Solana Price Surge $243 With 20% Weekly Gain Today

Solana Treasury Firms Hold Over 11 Million SOL — What That Means

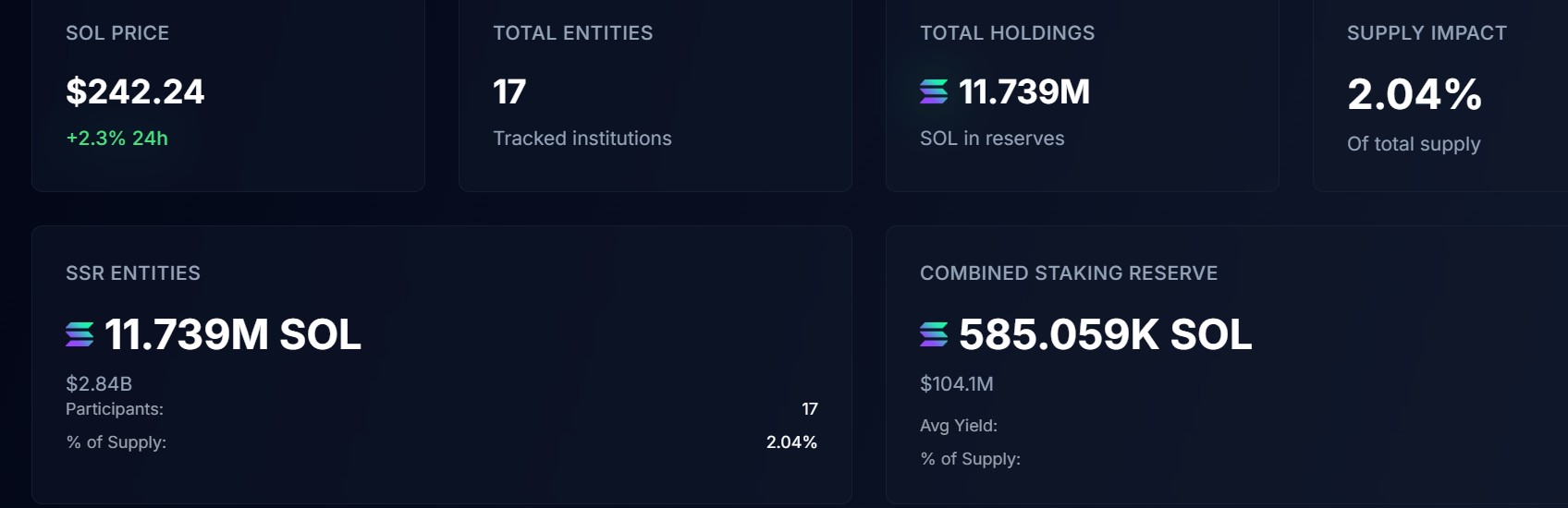

Big holdings by treasury firms and r ecent on-chain research shows 17 corporate treasuries together hold about 11.739 million SOL, worth roughly $2.5 billion. That stash equals about 2.04% of Solana’s total supply. The report names Sharps Technology, DeFi Development, and Upexi as three companies each holding over 2 million SOL.

Source : Strategicsolreserve

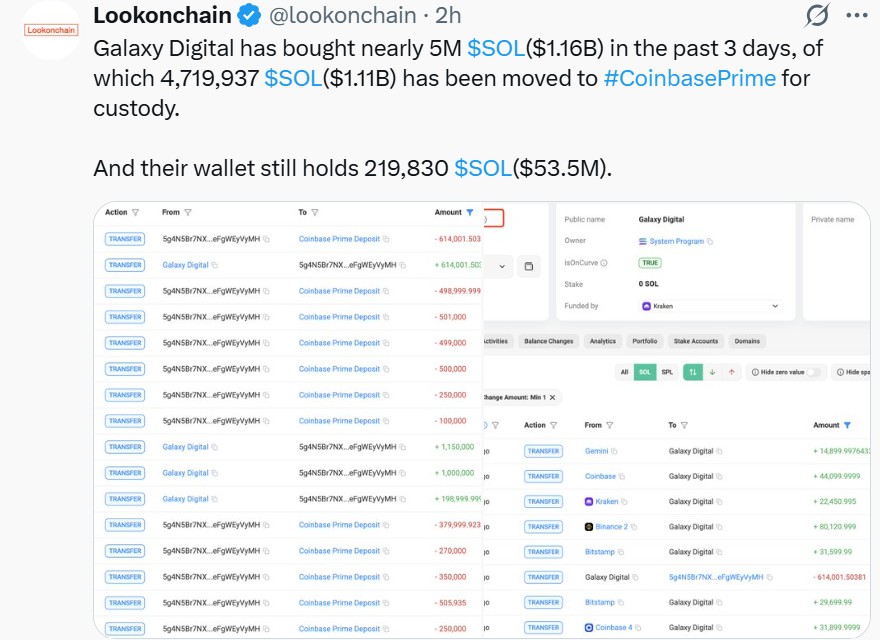

Galaxy Digital Buys 5 Million Solana in 3 Days

Blockchain trackers and Lookonchain reporting show Galaxy Digital bought nearly 5 million coins in a short span of 3 days. Around 4,719,937 coins were moved into Coinbase Prime custody, while a smaller remainder stayed in a Galaxy wallet. Those large purchases helped push fresh money into the cryptomarket and signalled strong institutional interest.

Source : Lookonchain

Companies hold this crypto token in treasuries to support business plans, diversify assets, or signal confidence in the blockchain. Large corporate treasuries reduce sell pressure and boost the cryptomarket.

Solana's Alpenglow network upgrade aims for faster finality and better decentralization, pleasing developers and validators. Improved technical performance can attract more apps and institutional users over time.

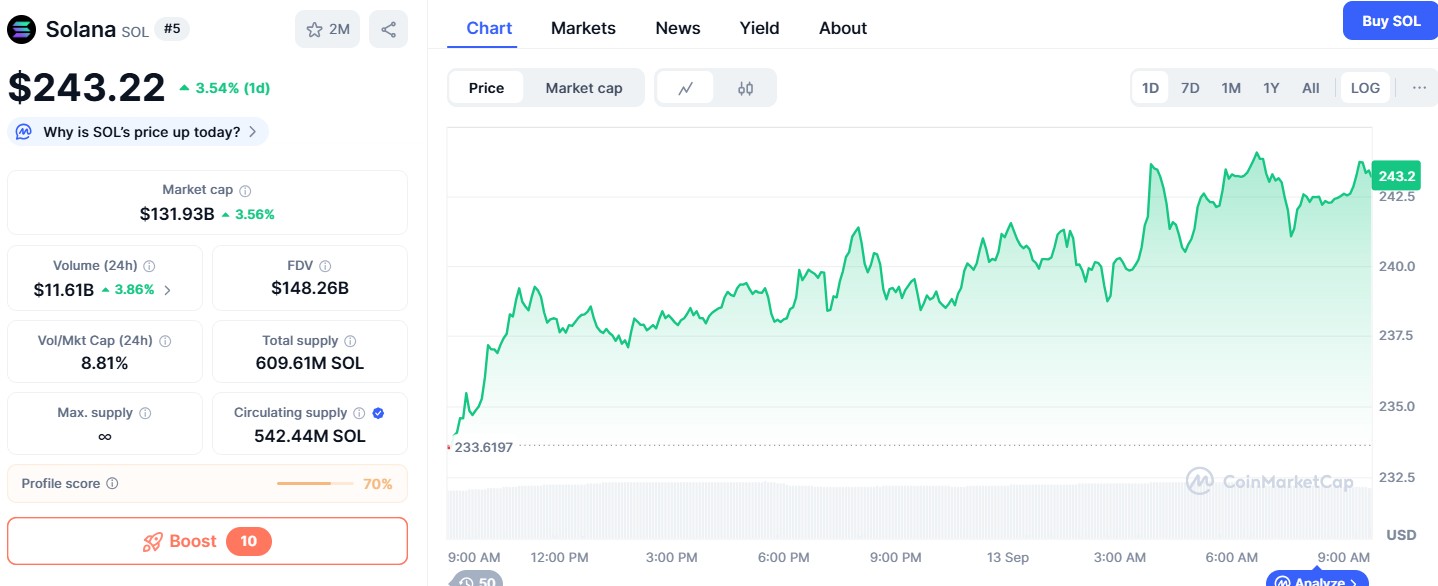

Current Price and Market Sentiment

Big buys by institutions — including Galaxy Digital’s recent purchases — have added pressure on price and sent strong buying signals to the market. On-chain trackers report Galaxy bought $5 millions of coins and moved much of it to custody.

Source : Coinmarketcap

The token is trading near $243 , with a market cap near $132 billion, according to CoinMarketCap. The token surged by ~4% in the last 24hrs. The coin has also seen a massive high of approx 20% in the past week. Crypto community sentiments are more bullish with 85% towards the token.

Price Forecast and Outlook

The price sits in the low-to-mid $200s as institutional buys and treasury holdings drive optimism. The Alpenglow upgrade adds a technical reason for confidence.

Short-term momentum looks bullish: if demand stays, the token may test $260–$320 in the coming weeks. A steady push above $320 would point to a larger rally.

However, markets can reverse quickly; major sell-offs or negative ETF or regulatory news could pull price back toward $180–$200 support.

This is a market view — not financial advice.

What Solana’s Growth Means Going Forward

Put simply: big corporate treasuries + Galaxy Digital’s purchases + a positive upgrade = stronger market sentiment. These signals arrived together and helped push the coin higher. The move is not only about price — it is about confidence in Solana’s technology and future use.

Also read: Spell Wallet Daily Puzzle 14 September 2025: Earn Reward免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。