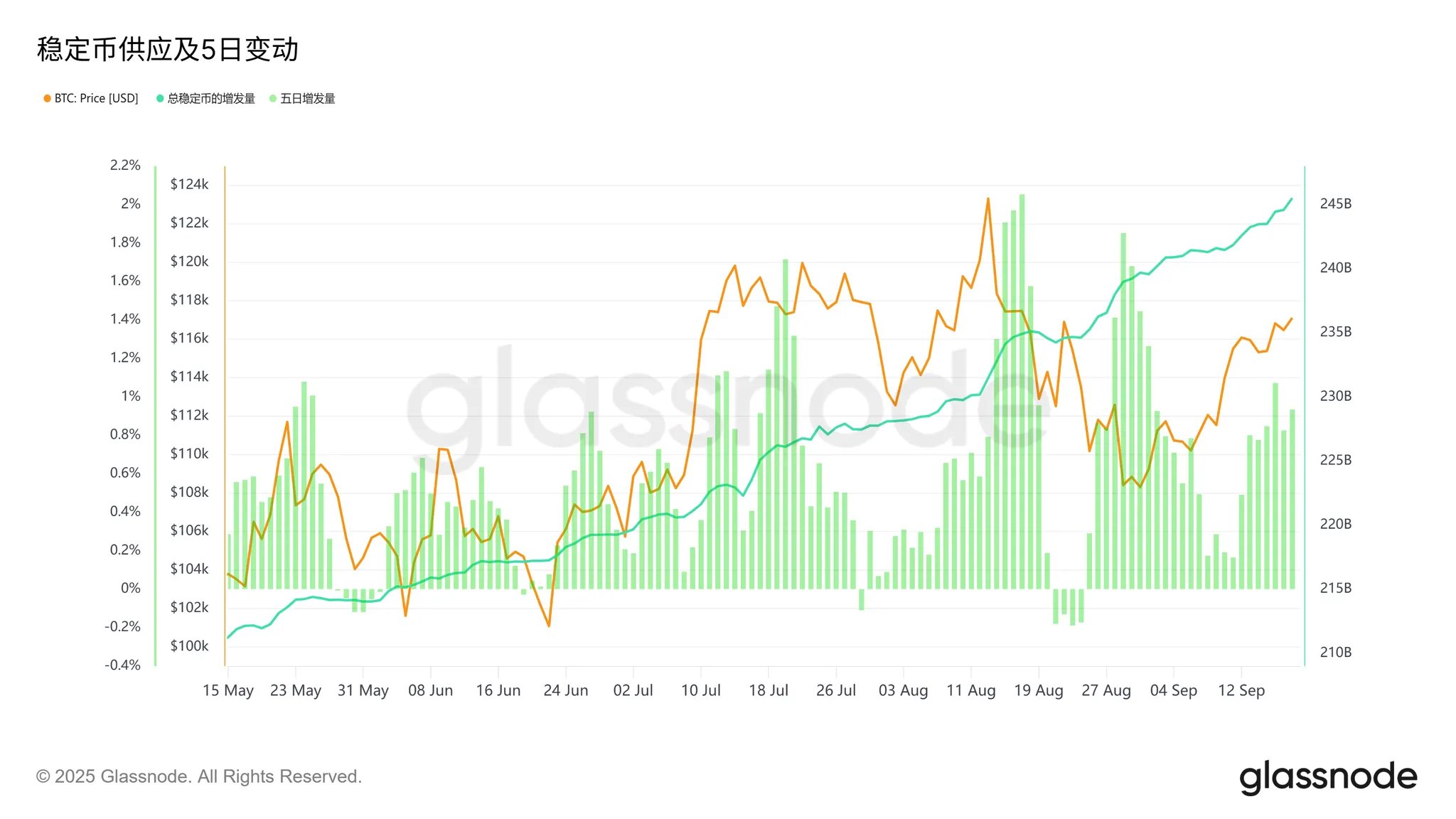

2.2.1 稳定币资金流动情况

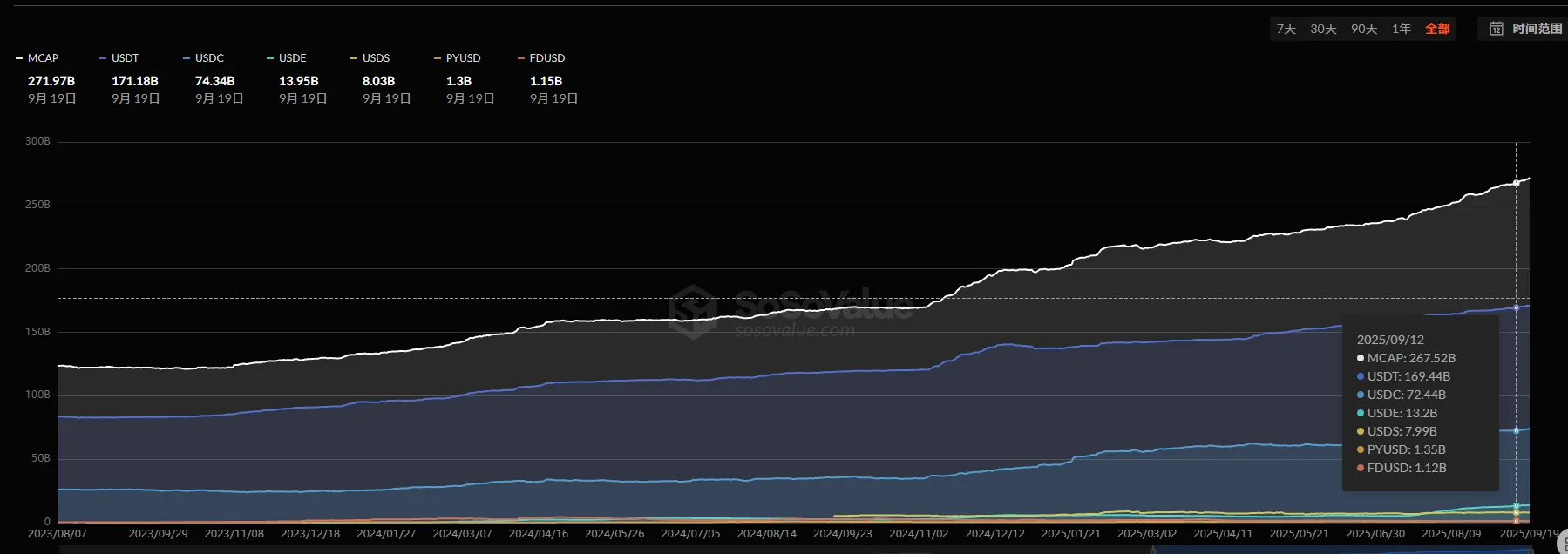

本周稳定币增发总量来到了2455.04亿美元,单周增发量相较于上周来说从9.36亿美元上升到了36.57亿美元,出现了明显的回温,日均增发也从1.34亿美元上升到了5.22亿美元,整体增发水平相比上周环比+290%。结合大盘来说,虽然大盘在本周前半段议息会议开始之前整体情绪偏向于观望避险走出了一定的调整,但在议息会议明确降息之后,再伴随着本周稳定币持续高增发的背景市场还是在本周后半段走出了进一步的上涨。

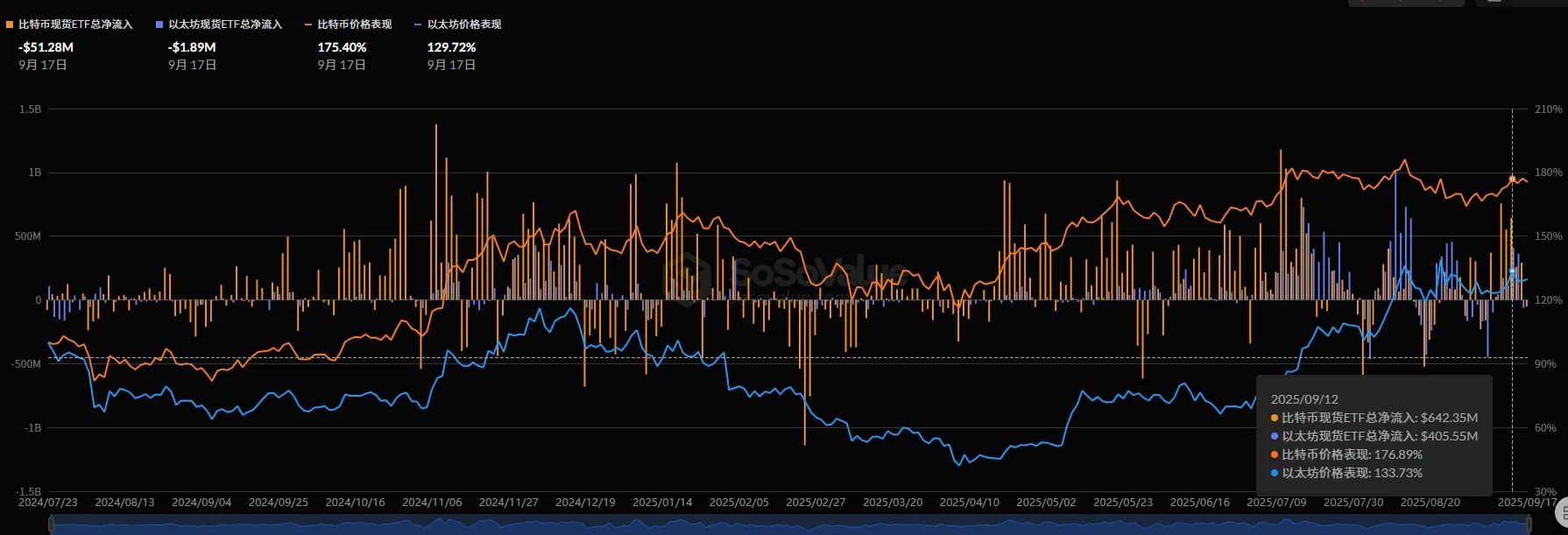

2.2.2 ETF资金流动情况

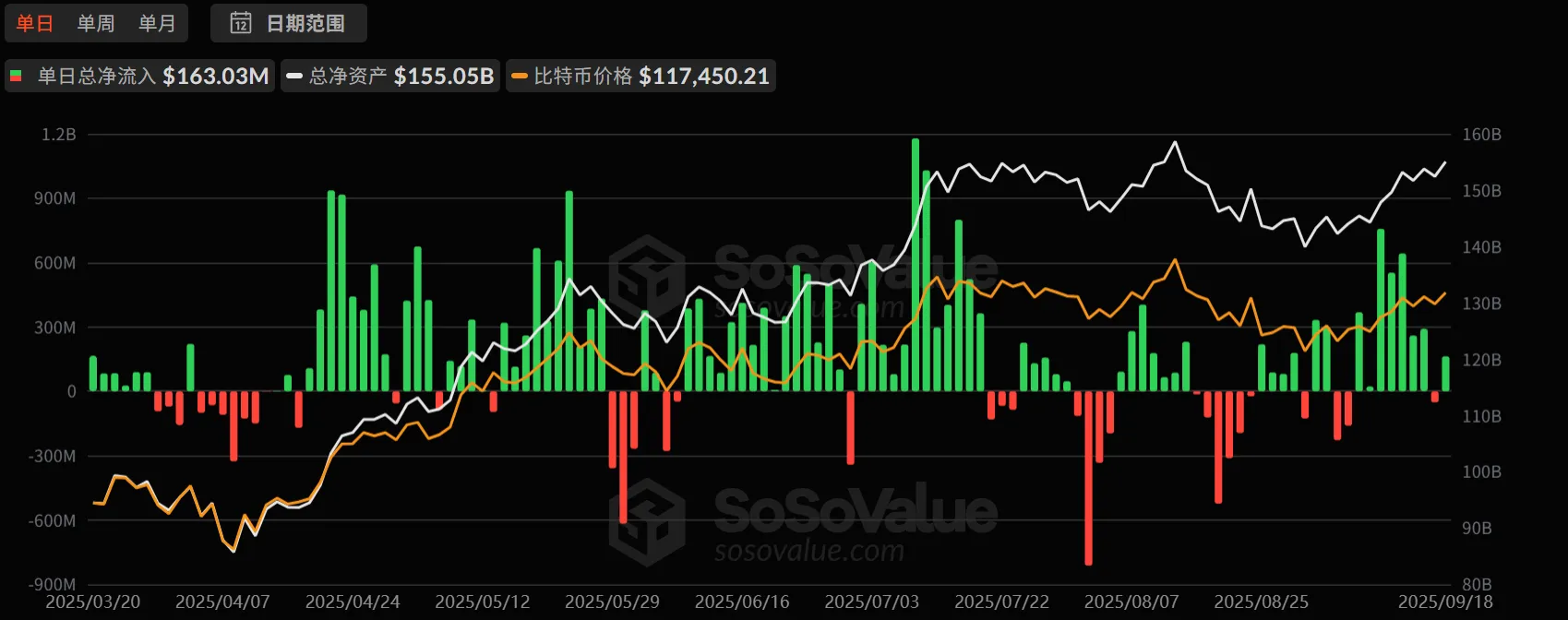

本周比特币的ETF资金流入13.0639亿美元,虽然相较于上周的15.4104亿美元的净流入来说是环比下降了2.3466亿美元,但是和8月份相比依旧是处于一个较高的流入水平,同时比特币的价格也是从8月份的持续走弱下跌转为了9月的持续反弹上涨,后续反弹能否继续持续则需要继续关注下周的ETF资金流入水平。

2.2.3 场外折溢价

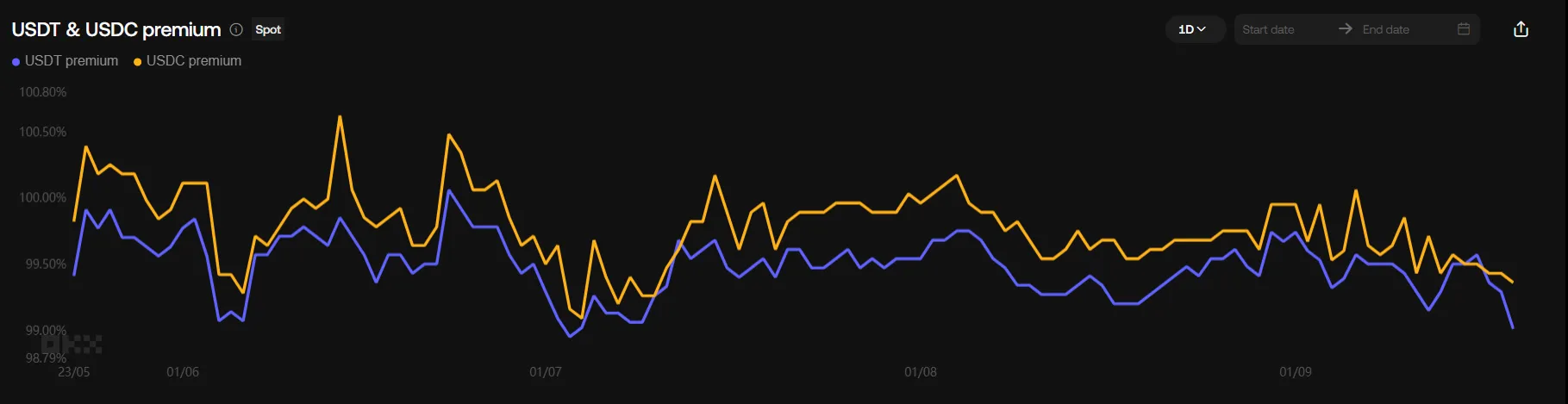

本周usdt和usdc的场外折溢价整体处于一个下降的走势,可以看出在本周议息会议之前市场情绪处于一个保守和观望的态度,即使在本周前半段大盘出现了一定程度的回落调整时,仍没有激发场外资金的进出抄底意愿,同时在议席会议之后,大盘反弹的过程中依旧没有激发场外资金进场追涨的fomo情绪,整体还是一个相对冷静的观望态度。

2.2.4 以太坊ETF资金流动情况

本周以太坊ETF资金流动情况相较于上周2.1458亿美元的净流出来说是出现了9.1472亿美元的净流入,但净流入水平和8月份相比并不算高,并且本周仍然是低于比特币的ETF资金流入水平,反应到以太坊的价格上虽然也有不错的反弹,但是和比特币和sol相比还是相当偏弱一些,后续还有持续跟踪其下周的ETF资金流入情况。

2.2.5 比特币微策略购买

本周微策略于9月15日再次花费6000万美元以114562的平均价格购买了525枚比特币,虽然买入数量要少于本月前两次的购买数量,但其持续购买的行为依然能起到一定的振奋市场情绪的作用。

2.3本周影响行情的中期行情数据变化

2.3.1持币地址持币占比和URPD

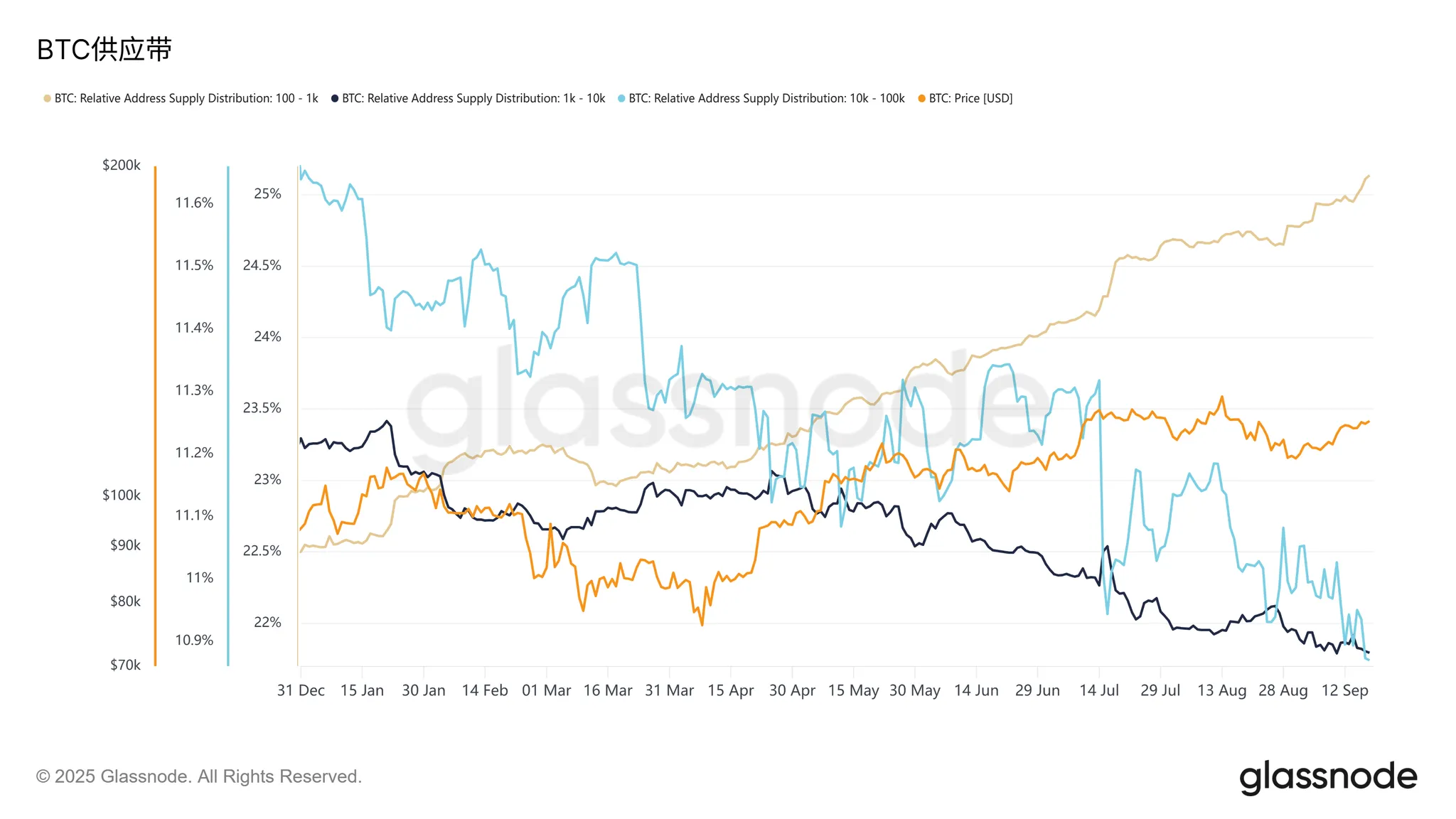

本周从比特币的持币地址持币占比来看,大于100小于1K的持币地址持币占比依旧保持一个的上升趋势并且在本周走出了一定程度的加速上升,反应出这部分地址在本周是出现了一个吸筹加速的状态,而大于1K小于10K的持币地址持币占比和大于10K小于100K的持币地址持币占比目前整体还是一个震荡下行的趋势,意味着这部分地址暂时还是处于一个派发的状态。

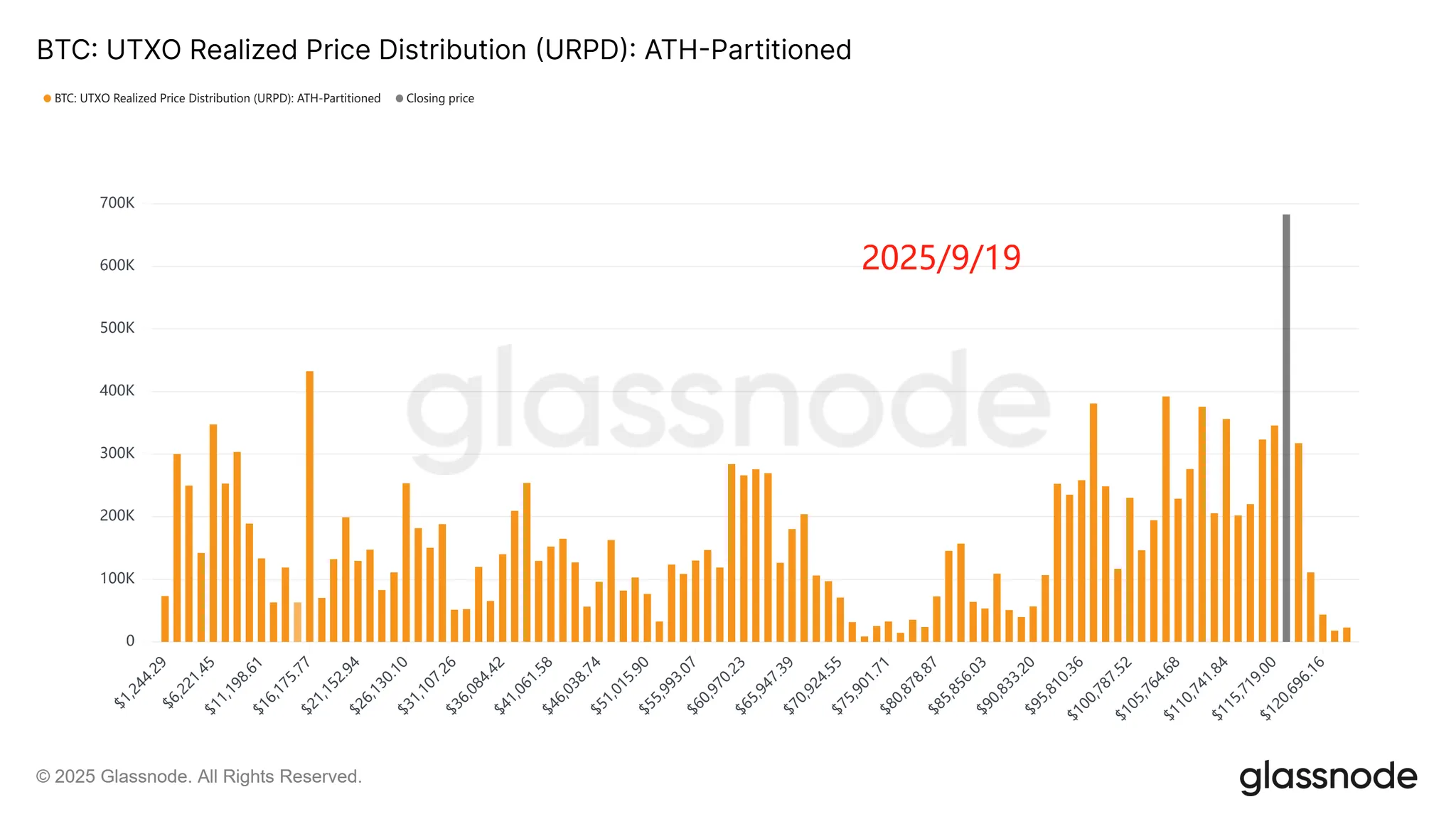

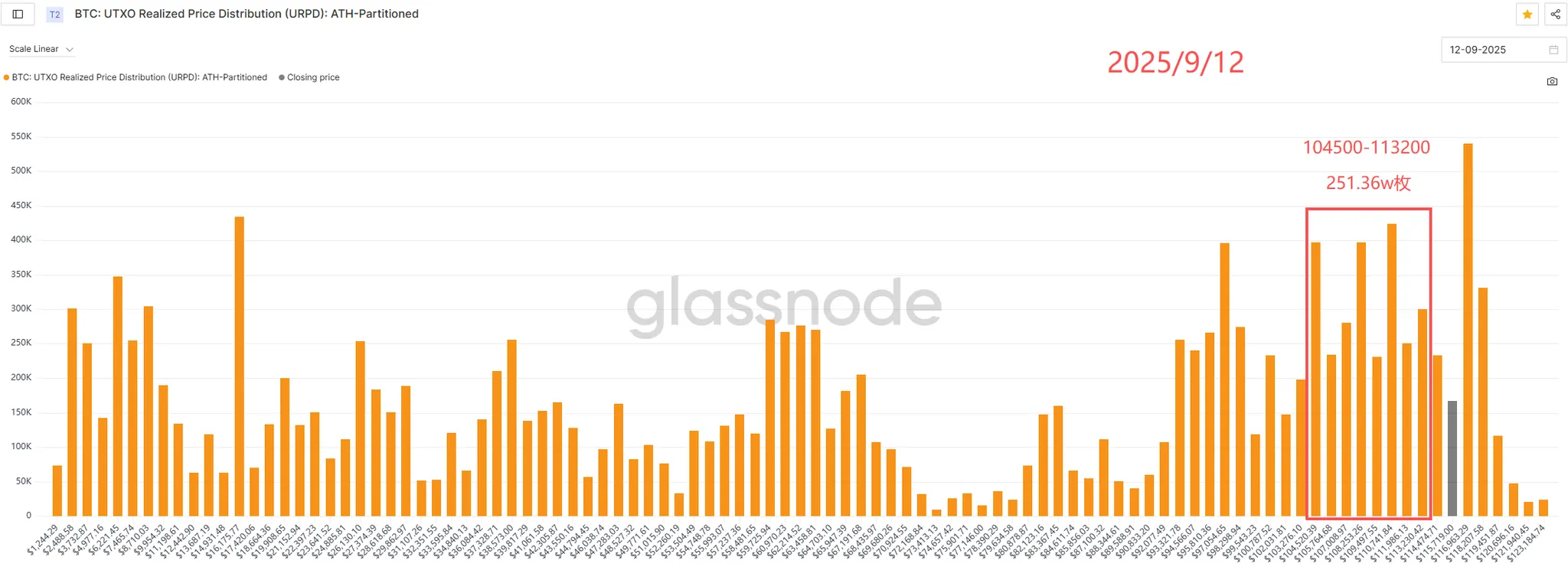

本周从比特币的筹码分布来看,可以发现相比上周来说,本周比特币在117000美金的价格附近的价格是再次出现了大量的换手,在上周我们就有提到比特币117000附近的巨量筹码峰可能会对价格产生一定的压制作用,从目前的这里的大量换手以及比特币目前的价格来看,压制作用已经显现,那么后续比特币能否进一步反弹,关键就看117000美金附近的筹码密集区能否成功突破。

三、山寨市场解析

我们的山寨市场部分分析具体会从4大板块来进行拆解:

3.1 市场总览

3.1.1 山寨币市值

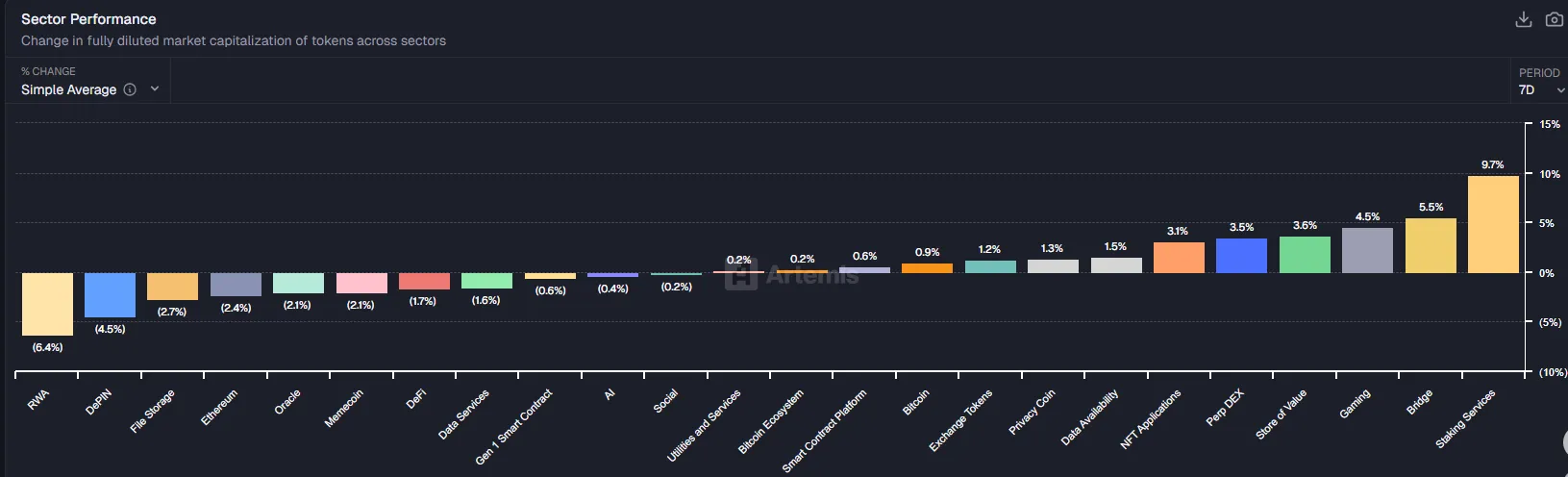

本周五TOTAL2(除BTC,ETH外全代币市值)11500亿美元,环比增长1.76%。本周四美联储如预期降息25bp,市场情绪较好,主流币稳步上涨,山寨也逐步走高。整体上本周是偏震荡的一周,主要还是市场之前对降息预期较高,有一定的提前抢跑。

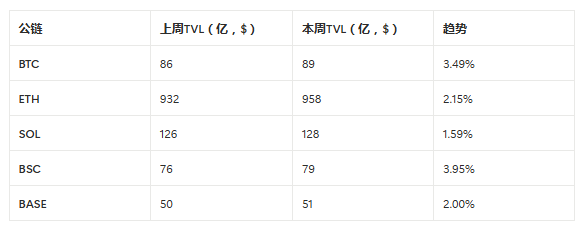

3.1.2 链上TVL总览

链上总TVL(蓝线)1632亿美元,环比上周上涨2.13%。本周tvl随着价格上涨,tvl同步上涨,整体链上质押数量还是基本不变,市场对未来阶段性相对乐观。

3.1.3 稳定币市值与交易所储备

稳定币总市值2720亿美元,环比增加继续1.68%,当周增加值继续上升。

法币支持稳定币净流入方面截止周五合计净流入31.6亿美元,流入幅度较大。

交易所稳定币余额方面本周加速流入,整体趋势较好。

山寨指数:本周五山寨指数73,较上周小幅上升,想比较主流币btc表现较好。

市场情绪:周五情绪指数52,较上周有所上升,市场轮动有序,赚钱效应依旧不错。

山寨总览:周市场山寨情绪依旧保持不错,热点层出不穷,小市值代币tst,dam 依旧活跃 , 链上合约交易平台 avnt drift apx(aster空投)。整体上相对低位代币都有所表现,之前涨过幅度较大相对高位币下跌,依旧警惕追高。

逃顶指标:逃顶合集方面本周:山寨币季节指数依旧显示见顶出现,其它指标未出现。本周依旧表现出的市场分化,整体上赚钱效应较好,低位普遍上涨,但是涨幅较大的下跌。

山寨热度:本周山寨热度 从具体的单个标的资金费率来看,从图中颜色显示明显边际转好,随着大盘企稳走高,山寨有望扩散,轮动上涨。

3.2 二级市场行情分析

3.2.1 山寨强弱分析

BTC市占率

本周五BTC市占率为56.02%,基本处于震荡状态,山寨市场的表现相对有所不及预期的。

SOL/BTC、ETH/BTC、BNB/BTC 汇率

本周BTC震荡走高,市场情绪边际好转,sol bnb明显跑赢btc,还是eth表现一般。本周sol财库 galaxy digital 购买16亿sol。

3.2.2 市场流量

板块流入流出方面,按照交易所币种板块排序,本周表现有所分化,涨跌各一半,没有出现情绪进一步大幅扩散。

机构侧方面,本周btc eth etf均流入,但是 eth的财库公司购买力度边际走弱,本周依旧是仅小幅增加,sol明显增长 主要是galaxy digital购买的16亿,融资金额已全部购买完。

3.3 一级市场数据分析

3.3.1 四大公链现状

本周链上TVL小幅增长,整体情况较好,特别是eth链 增长明显。

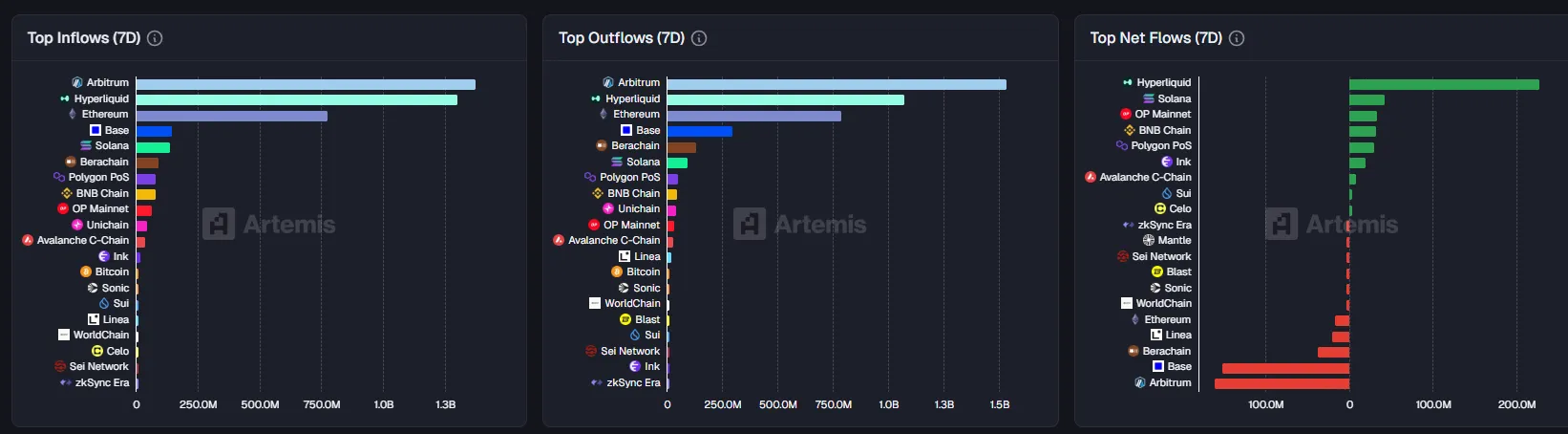

3.3.2 链上资产流向

本周链上DeFi 桥接资产流向方面,净流入最多是hyperliquid链,净流出最多arb链,后续值得持续关注。

本周稳定币增发最多usdt,usde增发亮眼,eth链增长势头依旧保持较好,cex本周流入最多。

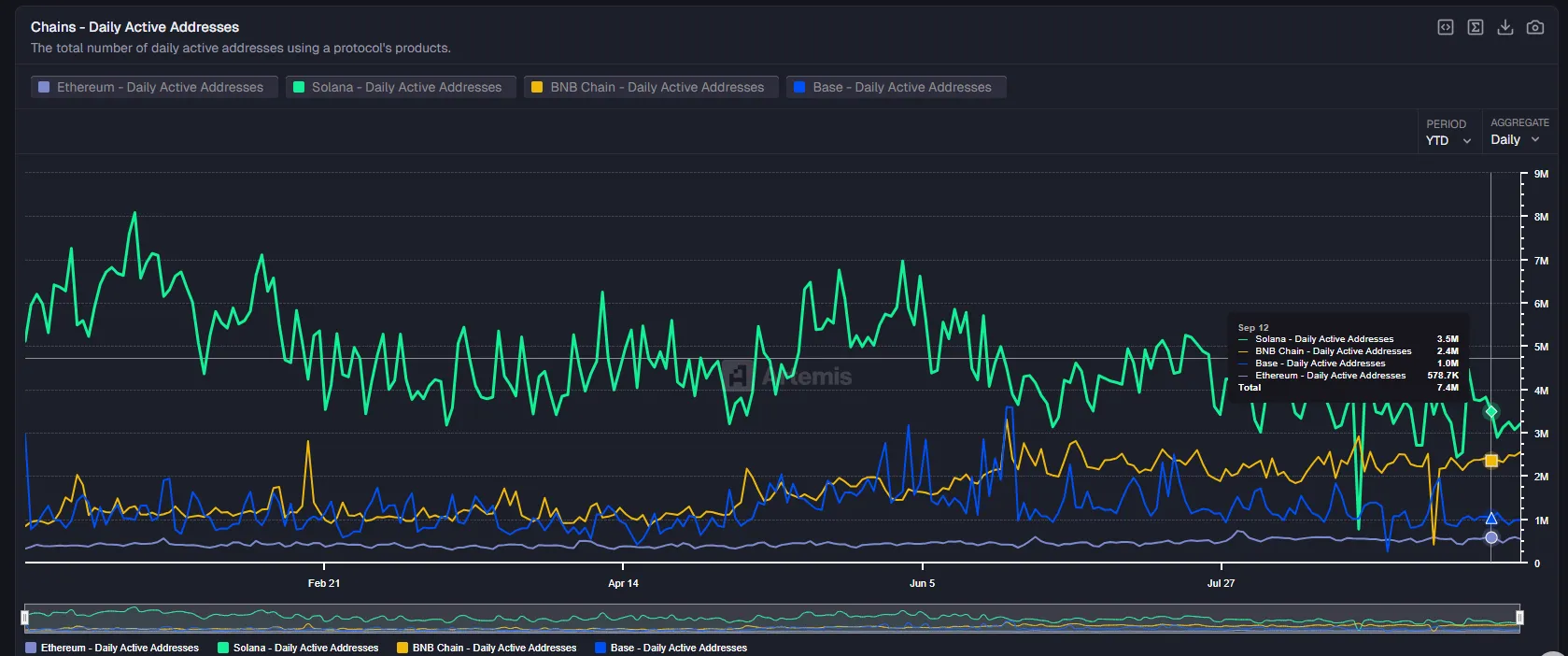

3.3.3 链上用户活跃度和投机情绪

活跃情况方面 链上依旧表现一般,交易所的二级市场的热度传到到链上需要链上有新的玩法吸引用户参与,bnb链本周受cz回归的消息 链上相对活跃点。

投机情绪方面,DEX的协议收入、活跃用户、交易量情况环比上周边际好转,整体趋势相对稳定。

3.3.4 链上荣枯指数

综上所述,我们将四大公链TVL变化情况以及链上数据情况分别进行加权汇总(满分100),并定义各区间:

极度繁荣:80分

上升线:60分

衰退线:50分

熊市:30分

四、市场展望与关键关注点

美联储政策跟踪:FedWatch 数据显示 10 月、12 月降息概率分别达 87.7%、80%,年内降息 3 码几成定局,后续需关注非农就业、核心 PCE 等数据是否符合预期,避免 “数据不及预期→政策转向” 风险。

美国政治风险:9 月 30 日前需关注国会政府拨款进展,避免政府关门;特朗普潜在的 “国防支出 + 基建投资 + 企业减税” 计划,将影响经济能否达到 SEP 预期的 1.8%-2% 长线增速。

加密市场关键节点:BTC 需突破 11.7 万美元筹码压力位,ETH 需等待 ETF 资金补量;山寨市场需警惕 “季节指数见顶” 信号,优先布局低位、有生态支撑的标的(如 ETH 链合约平台、SOL 生态)。

上述报告数据由 WolfDAO(X:@10xWolfDAO) 编辑整理,如有疑问可联系我们进行更新处理;

撰文:WolfDAO

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。