TRUMP token, as a political meme coin, shows a strong emotional-driven correlation with significant political and business milestones of Trump. The token's price not only reflects the market's emotional response to Trump's political status but also demonstrates the impact of his overall cryptocurrency strategic layout on market confidence.

Detailed Correlation Analysis of Significant Milestones and Token Trends

Phase One: Outbreak Period (January 17-20, 2025)

1. Token Issuance Milestone (January 17, 2025)

Trump announced the launch of the $TRUMP token on Truth Social and X platform, directing users to visit “GetTrumpMemes.com”.

Emotional Aspect:

- Extreme excitement and historic FOMO sentiment

- Unprecedented scarcity psychology of "presidential token issuance"

- Emotional identification of MAGA supporters converted into economic investment

- Super expectations for "pro-cryptocurrency president" policies

Price Performance:

2. Surge Phase (January 19-20 Morning)

The TRUMP token experienced a typical parabolic surge. The price quickly climbed from a low point to a peak of around $75, perfectly aligning with the previously analyzed historical high of $75.35. Trading volume was exceptionally high during this phase, with green bars indicating extremely active buying, reflecting the massive FOMO sentiment triggered by the unprecedented event of "presidential token issuance".

3. Rapid Correction Phase (January 20 Afternoon-21)

After reaching its peak, the price experienced a classic "waterfall" decline, quickly retracing from $75 to the $30-35 range, a drop of over 50%. This correction coincided perfectly with Trump's inauguration day and thereafter, perfectly validating the market rule of "buy the expectation, sell the reality". Red candlesticks appeared densely, and trading volume remained high, indicating a significant outflow of profit-taking.

4. Consolidation Phase (January 21-22)

The price formed a relatively stable horizontal consolidation pattern in the $35-50 range. Characteristics of this phase include:

- Noticeable narrowing of volatility, shifting from extreme one-sided trends to two-way fluctuations

- Gradual shrinkage of trading volume, with market sentiment returning from frenzy to rationality

- Slight downward shift in price center, indicating continued selling pressure

Phase Two: Policy Implementation Period (March-September 2025)

1. Cryptocurrency Strategic Reserve Plan (March 3, 2025)

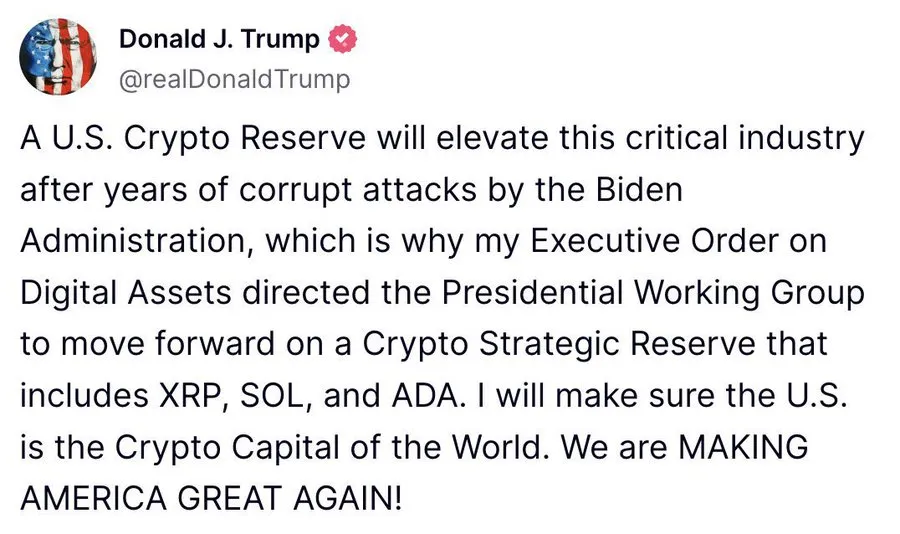

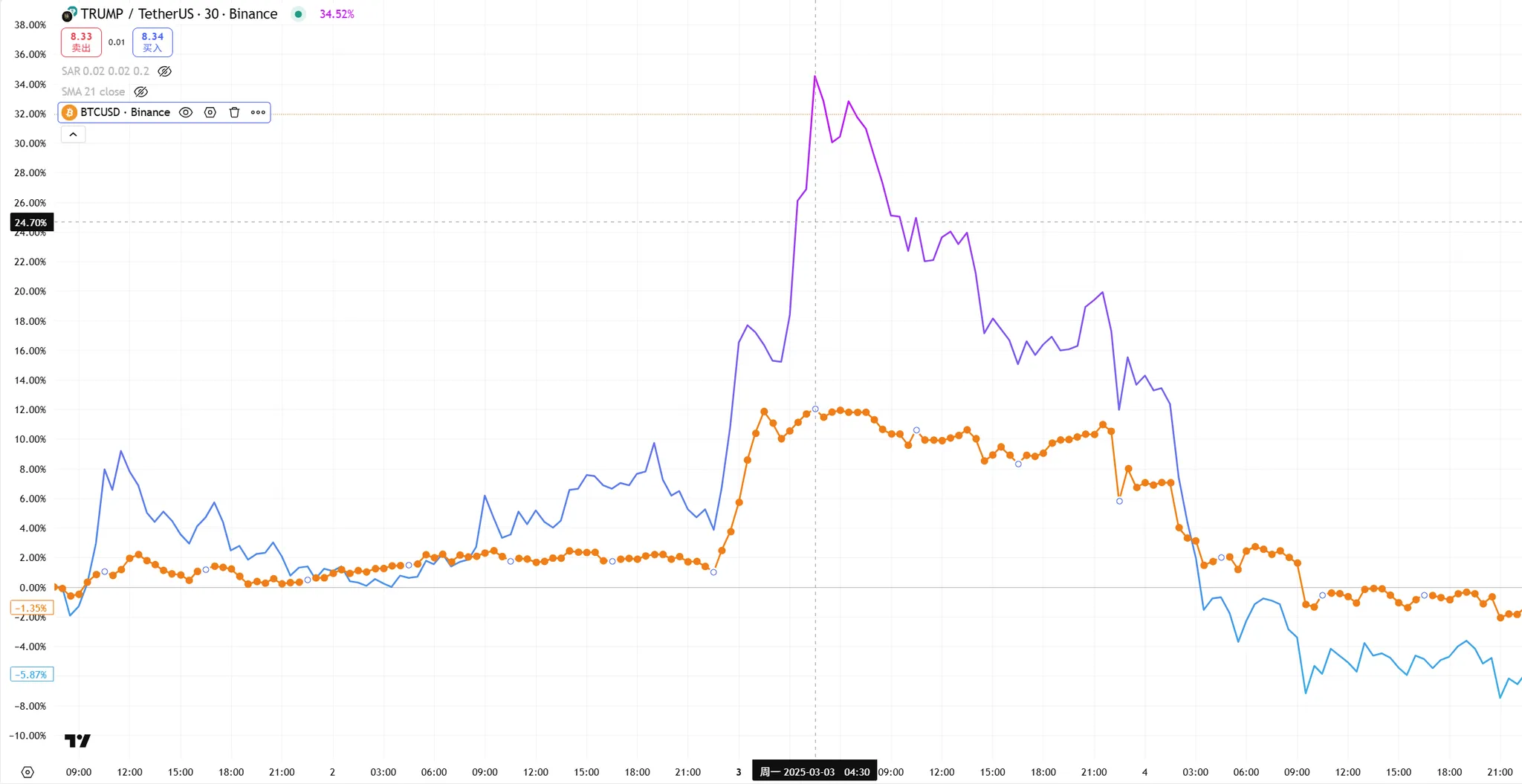

On March 3, Trump tweeted twice in succession. The first tweet announced, "U.S. Crypto Reserve will elevate this industry" and designated XRP, Solana, and Cardano as reserve currencies; an hour later, he added, "I also love Bitcoin and Ethereum!".

Emotional Aspect: Strong confidence boost in policy implementation

- Transitioning from personal token issuance to national strategic level

- Inclusion of multiple currencies reflects ecological thinking

- Concrete vision of becoming a global cryptocurrency capital

Market Impact:

- Bitcoin rose 11% to $94,164

- TRUMP surged nearly 30% to a short-term high of $17

- Overall cryptocurrency market added approximately $300 billion in market value

Support from the policy level provided fundamental backing for the TRUMP token, alleviating speculative corrections.

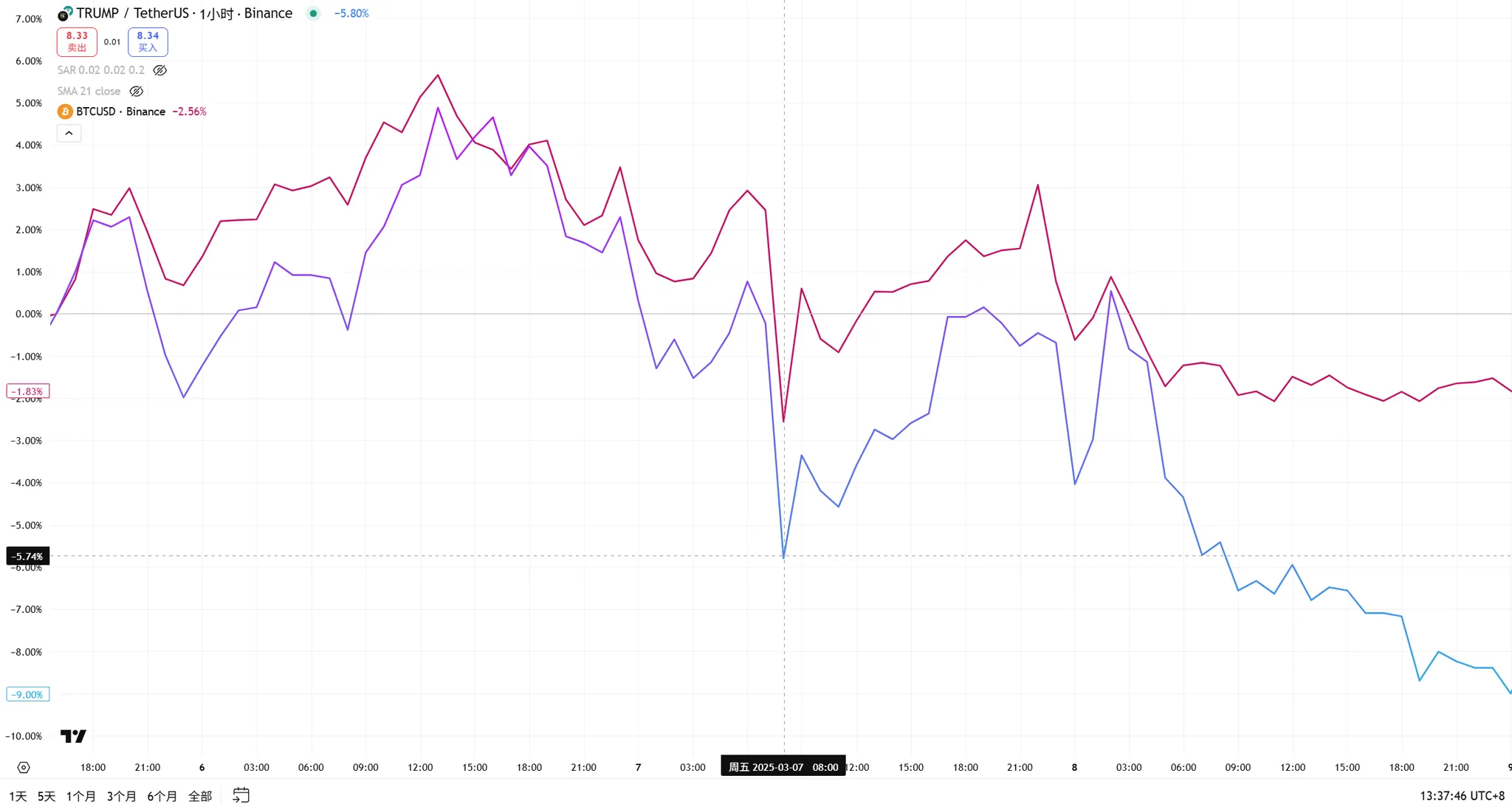

2. Strategic Bitcoin Reserve Executive Order (March 6, 2025)

On March 6, Trump signed the Strategic Bitcoin Reserve Executive Order, officially confirming that the federal government would retain the existing 200,000 bitcoins without selling them.

Although this executive order fell short of some investors' expectations as it did not involve repurchasing more bitcoins from the market, causing the bitcoin price to temporarily drop to $86,500, the TRUMP token also declined with the market but did not experience significant overselling.

3. White House Cryptocurrency Summit (March 7, 2025)

As the first high-level meeting specifically targeting the cryptocurrency industry held at the White House in U.S. history, the summit gathered about 30 government officials, congress members, and corporate executives, including Treasury Secretary Scott Benset, Commerce Secretary Howard Lutnick, and digital asset advisor Bo Hines, among other key policymakers. The core agenda of the summit revolved around ending the "regulatory war" against the cryptocurrency industry and pushing Congress to pass legislation to provide regulatory certainty for cryptocurrencies. The holding of this summit indicated that the Trump administration elevated cryptocurrency policy to a national strategic level.

However, the results of the summit were relatively bland, only committing to develop a stablecoin legislative framework before August and ensuring more lenient regulatory measures. These initiatives failed to ignite market sentiment as expected, with altcoins like XRP, ADA, and SOL experiencing significant declines, while BTC and TRUMP were not significantly affected.

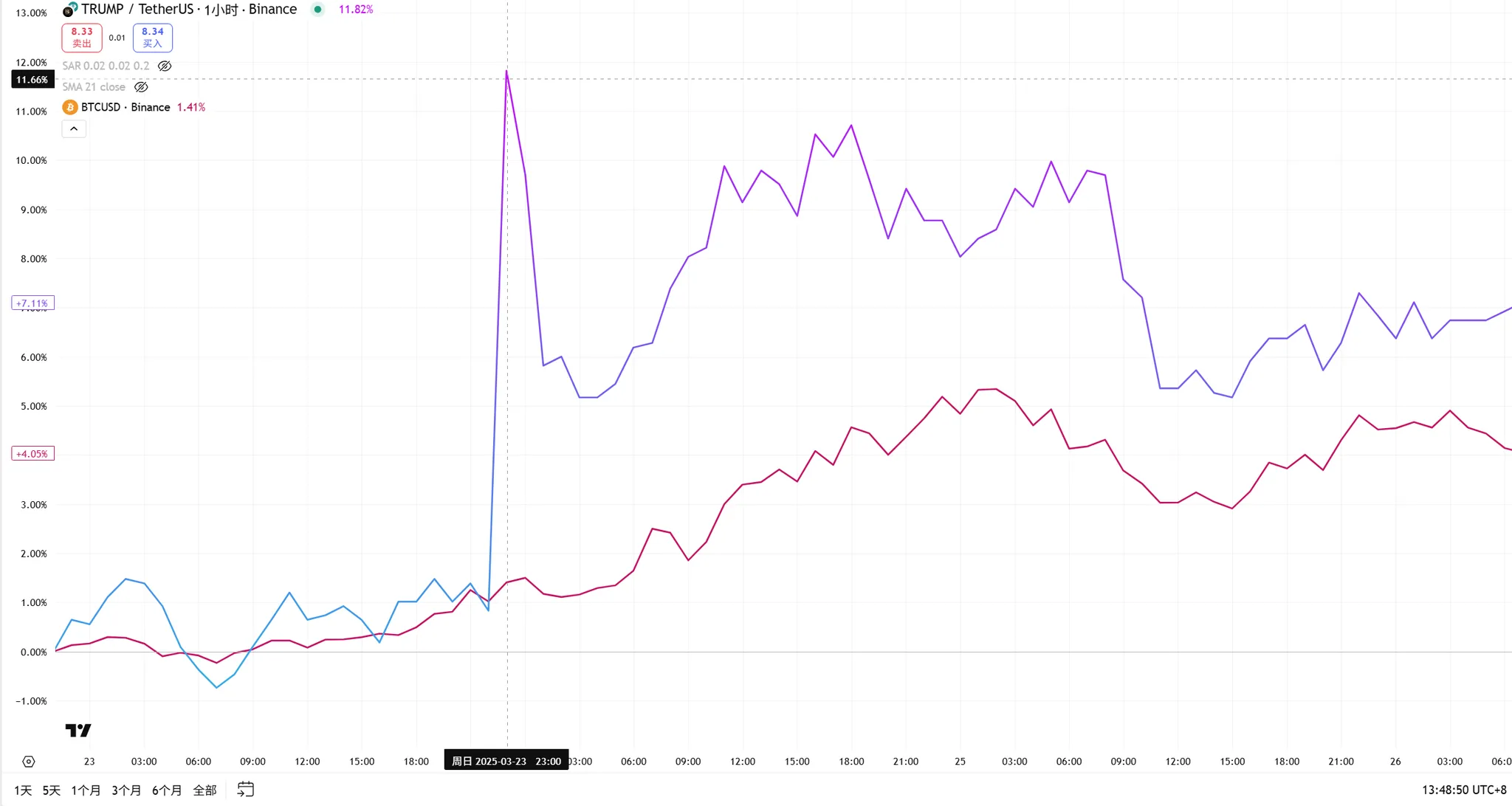

4. Twitter Endorsement (March 23)

On March 23, Trump unusually directly endorsed his own token, stating on Truth Social that the TRUMP token is "SO COOL" and hailed it as the "Greatest of them all".

This tweet pushed the token price from $10.91 to $12.11, an 11% increase, instantly adding $400 million to its market cap. Although the price subsequently retreated, it still maintained a net growth of $100 million, with trading volume surging to the highest level since March.

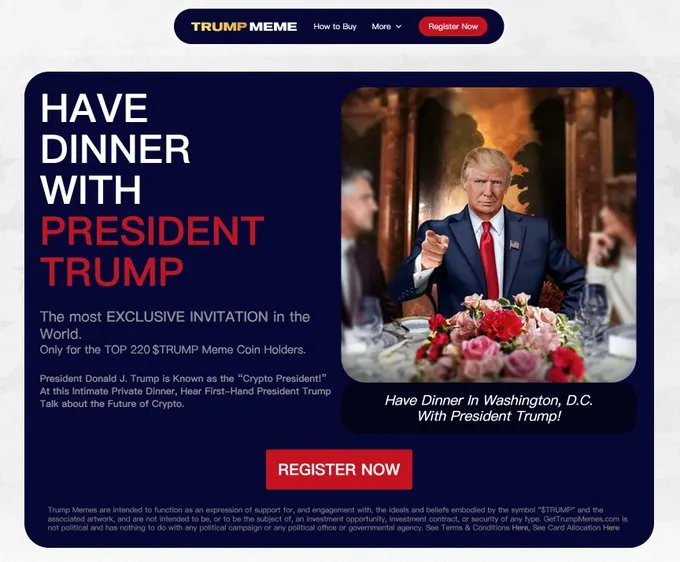

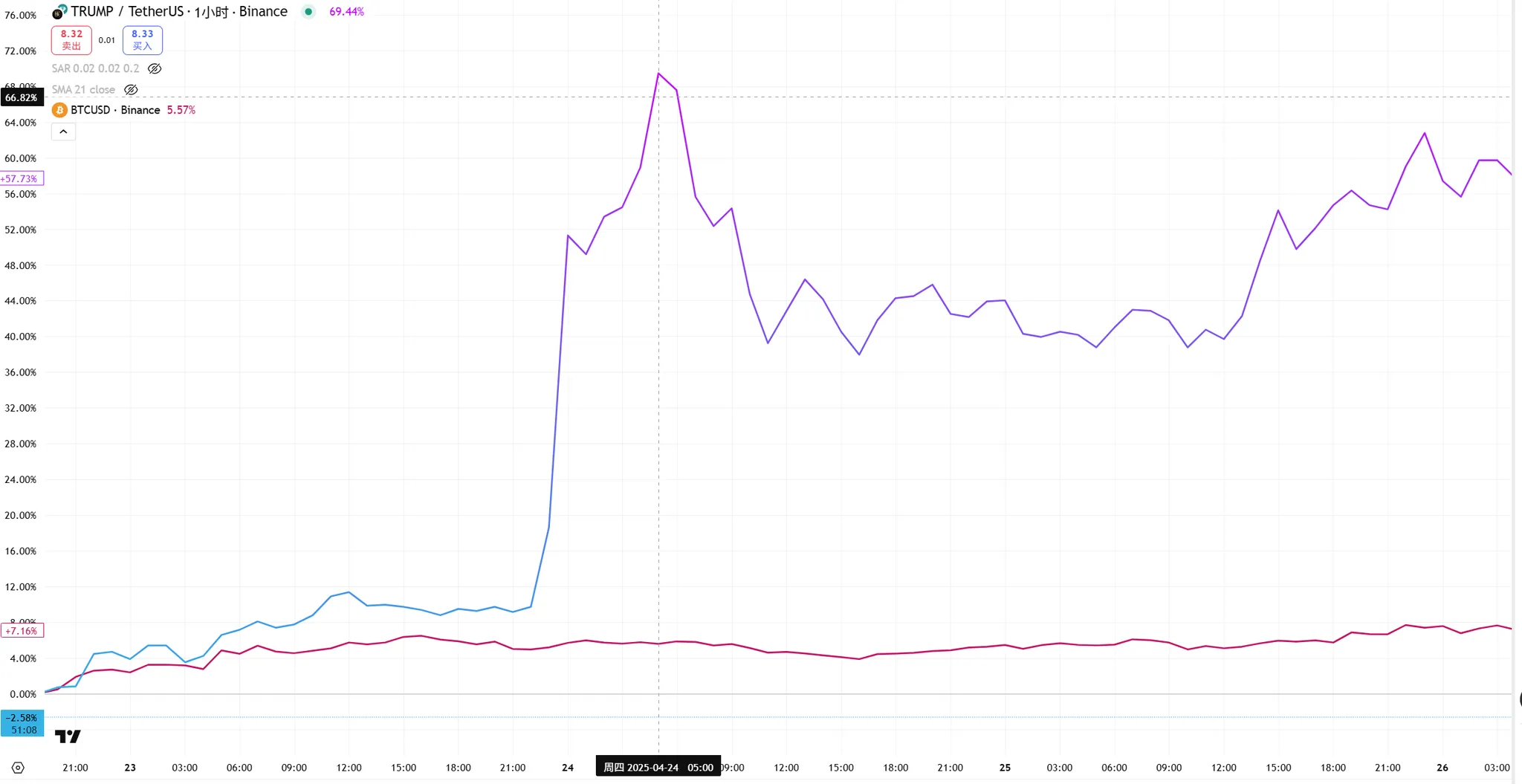

5. Announcement of TRUMP Dinner (April 22)

The official website of the Trump Meme coin announced that it would invite the first 220 token holders to dinner in Washington on May 22, claiming an opportunity to hear Trump's "first-hand" information about the future of cryptocurrency. The first 25 would receive private reception from Trump and a "special edition" White House tour. The website urged participants to "hold as many tokens as possible" before May 12.

The price of $TRUMP token surged 60% after the announcement.

Phase Three: Ecological Expansion Period (July-September 2025)

1. Signing of the GENIUS Act (July 18, 2025)

Trump signed the GENIUS ACT, the first major cryptocurrency legislation in the U.S., providing a federal regulatory framework for stablecoins (such as $USD1).

Strategic Significance:

- Paving the way for the Trump family's WLFI project’s USD1 stablecoin

- Building a complete Trump cryptocurrency ecosystem

Impact on TRUMP Token: Indirectly positive, but no significant price reaction, remaining in a consolidation phase.

2. $WLFI Token Listing (September 1, 2025)

As the governance token of World Liberty Financial, WLFI was packaged as a "legitimate" project with actual DeFi functionality, deeply tied to the USD1 stablecoin. The Trump family holds 2.25 billion tokens, with a book value of about $5 billion.

The token price plummeted from an opening of 40 cents to 21 cents, a drop of 48%, and then continued to decline to hover around -35%. This dismal performance of "high opening and low closing," combined with concentrated selling by major holders like Justin Sun, triggered strong resentment in the community towards the Trump family's "empty-handed" model, which not only failed to enhance the overall value of the Trump crypto ecosystem but also exposed the fundamental issue of over-packaging political IP, bringing a long-term trust crisis to the entire Trump crypto brand.

However, despite WLFI's continuous decline, Trump remained unaffected, still maintaining a consolidation phase.

Conclusion

1. Diminishing Emotional-Driven Effect

Diminishing Process:

- January Outbreak Period: 100% emotion-driven, unprecedented "presidential token issuance," large daily fluctuations, pure FOMO and political frenzy

- March to June Transition Period: Beginning to focus on policy fundamentals, but emotions still act as amplifiers, with fluctuations reduced to 30-50%

- From July to now: Rationality returns, primarily consolidating, with daily fluctuations narrowing to 10-25%, and an increase in long-term holders.

Core Reason: The market is shifting from a "gambling mentality" to "value discovery," with a maturation of participant structure, where policy expectations replace pure emotions as the main pricing factor.

2. Policy Expectations vs. Reality Gap

Typical Pattern:

- Expectation Phase: Policy rumors drive prices up, with vast market imagination space

- Announcement Phase: Specific details often fall short of expectations, revealing the "buy the expectation, sell the reality" rule

- Execution Phase: Actual effects determine long-term impact

Classic Cases:

- March 6 Bitcoin Reserve Order: Expectation of large-scale purchases, reality only promises not to sell, leading to price correction

- March 7 White House Summit: Expectation of revolutionary breakthroughs, reality of moderate commitments, leading to widespread declines in altcoins

- April 22 TRUMP Dinner: Expectation of direct contact with policymakers, surging 60% before retreating

Rule Summary: The sustainability of positive policy effects is limited; investors should adopt a "buy the rumor, sell the news" strategy.

3. The Double-Edged Sword Effect of Political IP

Advantages:

- Unreplicable Authority: The only presidential-level meme coin globally, with extreme scarcity

- Policy-Making Power: Directly influences U.S. cryptocurrency regulatory policies, creating a favorable environment for its ecosystem

- Super IP Effect: Global media attention, extremely low marketing costs, and significant influence

- Compliance Background: Government backing reduces the risk of regulatory crackdowns

Risks:

- Moral Controversy: Questions about the compliance nature of presidential token issuance and conflicts of interest

- Over-Reliance: Extreme dependence on Trump's personal reputation and political status

- Double-Edged Sword Nature: Political identity serves as both the greatest moat and the biggest source of risk, amplifying both advantages and disadvantages.

The above report data is edited and organized by WolfDAO (X: @10xWolfDAO). For any inquiries, please contact us for updates.

Written by: WolfDAO

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。