Author: Felix, PANews

Since its inception in 2009, Bitcoin, as the first decentralized digital currency, has gradually evolved from a niche experiment into a globally significant value storage and settlement network, now developing into an asset class valued at approximately $2 trillion. Despite Bitcoin's many achievements, new investors are eager to achieve high returns, and with Bitcoin prices soaring, it may be difficult to realize the substantial returns enjoyed by early investors.

Beyond passive asset appreciation, how to generate earnings from Bitcoin has also become a significant market demand. Data shows that currently over 98% of Bitcoin is idle. Unlocking the potential within this idle Bitcoin and transforming it from an early centralized value storage method into a distributed internet infrastructure used by billions is key to advancing Bitcoin's development to a new level.

Inspired perhaps by the emergence of DeFi from Ethereum, the idea of building DeFi based on Bitcoin has arisen. Starting with tokenized Bitcoin, Bitcoin has gradually transitioned from a static asset to programmable capital. Since the introduction of WBTC in 2019, the market has spawned 50 versions of tokenized Bitcoin across more than 20 blockchains. After six years of infrastructure development (from WBTC to transparent, permissionless solutions), significant leaps have been made in infrastructure technology, including cross-chain protocols, custody solutions, and regulatory frameworks. Currently, the on-chain value of tokenized BTC has reached $40.18 billion.

The First "On-Chain Bitcoin Economy Report" Released, Capital Integrating Around Three Major Competitive Advantages

As more holders turn their Bitcoin to other blockchain networks to unlock new features and generate earnings, the development of the on-chain Bitcoin economy is gradually moving out of the "wild" experimental phase, but research on the on-chain Bitcoin economy has yet to form a systematic and structured approach.

Recently, Bitcoin infrastructure builder Zeus Network released the first “On-Chain Bitcoin Economy Report”. The report provides a comprehensive overview of the on-chain Bitcoin economy, noting that various blockchain platforms are adopting differentiated development strategies based on their own advantages, with a survival of the fittest effect gradually emerging.

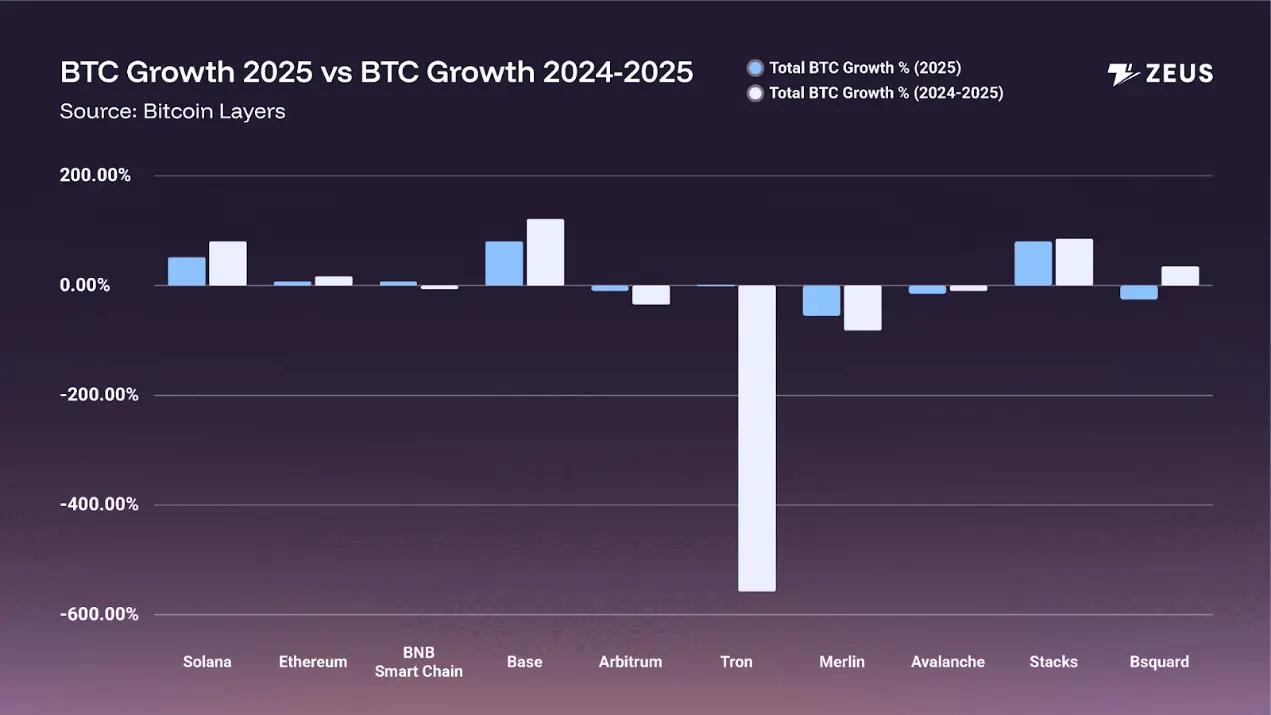

The “On-Chain Bitcoin Economy Report” indicates that the top four performing blockchains (Base, Ethereum, Stacks, Solana) are projected to grow by over 26,000 BTC by 2025, while the bottom five blockchains have collectively lost over 8,000 BTC.

Source: “2025 On-Chain Bitcoin Economy Report” (Author: Zeus Network)

The report mentions that Bitcoin capital is currently integrating around three major competitive advantages: native Bitcoin integration (Stacks), access to a mature user base (Base), and excellent DeFi performance (Solana).

Among them, Base, driven by the user base advantage of Coinbase, achieved a growth rate of 99.83%, providing millions of users with convenient bridging access and offering institutional clients a pathway for Bitcoin deployment. Its outstanding performance indicates that mature platforms have a significant competitive advantage compared to purely technical solutions.

Following closely is Stacks, with a growth rate of 79.65%, indicating a strong market preference for infrastructure that aligns closely with Bitcoin, maintaining a tighter connection with the base layer while supporting programmability.

The head platform effect is also gradually emerging, as weaker participants like Tron (-541%) and Merlin (-80%) have seen significant declines, suggesting that the market is consolidating around mature solutions.

Notably, Solana achieved a growth rate of 76.56%, showcasing its performance advantages. Bitcoin holders prioritize practical advantages such as speed, low cost, and robust DeFi functionality when choosing effective deployment locations for their assets.

Currently, the Bitcoin tokenization options on the Solana platform have increased from 2 (WBTC and tBTC) in August 2024 to 8 in August 2025, forming a comprehensive ecosystem consisting of 21 projects, including 4 DEXs (APOLLO, HawkFi, Jupiter, and Meteora), 12 DeFi protocols (including btcSOL, Drift, Kamino, Orca, and Raydium), 4 infrastructure projects (Portal/Wormhole, Zeus Network, Threshold), and 1 DAO (MonkeDAO).

Among them, APOLLO, as the first on-chain Bitcoin exchange on the Solana platform, plays an important role in expanding the influence of native Bitcoin on Solana.

Exchange APOLLO and Re-Staking Model btcSOL Expand User Base and Application Scope

As a permissionless Bitcoin infrastructure protocol on the Solana platform, Zeus Network is dedicated to accelerating the development of Bitcoin's on-chain economy and applications. It has not only launched the first permissionless Bitcoin zBTC on Solana but also released subsequent dApp products that expand the user base and application scope of zBTC, increasingly highlighting its role on the Solana platform.

In March 2025, Zeus Network launched APOLLO Mainnet v1, the first on-chain Bitcoin exchange on Solana, aimed at providing a seamless, permissionless way to trade and manage assets.

As Zeus Network's flagship dApp, APOLLO differs from centralized platforms by allowing Bitcoin holders to trade, exchange, and earn various versions of Bitcoin on-chain without intermediaries or restrictions. By introducing the zBTC asset, which is pegged 1:1 to Bitcoin, APOLLO seamlessly integrates Bitcoin liquidity into the Solana ecosystem, providing trustless decentralized solutions for retail, developers, and institutional investors to unlock the full potential of Bitcoin in the DeFi space.

Notably, APOLLO also launched the Earn feature in August, providing users with ways to earn returns. On APOLLO Earn, users can choose lending, liquidity pool, or staking strategies, each integrated with currently supported zBTC protocols. In the future, APOLLO will continue to collaborate with DeFi protocols to update Earn and introduce new strategies, offering users more diverse Bitcoin earning options.

Following the launch of APOLLO, Zeus Network's second dApp product, the re-staking model btcSOL, also went live in July, providing Solana users with a convenient, permissionless way to enter BTCFi. btcSOL allows holders of SOL or LST-SOL (Solana liquid staking tokens) to stake their tokens and accumulate BTC, with the system automatically converting the staked tokens into btcSOL re-staking tokens based on a price index, generating on-chain returns that are automatically converted into zBTC.

Additionally, btcSOL has partnered with the liquid staking platform Marinade Finance on Solana, where 5.5% of users' staked SOL will continuously convert into zBTC, steadily increasing Bitcoin exposure without any extra steps. The btcSOL v1.5 version released on September 9 added jupSOL and kySOL. Currently, users can stake SOL, mSOL, JupSOL, and kySOL to accumulate zBTC (Solana native Bitcoin).

Although the market competition for Bitcoin tokenization is fierce, Zeus Network has found a differentiated market position through unique design choices and functional positioning. With its technological advantages, strong team, and partner network, along with support from the Solana ecosystem, it has the potential to capture significant market share in this field.

However, like all blockchain projects, Zeus Network also faces certain risks and challenges, such as security vulnerability risks, regulatory uncertainties, market acceptance, and some reliance on the continued growth and success of the Solana ecosystem.

In the future, Zeus Network plans to achieve multi-chain expansion, integrating more blockchain networks beyond Bitcoin and Solana; additionally, it plans to cultivate a thriving developer community by releasing programming libraries and developer tools, gradually achieving decentralized governance.

Conclusion

The transformation of Bitcoin into an income-generating asset is no longer a question of "if," but "when." Not only have institutions created their branded packaged Bitcoin, but the emergence of permissionless infrastructure allows any community, protocol, or collective to create transparent, verifiable representations of Bitcoin based on their specific needs. Zeus Network provides a promising solution for unlocking the immense potential value of Bitcoin by innovatively addressing the cross-chain communication issues between Bitcoin and Solana.

Related Reading: Permissionless Bitcoin on Solana: Zeus Network Launches APOLLO Platform and zBTC

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。