作者:Eric,Foresight News

一个 X 账号注册于两个月前,关注人数仅有不到 2000 的代币发行平台 Soar 因为一篇阅读量超 35 万的文章(https://x.com/LaunchOnSoar/status/1965476405455864175)火了。

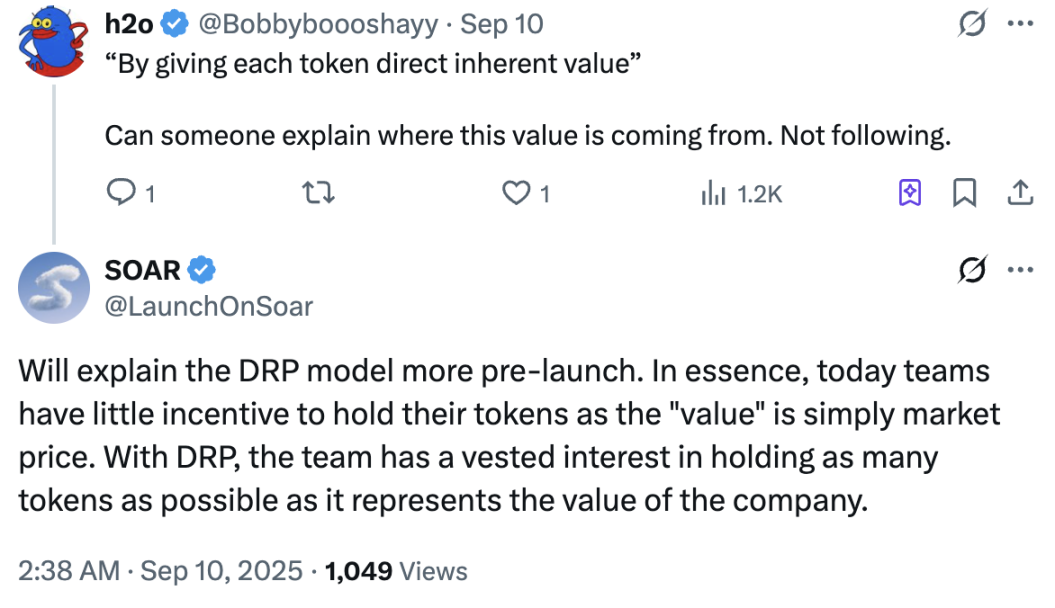

在这篇文章中,Soar 毫不避讳得批评了当前加密货币市场的乱象,直指三个重要的问题:发行的代币没有真正意义上的价值、代币抛售缺乏透明度、创始人因持币比例过低而没有任何专注长期价值的动力。

Soar 决定用一个正在申请专利的代币标准和新的平台来尝试为行业带来一些改变。目前项目团队仅对新的代币标准进行了一些概念上的阐述,也表示会在正式发布前给出进一步的解释。笔者暂且根据已有信息描述 Soar 的运行机制。

Soar 推出的新代币标准名为 DRP(Digital Representation of Participation),大概译为「参与度的数字表示」。对于 DRP 的机制,Soar 给出了一段非常晦涩的解释:

- 通过 DRP 标准部署的代币,无论在性质上还是事实上,都不会成为、也永远不会是任何形式的股权;

- 它们仅代表特定的价值关系:保留的,或应归属他处的价值;

- 该关系由代币部署方(「发行方」)与提供 DRP 标准使用权的实体(「提供方」)之间的私人合同(「协议」)所约束;

- 在 DRP 标准下,发行方在部署代币时会损失一定数量的价值,但可随时通过回收代币重新获得该价值;

- 首次部署后,发行方必须等待一段时间,才能将其保留的任何代币投放市场(「持有期」);

- 持有期结束后,每当发行方释放其此前持有的代币,都必须向外界明确披露其拟释放的代币数量及原因(「披露」);

- 任何披露之后,发行方必须再等待一段时间,才能将代币投放市场;

- 在任意时点,协议都会自动反映发行方与提供方之间的相对价值,并设有特定触发条件(「事件」),一旦触发,相关价值将在双方之间自动结算;

- DRP 标准还包含许多其他机制 / 功能,用以提升透明度、强化问责,并在代币持有者与发行者之间形成激励平衡。

在此标准之下,公司作为代币发行方,Soar 作为 DRP 标准的提供方:

- 公司自身持有一定数量的该等代币,该数量即代表公司在任意时点所保留的价值;

- 公司在任意时点未持有的那部分代币(即由外界持有的部分),对应的就是公司在该时点不再保留或无法控制的价值;

- 依据私人合同,Soar 有权获得、且公司应以优先地位向 Soar 支付上述公司未保留的价值;

- 一旦发生公司清算事件(Company Liquidity Event),Soar 即成为该等价值的受领方,并可自行决定如何处置。

总体来说,采用 DRP 标准发行的代币,一定需要在发行之初约定代币代表的「价值关系」,而这种价值关系意味着代币一定要代表例如公司价值等具体的价值,而不能单纯仅仅作为例如治理代币的形式推出。而且这种价值关系是事先受到合同约束的。

但 Soar 也表示这种代币不会是股权,笔者猜测 Soar 旨在推出一种能代表某个实体的具体价值,但又不受到传统股权限制的代币,来在初期就明确解决所发行代币「究竟是什么」的问题。

在代币发行之后,发行方必须持有一段时间后才能开始出售自己所持有的代币,在出售前需要披露出售的意图和具体数量,并且披露完成后仍然需要等待一段时间才能正式出售。

DRP 机制最难理解的部分在于所谓触发特定条件时代币发行方(即所谓的公司)需要向 Soar 支付的价值。笔者认为,这一机制本身类似于股票市场中上市公司的「私有化退市」,即如果上市公司想要私有化退市,必须回购公开发行的股票,使得公众持有量低于交易所的规定。在 Soar 的设计中,未被「公司」持有的代币,在「公司」计划进行清算时需要「公司」为之负责。这就在很大程度上防止了 Rug 行为。

Soar 明确表示,DRP 的设计借鉴了传统证券市场的部分规定,将随意发行代币后抛售再 Rug 的行为从根源上阻断,使得基于该标准发行的代币必须代表实际价值并严格遵守出售前的披露准则。

因 Soar 没有额外的信息,这是我们目前能得出的全部结论。笔者一直认为,下一轮山寨币牛市的大前提一定要解决「山寨币究竟代表着什么」这个问题。当前大量项目所发行的代币本质上没办法与项目的实际价值挂钩,也没有任何项目明确解释其所发行的代币代表着什么。而这些问题很可能就是青睐加密货币但目前只敢选择比特币的投资者面前最大的阻碍。

虽然 Soar 机制设计标准非常严格,但其中所设计的标准究竟是通过「君子协定」实现,还是在智能合约层面实现;如果「公司」清算,如何能保证「公司」会对在外流通的代币负责,都需要等待项目给出更多的信息。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。