According to the Anthropic Economic Index report, 77% of Claude users' use cases are concentrated in commercial applications, with 36% specifically for programming tasks, demonstrating clear enterprise-level characteristics.

Written by: Dong Jing, Wall Street Insights

The global AI market is showing a clear trend of user group differentiation. The latest data from the two giants, OpenAI and Anthropic, indicates that ChatGPT is becoming the preferred personal life assistant, while Claude dominates in enterprise automation deployment.

According to previous reports from the Trading Desk, Barclays stated in its latest research that data shows Anthropic's API business revenue accounts for as much as 90%, far exceeding OpenAI's 26%, highlighting Claude's strong position in the B-end market.

User behavior analysis further confirms this differentiation trend. According to the Anthropic Economic Index report, 77% of Claude users' use cases are focused on commercial applications, with 36% specifically for programming tasks, showcasing clear enterprise-level characteristics. In contrast, OpenAI's research shows that 73% of ChatGPT's uses are unrelated to work, taking on more of a personal assistant role.

Analysis points out that the two top AI models globally are following distinctly different commercial paths: Claude, with its advantages in API integration and enterprise automation, is reshaping the B-end AI service landscape, while ChatGPT continues to solidify its leadership position in the consumer market.

Claude Establishes Leading Advantage in the API Market

According to reports from the Trading Desk, Barclays previously stated that Anthropic has built significant competitive barriers in the enterprise-level AI service market.

Data shows that 90% of Anthropic's revenue comes from its API business, while only 26% of OpenAI's revenue is derived from this channel, with its main revenue still relying on ChatGPT consumer products.

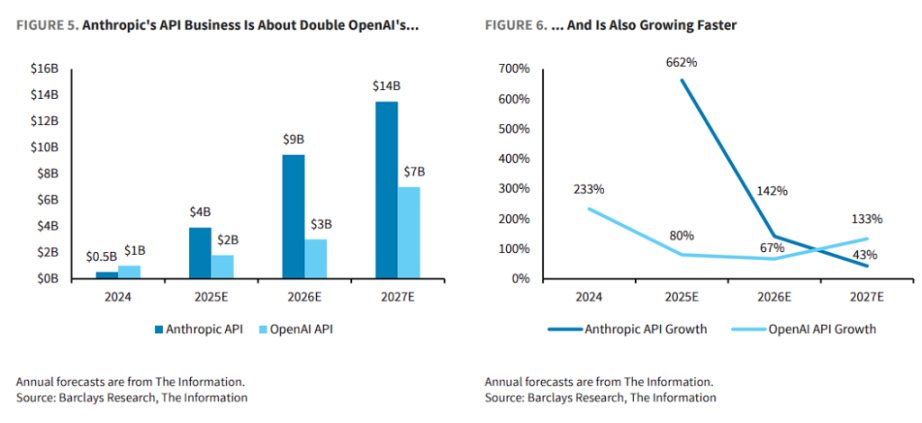

Revenue growth data further highlights Claude's strong momentum in the B-end market.

Anthropic's API business is expected to achieve $512 million in revenue in 2024, with projections to surge to $3.907 billion in 2025, a year-on-year growth of 662%. In contrast, OpenAI's API business is projected to generate $1 billion in revenue in 2024, increasing to $1.8 billion in 2025, with a growth rate of 80%.

Analysis indicates that this difference in revenue structure reflects the different strategic focuses of the two companies. Claude focuses on providing programmable integrated AI capabilities for enterprise clients, while ChatGPT relies more on a subscription-based consumer service model.

Differentiation in Use Cases Confirms Commercial Positioning Differences

User behavior data further confirms the different positioning of the two AI models.

According to the Anthropic Economic Index report, Claude users exhibit clear commercialization characteristics: 77% of use cases involve commercial applications, with 36% specifically for programming tasks.

Among API clients, this trend is even more pronounced, with 77% of enterprise usage showing an automation model, primarily for task delegation rather than collaborative interaction.

OpenAI's research paints a distinctly different picture.

Analysis based on 1.5 million user chat records shows that non-work use has become the primary application scenario for ChatGPT. By June 2024, work and personal use are expected to be roughly equal, but by June 2025, non-work use is projected to account for 73% of all conversations.

In over 1 million categorized conversations, "practical guidance" accounts for 28.3%, covering personal needs such as daily advice, academic help, and fitness guidance, with writing assistance coming in second.

The frequency of programming task usage also shows significant differences. Among Claude users, 36% are engaged in programming-related work, while only 4.2% of ChatGPT users' conversations involve programming, further highlighting the differentiation in their target user groups.

Enterprise Automation Demand Drives Claude's Growth

Claude's success in the enterprise market stems from its precise grasp of automation needs.

API data shows that enterprise clients primarily use Claude for programmable integrated task execution rather than collaborative human-computer interaction. This usage pattern aligns closely with enterprises' pursuit of efficiency and scalability.

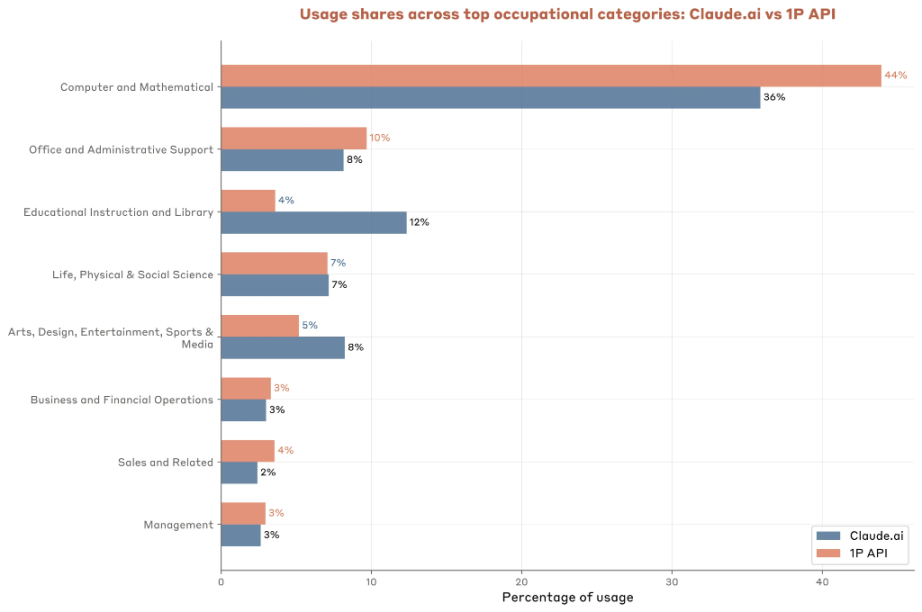

In terms of task distribution, Claude's API clients concentrate 44% of their usage on computer and mathematical tasks, significantly higher than the 36% on the Claude.ai platform. Meanwhile, office and administrative management tasks account for about 10%, reflecting strong demand for automated office solutions. Enterprises are also deploying Claude in areas such as marketing material creation and business recruitment data processing.

Surprisingly, enterprises show relatively low sensitivity to AI usage costs.

A 1% increase in cost only leads to a 0.29% decrease in usage frequency, indicating that model capability, ease of deployment, and economic value are more important than cost. More expensive tasks often have higher usage rates; for instance, computer and mathematical tasks have costs over 50% higher than sales-related tasks, yet their usage remains dominant.

Geographical Distribution Reflects Different Market Strategies

The geographical usage patterns of the two AI models also reflect their different market positioning.

Claude's usage rate is strongly positively correlated with the GDP of various countries, with a 1% increase in per capita GDP corresponding to a 0.7% increase in Claude's usage rate. Technologically advanced small economies like Israel and Singapore lead the world in Claude adoption rates.

In the U.S. market, Washington D.C. and Utah lead in per capita Claude usage rates, reflecting high demand for enterprise-level AI tools from government departments and the tech industry. This distribution pattern aligns with Claude's positioning towards high-value enterprise clients.

ChatGPT, on the other hand, shows a broader trend of global adoption.

OpenAI's research indicates that ChatGPT is growing faster in poorer countries than in wealthier ones, with a more diverse user base. By June 2025, 52% of ChatGPT users are expected to be female, with nearly half of the users aged between 18-25.

Differentiated Technical Capabilities Shape Competitive Landscape

The differing technical capabilities of Claude and ChatGPT are shaping their respective competitive advantages.

Claude excels in code generation, debugging, and technical problem-solving, closely linked to its success in the API market.

The rapid adoption of new tools by the developer community and the relatively low organizational barriers for individual developers have laid the foundation for Claude's enterprise-level applications.

ChatGPT, on the other hand, has a stronger advantage in information retrieval and personal guidance.

"Information search" has become the third-largest use case for ChatGPT, with users viewing it as an alternative to web search. Analysis suggests that this application model poses a potential challenge to traditional search engines like Google and creates opportunities for OpenAI to explore new revenue sources such as advertising and e-commerce recommendations.

The differences in human-computer collaboration modes between Claude and ChatGPT are also noteworthy.

Claude users are more inclined to delegate complete tasks to AI, reflecting enterprises' preference for automation. ChatGPT users, however, tend to engage in collaborative interactions, aligning with personal users' learning and exploration needs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。