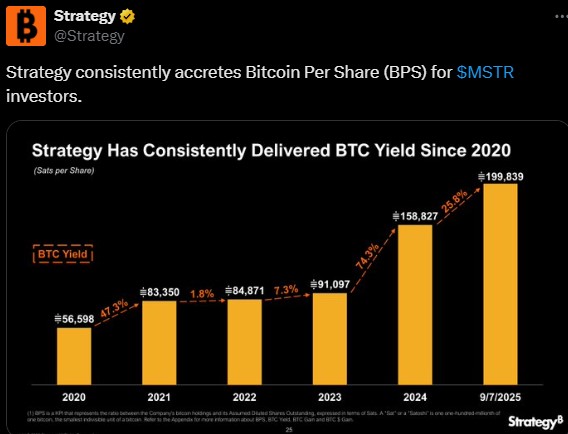

策略比特币增长:MicroStrategy的每股比特币价值在2025年激增25.8%

MicroStrategy($MSTR),现在称为Strategy,作为全球最大的企业比特币持有者,再次展示了其与这一黄金资产的紧密联系。到2025年9月7日,Strategy每股比特币价值(BPS)已攀升至199,839个聪(satoshis),这是其历史最高水平。

来源: X

多年来的稳定增长

早在2020年,每个$MSTR股票的价值为56,598个聪。如今,这一数字已增长了三倍多。该公司每年稳步增加比特币持有量,近年来增长速度加快。仅在今年,BPS就上涨了25.8%,显示出公司比特币基础的快速增长。

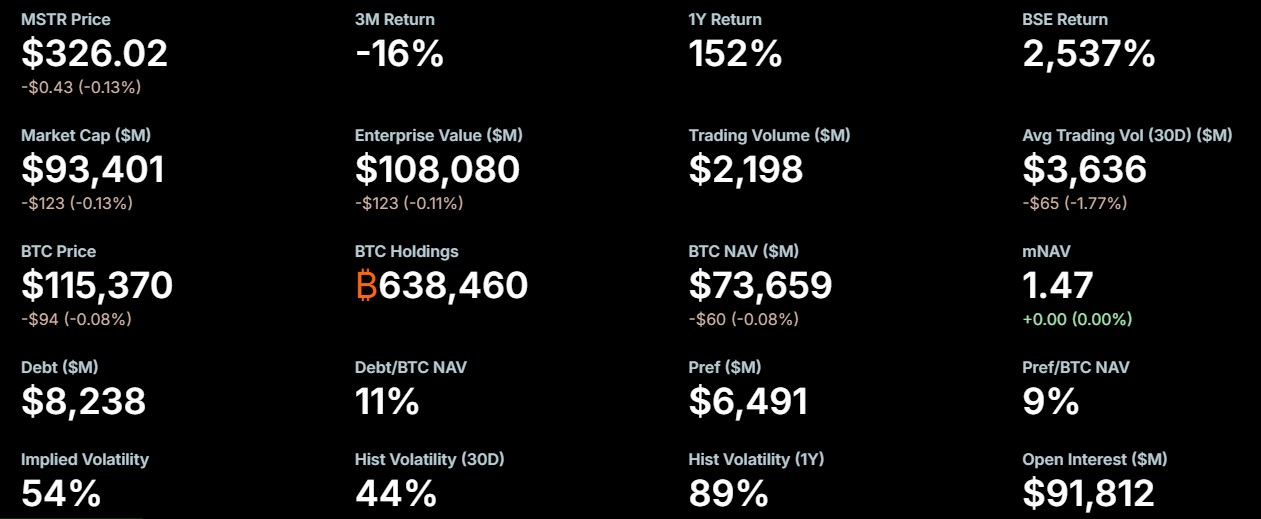

当前市场快照

来源: Microstrategy

其mNAV为1.47,意味着股票交易价格比其BPS价值高出47%,显示出投资者的信任。尽管债务仅占小部分(与其比特币价值相比约为11%),且交易活动非常活跃(每日交易22亿美元),该公司财务状况良好。

市场背景:资产定位

比特币(BTC)目前交易价格为115,331美元,几乎没有变化。尽管在短期内,币价和$MSTR股票可能会波动,但自2020年比特币进入市场以来,其长期表现清晰,回报率达到2,537%。它的表现超过了大多数传统投资。

这为何重要

通过持有如此巨额的比特币,Microstrategy的股票表现就像比特币表现的镜子。那些不想直接购买比特币的投资者通常会选择购买$MSTR股票。由于投资者相信其长期战略和安全管理债务的能力,该公司的股票交易价格略高于其比特币价值。

展望未来,如果比特币继续上涨,接近2028年的减半事件,分析师认为Strategy的BPS在明年可能会突破每股250,000个聪。这将进一步巩固其作为传统股市中比特币敞口领先公司的地位。

另请阅读: 美联储降息2025:加密货币和全球市场如何受益

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。