25 Diverse Airdrop Projects to Earn Returns with Simple Operations!

Author: thedefinvestor

Translated by: Baihua Blockchain

Airdrops are no longer as generous as they used to be.

But you can still make decent money from them.

For example, if you hold stablecoins, the yields in DeFi can be several times higher than fiat currencies in traditional finance (TradFi).

The key is to choose the right protocols for "farming." Personally, I have been heavily involved in airdrop farming for over two years, and to this day, I can still earn a considerable income from it, so I believe it is still worthwhile.

Here is a list of 25 airdrops I am currently farming:

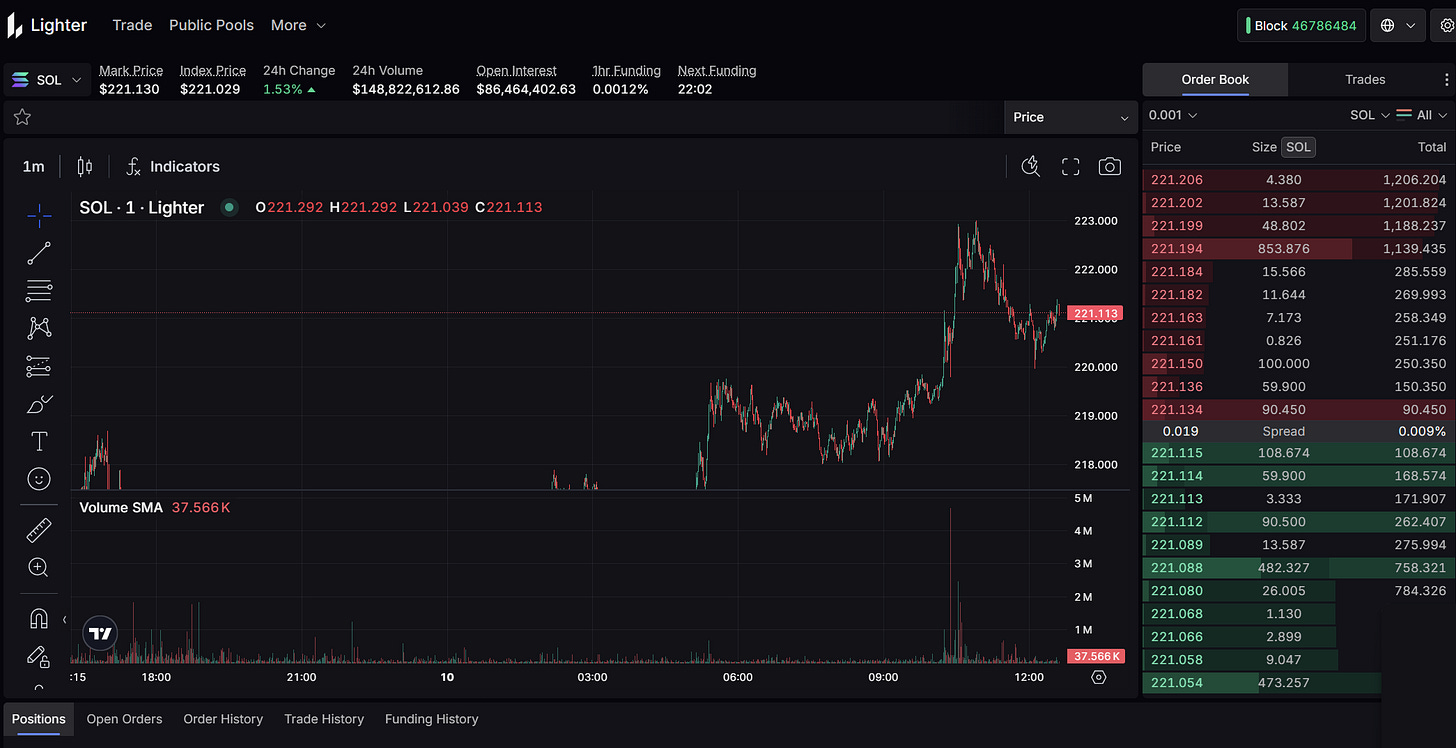

Lighter

Lighter is the first zero-fee perpetual contract decentralized exchange (DEX) launched a few months ago, quickly becoming one of the fastest-growing perpetual DEXs.

If I could only choose one airdrop to farm, I would choose Lighter.

My strategy: I trade perpetual contracts on Lighter, trying to generate as much trading volume as possible (Pro tip: If you trade low market cap altcoins, you will earn more points).

Rewards: Lighter points (the team hinted in an AMA that they will allocate 30-50% of the tokens for airdrops, similar to HYPE's airdrop distribution).

Additional notes:

- Lighter is currently still in an invite-only phase but has become the second-largest perpetual DEX by daily trading volume.

- The team stated that the token generation event (TGE) will take place in the fourth quarter.

- Lighter points are becoming increasingly scarce over time—fixed amounts of points are allocated to traders weekly, regardless of how the protocol's trading volume grows, which is very beneficial for early participants.

- If you are not a trader, you can use a neutral strategy to generate significant trading volume (I explained how to do this here).

Here is the invitation link: https://app.lighter.xyz/trade/ETH?referral=PD7EH9KNK7BW

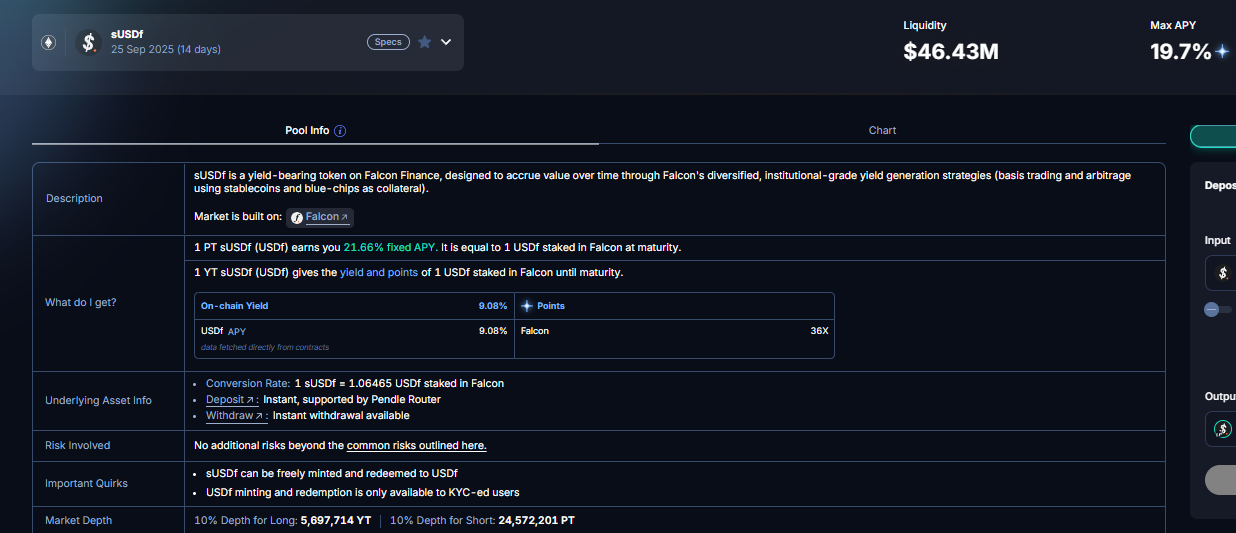

Falcon Finance

Falcon is a stablecoin protocol that generates returns through various neutral strategies such as arbitrage, staking, and yield farming.

In the past six months, its total locked value (TVL) has grown from $85 million to $1.54 billion.

My strategy: I provide USDf as liquidity in the Falcon sUSDf pool on Pendle (you can exchange USDC for Falcon's USDf stablecoin on the Falcon website).

Rewards: 17.61% base annual percentage yield (APY) + 36 times Falcon Miles points.

Additional notes:

- The TGE timeline has not been announced, but Falcon recently raised $10 million, which makes me believe it will eventually issue tokens.

- sUSDf is Falcon's yield-bearing stablecoin, with annualized yields ranging from 7% to 11% in recent weeks, which is quite high.

Here is the invitation link: https://app.falcon.finance/swap/mint?r=ef0a57c6d8bd23f88a7aa48ce98ac58f

Kinetiq

Kinetiq is Hyperliquid's native liquidity staking protocol.

It may be the most popular DeFi protocol in the HyperEVM ecosystem and currently has the largest TVL among decentralized applications (dApps) in HyperEVM.

My strategy: I provide HYPE as liquidity in the Kinetiq vkHYPE pool on Pendle (on HyperEVM).

Rewards: 8.17% base APY + Kinetiq points.

Additional notes:

- The TGE timeline is unknown.

- Kinetiq points are currently trading at about $4.66 on Rumpel (if you want to trade OTC).

- Given Kinetiq's immense popularity, I think it's a good idea to farm it if you hold HYPE, as a strong community often leads to higher token valuations.

Here is the link to Kinetiq: https://kinetiq.xyz/

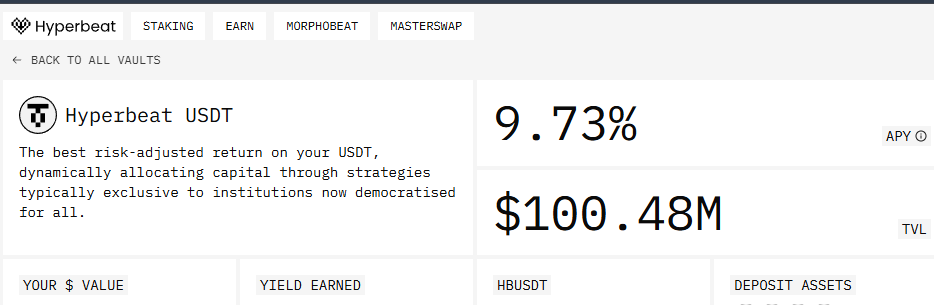

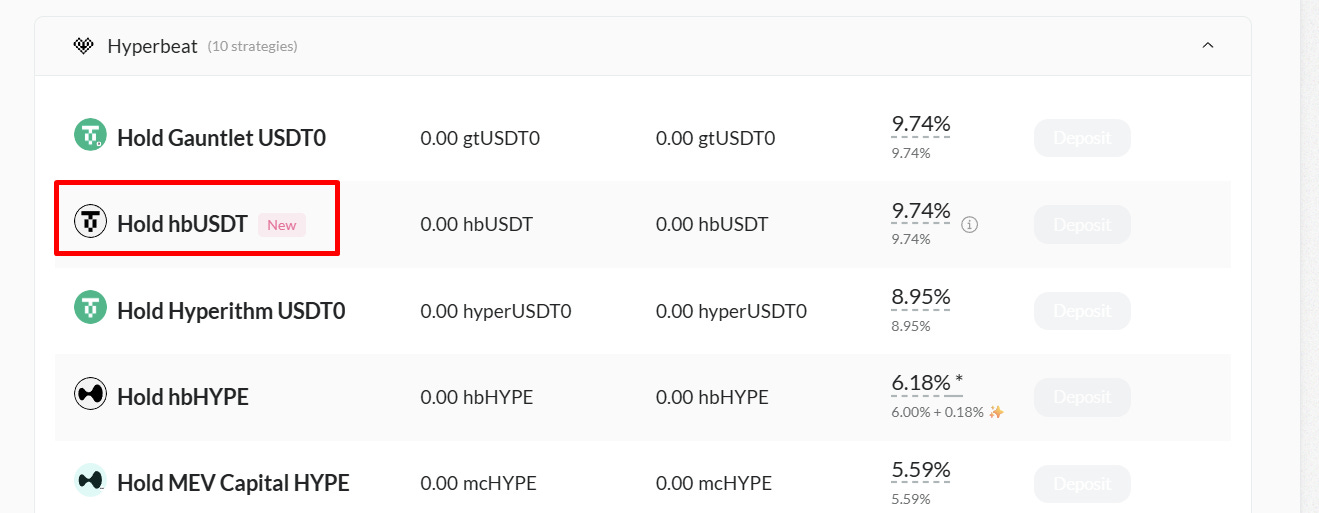

HyperBeat

HyperBeat is one of my favorite protocols in the Hyperliquid ecosystem.

It offers various products, including automated DeFi vaults, money markets, and a swap aggregator for HyperEVM.

My strategy: I provide USDT as liquidity in HyperBeat's USDT vault (on HyperEVM L1), which you can find on its "Earn" page.

Rewards: 9.73% base APY + HyperBeat Hearts points + 7 other HyperEVM ecosystem points.

Additional notes:

The TGE date for HyperBeat has not been announced, but there are rumors that its airdrop will be tiered, with smaller capital users benefiting more.

HyperBeat's USDT vault generates returns by automatically providing liquidity to various protocols in HyperEVM, allowing for the earning of multiple points.

You can bridge USDT to HyperEVM via thehyperliquidbridge.xyz (a bridge supported by LayerZero).

Here is the invitation link for HyperBeat: https://app.hyperbeat.org/earn?referral=CD6E6FBA

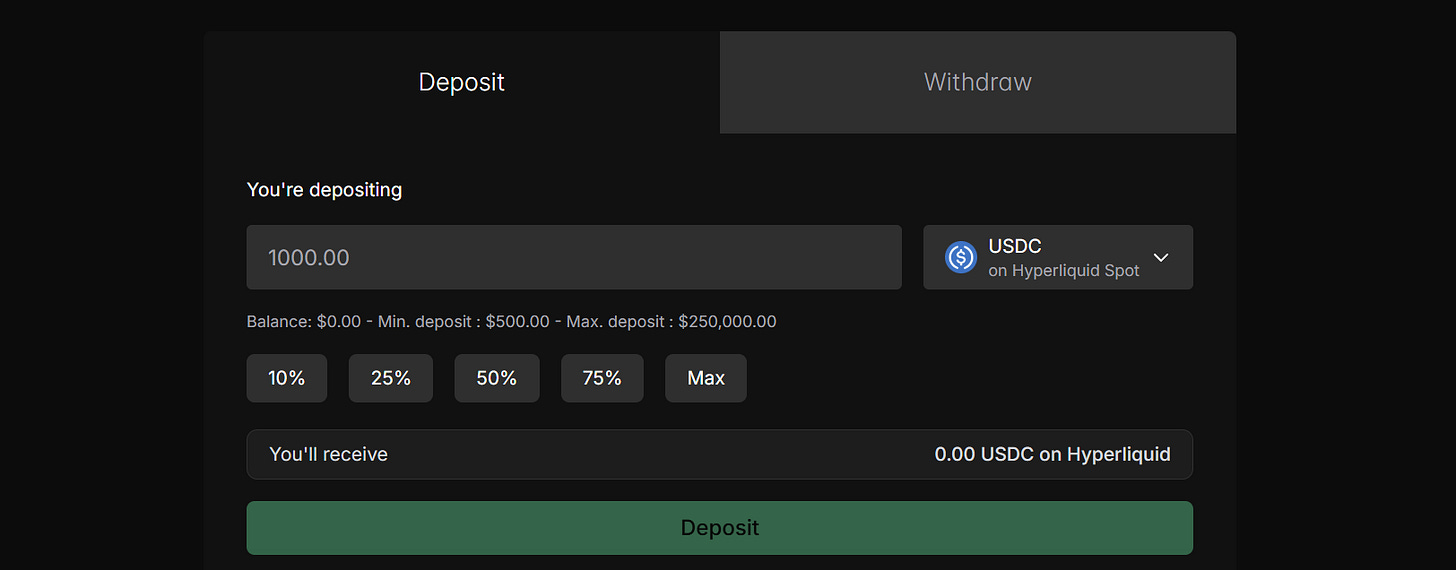

Mass (+Hyperliquid)

Mass is the best DeFi mobile application I have tried.

It allows you to swap, trade perpetual contracts supported by Hyperliquid, purchase tokenized stocks, and conduct fiat on/off ramps.

My strategy: I mainly trade perpetual contracts through its Hyperliquid integration (you need to download its mobile app first).

You can also earn MASS incentives through swaps and other activities.

Rewards: For every $1 fee paid to Mass, you can earn 2 MASSTokens that will unlock at TGE.

Additional notes:

The TGE timeline has not been announced.

Trading perpetual contracts seems to be the easiest way to farm MASSTokens (which may also qualify you for a second airdrop from Hyperliquid), and I love that it can be operated on a mobile phone.

Here is the invitation link for Mass: https://massdotmoney.app.link/tjIEFduaGUb?_p=c1143fdc990163eee31e87e3e9bdbc

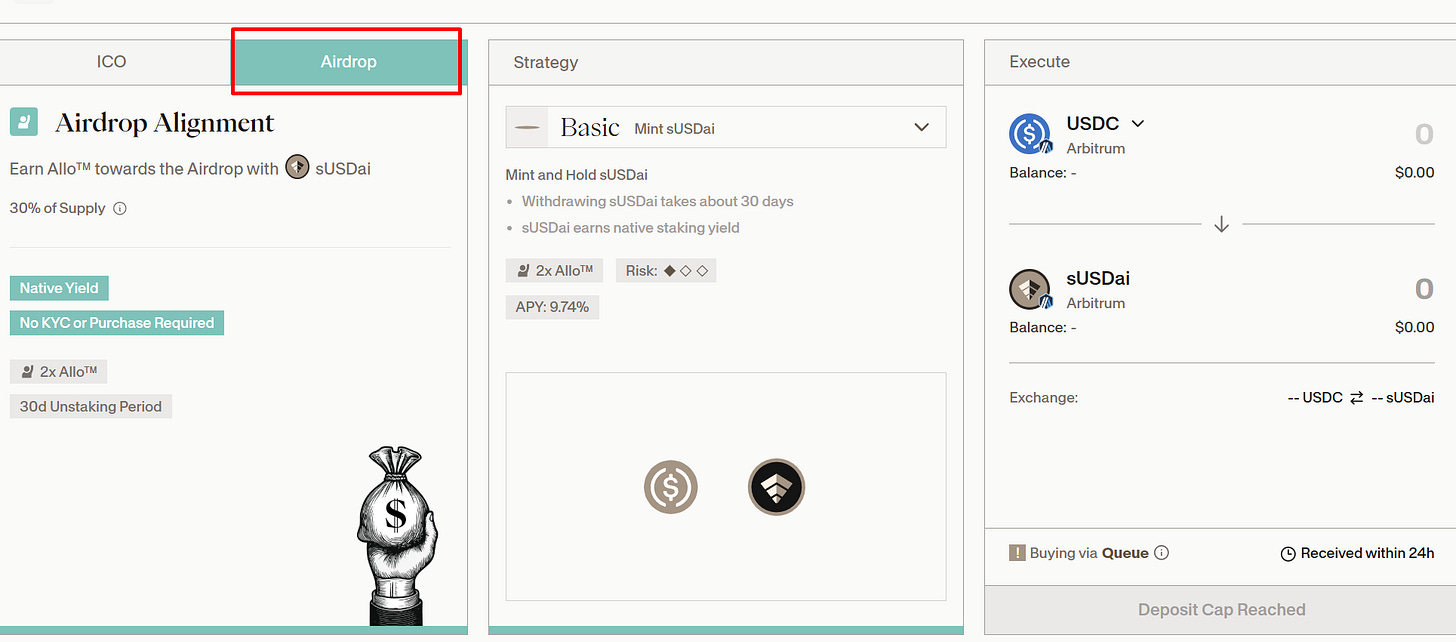

USD.AI

USD.ai is a stablecoin protocol supported by AI infrastructure credit.

It aims for an annualized yield of 15-25% by providing loans to emerging AI companies (secured by hardware).

The protocol is gaining significant attention, and I believe USDai has the potential to provide one of the largest airdrops for stablecoin holders in the near future (in terms of annualized yield).

My strategy: Mint sUSDai on the USDai dApp and provide it as liquidity in the sUSDai pool on Pendle (however, the protocol's TVL cap is currently full, so you will need to wait for a new cap increase to mint sUSDai).

In the meantime, you can earn 3.71% APY + 10 times USDai points by lending USDC to the "K3 Capital USDai Cluster" pool on Euler.

Rewards (Pendle sUSDai LP strategy): 23% base APY + 12 times USDai points.

Additional notes:

The points program for USDai will end within six months or after generating $20 million in revenue.

Unlocking sUSDai takes about 30 days (which is quite a long period, so be aware).

The protocol raised $13.4 million in Series A funding, supported by YZi Labs (formerly BN Labs).

Here is the invitation link for USD.AI: https://app.usd.ai/rewards?code=ov8ci&tab=team

Cap Money

Cap is known as the first "third type" stablecoin.

Its uniqueness lies in outsourcing yield generation. Its cUSD stablecoin funds are lent to operators (financial institutions) who generate returns through various strategies and return them to cUSD holders.

My strategy: I provide stcUSD as liquidity in the stcUSD pool on Pendle (you can purchase stcUSD on the Cap website, which is the staked version of Cap's cUSD stablecoin).

Why do I often use Pendle? Because liquidity pools on Pendle usually offer the highest airdrop point multipliers.

Rewards: 13.4% base APY + 5 times Cap points.

Additional notes:

The project's first points program is confirmed to last a maximum of 5 months (so the TGE may occur in the first quarter of 2026).

I enjoy farming this because Cap has built a stablecoin with a unique architecture, and novel prototype tokens often have higher fully diluted valuations (FDV) due to speculative premiums at TGE.

If you want to earn 20 times Cap points (instead of 5 times), you can provide liquidity for the cUSD pool on Pendle, but the base APY will be lower.

Here is the link to Cap: https://cap.app/

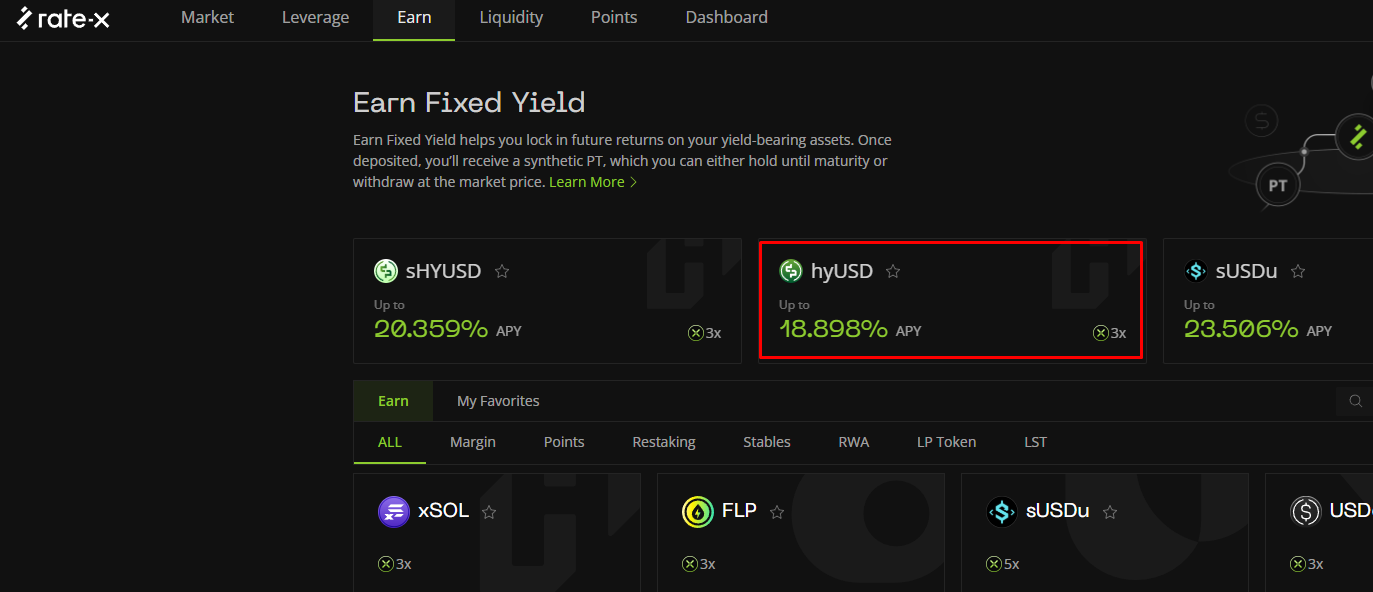

RateX

RateX is the first leveraged yield trading platform on Solana.

You can think of it as Pendle on Solana.

My strategy: I buy hyUSD on Jupiter and deposit it into the "Earn" section of RateX.

Rewards: 18.893% fixed APY (you are essentially exchanging Hylo points for fixed returns) + 3 times RateX points.

Additional notes:

The TGE date for RateX is unknown, but the 18.893% fixed APY + airdrop points on stablecoins is a great opportunity for me.

RateX is currently the largest yield trading DEX on Solana.

You can also provide liquidity or earn fixed returns on other assets (such as SOL, JTO, and JLP) on RateX.

Here is the invitation link for RateX: https://app.rate-x.io/referral?ref=MLAt7yEV

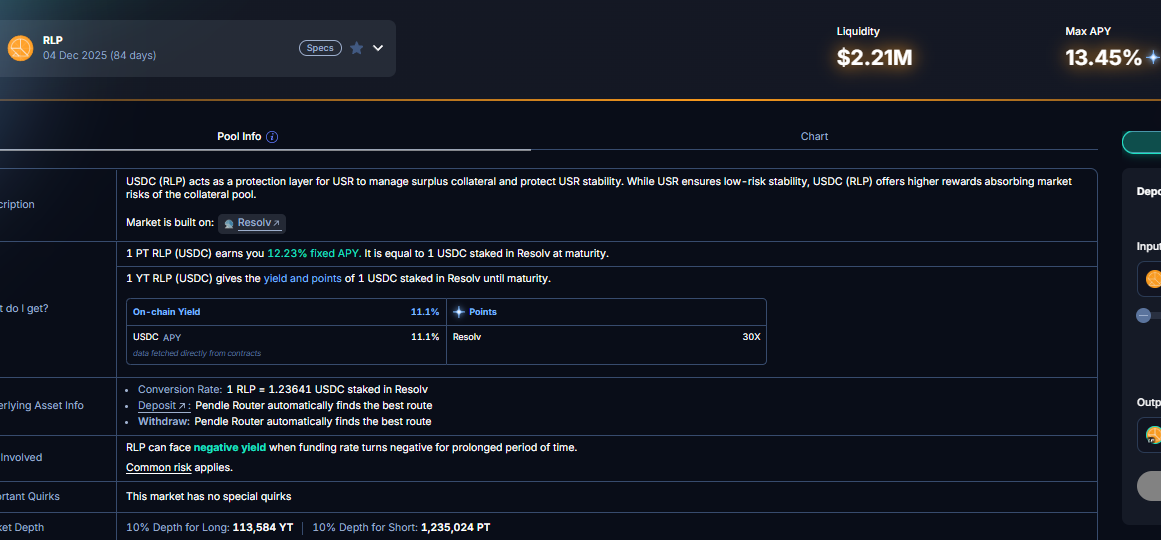

Resolv

Resolv is an innovative neutral stablecoin protocol with a dual-layer model.

I have been using it for a long time because the yield on its RLP neutral token is much higher than Ethena's sUSDe yield.

My strategy: I buy RLP on Resolv and provide it as liquidity in the RLP pool on Pendle.

Rewards: 11% base APY + 30 times Resolv points.

Additional notes:

The third quarter airdrop for Resolv will end on December 9, with 3% of the RESOLV token supply allocated to it.

The 1-year APY for Resolv's RLP is 17.61%, which is very hard to beat, making it a great strategy even without considering future RESOLV airdrops.

The high APY for RLP comes from its exposure to the risks of Resolv's neutral strategies, but I believe the risk of significant losses is low.

Here is the invitation link for Resolv: https://app.resolv.xyz/points/invite?af=defi1

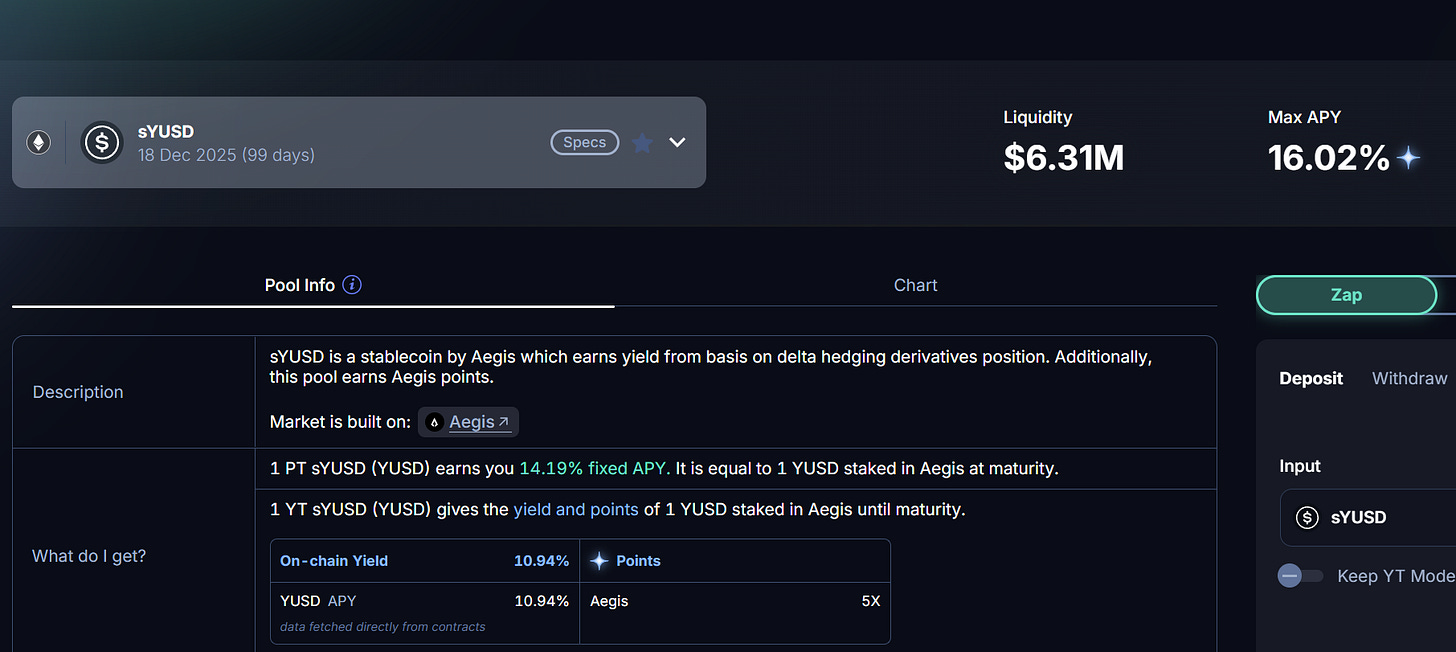

Aegis

Aegis is a stablecoin protocol that generates returns through BTC funding rate arbitrage.

My strategy: I provide YUSD as liquidity in Aegis's sYUSD pool (you can buy YUSD on the Aegis website).

Rewards: 13.79% base APY + 5 times Aegis points.

Additional notes:

One thing I like about Aegis is that it allocates a fixed 0.3% of the Aegis token supply to users weekly (which means the earlier you participate, the larger the airdrop, as an increase in TVL will not dilute your share).

The TGE is expected to take place at the end of the fourth quarter.

You can check your wallet's expected airdrop allocation on Aegis's points page.

Here is the invitation link for Aegis: https://app.aegis.im/sign-in

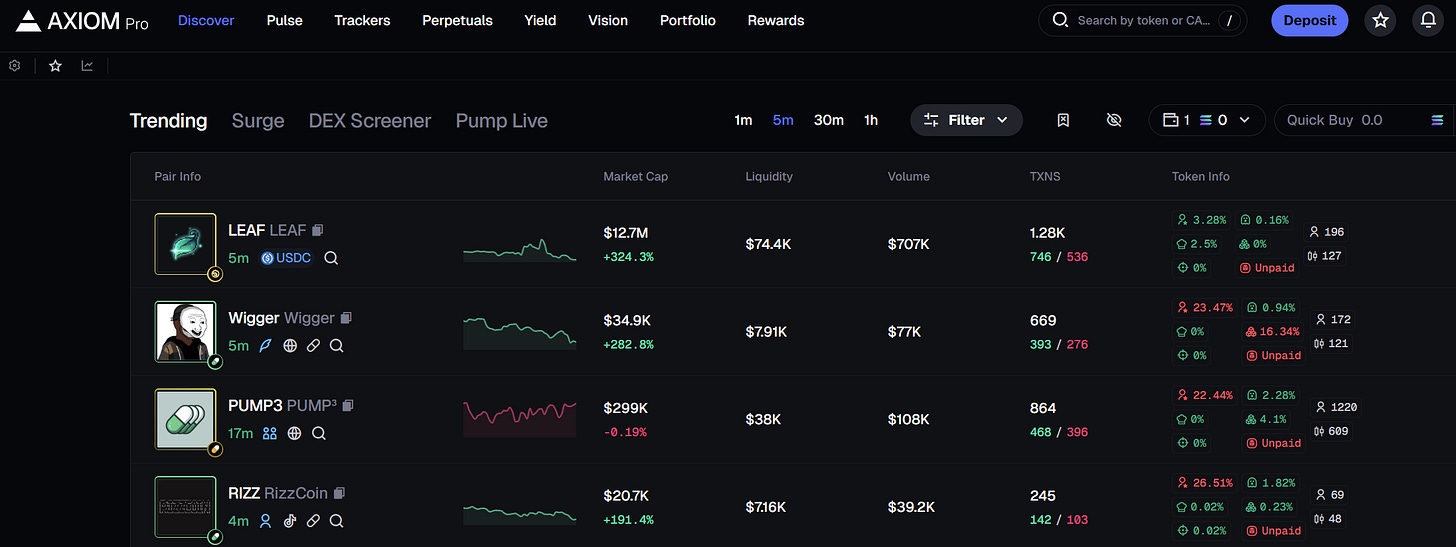

Axiom

Axiom is a trading platform that allows you to buy SolanaMeMe (essentially a competitor to Pump Fun).

It is an extremely profitable application. Several times, it has even surpassed Hyperliquid's daily revenue, leading me to believe its token will have a high FDV.

Even crazier, it achieved $100 million in revenue in just 5 months!

My strategy: I am not very keen on MeMe, so I don't use Axiom often, but I still try to generate trading volume with it from time to time. However, if you are a SolanaMeMe trader, I highly recommend using Axiom.

Rewards: Axiom points.

Additional notes:

The TGE date is unknown, but given that it has a points program, I believe an airdrop is inevitable at some point in the future.

In terms of user experience, I think Axiom is much better than Pump Fun.

You need to manually claim Axiom XP points under the "Rewards" tab.

Here is the invitation link for Axiom, which offers a 10% discount on trading fees: https://axiom.trade/@defii

Loopscale Loopscale is a modular, order book-based lending protocol on Solana.

Interestingly, it is backed by many top-tier venture capital firms, such as Solana Ventures, Coinbase Ventures, and Jump Crypto.

My strategy: The simplest farming method is to provide USDC/SOL as liquidity to its USDC Genesis vault or SOL Genesis vault.

Loopscale also has a "Loop" feature that allows one-click access to leveraged yield strategies. These strategies can be very profitable but require active management, as you may incur losses if interest rates rise significantly.

Rewards: 11% APR for USDC lending / 8.22% APR for SOL lending + Loopscale points.

Additional notes:

The TGE date has not been announced.

One interesting feature of Loopscale is that it allows borrowing at a fixed lending rate, and you can manually select the loan term.

Loopscale also accepts RateX's fixed return tokens (such as Pendle PTs) as collateral, which opens up some interesting yield opportunities.

Here is the invitation link for Loopscale: https://app.loopscale.com/lend

Altitude

Altitude is a DeFi lending aggregator for crypto loans.

If you borrow through Altitude, it checks the lending rates of blue-chip money markets like Aave and Compound and selects the best loan conditions for you.

Additionally, it actively manages your idle capital to generate returns.

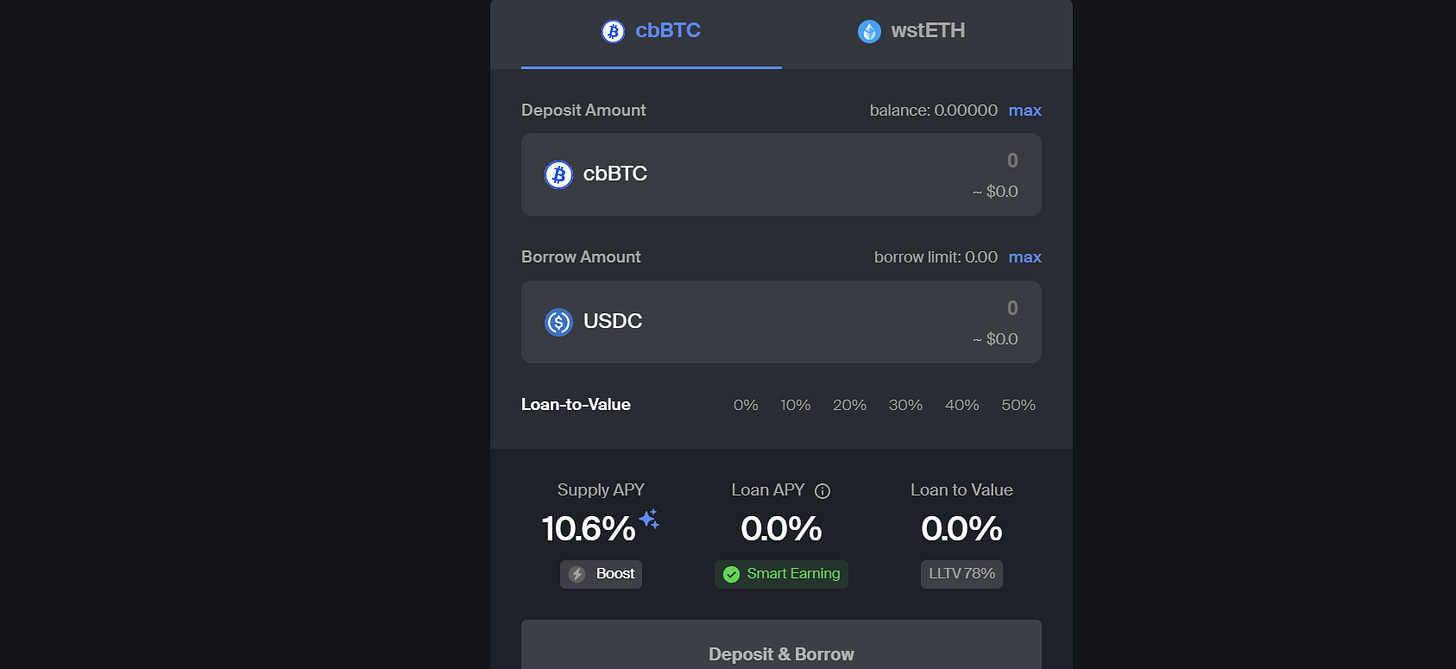

My strategy: I borrow USDC using cbBTC as collateral.

Rewards: Zero borrowing cost for loans + 10.6% APR on cbBTC, primarily in the form of future token incentives (assuming ALTIToken trades at a $70 million FDV).

Additional notes:

Altitude's TGE may take place in the fourth quarter.

If you hold blue-chip tokens (such as cbBTC or wstETH) and want to borrow, Altitude is a good choice, as it will seek the best conditions for your loans from top money markets.

Here is the link to Altitude: https://app.altitude.fi/

Hylo

Hylo is a yield-bearing stablecoin protocol native to Solana.

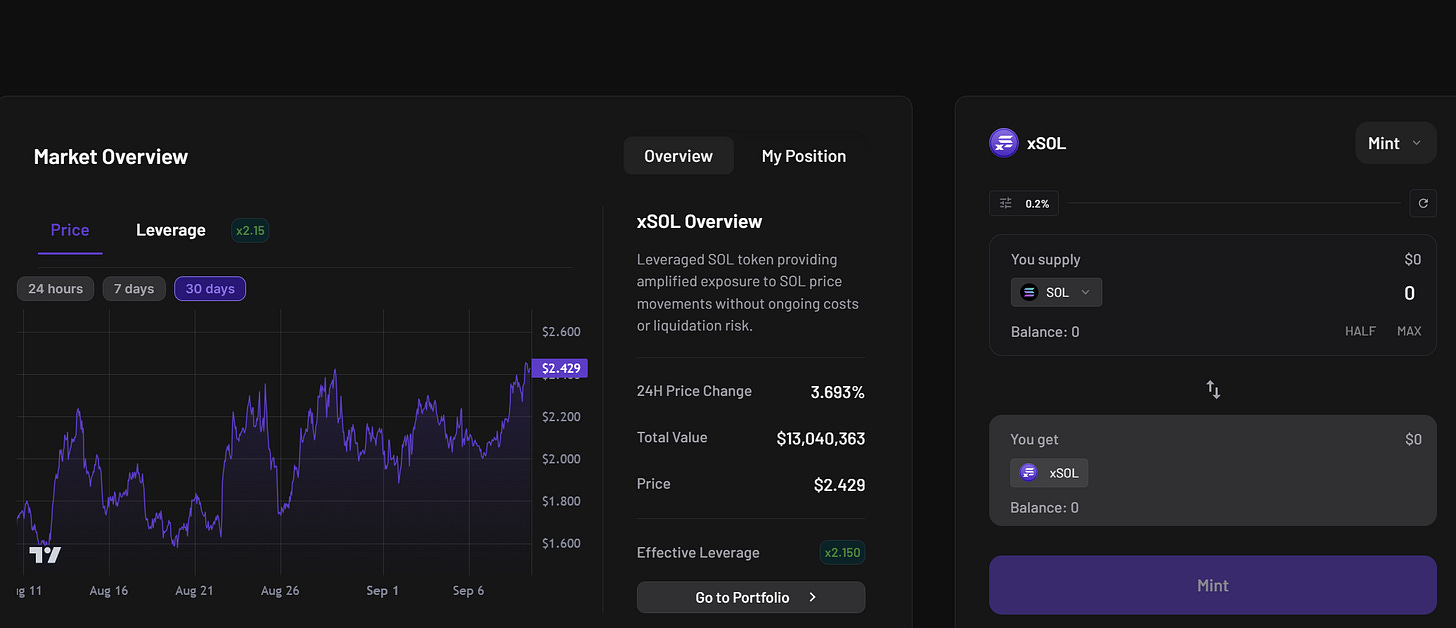

Hylo achieves neutral positions through a dual-token system, including its native stablecoin hyUSD and leveraged SOL Token xSOL.

Its operation is unique: hyUSD is backed by SOL LSTs, and xSOL acts as a volatility barrier, absorbing SOL price fluctuations to maintain the peg of hyUSD.

My strategy: I purchase xSOL on Hylo with a small portion of my SOL holdings.

xSOL provides amplified exposure to SOL prices (2-4x leverage, with no liquidation risk). If you are bullish on SOL, you can buy xSOL for higher returns, but I recommend not buying too much due to its high volatility.

Rewards: 20 times Hylo points (the highest point multiplier).

Additional notes:

The protocol raised $1.5 million in funding, supported by Solana Ventures.

There is a 1% fee for minting/redeeming xSOL (but no other interest rates to pay, and no liquidation risk).

If you do not want exposure to xSOL, you can farm Hylo by purchasing hyUSD and staking it on Hylo for 16% APR + 1 time Hylo points.

Here is the invitation link for Hylo: https://hylo.so/leverage?ref=Y6U3O1

Liminal

Liminal automates neutral strategies on Hyperliquid to generate returns.

It is one of the hottest dApps in the HyperEVM L1 ecosystem, allowing you to earn returns from funding rate arbitrage with just a few clicks.

My strategy: I deposit some USDC in its application, and Liminal opens neutral positions for assets like HYPE, ETH, SOL, and BTC with those USDC.

Rewards: 10% base APR (based on 30-day performance) + potential Liminal airdrop.

Additional notes:

The TGE timeline for Liminal is unknown.

If you choose "Pro" on Liminal, you can customize its funding rate arbitrage strategies and select the assets Liminal uses for neutral strategies.

Using Liminal may qualify you for the Unit airdrop (Unit is the tokenized layer of Hyperliquid), as Liminal uses Unit in its strategies.

👉 Here is the invitation link for Liminal: https://liminal.money/join/DEFINVESTOR

Rumpel

Rumpel is a tokenization protocol for points.

By depositing your LP tokens into the wallet automatically created for you by Rumpel, you can sell the points you earn as tokens at any time.

Alternatively, if you want exposure to a certain airdrop, you can use the protocol to purchase points.

My strategy: I provide USDT as liquidity in the HyperBeat USDT vault on HyperEVM to earn hbUSDT, then deposit hbUSDT into Rumpel.

Rewards: 9.73% base APY + 8 types of HyperEVM ecosystem points from HyperBeat + Rumpel points.

If you want to sell the points accumulated since using Rumpel, you can go to the "Mint" page, click "Mint" to mint points, and then find a DEX to sell on the "Trade" page.

Additional notes:

The TGE timeline for Rumpel is unknown.

Rumpel supports dozens of airdrop farming strategies on Ethereum L1 and HyperEVM.

You can bridge USDT to HyperEVM via thehyperliquidbridge.xyz (a bridge supported by LayerZero).

Here is the invitation link for Rumpel: https://www.app.rumpel.xyz/?ref=5ALC4P

DeFi App (+Hyperliquid)

DeFi App is a user-friendly all-in-one crypto application.

Through it, you can easily perform cross-chain swaps and trade perpetual contracts with a CEX-like user experience.

My strategy: I mainly use it for perpetual contract trading and occasionally for swaps.

Rewards: DeFi App XP points + Hyperliquid points (if there is a second HYPE airdrop).

Additional notes:

I like that its perpetual contract product is built on Hyperliquid, so using it allows you to farm for the next HYPE airdrop and DeFi App points simultaneously.

10% of the HOMEToken supply in DeFi App is allocated for the next airdrop.

The next HOME airdrop may occur at the end of the fourth quarter or early in the first quarter of 2026.

Here is the invitation link for DeFi App: https://app.defi.app/login?join=9IneP5&mode=email

Neutral Trade

Neutral Trade is described as an on-chain hedge fund on Solana.

It has many vaults that generate returns for depositors through liquidity provision and neutral strategies.

My strategy: I deposited some USDC in its Neutralized JLP vault and Hyperliquid Funding Arb vault.

Rewards: 10%+ APR (varies based on the vault you choose) + Neutral points.

Additional notes:

The TGE timeline for Neutral Trade is unknown, but the protocol has been live for over a year.

For stablecoins, Neutral Trade currently offers some of the highest yields on Solana.

Here is the link for Neutral Trade: https://www.app.neutral.trade/strategies

Multipli

Multipli is a DeFi protocol that generates returns through arbitrage strategies.

My strategy: I deposited BTC on Multipli.

Rewards: 4.82% APY on BTC + Multipli ORB points.

Additional notes:

You can also deposit USDT or USDC, but I prefer to deposit BTC because there are not many yield opportunities for BTC.

The team stated that the TGE needs to reach a $300 million TVL milestone, and the current TVL is $79 million (so the TGE may take a while).

Multipli has raised $21.5 million from top venture capital firms like Pantera Capital and The Spartan Group.

Here is the invitation link for Multipli: https://app.multipli.fi/?referral_code=BP3QF

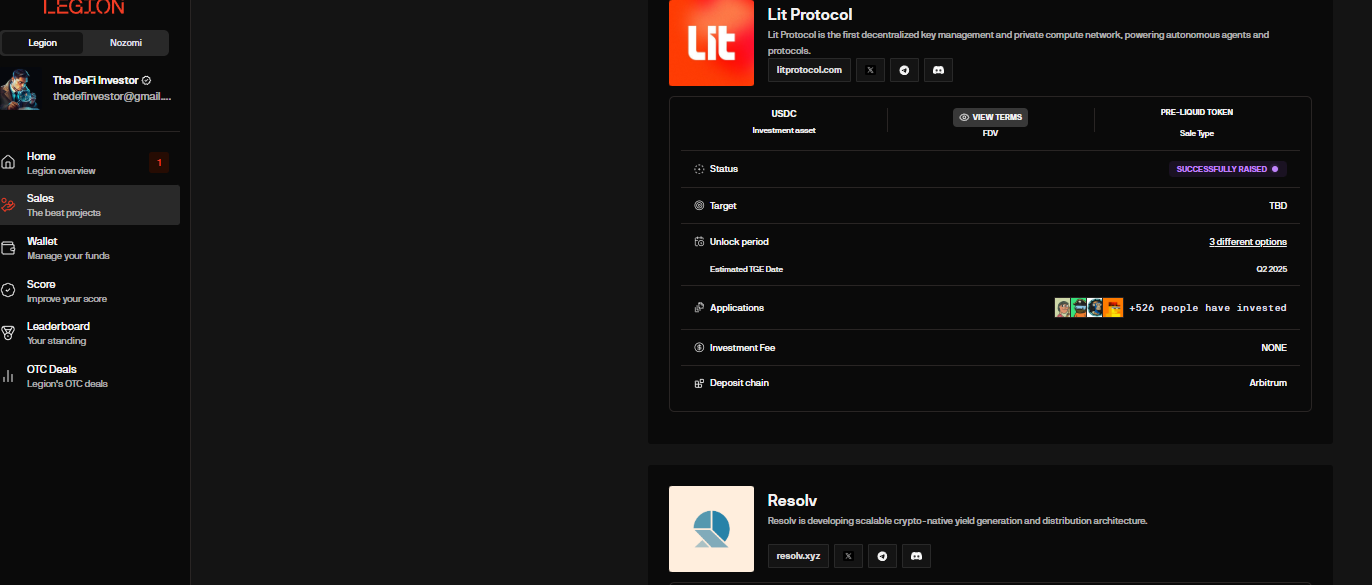

Legion

Legion is a crypto financing platform.

Investing in presale tokens or ICOs is usually very risky, but if you want to participate, Legion makes it easy to invest in projects before their TGE.

I initially didn't think it would do an airdrop, but the Legion team recently raised $5 million, so the likelihood of issuing tokens is high.

My strategy: Create an account, complete KYC, link social accounts, GitHub account (if you are a developer), and your wallet to generate your Legion score and participate in token sales.

Rewards: Potential Legion airdrop (although not yet confirmed).

Additional notes:

My advice is to only participate in ICOs of projects you truly believe in (don't just participate to farm Legion airdrops, as it may not be worth it).

Many well-known projects like Resolv, Fragmetric, and Fuel have raised funds through Legion.

Here is the invitation link for Legion: https://legion.cc/?homie=D04C7FAD

Turtle Club

Turtle Club is a liquidity allocation protocol.

The protocol collaborates with many DeFi projects to promote their incentive programs in exchange for higher rewards for their users.

This airdrop is very easy to farm.

My strategy: Go to Turtle Club, register, and connect all your on-chain wallets.

Why do this? By registering with Turtle Club, you automatically receive reward boosts when using its partner protocols. This includes well-known protocols like Euler Finance, Lombard, Veda, Solv, etc.

For example, if you register with Turtle Club and use Euler Finance, you will receive a 15% boost on Euler Finance's rEUL rewards.

Rewards: Reward boosts when using Turtle partners + potential Turtle airdrop.

Additional notes:

Turtle has confirmed that it will launch $TURTLE, but the TGE timeline is unknown.

You can visit the "Deals" page to see the points/token reward boosts for all projects collaborating with Turtle.

Here is the invitation link for Turtle: https://app.turtle.xyz/referrals?ref=TBOOST

InfiniFi

InfiniFi is a DeFi protocol based on Ethena, with a TVL of $116 million.

It is a partially collateralized stablecoin protocol that allows you to lock stablecoins for a period in exchange for higher returns.

The protocol uses Ethena assets like USDe, sUSDe, and PT-sUSDe to generate yields.

My strategy: Go to InfiniFi's Lock page, deposit USDC, and choose a 1-week lock (you can choose a longer lock if you wish).

A 1-week lock means you will get back your USDC within a week after requesting a withdrawal.

Rewards: 13.46% APY + 1x InfiniFi points + 5x Ethena Sats.

If you choose an 8-week lock, you can earn a higher APY: 14.99%.

Additional notes:

The TGE for InfiniFi is expected to occur in December or early in the first quarter of 2026.

The project raised $3 million from venture capital.

You can earn point multipliers by holding vePendle or providing over $250 in USDC on Morpho (check "Bonus Bytes" on InfiniFi's "Points" page).

Here is the invitation link for InfiniFi: https://app.infinifi.xyz/points?ref=PACAV74K

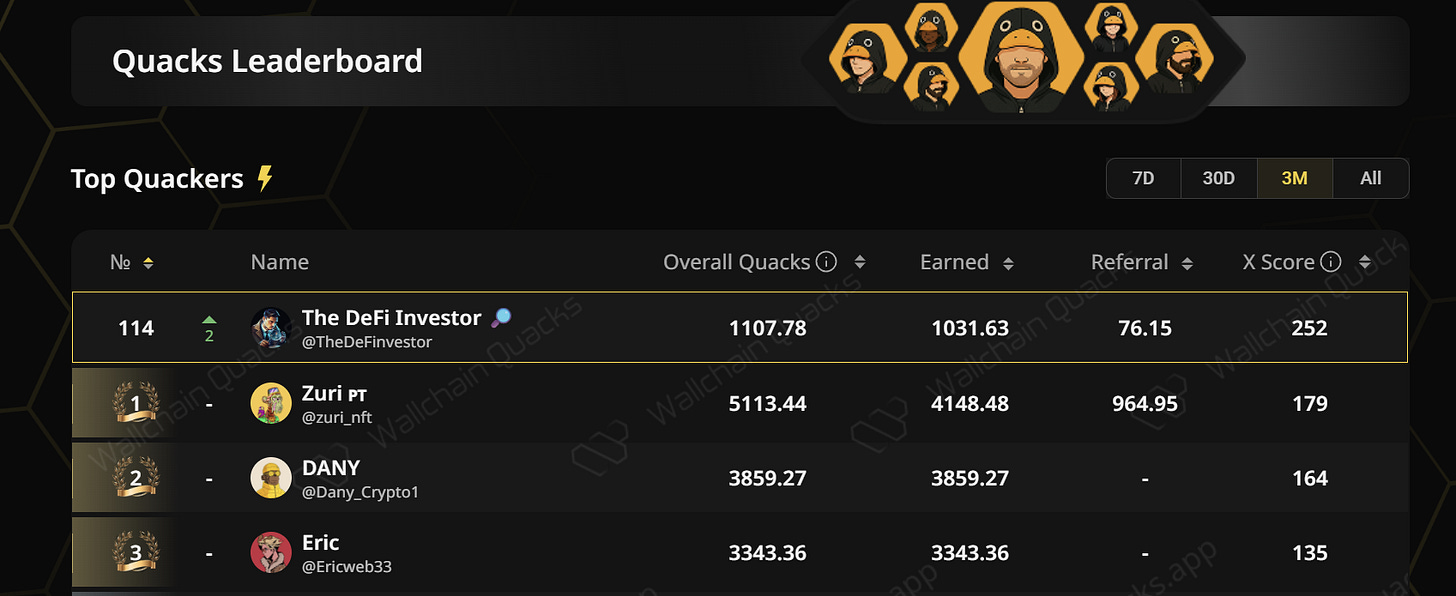

Wallchain Quacks

Wallchain is an InfoFi platform similar to Kaito.

My strategy: Register on Wallchain using your X account.

If you are active on X, this is an effortless operation that could qualify you for future airdrops in just a few seconds.

Additional notes:

The TGE date for Wallchain is unknown.

You can check your ranking on Wallchain's Quacks leaderboard.

Here is the invitation link for Wallchain: https://app.wallchain.xyz/auth?ref=TheDeFinvestor

Fantasy Top

Fantasy Top is a popular crypto consumer application.

Recently, its team released Clout—a leaderboard similar to Kaito's yap leaderboard.

My strategy: Register for Fantasy Top Clout using your X account.

If you create content or are active on X by posting comments, this is an effortless airdrop farming opportunity.

Additional notes:

The token release timeline is unknown, but the project raised funds from venture capital in 2024, so it is likely to issue tokens.

Here is the invitation link for Fantasy Clout: https://fantasy.top/clout/invite=TheDeFinvestor

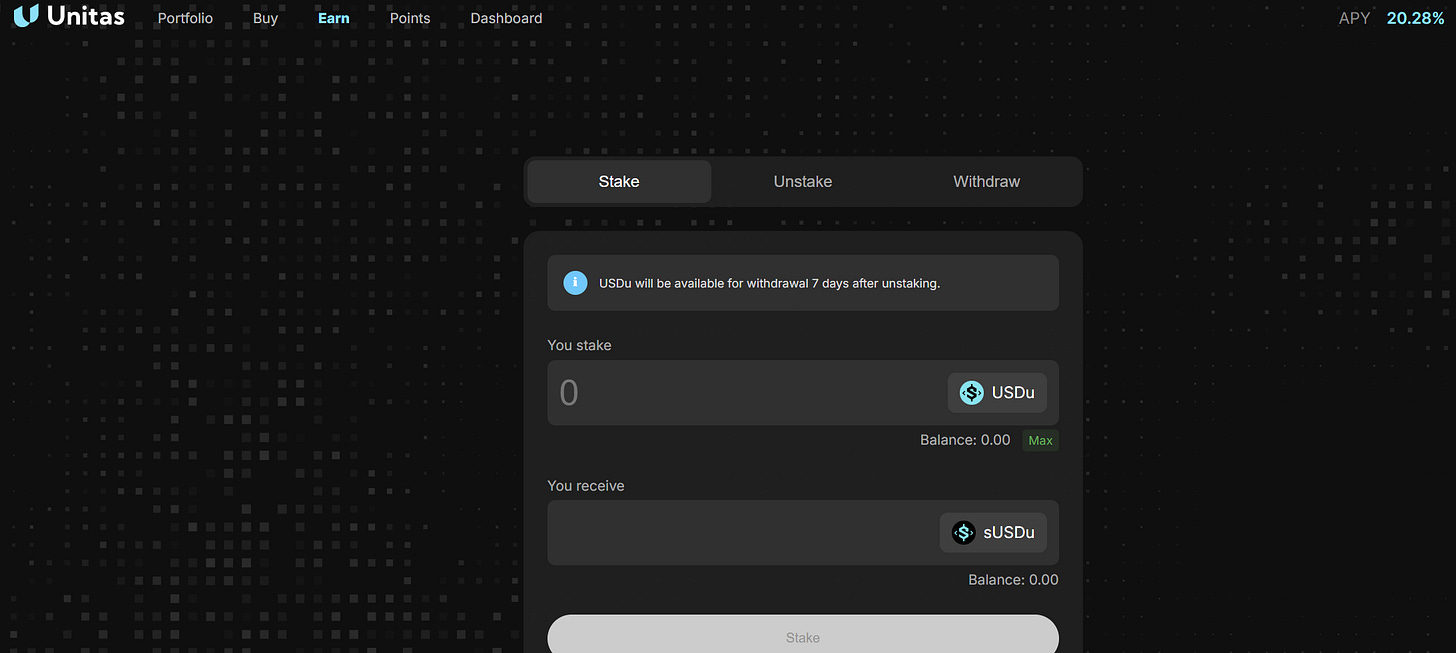

Unitas

Unitas is a stablecoin protocol on Solana that generates returns through JLP neutral arbitrage strategies.

It has just launched, so I do not recommend depositing large amounts of funds. However, given that it raised $3 million, it may continue to exist.

My strategy: I buy USDu on its website and stake it as sUSDu.

The 30-day APY for sUSDu at the time of writing is 19.52%, which is a huge APY for stablecoins (if they can maintain it).

Additional notes:

Rumors suggest that Unitas's TGE will occur in the first quarter of next year.

The protocol's TVL has just surpassed $10 million and is supported by Amber Group.

sUSDu has a 7-day withdrawal period (similar to Ethena's sUSDe).

Here is the invitation link for Unitas: https://app.unitas.so/points?ref=defi

That's all. I personally farm all these airdrops with my own funds.

This article took me a lot of time to organize, but I hope you enjoy it!

I tried to find and cover the important details of each opportunity.

If you are farming other interesting airdrops, please let me know in the comments, as I am always looking for new opportunities.

Best wishes

Article link: https://www.hellobtc.com/kp/du/09/6025.html

Source: https://www.thedefinvestor.com/p/25-airdrops-im-farming-today

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。