Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

On the eve of the Federal Reserve's interest rate decision, a cautious sentiment pervades the global market. The record streak of gains in the U.S. stock market has come to a halt, with both the S&P and Nasdaq retreating from historical highs. However, the Chinese concept stock index rose nearly 2% against the trend, reaching a new closing high since February 2022. The dollar index fell to a three-and-a-half-year low, while the offshore yuan broke through 7.11 during trading, hitting a ten-month high, and gold prices surged past $3,700, setting a new record.

The market generally expects the Federal Reserve to cut interest rates by 25 basis points. Notable financial journalist Nick Timiraos pointed out that the recent slowdown in job growth is the main reason. Federal Reserve Chairman Powell has signaled that he will prioritize employment over inflation. Both JPMorgan and Bank of America predict that gold prices may exceed $4,000 in the first quarter of 2026, emphasizing that investor demand has replaced central banks as the core driving force behind rising gold prices. They also warned that if the independence of the Federal Reserve is compromised, gold prices could even surge to $5,000 within two quarters.

Bitcoin is making its fourth attempt to challenge the key resistance zone of $117,000 to $118,000. Analyst Murphy noted that over 800,000 BTC sell orders are stacked in this range, making a breakout difficult. He believes that future trends should focus on ETF fund inflows, the profitability index of short-term holders, and whether the price can stabilize above $117,000 after a pullback. AlphaBTC also predicts that the price may briefly touch $118,000, but whether it can hold $115,000 after the FOMC interest rate decision is crucial. Although Rekt Capital considers recovering the $114,000 support level a positive signal, he stated that if BTC can successfully retest and stabilize above $117,200 after a daily close, it will further open up an upward trend. Despite CryptoQuant data showing that 8 out of 10 bull market indicators have turned bearish, some traders believe the macro environment still supports BTC's rise. Investor Jelle pointed out that the weekly RSI indicator has issued a historic bullish signal, which could drive the price to $155,000; network economist Timothy Peterson further predicts that BTC may reach $200,000 within 170 days based on cyclical patterns.

Ethereum is maintaining above the key trend line of $4,450 ahead of the Federal Reserve's decision. Mark Newton, an analyst at Tom Lee's fund, stated that Ethereum (ETH) is currently experiencing a normal correction that did not occur last week. He believes that the ETH price is unlikely to fall below the previous low of $4,233 but may dip to $4,418 or $4,375 within the week. He suggests that investors take advantage of price pullbacks to buy at lower levels, predicting that ETH prices will rise to around $5,500 before mid-October. Several analysts, including Ash Crypto and TheBullishTradR, believe that even if the price temporarily pulls back to the $4,100 to $4,350 range, it still presents a good buying opportunity. Tesseract CEO James Harris also believes that the bullish flag pattern formed by ETH indicates that if it can successfully break through, the target price could reach $6,750. Meanwhile, Wall Street giant Citigroup has provided a relatively conservative year-end forecast of $4,300.

In the broader market, BNB was boosted by signals of founder Zhao Changpeng's (CZ) possible return and news of Binance negotiating to lift supervision with the U.S. Department of Justice, briefly breaking through $960, with a market cap exceeding $133 billion, surpassing UBS Group. At the same time, there have been some new developments in the AI field, where Google, in collaboration with Coinbase, the Ethereum Foundation, and EigenLayer, launched an open-source AI payment protocol (AP2) aimed at achieving automated fund transfers between AI agents, seen as the beginning of the "machine economy" era. Additionally, the Ethereum Foundation recently established a dedicated dAI team to make Ethereum the core infrastructure for AI development and promote related technical standards.

2. Key Data (as of September 17, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $116,441 (Year-to-date +24.69%), daily spot trading volume $41.051 billion

Ethereum: $4,500.28 (Year-to-date +35.45%), daily spot trading volume $30.023 billion

Fear and Greed Index: 54 (Neutral)

Average GAS: BTC: 1.11 sat/vB, ETH: 0.12 Gwei

Market share: BTC 57.7%, ETH 14.01%

Upbit 24-hour trading volume ranking: ETH, XRP, AVNT, DOGE, BTC

24-hour BTC long-short ratio: 49.56%/50.44%

Sector performance: CeFi up 1.78%, L2 up 1.34%

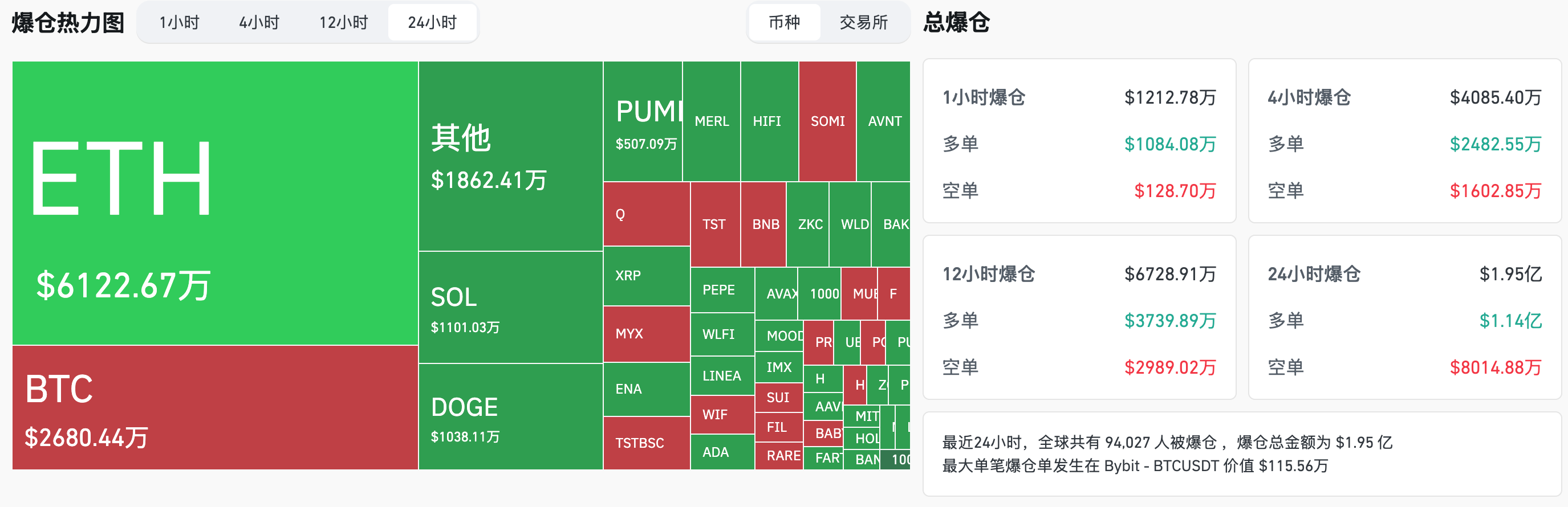

24-hour liquidation data: A total of 94,027 people were liquidated globally, with a total liquidation amount of $195 million, including $26.8 million in BTC, $61.22 million in ETH, and $11.01 million in SOL.

BTC medium to long-term trend channel: Upper line ($115,184.92), lower line ($112,904.03)

ETH medium to long-term trend channel: Upper line ($4,523.04), lower line ($4,433.47)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of September 16)

Bitcoin ETF: +$292 million, net inflow for 7 consecutive days

Ethereum ETF: -$61.74 million, only Bitwise ETF ETHW achieved net inflow

4. Today's Outlook

Aster will have its TGE on September 17, airdropping 7.04 million ASTER tokens to users

Binance Alpha will list Lombard (BARD) on September 18, DeAgent AI (AIA)

Bloomberg analyst: REX-Osprey Dogecoin ETF is expected to be listed on September 18

U.S. Federal Reserve interest rate decision (upper limit) as of September 17: Previous value 4.50%, expected value 4.25% (September 18, 02:00)

Federal Reserve Chairman Powell will hold a monetary policy press conference. (September 18, 02:30)

U.S. President Trump will be interviewed by Fox News in the UK. (September 18, 03:00)

Cronos (CRO) will unlock 1.17 billion tokens on September 17, worth approximately $360 million

Velo (VELO) will unlock 2.55 billion tokens on September 17, worth approximately $37.71 million

ZKsync (ZK) will unlock approximately 173 million tokens at 4 PM on September 17, representing 3.61% of the current circulation, worth approximately $10.7 million;

Fasttoken (FTN) will unlock approximately 20 million tokens at 8 AM on September 18, representing 2.08% of the current circulation, worth approximately $89.8 million;

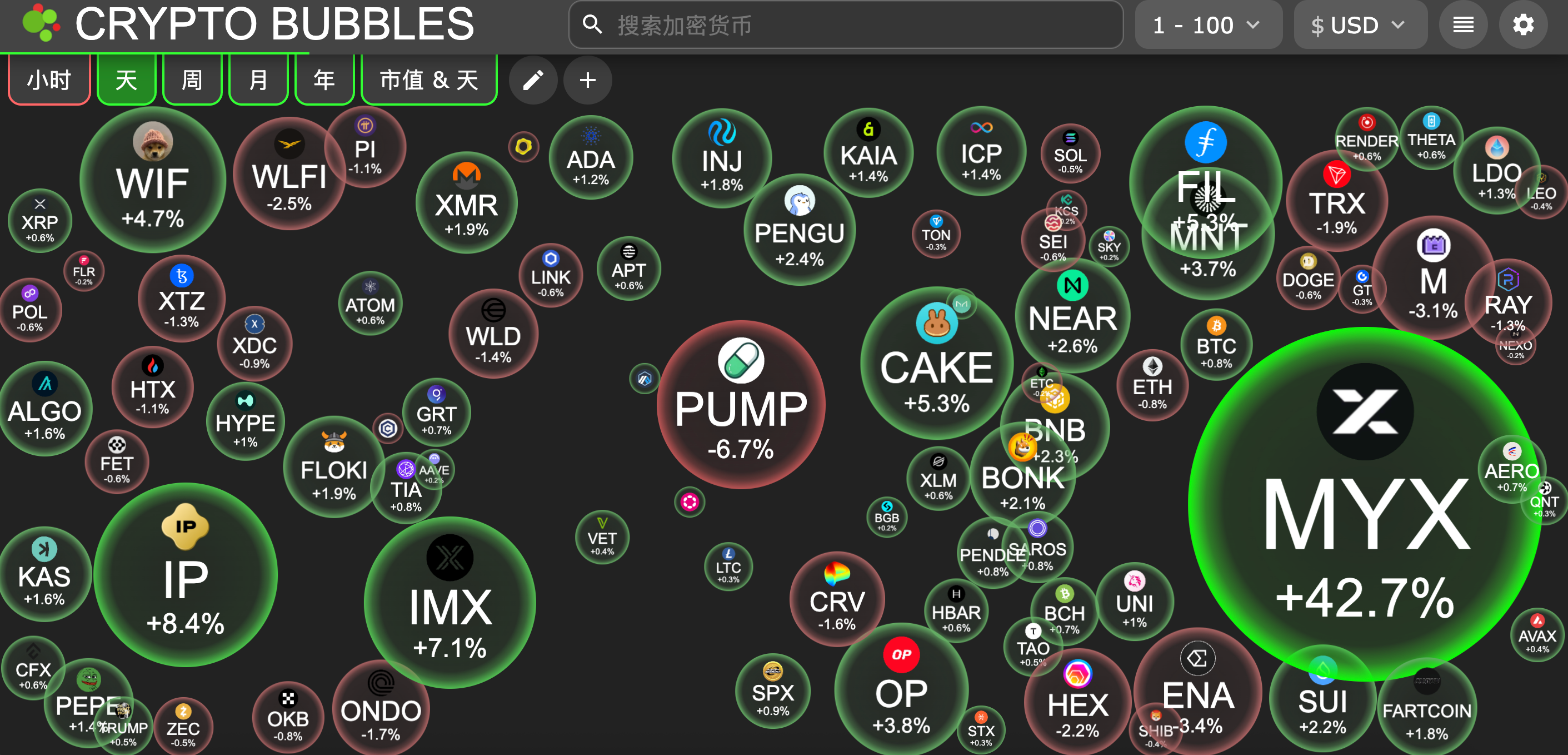

The largest gain among the top 100 cryptocurrencies today: MYX up 42.7%, Story up 8.4%, Immutable up 7.1%, PancakeSwap up 5.3%, Filecoin up 5.2%.

5. Hot News

Grayscale's Ethereum Mini Trust ETF address transferred 214,400 ETH to 67 new wallets

Upbit will list EUL and PLUME in the BTC and USDT markets, and TOSHI in the KRW and USDT markets

Qianxun Technology will acquire the Web3 fintech company Punk Code for no more than 25 million HKD

FalconX has withdrawn SOL tokens worth $98.4 million from multiple CEXs in the past 8 hours

Listed company GD Culture will acquire 7,500 bitcoins in the acquisition of Pallas Capital assets

Yala announces recovery plan: will burn illegally minted YU tokens on September 23

Zhao Changpeng updates his X account profile, possibly hinting at a return to Binance

Forward Industries invests $1.58 billion to acquire over 6.82 million SOL

Strategy purchases an additional 525 bitcoins, bringing total holdings to 638,985 bitcoins

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。