Author: momo, ChainCatcher

Recently, with Binance announcing the launch of Ethena USDe (USDe), ENA has seen a significant surge, once again showcasing the immense potential of innovative products like CeDeFi Vault in the market.

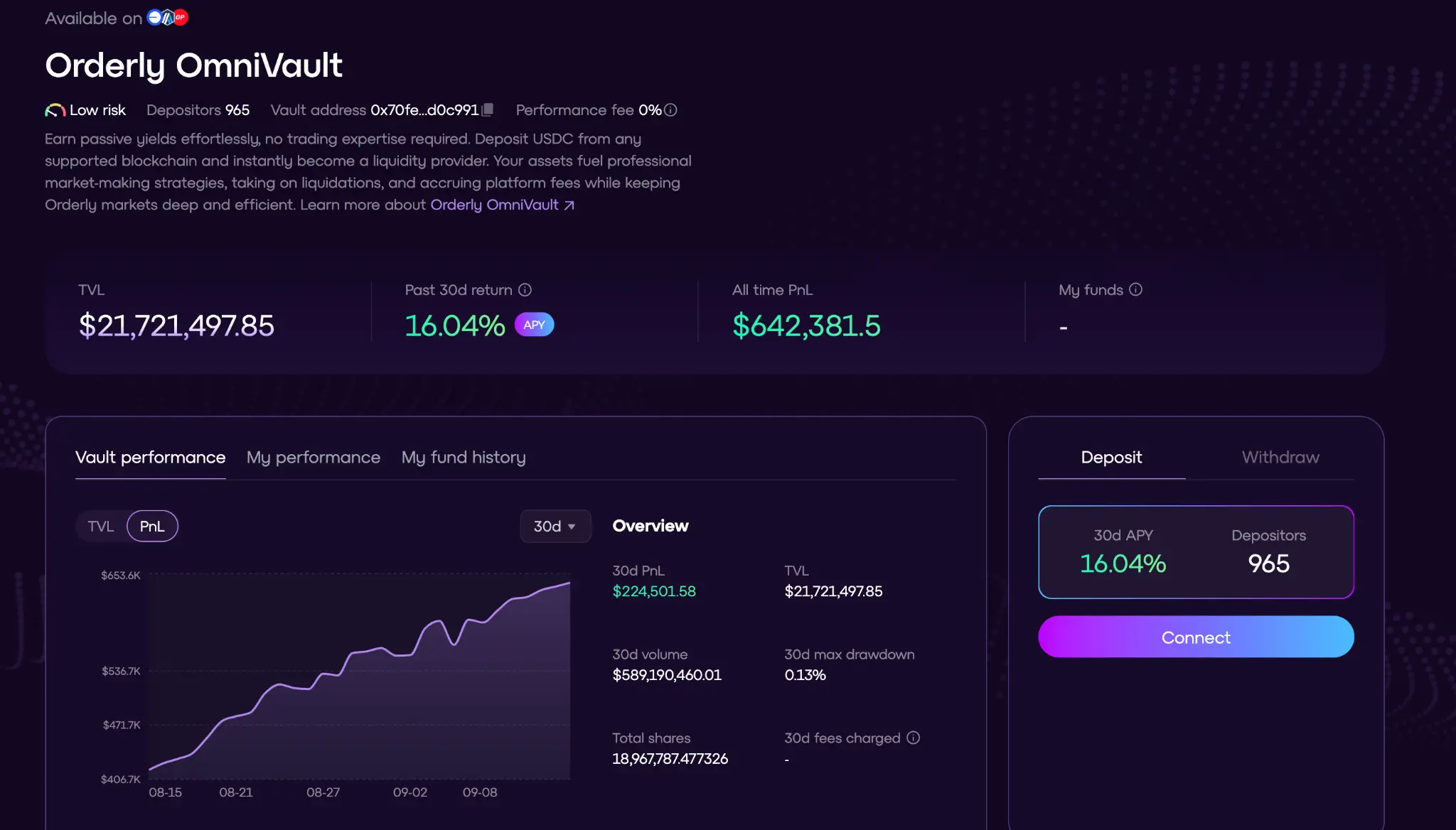

Following Ethena, Orderly's cross-chain liquidity vault, OmniVault, has also begun to emerge. After integrating Binance liquidity through Ceffu, OmniVault has performed strongly: its TVL quickly surpassed $21 million, with nearly $600 million in trading volume over the past 30 days. This impressive performance has also helped Orderly successfully qualify for the BNB Chain Annual Awards in 2025.

The rapid rise of OmniVault not only marks its evolution from the Ethena model but also reveals its ambition to create a core entry point for future on-chain asset management and become a liquidity hub in the CeDeFi ecosystem.

Why is OmniVault considered an evolved version of Ethena Vault?

High Yield with Low Drawdown Performance

Orderly is a modular trading infrastructure that provides developers with a composable and pluggable trading system. In April of this year, Orderly launched the OmniVault, a full-chain liquidity vault, which has become a representative vault product of the CeDeFi model after integrating Ceffu. OmniVault aims to provide users with a more stable on-chain wealth management channel while pursuing higher yields.

Using OmniVault is not complicated; after users deposit USDC, their funds automatically participate in market-making activities on the Orderly network, running Kronos Research strategies across multiple chains such as Arbitrum, Optimism, and Base, thus earning real, verifiable LP returns. Notably, OmniVault supports flexible deposits and withdrawals every three hours, which is rare in the DeFi space.

The yield performance is also quite attractive. At launch, the APY (annual percentage yield) once exceeded 50%, while the recent 30-day APY has maintained around 20%, higher than most traditional DeFi vaults. Additionally, its risk control capabilities are solid, with the maximum drawdown kept within 0.13%.

Three Major Evolutions Compared to Traditional DeFi Vaults

The ability to achieve such high yield with low drawdown performance stems from three key evolutions that OmniVault has realized compared to traditional DeFi vaults:

1) Support for Multi-Strategy Trading. Unlike traditional DeFi vaults that generally rely on a single strategy, "simulated matching," or "internal loop trading" for yield, OmniVault leverages the dual advantages of CeFi and DeFi to implement diverse trading strategies and sources of income, allowing yields to come from real on-chain order matching trades, thus possessing stronger sustainability and volatility resistance.

For example, OmniVault collaborates with professional institutions like Kronos Research to adopt high-frequency multi-exchange trading strategies, obtaining stable returns through hedging operations across multiple exchanges. This strategy has typically been used only in professional trading institutions, but OmniVault has made all operations and yield distributions transparently recorded on-chain, making it accessible to ordinary users. This allows users to enjoy the high execution efficiency and stable returns of CeFi without sacrificing the low barriers to entry, openness, and transparency of DeFi.

2) Integration of CeFi Liquidity. OmniVault integrates with Binance's institutional custody platform Ceffu to access Binance liquidity while retaining some funds in on-chain smart contracts. This design preserves the liquidity and trading opportunities of centralized exchanges while ensuring the transparency and security of on-chain operations. Additionally, the Orderly protocol allocates up to 40% of net income and part of the insurance fund fees to the vault, further enhancing the stability and volatility resistance of returns.

3) Multi-Chain Support. Traditional DeFi vaults are often limited to a single chain, while OmniVault relies on Orderly's full-chain liquidity layer, allowing users to seamlessly deposit and withdraw across multiple chains. For instance, users can deposit USDC on Optimism and withdraw on Base, reducing operational costs caused by fragmented liquidity and providing capital efficiency.

Beyond Ethena: Full-Chain Expansion and Diverse Strategies

Overall, OmniVault can be seen as an evolution of the Ethena model. Ethena primarily operates within the Ethereum ecosystem, generating yields through staking ETH derivatives and hedging strategies, with relatively singular strategies and limited cross-chain expansion capabilities.

In contrast, OmniVault natively supports multiple chains and successfully accesses the liquidity of mainstream exchange Binance through Ceffu, establishing a more efficient connection between CeFi and DeFi. More importantly, it plans to introduce multiple managers and diversified strategies, allowing users to flexibly allocate assets based on their risk preferences while enjoying a transparent and convenient trading environment with richer yield path options.

Behind High Growth: On-Chain Wealth Management Shifting from Speculation to Real Returns

If the innovative product design laid the foundation for OmniVault's explosion, its actual performance post-launch confirms the market's demand for this model.

Data shows that OmniVault's trading volume in the past 30 days approached $600 million, with its TVL surpassing $21.7 million in a short time, attracting nearly a thousand deposit users and generating over $640,000 in cumulative returns for depositors.

"The data performance has indeed exceeded our initial expectations," said Orderly co-founder Ran in a recent interview, acknowledging that OmniVault meets users' urgent need for stable on-chain wealth management. OmniVault has not conducted large-scale market promotions; its funds have naturally flowed in entirely based on "yield performance."

The rapid emergence of Hyperliquid and then Orderly OmniVault also indicates that as the benefits of DeFi airdrop subsidies fade, current on-chain funds are shifting from "speculative assets" to "structural investments," accelerating the flow of capital towards new infrastructures that can generate real returns and enhance trading efficiency.

Hyperliquid has created a system that closely aligns with the needs of professional traders through "centralized experience + on-chain asset settlement," becoming a dark horse in the DEX space, while Orderly OmniVault, with its "CeFi-level asset management strategies + on-chain transparent yield distribution" CeDeFi structure, is pioneering a new paradigm of on-chain wealth management with higher yields and stronger stability, becoming a new choice for more on-chain users.

Currently, the synergistic effect between OmniVault and the Orderly ecosystem is becoming evident. OmniVault not only optimizes strategy execution by utilizing Orderly's liquidity depth but also feeds back into the ecosystem, attracting more traders and capital. Since the launch of OmniVault, the overall TVL of Orderly has surpassed $51 million, with the user base approaching 900,000.

The Ambition to Become the "Core Entry Point for On-Chain Asset Management"

OmniVault's ambition goes far beyond being a single blockbuster product. According to Orderly co-founder Ran, its long-term goal is to create a truly meaningful entry point for on-chain asset management, building a closed-loop ecosystem of "on-chain financing and off-chain income generation."

He emphasized in the interview that on-chain asset management is currently building up for an explosion, and the wealth management needs of crypto users will gradually shift from centralized exchanges to on-chain. "In the future, centralized exchanges will serve as the entry point for fiat deposits and withdrawals and KYC services, guiding users and capital into the on-chain liquidity and wealth management space. Following Aave and Pendle, more complex and higher-yielding on-chain wealth management products will emerge."

In this vision, OmniVault's business boundaries are expected to continue expanding. In the short term, the team will support more asset types, expanding from the current USDC to mainstream currencies like USDT and Ethereum to meet users' diverse asset allocation needs. At the same time, the platform plans to introduce multi-strategy management and a multi-manager system, breaking the reliance on a single strategy and providing users with a range of risk products from conservative to high-yield.

In the long term, as TVL continues to grow and the integration with infrastructures like Ceffu deepens, OmniVault is likely to evolve along the "reverse path of Ethena": from the existing DEX + Vault model, gradually moving towards issuing native stablecoins, exploring more forms of yield tokenization, enhancing capital liquidity and composability, and forming a more complete asset closed loop and value cycle.

OmniVault is steadily moving towards its goal of becoming the core entry point for on-chain asset management and hopes to redefine the future form of CeDeFi asset management.

How Can Ordinary Players Participate in OmniVault?

For ordinary users, participating in OmniVault is very simple and does not require complex on-chain operations or strategic knowledge.

Users only need to log in to Orderly's official OmniVault page and connect a supported wallet. For example, users can directly deposit USDC into the OmniVault vault using Binance Wallet and automatically enjoy real passive income generated by strategies managed by professional market makers like Kronos Research. After depositing, users can check their asset status and accumulated returns at any time and have flexible redemption rights every three hours.

It is worth mentioning that with Binance Wallet, OmniVault has access to a user base in the hundreds of millions and the potential for billions of dollars in liquidity.

Regarding users' concerns about asset security and transparency, all user funds in OmniVault are stored in audited smart contracts, with key operations supervised by a decentralized governance mechanism. Additionally, through institutional-level custody and multi-signature risk control in collaboration with Ceffu, asset security is further ensured. Users can verify all position statuses, transaction records, and yield distributions on-chain in real-time, minimizing information asymmetry.

The insurance fund mechanism of the Orderly protocol itself and the design of part of the protocol's income feeding back also provide an additional buffer layer to cope with extreme market conditions.

Conclusion: Can it Become the Liquidity Hub of the CeDeFi Ecosystem?

The rapid rise of OmniVault signifies not just the success of a single product but marks a new stage where on-chain asset management is shifting from "short-term speculation" to "infrastructure reconstruction."

With its innovative CeDeFi architecture, OmniVault not only achieves a yield-risk ratio far superior to traditional models but, more importantly, validates a sustainable and scalable way of organizing on-chain liquidity.

Currently, OmniVault is still in its early development stage, but its performance clearly points to a grander future: it is no longer just the growth engine of the Orderly ecosystem but is gradually becoming the underlying hub connecting CeFi and DeFi liquidity, multi-chain assets, and user yield demands.

Its continuous evolution not only provides growth momentum for the Orderly ecosystem but also offers a practical example for the industry to explore the next generation of on-chain asset management models.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。