Security Concerns Grow as Monero Network Endures 18-Block Reorg Attack

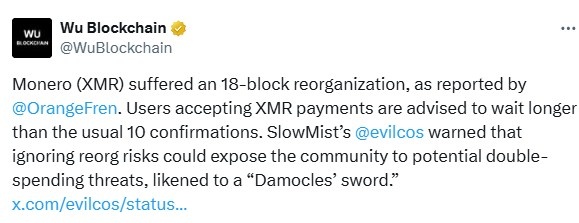

The Monero network came under fresh pressure this week after suffering an 18-block reorganization that unsettled users and raised fears of a possible 51% attack.

Known for its strong privacy features, it has built a loyal community, but the reorg has once again put a spotlight on the coin’s security.

Source: X (previously Twitter)

Source: X (previously Twitter)

A blockchain reorg happens when miners replace part of the chain with a new version. This can lead to older transactions being reversed, raising the risk of double-spending.

For merchants who accept the XMR token, the event served as a warning to wait longer for confirmations before finalizing payments.

Experts Warn of Double-Spend Risks

Security researchers reacted quickly. SlowMist’s co-founder, known online as @evilcos, said ignoring such risks is like “living under a Damocles’ sword.”

He explained that repeated reorganizations could allow attackers to spend the same Monero token more than once.

This is not the first time the Monero network has been tested. Analysts have long warned that if one party controlled enough hash power, a attack could destabilize the chain. The latest reorg shows those concerns remain valid.

XMR Price Defies the Fear

Despite the scare, the XMR price actually moved higher. it rose 1.11% in the past 24 hours to trade at $289.03, outpacing the broader crypto market, which slipped 0.36%.

Over the past week, the coin has gained 6.59%, and in the past month it’s up 21.39%.

Traders pointed to several reasons for the rebound:

Technical Breakout: The XMR token is maintaining above significant Fibonacci support, with temporary buyers in action after breaking $276.72.

Network Resilience: The network recently reacted to mining centralization threats associated with Qubic by redistributing power back to small pools.

Leverage Demand: GMX introduced XMR/USD trading with up to 100x leverage, enhancing market activity.

Technical Momentum Looks Strong

-

Charts indicate that XMR is above its 7-day SMA ($273.46) and 30-day SMA ($267.48).

-

The RSI is at a neutral point of 60.58 but rising.

-

The MACD histogram shifted positive (+2.66) as a bullish sign.

-

Traders are watching the 200-day SMA at $279.26.

-

A strong close above that line could push the coin toward $305.74, based on Fibonacci extension levels.

Network Security Still a Key Debate

The Monero network has faced concerns about mining centralization. In August, Qubic’s pool briefly controlled 35% of the hashrate, sparking fears of a 51% attack.

While Kraken even paused deposits at the time, the community quickly acted by moving hash power into smaller pools like P2Pool. Qubic’s share has since dropped, and P2Pool now controls about 15%.

This rapid reaction has strengthened confidence, but experts note that decentralization continues to be essential for long-term trust. If threats can consolidate power again, another Monero attack may ensue.

Can $XMR Hold Its Momentum?

The Monero network has been resistant in the past, withstanding exchange delistings and regulatory crackdowns. Its proponents believe privacy coins continue to play a vital niche role in crypto.

For the time being, traders appear to be banking on the positive momentum. The XMR token is providing good technical cues, and the network's quick response to centralization threats has alleviated some of the fears. However, the recent reorg reminds us that the battle to keep Monero secure remains ongoing.

As the users and market keep a keen eye, the resilience of Monero's network will again be put to test in the next few weeks.

Also read: Spur Protocol Daily Quiz Answer 14 September 2025: Earn Rewards免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。