撰文:World Capital Markets

编译:Saoirse,Foresight News

应用链(Appchains)与通用链(GP Chains)之间的争论从未停歇。这两种模式各有其优势,但当我们从历史与经济学角度审视便会发现,在通用链上搭建永续合约的合理性不言而喻。

事实上,认为应用程序应自建独立链条的想法,完全是本末倒置。真正优质的应用程序应当为通用链提供支持,而非分裂成一个个孤立的「信息孤岛」。

金融的本质是整合,而非分散

金融行业的发展规律从来不是分散化,而是不断整合。

1921 年,美国约有 3 万家银行;如今,这一数字仅剩下约 4300 家,降幅达 86%。为何会出现这种变化?答案在于共享基础设施、统一标准与高效结算机制。基础设施越少,流动性就越强,规模效应也越显著。

尽管每年都会涌现一批全新的区块链项目,但即便各类替代方案如「寒武纪生命大爆发」般层出不穷,以太坊这个速度慢、成本高的区块链,在锁仓总价值(TVL)排名中依旧稳居第一,且领先优势巨大:其规模几乎是 Solana 的 10 倍。

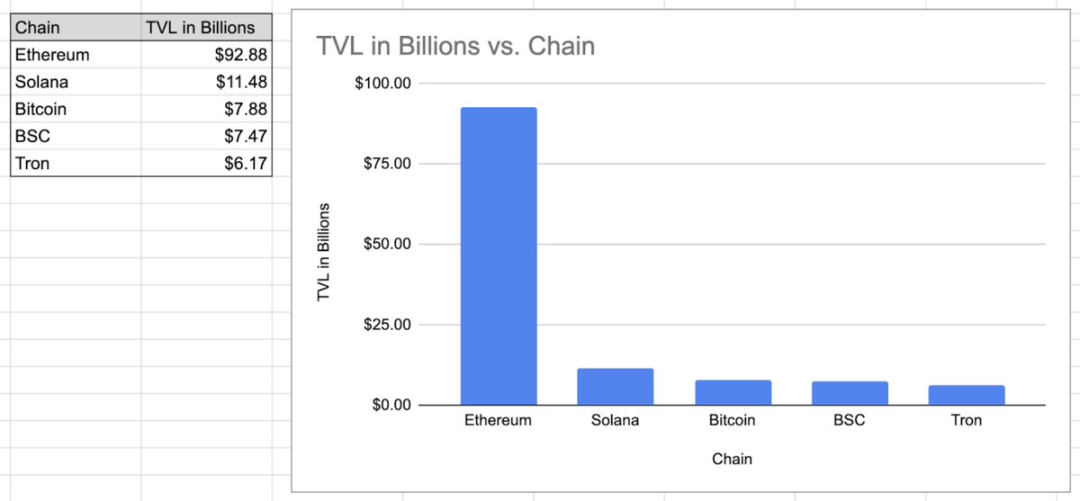

以下是截至 2025 年 8 月 31 日,锁仓总价值排名前五的区块链

数据来源:https://defillama.com/chain/ethereum

在以太坊之后,排行榜中仍以通用链为主。最终你会看到 HyperEVM—— 另一条通用链,它承载着 Hyperliquid 的运行;而 Hyperliquid,也是迄今为止唯一真正成功的应用链。

由此可见,共享结算才是区块链金融的最终方向,而非分散的「特定应用孤岛」。

分销是核心:金融领域的「制胜关键」

有一种常见说法认为,「通用链只解决了分销问题」。「只」解决了?这种说法就好比说「一种药物只治愈了癌症」。在金融领域,分销本身就是核心竞争力。

你日常使用的金融产品,在不同服务商之间的差异究竟有多大?

从支票账户,到纽约证券交易所(NYSE)与纳斯达克(Nasdaq)的对比,除了「分销能力」和「已形成的网络效应」,我很难发现这些业务之间存在本质区别。要知道,服务器等硬件成本低廉,但分销能力却是无价的。

平台经济学:真正的启示

平台是极具影响力的分销载体。

回顾平台的发展历史 —— 从操作系统、应用商店(App Store)、Xbox 游戏主机,到互联网,再到近年的 Telegram—— 规律无比清晰:那些突破性的应用程序,无论主动选择还是被动适应,都会为平台提供支持,而非脱离平台独立发展。

不妨想想分销对平台的重要性:你的 iPhone 上,有多少应用是不通过 App Store 下载的?你又有多少次不使用浏览器就能访问网站?TikTok 没有打造更好的操作系统,Facebook 没有开发更好的浏览器,Halo 也没有制造更好的 Xbox 主机。

事实上,与当前一些观点相反:优质的应用程序反而有动力为平台的发展提供支持。

热门应用希望平台取得成功,这就形成了一个「飞轮效应」:应用带来流量,流量吸引更多应用入驻,进而带来更多流量。

而区块链通过去中心化治理,解决了传统平台的唯一核心弊端 ——「平台风险」(即平台方可能单方面变更规则、限制应用等)。在去中心化平台上,不会再出现类似《开心农场》(FarmVille)因平台规则变动而衰落的情况。你能享受平台的所有优势,却无需承担「被平台压榨」的风险。当然,需要说明的是,由于当前技术中「性能」与「去中心化」存在固有权衡,MegaETH 仍带有一定中心化属性;但重要的是最终目标,而非初始状态。

结论:网络效应驱动的「胜者通吃」

金融行业在持续整合,平台在分销中占据主导,分销能力比产品功能更重要。

而区块链与历史规律的唯一区别,在于它会进一步放大这些效应。

未来的趋势是:永续合约(以及所有「杀手级应用」)将让头部通用链变得更加强大。因为网络效应不会分散,只会层层叠加、不断强化。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。