近期,OpenAI与Anthropic相继发布了关于ChatGPT和Claude的核心用户报告。这两份文件并非简单的业绩展示,而是揭示了当前人工智能产业一个至关重要的趋势:两大头部模型正沿着截然不同的路径演进,其市场定位、核心应用场景与用户互动模式已出现显著分化。

为此,硅兔君结合与其硅谷专家团队的交流对两份报告进行比较分析,提炼其背后隐藏的产业信号,并探讨其对未来技术路线、商业模式及相关投资策略的深层启示。

两份报告的数据清晰地展示了ChatGPT与Claude在用户基础和核心功能上的不同侧重,这是理解其长期战略分野的起点。

ChatGPT:在通用型应用领域的市场渗透

OpenAI的报告证实了ChatGPT作为现象级应用的地位。截至2025年7月,其周活跃用户已超过7亿。用户结构呈现出两个关键特征:

首先,用户群体已成功扩展至更广泛的人群,早期以技术人员为主的用户画像已转变为高学历、跨职业的白领群体;

其次,性别比例趋于平衡,女性用户占比上升至52%。

在应用场景方面,ChatGPT的核心功能集中在三个领域:实用指导、信息查询和文书写作,这三项占据了对话总量的近80%。

用户主要将其用于辅助日常生活与常规办公任务。值得注意的是,报告明确指出,编程等专业技术类协助的使用比例,已从12%显著下降至5%。

综合来看,ChatGPT的战略路径是成为一个服务于广泛用户群体的通用型AI助理。其核心壁壘在于巨大的用户基数和由此形成的网络效应,以及在用户日常信息处理流程中的高渗透率。

Claude:聚焦企业级与专业自动化场景

Anthropic的报告则描绘了一幅截然不同的图景。Claude的用户分布与地区的经济发展水平(人均GDP)呈现强正相关性,表明其主要用户群体是发达经济体中的知识型工作者和专业人士。

其核心应用场景高度聚焦。报告数据显示,软件工程是几乎所有地区最主要的应用领域,相关任务占比稳定在36%至40%之间,这与ChatGPT在该领域的应用趋势形成鲜明对比。

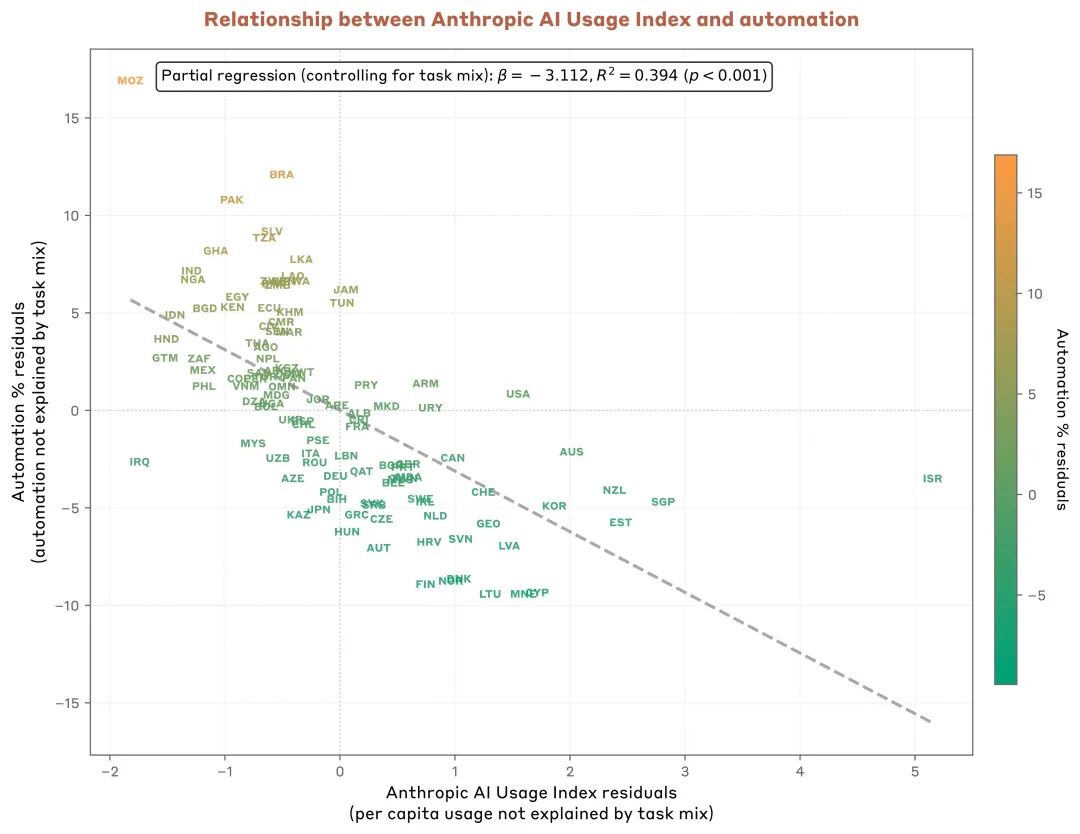

报告中最具冲击力的数据,体现在“自动化”任务的占比上。在过去8个月内,用户直接下达指令、由AI独立完成大部分工作的“指令式”自动化任务,其份额从27%大幅提升至39%。

在付费API的企业级用户中,这一趋势更为明显:高达77%的对话交互呈现出自动化模式,且绝大多数为最低程度人工干预的“指令式”自动化。

因此,Claude的战略定位十分清晰:成为一个深度整合至企业核心工作流的专业级生产力与自动化工具。其竞争优势在于对特定专业领域(尤其是软件开发)的深度优化和对任务执行效率的极致追求。

基于上述战略分野,硅兔君及其硅谷专家团队对两份报告的数据进行交叉比对,为投资者提炼出三个具有前瞻性的产业洞察。

一:“编程应用”分化,预示专业化AI工具市场的崛起

ChatGPT与Claude在编程应用上的此消彼长,并非反映了市场需求的波动,而是用户需求向“专业化”和“集成化”的升级。

通用型对话界面已难以满足专业开发者在复杂工作流中的深度需求。他们需要的是能够与集成开发环境(IDE)、代码版本控制系统和项目管理软件无缝对接的AI功能。

这一趋势预示着一个重要市场机会的出现:专为特定行业(如软件开发、金融分析、法律服务)打造的,与现有工作流深度绑定的“AI原生工具链”。

这要求AI不仅要具备模型能力,更要具备对行业的深刻理解。对于相关领域的投资而言,评估标的是否具备构建这种“深度集成”的能力,将成为关键考量点。

二:“77%自动化率”,量化企业任务自动化进程的加速

Anthropic报告中“77%的企业API自动化率”是一个极强的信号,它表明在商业应用前沿,AI的角色正在从“人类辅助”快速转向“任务执行”。

这一数据要求我们重新评估AI对企业生产力、组织结构和成本模型的影响速度。过去市场普遍关注AI的“增效”价值,但现在必须将“替代”价值纳入核心分析框架。

投资逻辑需从评估“AI如何辅助人类员工”,扩展至“在哪些知识型工作领域,AI能以更高效率和更低成本独立完成标准化任务”。

财务报表生成、合同初审、市场数据分析等流程化、高人力成本的领域,将是AI自动化技术最先产生显著经济效益的方向。

三:“协作与自动化”模式差异,揭示AI商业模式的演进路径

报告中一个反直觉的数据点是:人均Claude使用率越高的地区,用户越倾向于“协作”模式;反之,使用率较低的地区更倾向于“自动化”模式。

这可能揭示了AI商业模式与用户成熟度的演进关系。在市场的早期渗透阶段,用户更倾向于将AI作为简单的效率工具,用于替代性地完成独立任务(自动化)。

而当用户(尤其是专业用户)对AI的能力边界和交互方式有了更深的理解后,他们会开始探索如何与AI进行复杂的协同工作,以完成过去难以实现的、更具创造性的任务(协作)。

这对AI的长期商业模式提出了新的思考。除了通过自动化替代来削减成本(SaaS模式),通过人机协同来创造全新价值和提升决策质量,可能催生出更高级的商业模式,例如基于效果付费或决策支持订阅。投资者在评估AI项目时,应同时考量其在“自动化”和“协同创造”两条路径上的发展潜力。

以上基于公开报告的分析,仅是决策流程的起点。一份完整的决策,还需要回答更深层次的、关于“如何实现”以及“由谁实现”的关键问题,例如:

在“AI原生工具链”领域,最具潜力的初创公司的技术架构、团队构成和市场验证情况如何?

在头部科技公司内部,实现高比例任务自动化的真实技术路径、部署成本和投资回报率(ROI)的具体数据是什么?

像苹果这样的公司,其闭环生态下的AI战略,特别是自有大模型的底层技术逻辑和商业化路径是怎样的?

这些信息无法从公开报告中获得,它们源于产业一线的实践经验。要真正理解当前AI产业的动态,就需要与正在定义这些技术和产品的核心人物进行直接对话。

例如,为深入研究行业一线,我们的金融客户近期曾与以下两位专家进行过深度交流:

一位来自Apple机器学习部门的ML/DL/NLP科学家、技术负责人。 作为从零开始训练苹果自有大语言模型(LLM)的核心成员,他能够直接揭示科技巨头在自建核心AI能力时面临的技术挑战、真实的训练成本,以及直接向最高管理层汇报的战略考量。

一位Meta生成式AI组织的技术主管(Engineer Lead)。 作为创始工程师,他不仅深度参与LLM大模型的研发,更关键的是,他主导了将GenAI技术与广告排名、推荐系统等核心商业引擎相结合的落地过程。与他的交流,能够清晰地勾勒出从模型能力到商业ROI的转化路径,以及他对北美前沿AI创业公司的投资观察。

来自这类专家的见解,将公开报告中的宏观趋势,转化为可以指导具体决策的、颗粒度极细的战术信息。在一个信息快速迭代的产业环境中,获取超越公开信息的深度洞察,是建立认知优势、做出精准决策的根本。如果您对上述议题有进一步探讨的需求,我们欢迎您与我们联系,以安排相应领域的专家交流。

当您的团队为技术路线争论不休时,当您的投资决策悬而未决时,当您的产品战略陷入迷雾时……请记住,您所面临的困惑,或许正是某位专家早已跨越的征途。我们硅兔君相信:真实的一手经验,永远来自正在推动行业变革的人本身。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。