Written by: Lei Jianping, Lei Di Network

Figure Technology Solutions Inc. (stock code: "FIGR"), a lending company based on blockchain technology, was listed on the NASDAQ in the United States yesterday.

Since 2025, the U.S. stock market has seen a significant recovery.

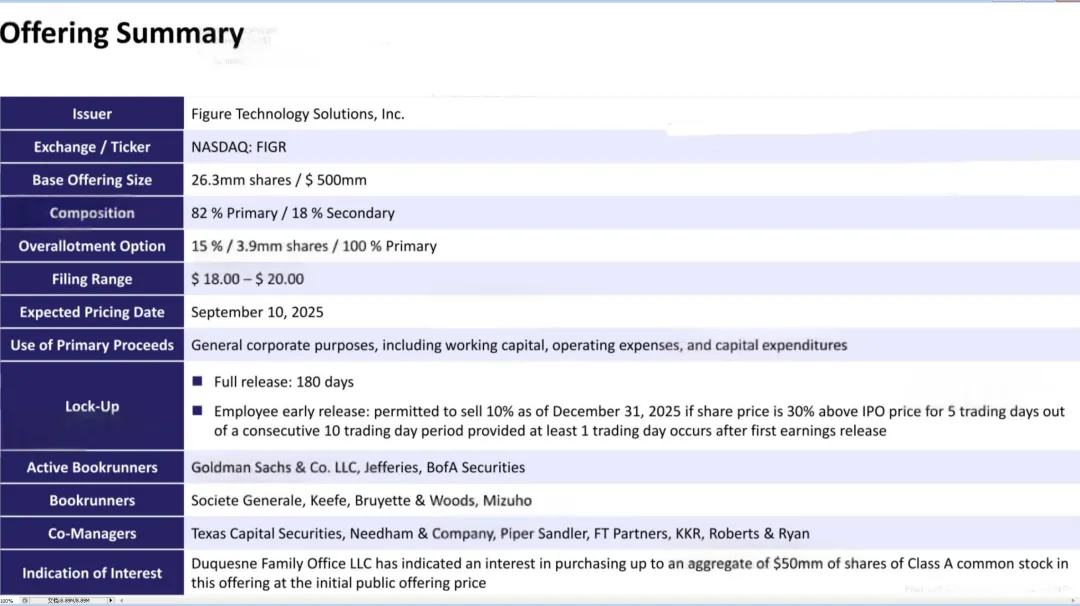

Before its listing, Figure raised its issuance range from $18 to $20 to $20 to $22, increasing the issuance scale from 26.32 million shares to 31.5 million shares.

The final issuance price of Figure was $25, raising a total of $788 million.

Figure's opening price was $36, a 44% increase from the issuance price; the closing price was $31.11, a 24% increase from the issuance price; based on the closing price, the company's market value is $6.6 billion.

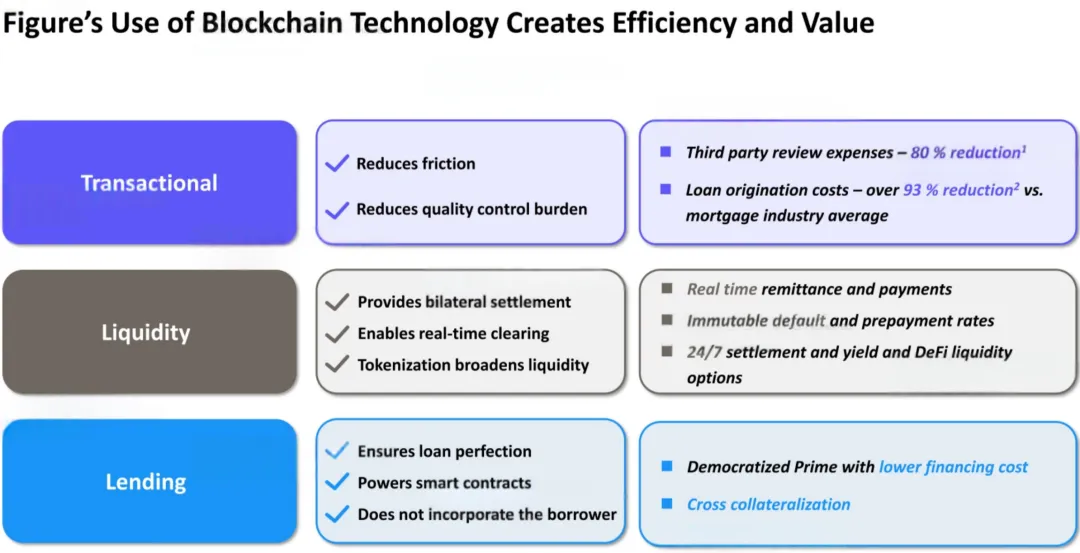

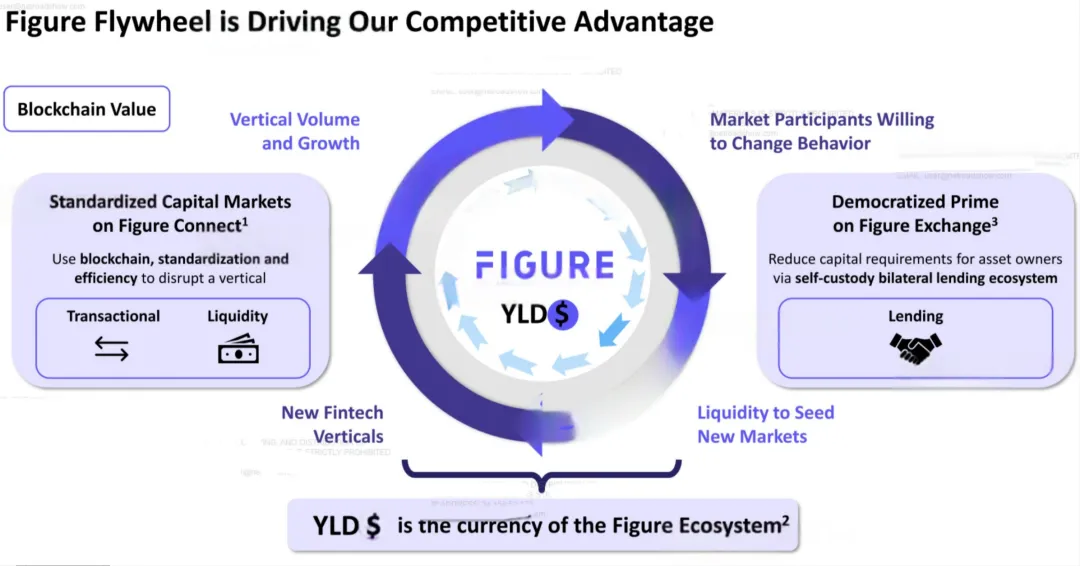

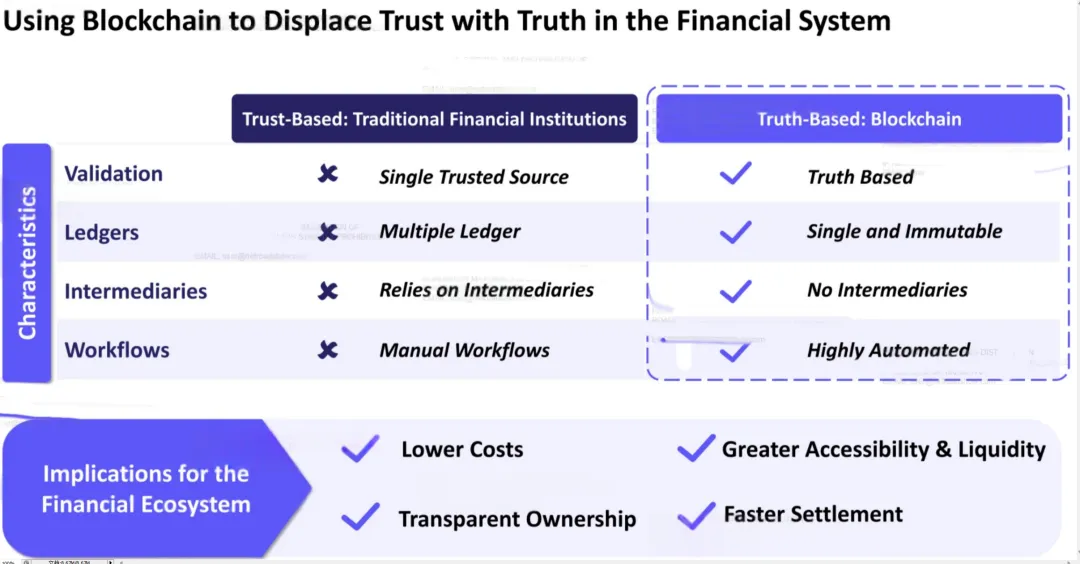

Figure co-founder Mike Cagney stated that his blockchain business is ready to seize significant opportunities. "If you think about the stock market, there are seven parties involved in every transaction between buyers and sellers. Blockchain can streamline the participants down to two parties."

This is another cryptocurrency industry company listed after the first stablecoin stock Circle and the first compliant exchange stock Bullish. The cryptocurrency exchange Gemini will be listed on NASDAQ tonight.

Revenue of $341 million in the first half of the year

According to reports, Figure was founded in 2018 by Mike Cagney, co-founder of SoFi. Mike Cagney was a member of the founding team of the online lending platform SoFi and served as CEO until his departure in 2018. This background has given Figure a strong fintech gene.

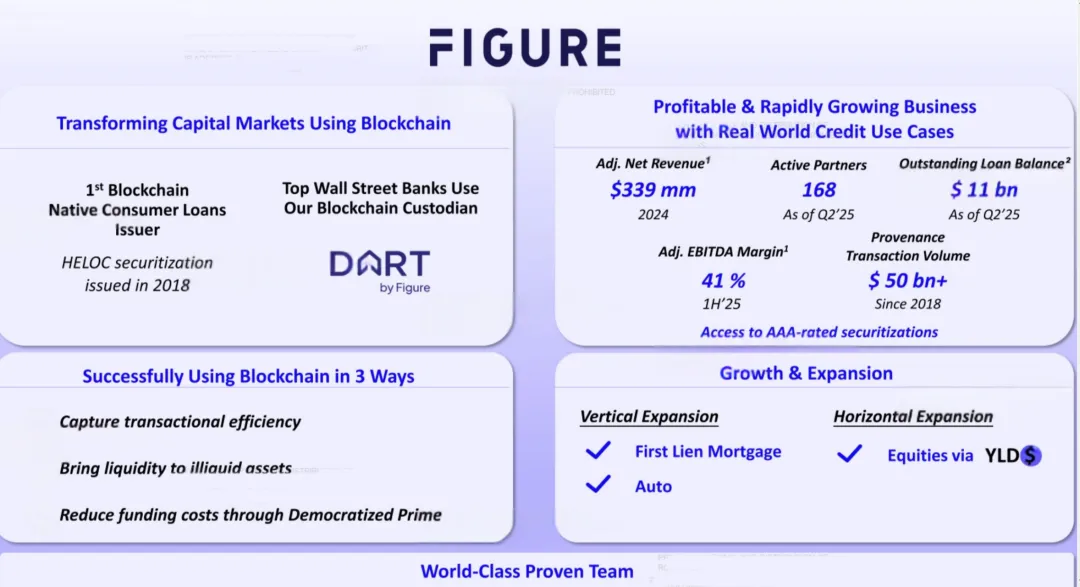

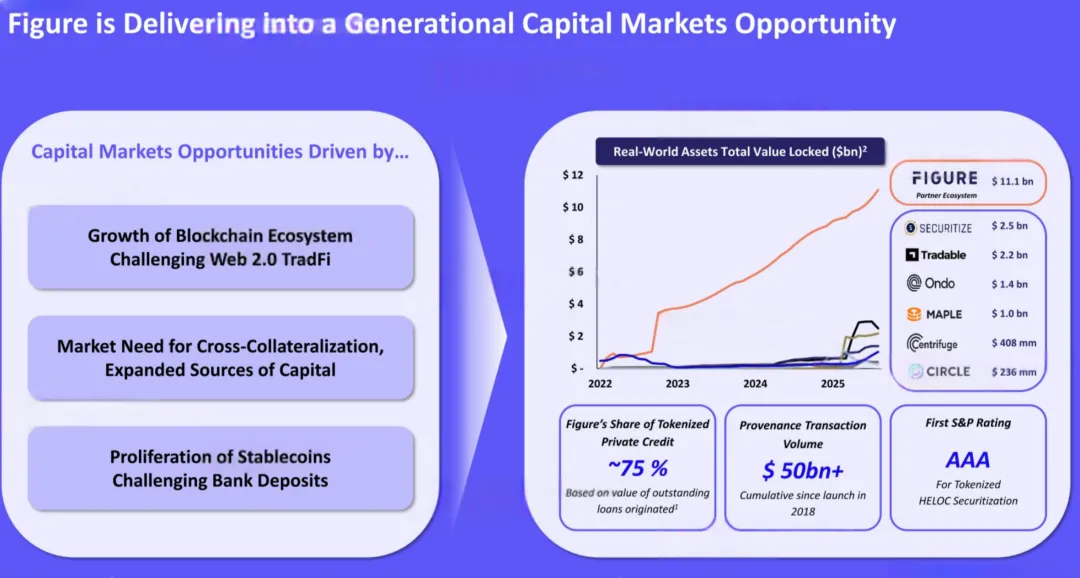

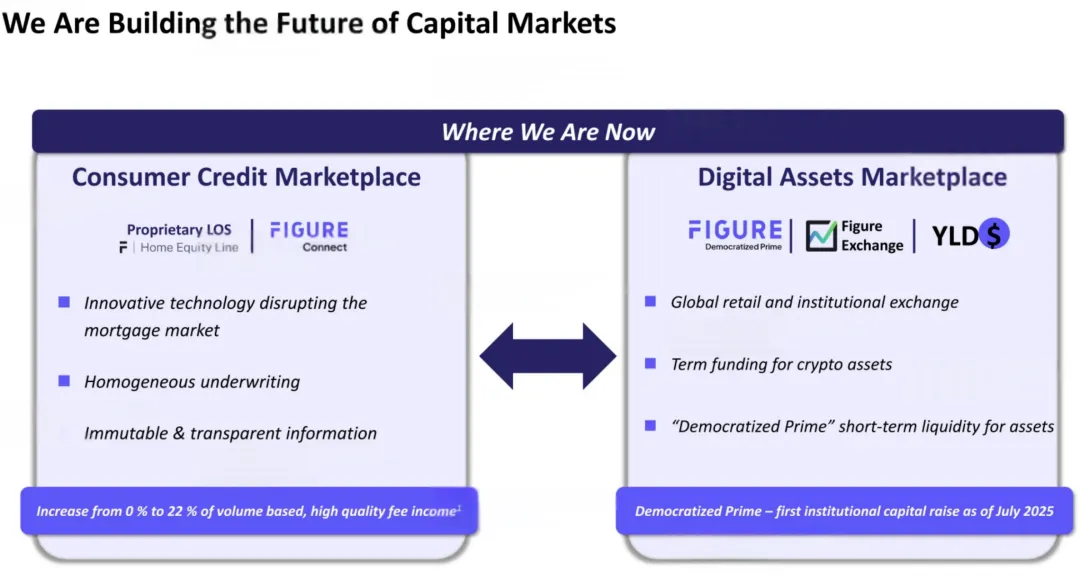

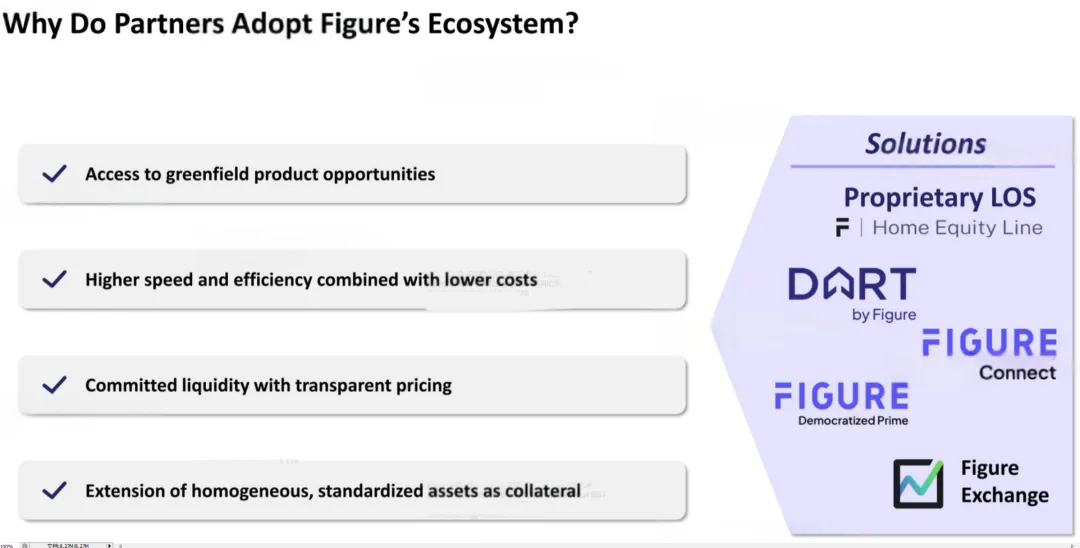

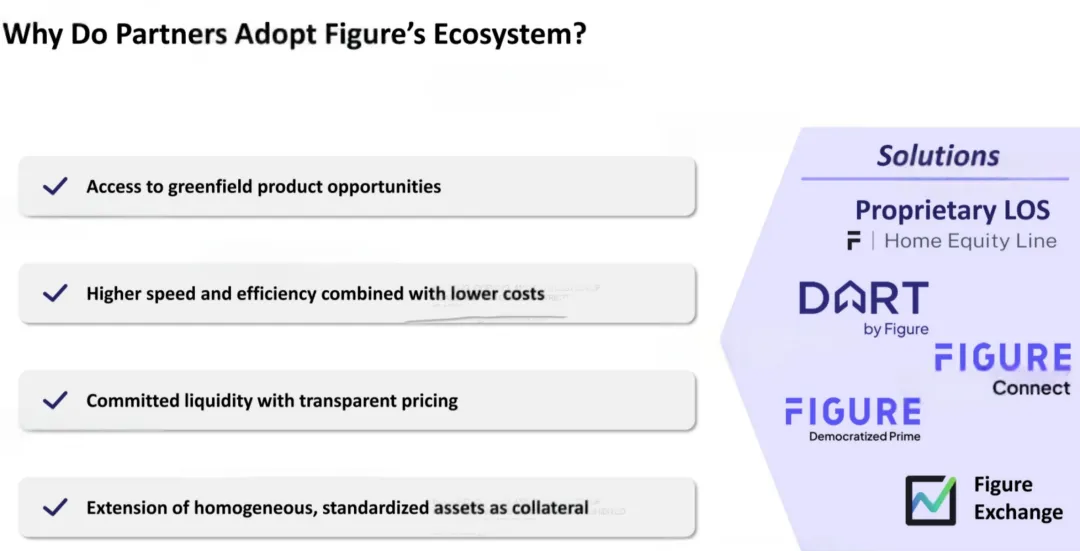

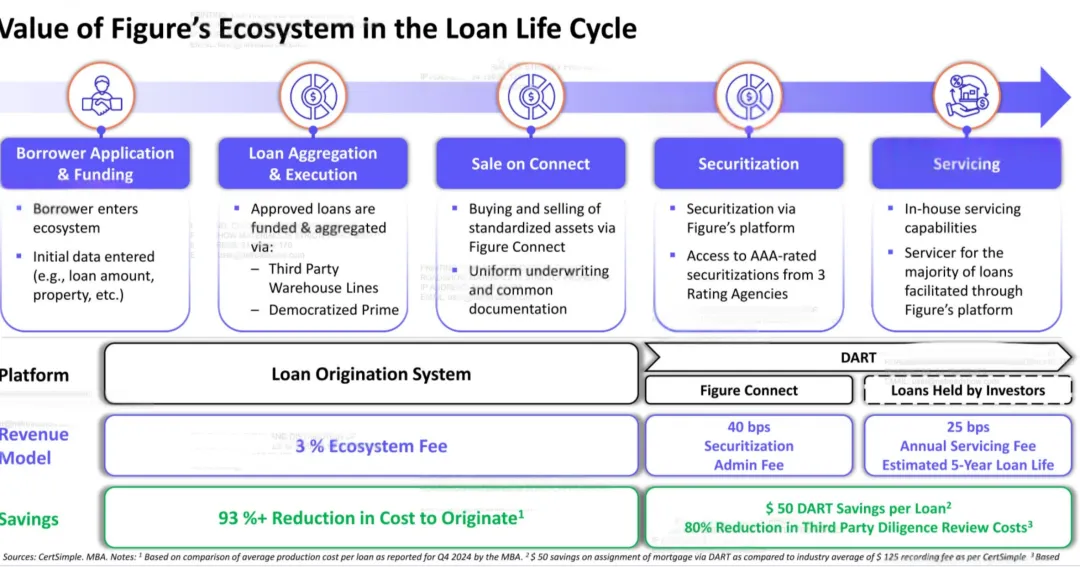

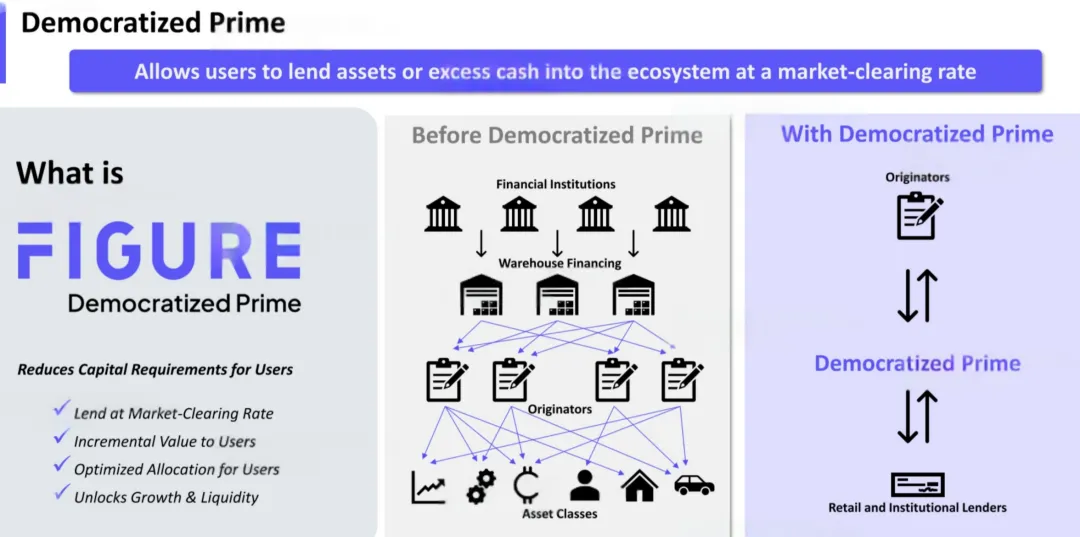

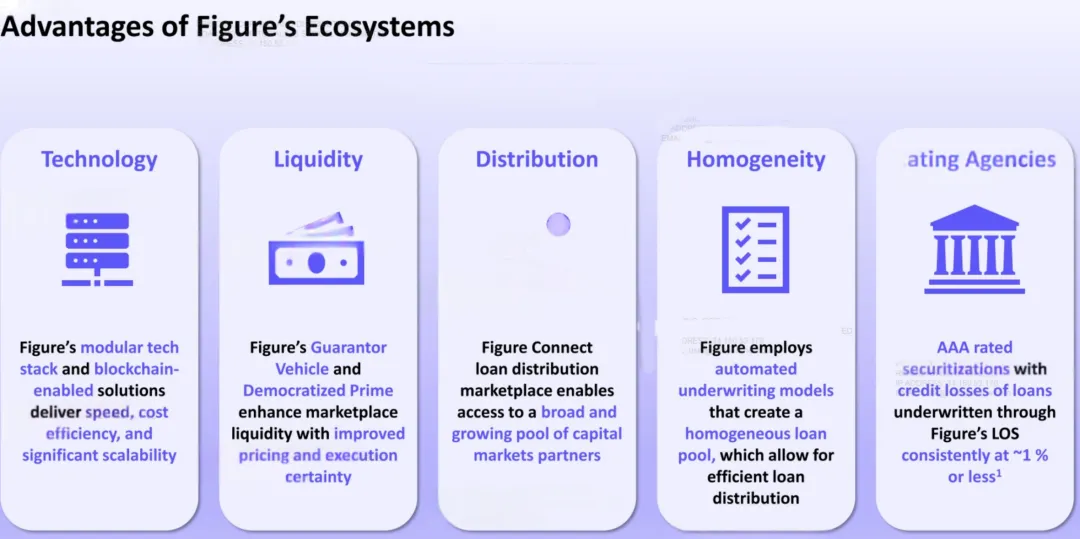

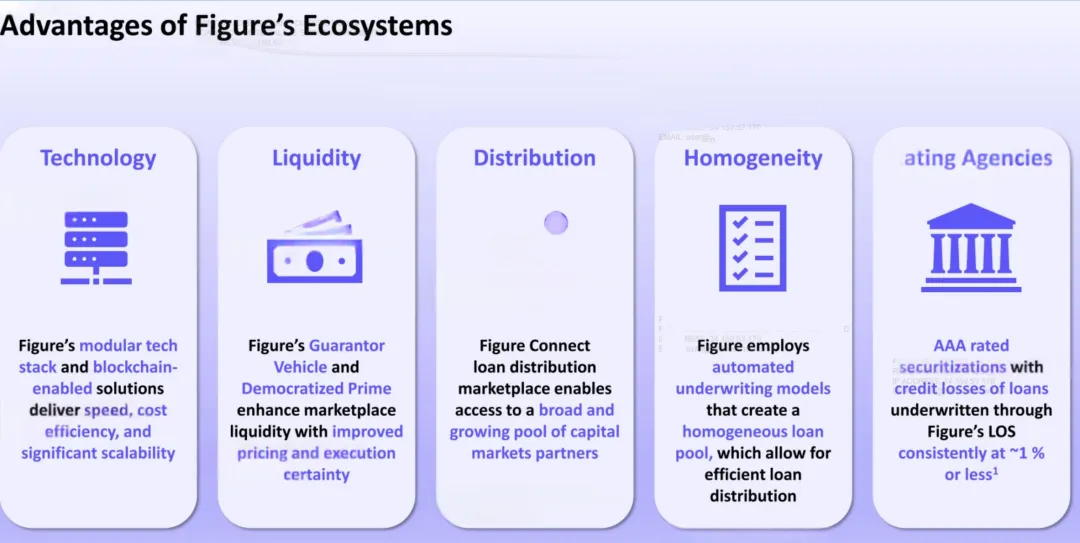

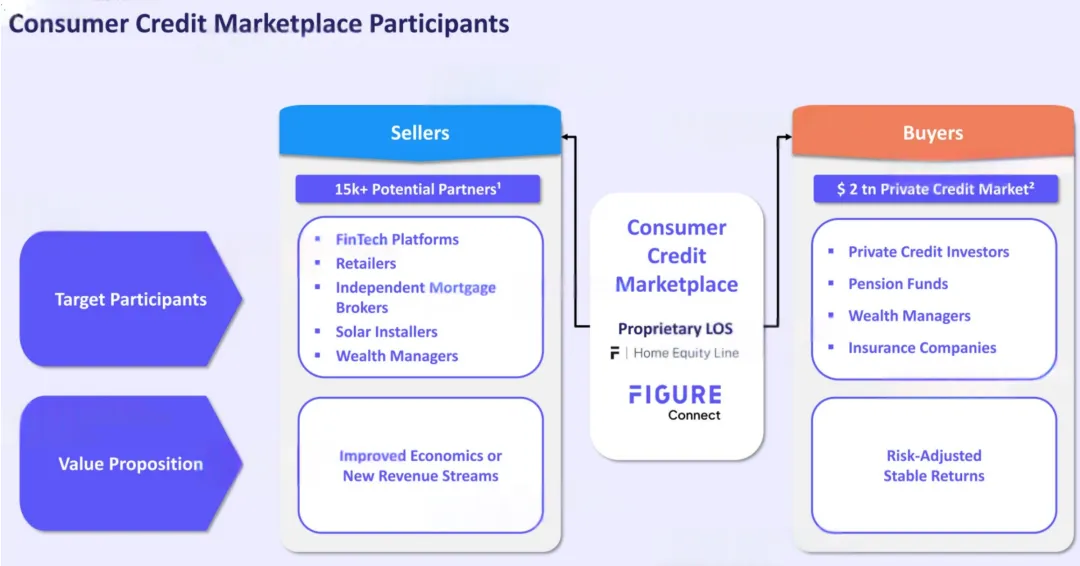

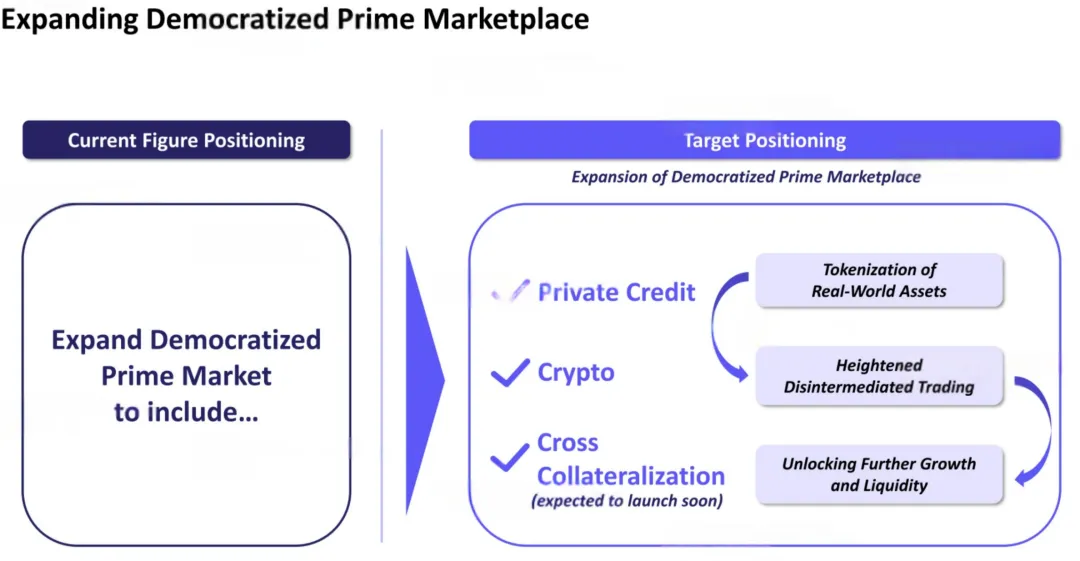

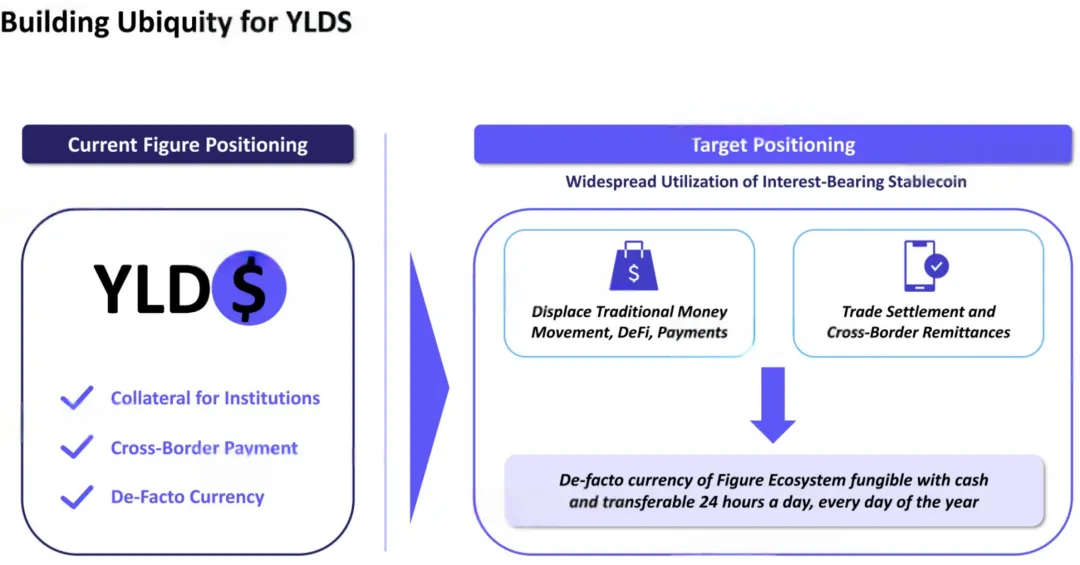

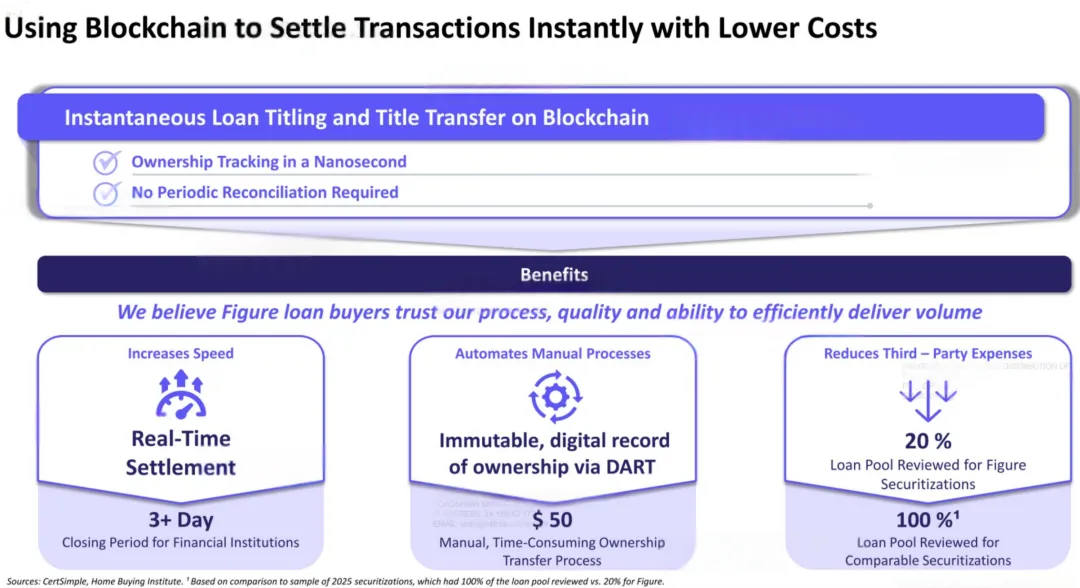

Figure's core business is to develop blockchain technology to facilitate lending operations.

In terms of technology application, Figure is using artificial intelligence technology to optimize business processes. The company uses OpenAI's technology to assist in evaluating loan applications and has deployed a chatbot powered by Gemini, a subsidiary of Google's parent company Alphabet, on its website.

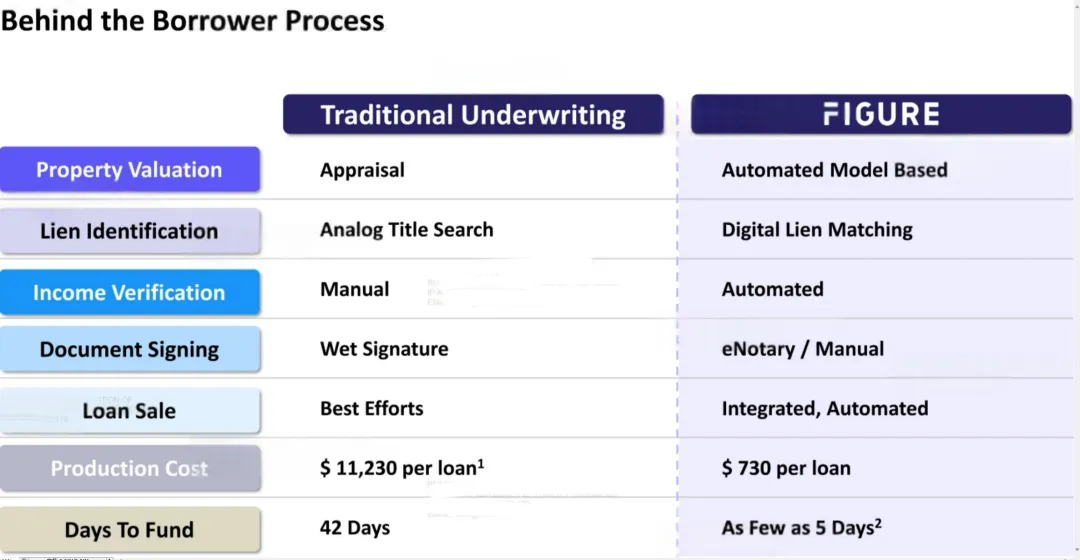

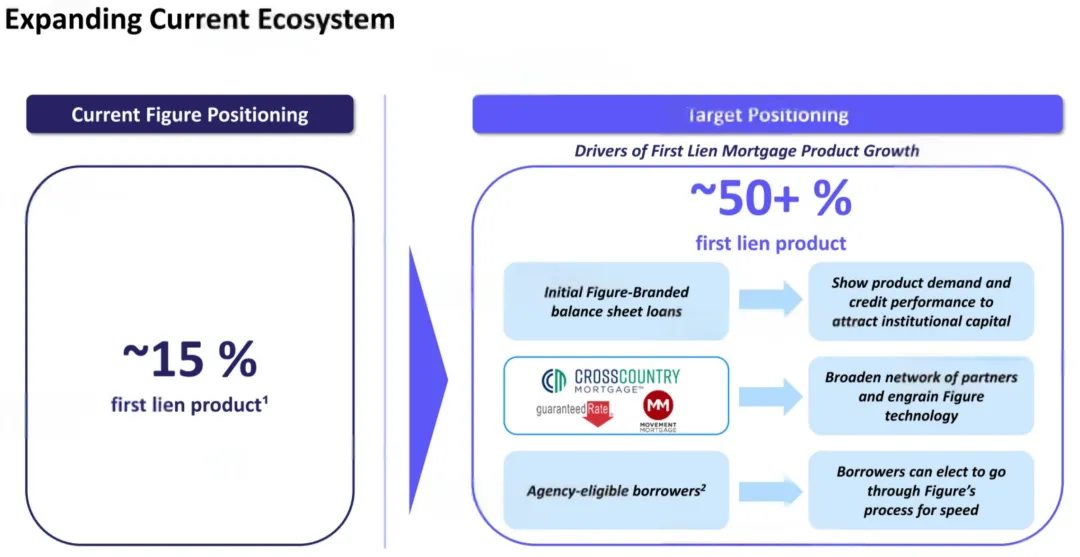

Figure's earliest entry point was home equity lines of credit (HELOC). This is the most commonly used financing method for U.S. residents, but the traditional process is cumbersome, averaging over 40 days. Figure has shortened the approval cycle to about 10 days using its self-developed Provenance blockchain.

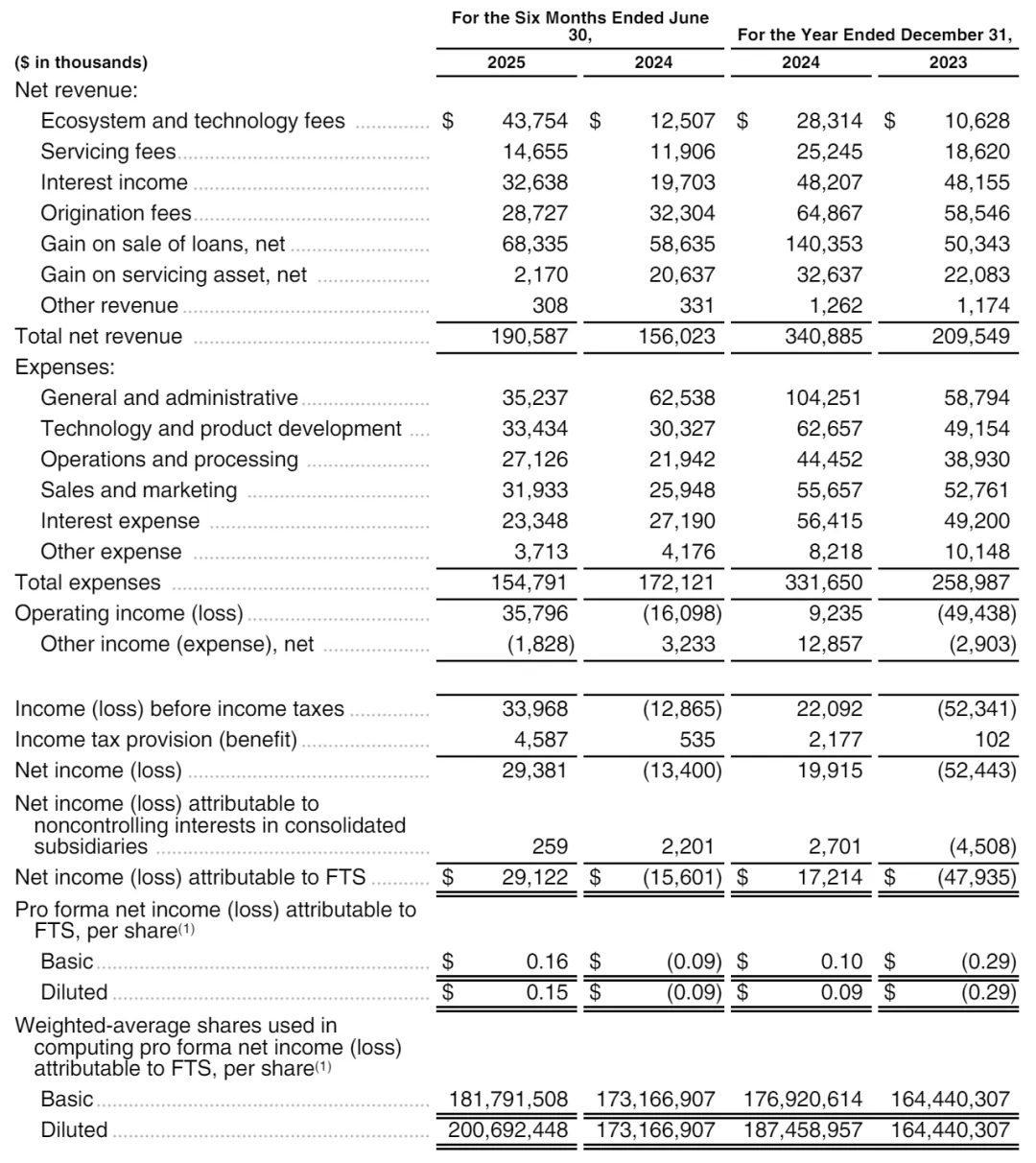

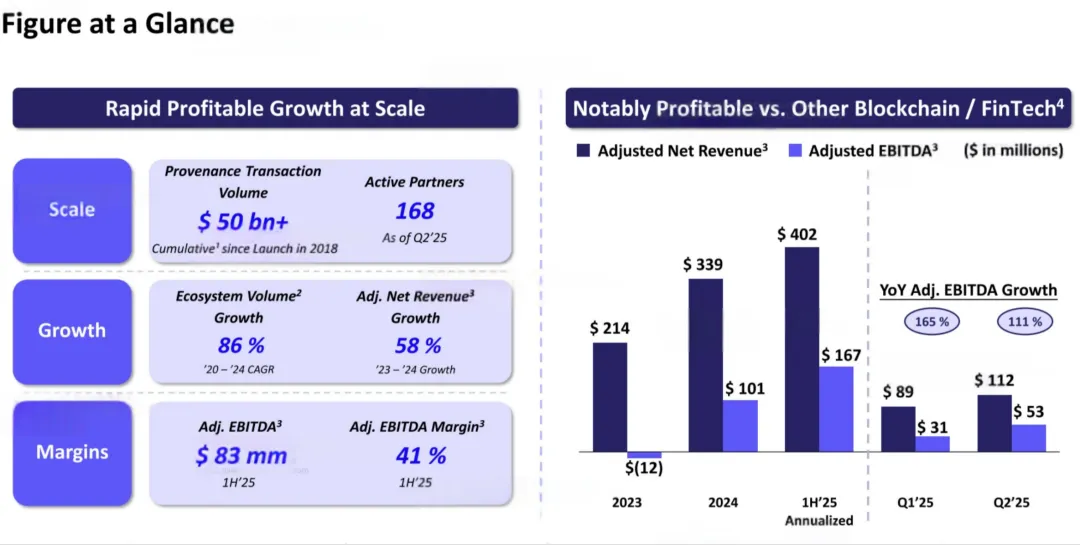

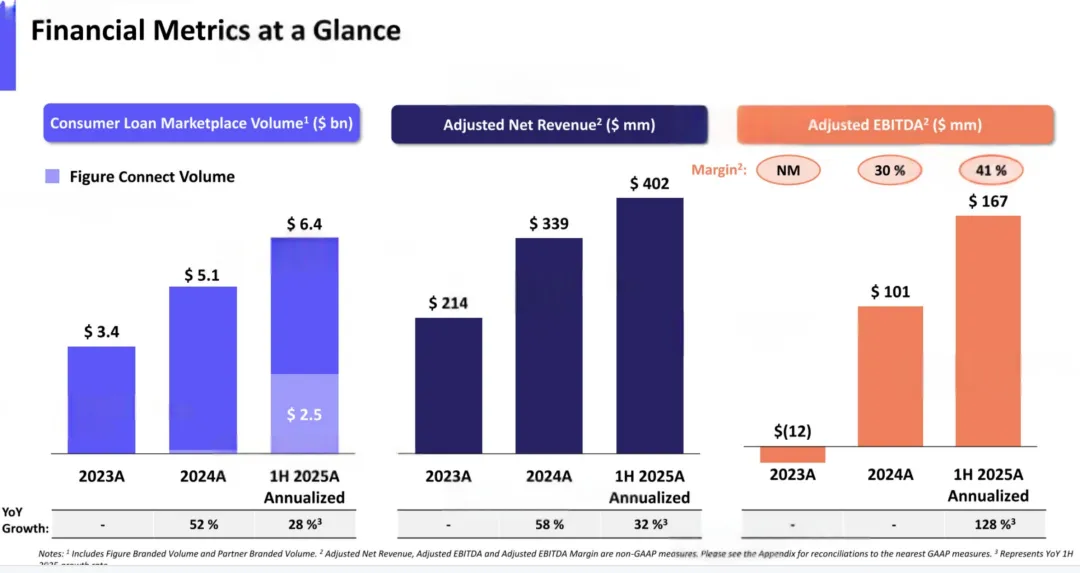

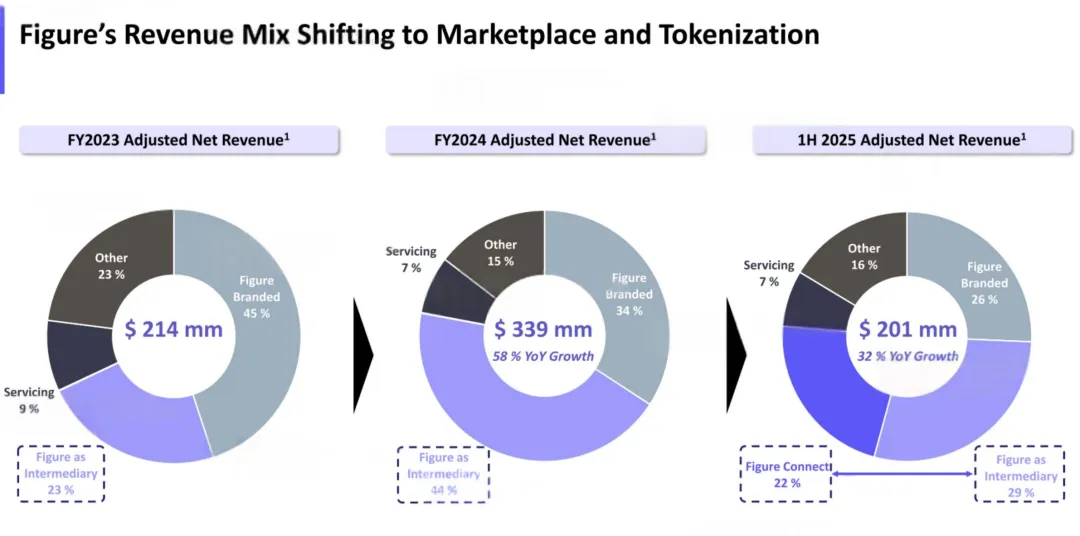

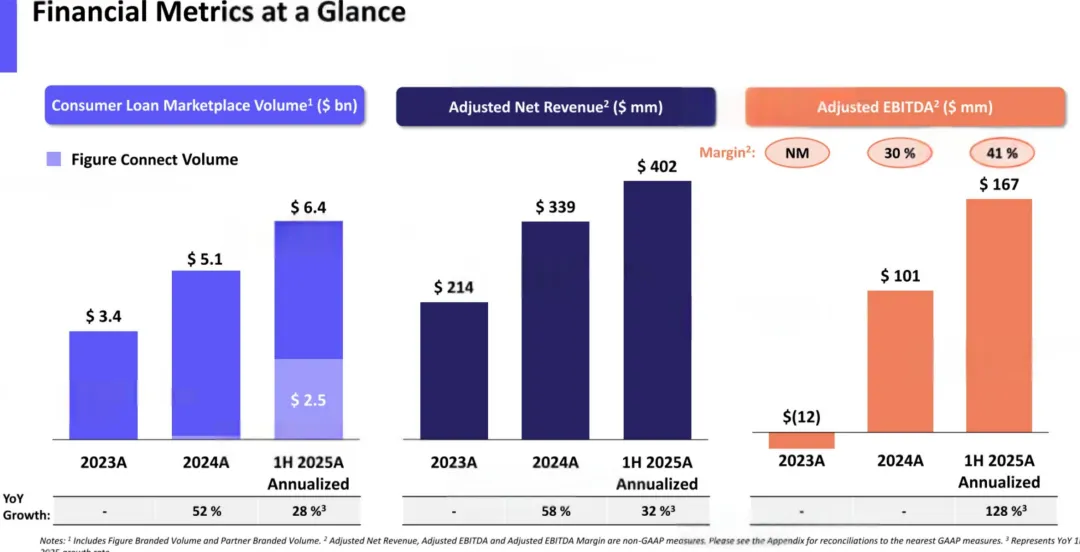

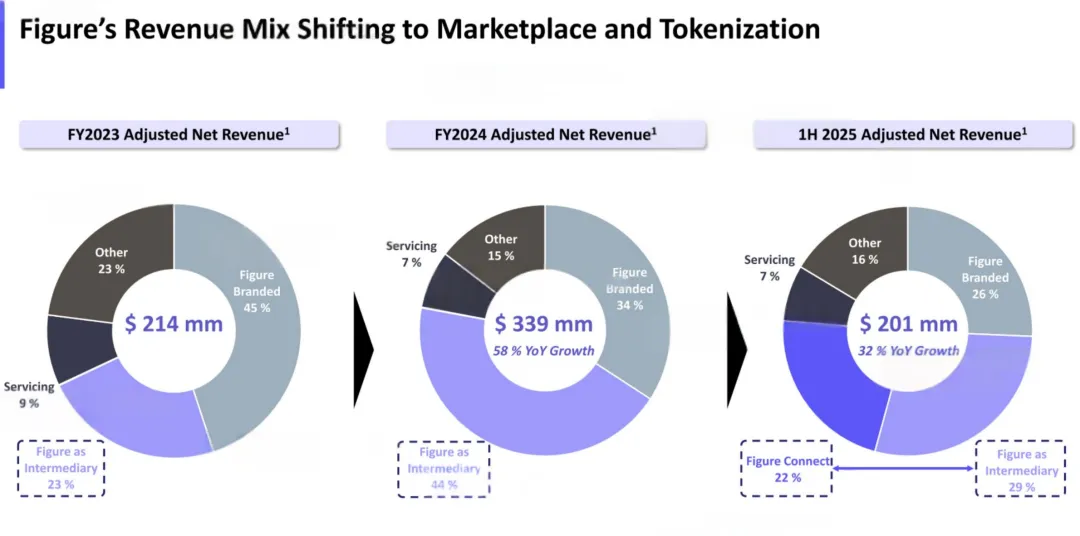

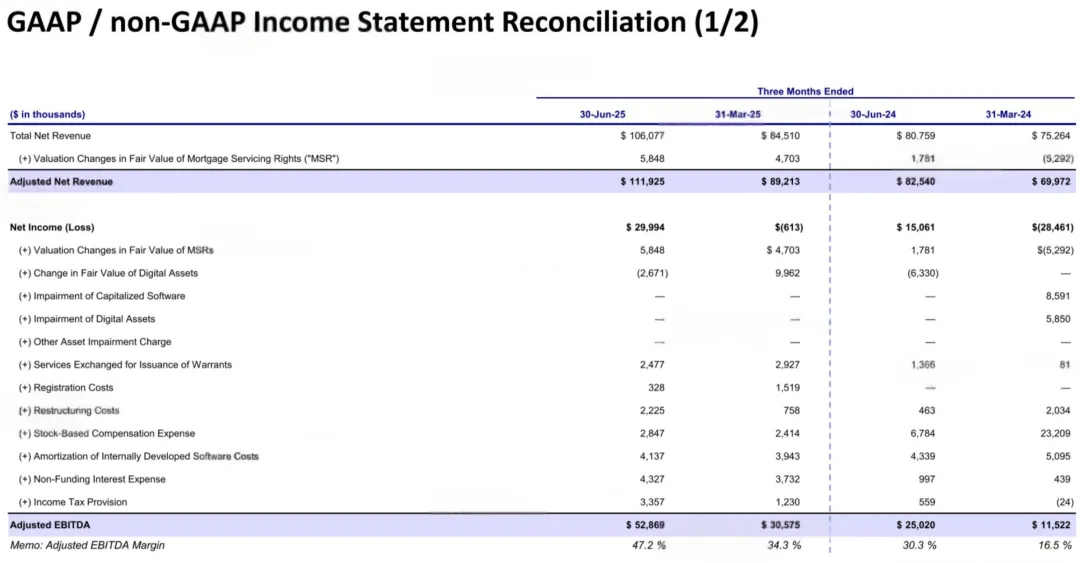

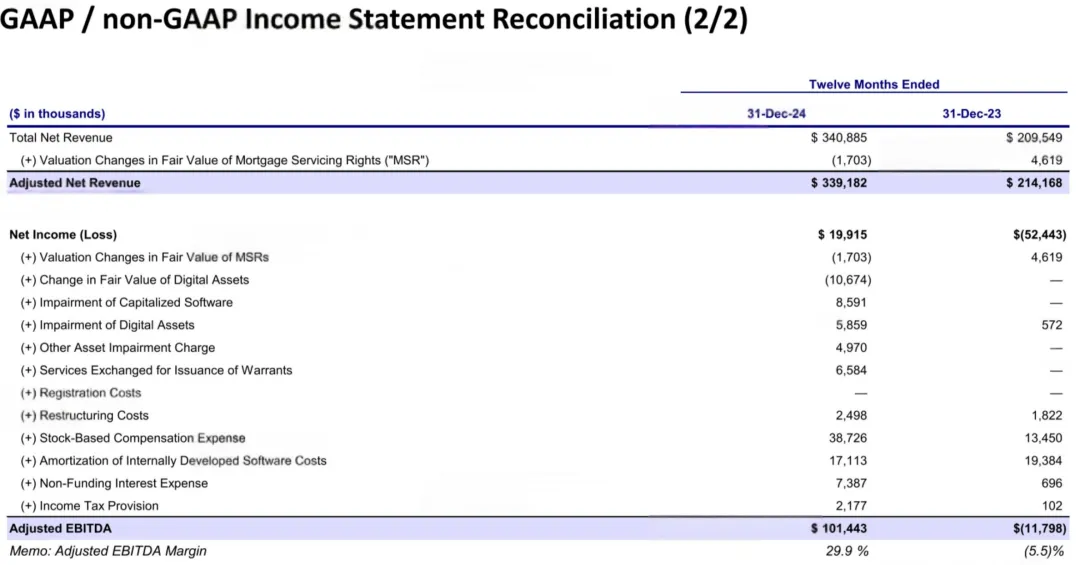

The prospectus shows that Figure's revenue for 2023 and 2024 is projected to be $210 million and $341 million, respectively; operating profits are projected to be -$49.44 million and $9.24 million; net profits are projected to be -$52.44 million and $19.92 million.

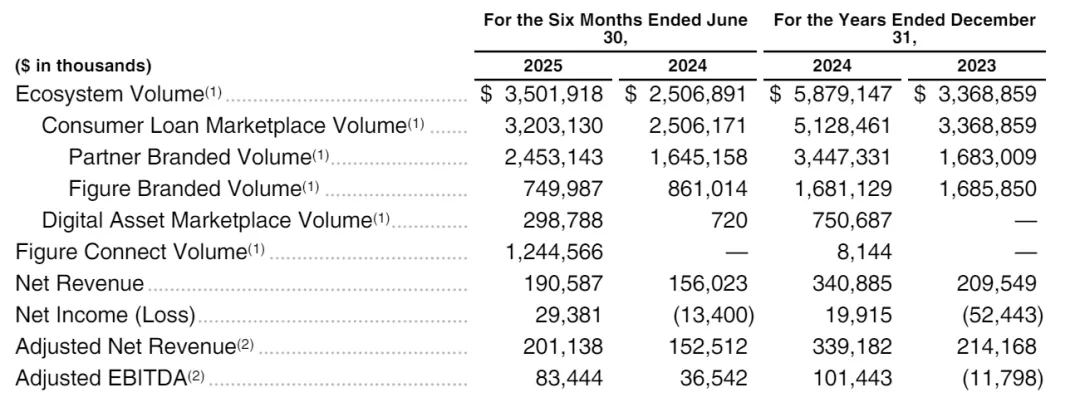

Figure's revenue in the first half of 2025 was $191 million, a 22.4% increase from $156 million in the same period last year; the main income comes from loan sales, with lending income in the first half of 2025 being $68.34 million, compared to $58.64 million in the same period last year;

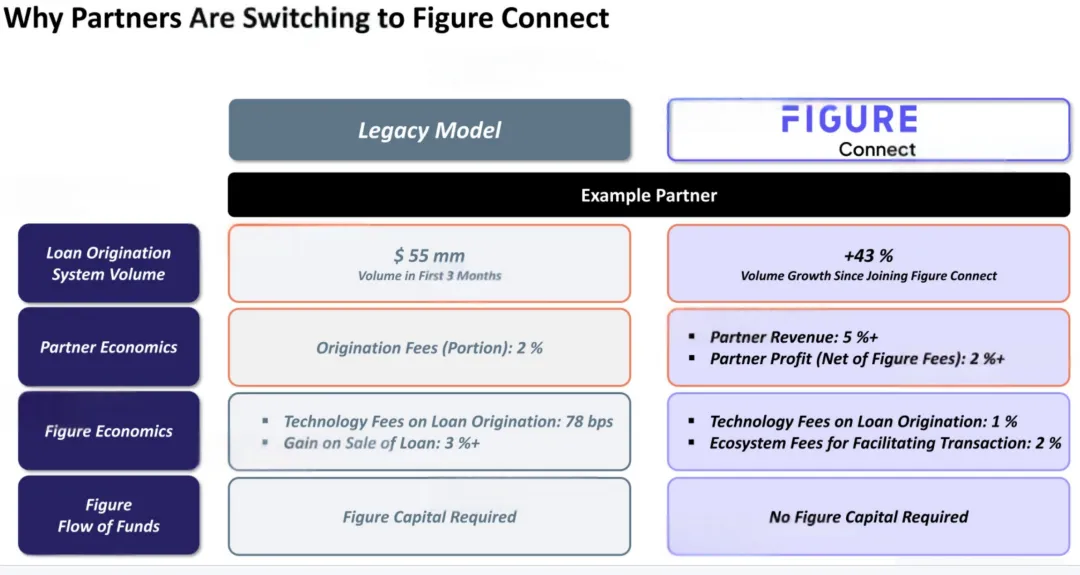

Figure's ecosystem and technology fees in the first half of 2025 were $43.75 million, compared to $12.51 million in the same period last year; interest income was $32.64 million, compared to $19.70 million in the same period last year.

Figure's net profit in the first half of 2025 was $29.38 million, compared to a net loss of $13.40 million in the same period last year; adjusted EBITDA was $83.44 million, compared to $36.54 million in the same period last year.

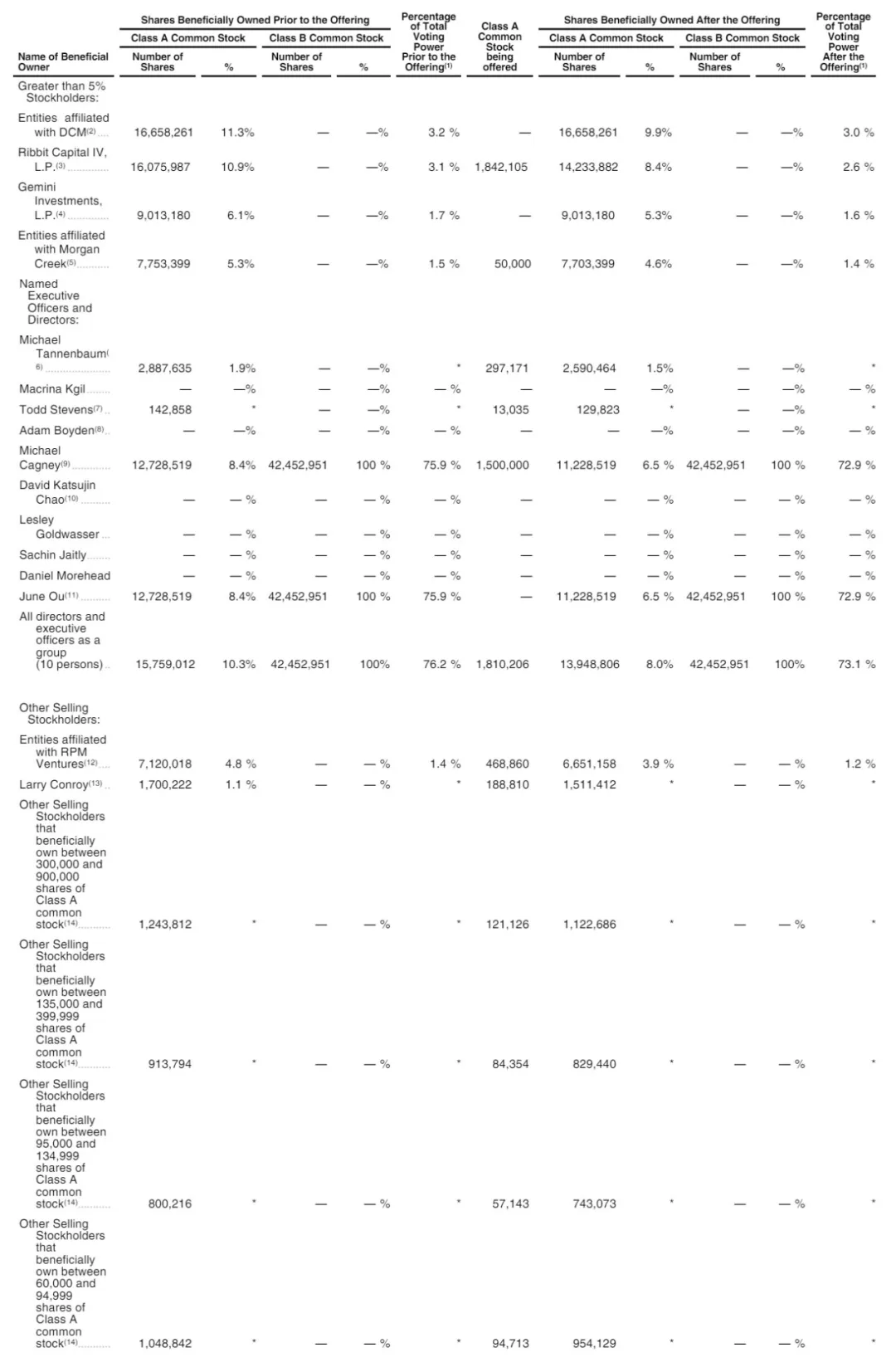

DCM and Ribbit Capital are shareholders

Before the IPO, DCM held 11.3% of Class A shares, with 3.2% voting rights; Ribbit Capital held 10.9% of Class A shares, with 3.1% voting rights;

Gemini Investments held 6.1% of Class A shares, with 1.7% voting rights; Morgan Creek held 5.3% of Class A shares, with 1.5% voting rights.

Michael Cagney held 8.4% of Class A shares and 100% of Class B shares, with 75.9% voting rights; RPM held 4.8% of Class A shares, with 1.4% voting rights; Larry Conroy held 1.1% of Class A shares.

After the IPO, DCM held 9.9% of Class A shares, with 3% voting rights; Ribbit Capital held 8.4% of Class A shares, with 2.6% voting rights;

Gemini Investments held 5.3% of Class A shares, with 1.6% voting rights; Morgan Creek held 4.6% of Class A shares, with 1.4% voting rights.

Michael Cagney held 6.5% of Class A shares and 100% of Class B shares, with 72.9% voting rights; RPM held 3.9% of Class A shares, with 1.2% voting rights.

Figure Roadshow PPT

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。