CPI Data Met Expectations Today, Is 25bps Fed Rate Cut Guaranteed Now?

Everyone was waiting to see if inflation would surprise the markets — but CPI data met expectations at 2.9%, and that brought a big sign of relief. This number may look calm, but it has started a new wave of tension.

It signals that the Federal Reserve might soon cut rates and follow the same pattern to turn expectations into reality, which could change the sentiment of stocks, crypto, and the whole market in the coming months.

US CPI Data Today Hits the Bullseye: Came At 2.9% as Expected

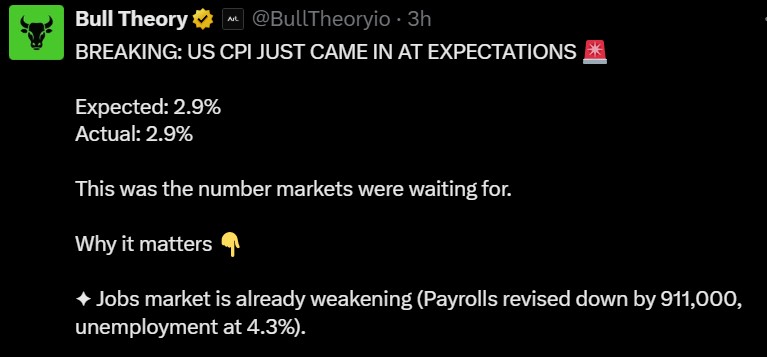

The highly anticipated Consumer Price Index update has arrived, and CPI data met expectations perfectly at 2.9%, as projected by Bull Theory official X post.

This report calmed worries about inflation rising again and showed that price pressures are starting to cool down across the economy.

After weeks of doubt, the CPI report released gave a clear signal — the fight against price increase is moving in the right direction, and it didn’t cause any panic in the market.

Why It Matters: Inflation Trend Confirms Cooling

Several macro indicators already hinted that disinflation was underway:

-

Job growth is slowing, with payroll figures revised down by 911,000 and unemployment at 4.3%.

-

Producer Price Index and Core PPI fell below forecasts, confirming lower upstream costs.

-

The CPI data released today confirms that consumer prices are aligning with the broader cooling seen in producer prices.

Together, this shows that US inflation news is finally favoring the Federal Reserve’s goal of stable price levels.

Effect of 88% Fed Rate Cut Probability Soar on Polymarket

Minutes after the CPI release, Ash Crypto reported that the fed rate cut probability on Polymarket jumped to 88%. This indicates traders are nearly certain that the Federal Reserve will deliver a 25bps Fed rate cut during the Fed meeting in September .

Further support came from The Kobeissi Letter , which highlighted that the U.S. 10-Year Treasury yield dropped below 4.00% for the first time since April — a major sign of dovish sentiment.

"That’s not it, but three cuts are priced by year-end now , bond traders believe the Federal Reserve will cut interest rates three times by 25bps each before the end of 2025."

This shows a big change from the earlier “higher for longer” view to a more gradual easing cycle. For the stock market, this could mean lower borrowing costs and better profit growth in Q4.

For riskier assets like cryptocurrency, the rally might start a bit later — but could rise much faster once it begins.

Big Picture: Calm Confirmation Before the Easing Wave

This outcome may not be as dramatic as a lower-than-expected report, but CPI data met expectations and clearly showed that:

-

Disinflation is real and happening across the economy.

-

The Fed news cycle is now clearly moving toward a dovish path.

-

Investors can move back into growth assets without worrying about inflation coming back.

-

This balance between CPI vs interest rates gives confidence that the crypto cycle is still strong.

This rate cut news update now sets the stage for the Fed meeting September decision, which could spark the next big wave of risk-on sentiment in the markets.

Conclusion

As CPI data met expectations gave markets what they craved most — clarity, today’s analysis shows that price increase is cooling, Fed rate cut probability going up, and the US 10-year bond yield drop showing trust in policy easing, things are clearly changing.

Bottom line: This is not the end of tightening — it’s the beginning of the easing era. Keep an eye on fed news, as the coming week is going to be a major breaker for the market.

This article is only for information and not financial advice — please do your own research.

Also read: Xenea Wallet Quiz Answer 12 September 2025: Play and Earn $Gems免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。