作者:J.A.E, PANews

2025年9月3日,桥水基金创始人瑞·达利欧在X平台发文称,美元债务困境是推动黄金和加密货币价格上涨的因素之一。就在同日,国际金价创下了每盎司3,578.32美元的历史新高。与此同时,加密行业的代币化黄金市场规模已突破26亿美元,Tether近期也传出消息正在洽谈投资黄金矿业。

在黄金市场一路高歌猛进,前线捷报频传,形势一片大好的节点,其内部却掀起了一阵“数字化转型”的浪潮。近日,世界黄金协会(World Gold Council, WGC)联合顶尖国际律所Linklaters共同发布了一份开创性的白皮书,正式提出了“全盘数字黄金”(Wholesale Digital Gold)生态系统与“池化黄金权益”(Pooled Gold Interests, PGI)的新定义。黄金市场的“数字化升级”不仅是一次单纯的技术变革,更是TradFi向加密市场的一次战略性回应。黄金作为最古老的金融资产也迎来了数字新时代强调效率与灵活性的洗礼,以解锁其在TradFi体系中的新用例。

从交易受限到抵押受阻,WGC为黄金市场开出“数字解方”

目前,伦敦的场外(OTC)黄金市场主要由两种清算模式构成:分配式黄金和非分配式黄金,其各自的优劣势组成了白皮书中指出的“机会缺口”。

分配式黄金即物理金库中具有唯一序列号、成色与重量信息的特定金条,其最大的优势在于所有权清晰,投资者拥有对实体金条的直接所有权,因此将有效隔离和托管银行之间的信用风险,但该模式的“代价”是较高的复杂性、仅接受以整根金条为单位(通常约为400盎司)交易的不可拆分性以及由此产生的流动性限制。

相对地,非分配式黄金则是一种投资者对托管机构持有的特定数量黄金的债权。由于不需要分配特定金条,该模式提供了更高的灵活性与流动性,交易单位可低至千分之一盎司,且结算流程更高效。然而,其劣势在于具有显著的交易对手风险。一旦托管机构破产,投资者对黄金的债权将和其他无担保债权人一并清算,资产难以获得司法保护。

白皮书点明,现行的两种模式在充当金融抵押品方面都存在严重的局限性。非分配式黄金因其债权性质,根据英国与欧盟的相关法律,通常无法被视作合格抵押品。而分配式黄金,虽然法律上可行,但其“代价”意味着在实操过程中需要频繁转移、交割与隔离实物,导致其成本与复杂性极高,因此难以被用作抵押品。

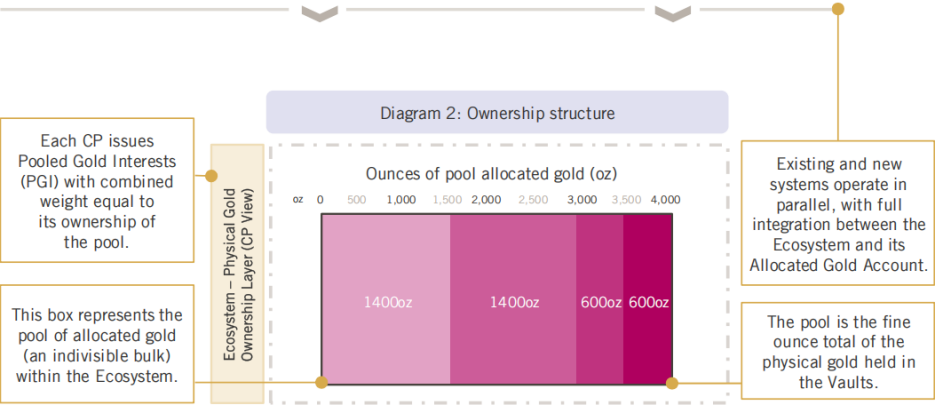

WGC提出了全新的PGI模式作为解决方案。PGI的基础是一个“核心参与者”共同持有且独立于托管机构自有资产的实物金条池,其权益具有可拆分性。

PGI的法律基石是其区别于现行模式的关键。白皮书指出,该方案是基于英国《1979年货物销售法》第20A条:允许在不拆分实物的条件下,转让在“已识别的大宗货物”中未分割份额的所有权。通过该法律架构,PGI可被定义为一种“无形动产”,意味着PGI的转让无须移动实物,而是一种在数字账本上执行的权利让渡。

PGI的核心优势主要表现在三个方面:首先,如非分配式黄金一般,其可被拆分为千分之一盎司的交易单位,提供了较高的灵活性;其次,因其“专有权利”的法律定义,PGI持有者的资产具有“抗破产性”,即使托管机构破产,其资产也不会被清算,从而填补了非分配式黄金的缺陷;最后,PGI作为一种无形动产天然适用于作为抵押品,且其设计兼顾欧盟、英国EMIR与美国《多德-弗兰克法案》等合规要求,或将激活黄金在OTC和中央清算对手方中的抵押品潜力。

代币化黄金的实践路径

其实,针对黄金市场长期存在的流动性低、抵押难、信用风险高等痛点,加密市场已通过代币化黄金进行了先行探索,为黄金的数字化与金融化提供了可行的实践样本。

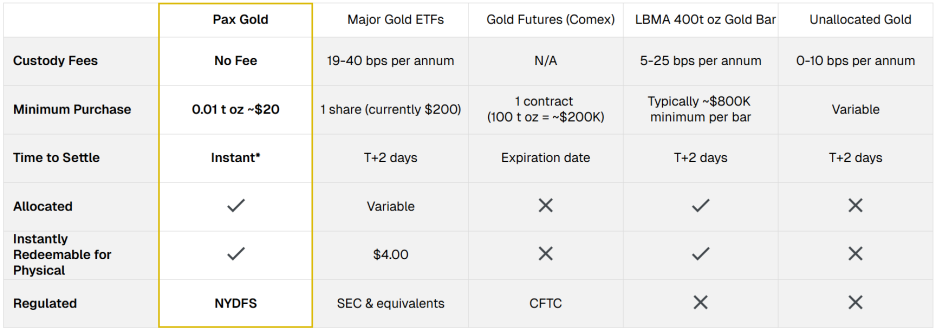

作为加密市场的拓荒者,Tether于2020年发行了Tether Gold (XAUT) 代币,目前市值突破13亿美元。每枚XAUT代币代表一金衡盎司的LBMA标准金条,存储在瑞士金库。从技术架构而言,XAUT是一种发行在以太坊上ERC-20代币,实现了24/7无间断的全球交易,不再受限于传统市场的交易时间。

XAUT具备高流动性、高可拆分性(可精确至百万分之一盎司)的优势,其作为加密资产在DeFi生态中亦被广泛采用。XAUT为加密市场的投资者持有黄金敞口提供了一条捷径,其可作为对冲加密货币波动性的工具。不过,XAUT的弊端在于其高度中心化的控制与透明度存疑,底层资产完全依赖Tether的信用与偿付能力,存在明显的交易对手风险。尽管Tether由英属维尔京群岛司法区管辖,但其法律框架并未在主流金融市场中得到广泛认可,其所有权属性类似于一种基于协议的受益人权利,而非法律上清晰的专有物权。

Paxos Gold (PAXG) 则代表了合规优先的代币化黄金路径,目前市值已高达约10亿美元。PAXG由信托公司Paxos Trust Company发行,受到纽约金融服务部(NYDFS)的严格监管。强监管背书是PAXG在合规性上区别于大量同类项目的显著优势。

同样地,PAXG也是一种发行在以太坊上的ERC-20代币,每枚代币即代表伦敦金库中的一金衡盎司LBMA标准金条。Paxos宣称,投资者对特定的实物金条拥有所有权,并开发了一项独特的功能:用户通过输入其以太坊钱包地址,即可查询与其代币相关联的实物金条序列号和物理特征 ,为持有者提供了一层额外的信任和透明度。

除监管背书外,PAXG的独特优势还包括灵活的兑换机制——机构投资者可将其直接赎回为实物金条。同时,PAXG在Curve、Aave等头部DeFi协议中获得了广泛认可,能够用于借贷与提供流动性,增加了收益属性。PAXG凭借其信托公司架构,在传统司法体系中建立类似专有权利的法律框架,并以此作为连接TradFi和加密市场的桥梁。

三类黄金数字化方案的范式之争

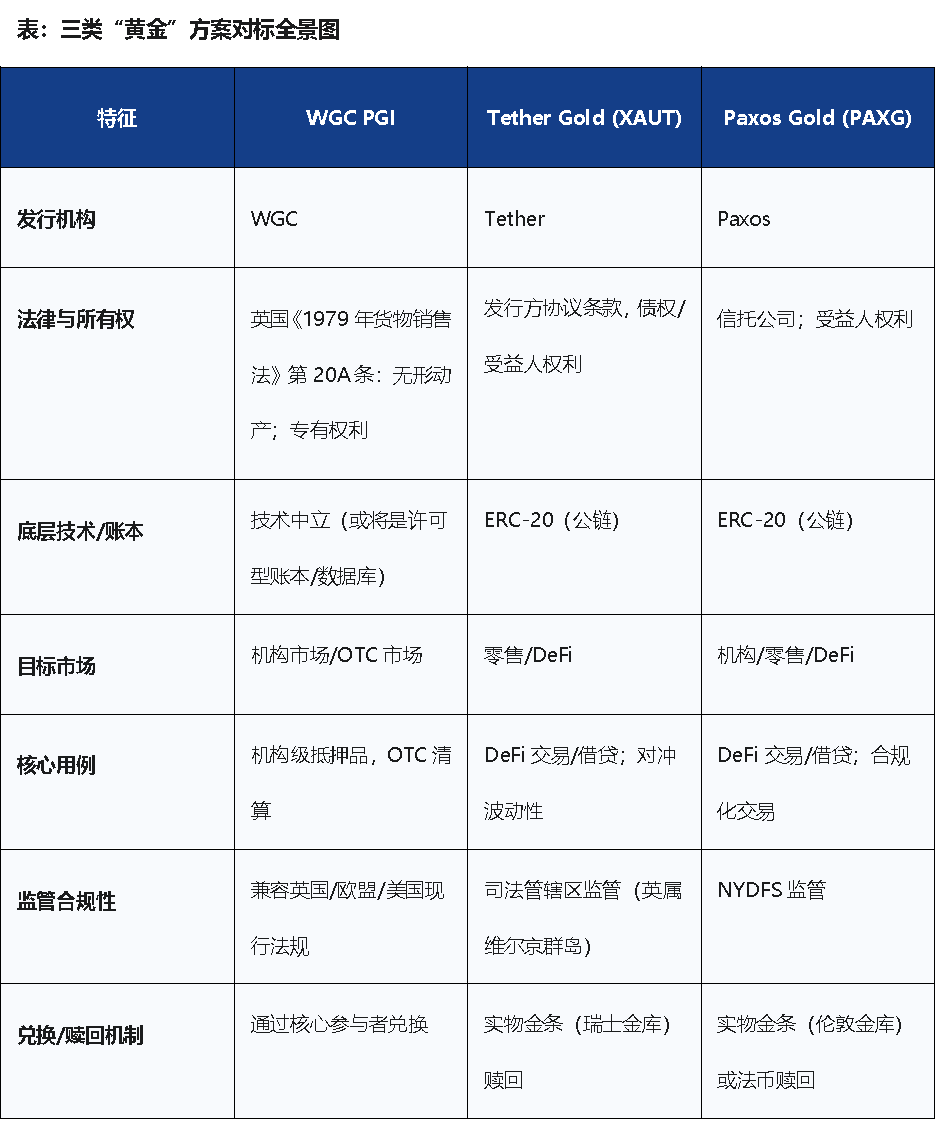

XAUT和PAXG的代币化黄金与WGC的PGI数字黄金方案在法律、技术、市场定位与核心用例上的根本差异,揭示了传统金融与加密市场在面对同一课题时选择的不同方向。

从法律与所有权而言,WGC更信任法律。PGI并非开发一种全新的资产类别,而是在现行法律框架下,建立一种“无形动产”的新型所有权定义,其优势在于法律效力和可执行性将被一个经由数百年验证的司法体系保障。尽管该方案可能将牺牲公链的部分去中心化优势,但其也为机构投资者提供了必要的法律确定性。

相较之下,加密货币则更信任代码。虽然PAXG借助其受监管的信托公司结构,尝试在传统法律框架中建立类似的专有权利,但ERC-20代币标准的去中心化属性与法律依然存在先天的矛盾;XAUT则主要由Tether的协议条款与智能合约定义来所有权,两者的法律效力均尚未在主流司法体系中被验证。

从技术架构与市场定位而言,PGI本质上是一套基础设施,其强调“技术中立”,允许兼容分布式账本技术等新兴解决方案。WGC的描述也许暗示了该方案更有可能是一条由核心参与者协同运营的许可型联盟链,目的在于数字化、自动化机构间的清算流程,其目标画像是高度封闭、对信任与效率要求极高的机构市场,针对性解决伦敦OTC市场中大型机构之间的清算和抵押品问题。

而XAUT和PAXG则更像产品,均发行在以太坊等公链上,成为一类无许可资产,任何用户都可通过加密钱包持有、转让与交易,无须经过TradFi机构复杂的KYC/AML流程。因此,其面向的是DeFi和零售市场,服务于加密原生协议与散户。

从核心用例而言,WGC的首要目标是激发黄金作为机构级抵押品的潜能。通过解决黄金在抵押条件下的法律与实操痛点,PGI将使黄金能高效地用于回购、借贷等场景,进而盘活万亿规模的存量资产。WGC CEO表示,黄金需要从一种“非生息”资产转变成一类“可生息”资产。

XAUT和PAXG则主要致力于赋能加密生态,其作为锚定黄金的稳定币,可被用于DeFi中的借贷、流动性提供、波动性对冲以及投资组合多元化。两种方案的用例表面相似,内在逻辑却完全不同。PGI的宗旨是改造一个历史悠久、规模庞大的TradFi市场;XAUT与PAXG则定位于增长迅猛的DeFi市场。

PGI是TradFi对区块链技术一次“取其精华”的尝试,其采用了数字化的形式,但也固守了TradFi的本质。此类有选择性的创新或将最大化数字技术融入现行框架的优势,同时尽可能规避监管风险。

PGI、PAXG及XAUT将有可能形成一个多维度、多层次的“黄金生态”。PGI主导机构市场,专注于解决高价值、大额清算与抵押品问题;PAXG依靠合规优势,有机会成为主流机构与加密市场之间的桥梁,在TradFi和DeFi之间提供一条可信赖、受监管的通道;XAUT则可继续聚焦零售与加密原生市场,以其高流动性与广泛兼容性占据一席之地。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。