联邦储备利率下调及其对加密货币和市场的影响

特朗普预测大动作——市场为联邦储备利率下调做好准备

唐纳德·特朗普总统在本周末表示,他预计联邦储备将在本周的会议上进行“大幅下调”。他告诉记者:“我认为你会看到一个大幅下调……这非常适合下调,”当他返回华盛顿时说道。

分析师表示,25个基点的下调可能会导致短期波动,但如果政策持续宽松,可能会在未来几个月帮助加密货币和黄金。

来源 : 彭博社

为什么预计联邦储备会下调利率

经济学家和交易员普遍预计,联邦储备将在9月17日的会议上将基准利率下调25个基点。联邦储备面临就业市场放缓和通胀尚未完全降温的局面,许多观察人士认为小幅下调是中央银行家们将采取的路径。

联邦储备的决定在异常的政治压力下进行。白宫多次推动宽松政策,这引发了对联邦储备独立性的质疑。不过,联邦储备在投票时仍需权衡通胀数据和就业市场的强度。

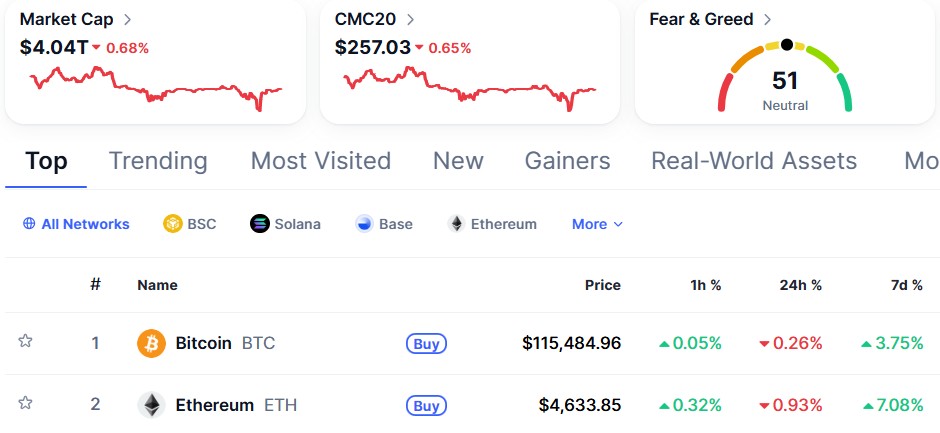

当前加密市场

今天全球加密市场总市值约为4.04万亿美元,24小时交易量处于低位。比特币仍然占据市场的一半以上。当大型中央银行放宽政策时,总体加密流动性和交易量通常会迅速上升。在撰写本文时,比特币和以太坊在过去24小时内略有上涨。

• 比特币 (BTC): $115,484.

• 以太坊 (ETH): $4,633.

来源 : Coinmarketcap

如果联邦储备下调利率,现金收益率将下降。这使得风险资产看起来更具吸引力,因为安全账户的收益较低。交易员和基金可能会将一些资金转移到比特币、以太坊和其他加密项目中以追求收益。短期内这可能会推高价格,并导致快速波动。

为什么Native Markets USDH新闻现在很重要

另外,Native Markets刚刚在Hyperliquid上申请了USDH代号,并将推出提案和ERC-20版本的稳定币。新的稳定币和交易所上市可以在网站和代币之间转移流动性,特别是在美国政策使更多资金追逐加密货币的情况下,这一点尤为重要。

换句话说:宽松的联邦政策 + 新的稳定币 = 更多交易者可以停放资金的地方。

接下来要关注什么

• 9月17日的联邦储备声明和主席讲话 — 注意关于未来下调的语言。

• 联邦储备后比特币和以太坊价格的波动 — 可能出现大幅波动。

• Hyperliquid和其他交易所的USDH交易和流动性流动 — 新的稳定币可能会改变短期交易量。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。