全球关注:亚历克斯·索恩预测美国比特币储备

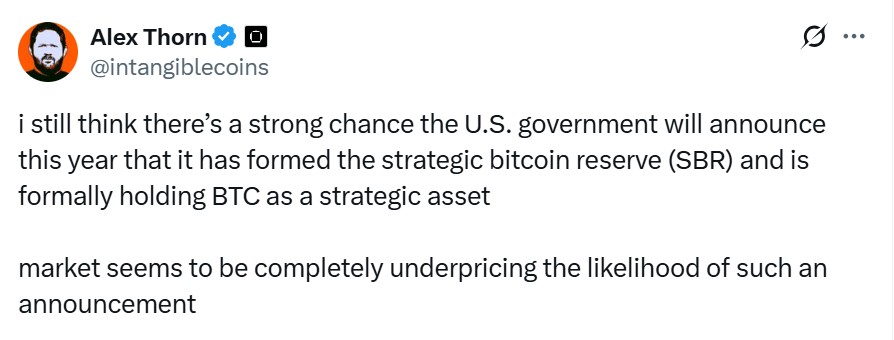

银河数字的研究主管亚历克斯·索恩表示,美国政府在年底前宣布战略比特币储备(SBR)的可能性很大。他写道,市场低估了这一可能性,并指出最近政府的举动使这一想法更具可行性。

来源 : X

SBR的含义及亚历克斯·索恩的建议

一个战略比特币储备意味着美国将比特币作为官方资产,类似于各国持有的石油或黄金储备。各机构已经控制了大量从案件中没收的比特币,因此国家已经拥有可以称之为“储备”的币。索恩指出,这些持有的比特币是实现SBR的最简单途径。

这个想法并不是全新的。在三月份,白宫和几个机构开始公开行动,指向一个正式的储备。报道称,政府已经控制了大量从没收中获得的比特币,并且正在起草关于如何保管和增加这一储备的规则。这些早期的步骤解释了为什么亚历克斯·索恩表示正式的SBR公告可能很快就会到来。

市场声音与更广泛的背景

行业声音各异。一些专家欢迎SBR可能带来的稳定性。另一些人则担心政治和利益冲突。亚瑟·海斯最近呼吁比特币持有者保持耐心,认为长期思考比追逐快速收益更为重要。这一提醒与索恩的主张并行,显示出辩论既涉及政策也涉及投资者行为。

全球影响及其他国家可能的反应

一些国家可能会效仿这一想法,开始建立自己的数字储备。已经持有比特币或拥有支持加密货币领导人的国家可能会更快行动。目前,许多国家已经开始建立自己的储备,并在其财政部中持有数字资产。

其他国家可能会担心政治风险,或要求更明确的规则来管理数字资产。此举可能加速全球关于国家应如何在官方金融中对待加密货币的辩论。

对美国加密市场的影响——短期与长期

如果美国表示将比特币作为战略资产,短期内价格波动是很可能的。一个正式的计划或购买项目可能会迅速推高价格,因为这表明政府的强烈需求。

在长期增长中,美国可能成为国家比特币财政的最大巨头。ETF发行人和银行将密切关注,并可能改变他们提供加密产品的方式。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。