每日行情重点数据回顾和趋势分析,由PANews出品。

1.市场观察

上周五公布的美国非农数据表现惨淡,仅新增2.2万个就业岗位,远低于预期,同时失业率攀升至4.3%的四年新高,显著推升了降息预期。投资者普遍押注美联储年内将降息三次,渣打银行更是在数据公布后修正其预测,认为劳动力市场的迅速放缓为更大规模的降息打开了大门,预计美联储将在9月进行50个基点的降息。市场的目光正聚焦于周二即将公布的非农就业年度基准修正,野村证券、高盛等机构警告称,由于统计模型失真等因素,此前的就业数据可能被大幅高估,或将一次性下修60万至90万个工作岗位,这让市场高度关注是否会重演去年因数据大幅下修而促使美联储超预期降息的历史。

穆迪分析的首席经济学家马克·赞迪将当前状况描述为一场“就业衰退”,指出若剔除医疗保健和酒店业,美国今年的就业增长将为零,甚至净流失岗位,这种情况通常只在经济衰退时发生。然而,美国财政部长贝森特对此不以为然,他将就业市场的疲软归咎于美联储未能更早降息,并预测在特朗普政府的经济政策推动下,第四季度经济将出现“大幅加速”。在此背景下,高盛对冲基金业务主管Tony Pasquariello重申其核心宏观观点:继续看空美元,同时看多以美股和黄金为代表的“价值存储”资产。

比特币价依旧在11.1万美元附近徘徊,对于短期走势,市场观点出现分歧:交易员Michaël van de Poppe认为,若价格能突破11.2万美元,将可能开启新一轮牛市;而交易员Cipher X与Crypto Tony则警示,如果无法有效站稳在11.3万美元之上,比特币或将回调至10万美元。从技术分析角度看,分析师TurboBullCapital指出,比特币正处于区间震荡,上方50日均线(约11.5万美元)构成阻力,下方关键支撑位于10.7万美元,若失守则可能下探至200日均线所在的10.1万美元附近。分析师ZYN通过斐波那契回撤分析,指出10万美元是关键的0.382回撤位,并预测最坏情况下比特币可能回调10%,但随后有望迎来一轮50%的强劲上涨,目标指向15万美元以上。与此同时,Breakout创始人Mayne将当前回调视为对前历史高点的支撑测试,认为守住10.9万美元至关重要。分析师Daan Crypto Trades则认为市场仍处不确定状态,预估价格可能在扫过月度低点后,于10.3万至10.5万美元区间获得支撑。加密分析师CrypNuevo则倾向于反向操作,他指出当前市场的看空情绪为布局提供了良机,并根据清算热图分析,关注上方11.5万美元和11.95万美元的算点和下方的10.67万美元清算点。

以太坊近期波动性逐渐减弱,价格在4200美元至4400美元区间内压缩,分析师Daan Crypto Trades分析师认为这通常预示着即将到来的较大价格变动,他指出虽然4200美元的支撑位被持续守住,但反弹力度减弱可能导致其最终失守,若价格能回调至3900美元区间,将是一个良好的波段做多机会。但当前情况下,他并不倾向于在现阶段进行多单操作,除非出现短期强势突破至4,500美元以上,或价格完成一次充分回调。分析师Axel Bitblaze则持看涨态度,他认为以太坊正在一个收紧的三角形形态内积蓄流动性,若市场情绪稳定,向上突破的路径相对清晰,短期目标看至4400美元,若动能持续则有望进一步上探4800美元。

Solana生态将于周二迎来一个重要事件,其首个数字资产国库(DAT)SOL Strategies即将在纳斯达克正式上线。据USELESS最大持有者Unipcs分析,参考比特币和以太坊在推出类似产品后的历史表现,此举可能推动Solana及其生态系统迎来一轮强劲上涨。尽管存在积极的独立催化剂,加密分析师CrypNuevo也提醒,山寨币的走势仍与整体市场情绪紧密相连,他预计若比特币市场走弱,SOL价格可能会回落至182美元。

2. 关键数据(截至9月8日12:00 HKT)

(数据来源:Coinglass、Upbit、Coingecko、SoSoValue、Tomars)

比特币:111,010美元(年初至今+18.57%),日现货交易量246.71亿美元

以太坊:4,303美元(年初至今+28.74%),日现货交易量为160.73亿美元

恐贪指数:50(中性)

平均GAS:BTC:1 sat/vB、ETH:0.165 Gwei

市场占有率:BTC 57.16%,ETH 13.5%

Upbit 24 小时交易量排行:XRP、RED、WLFI、ETH、DOGE

24小时BTC多空比: 50.1%/49.9%

板块涨跌:AI上涨6.98%,Meme上涨4.82%

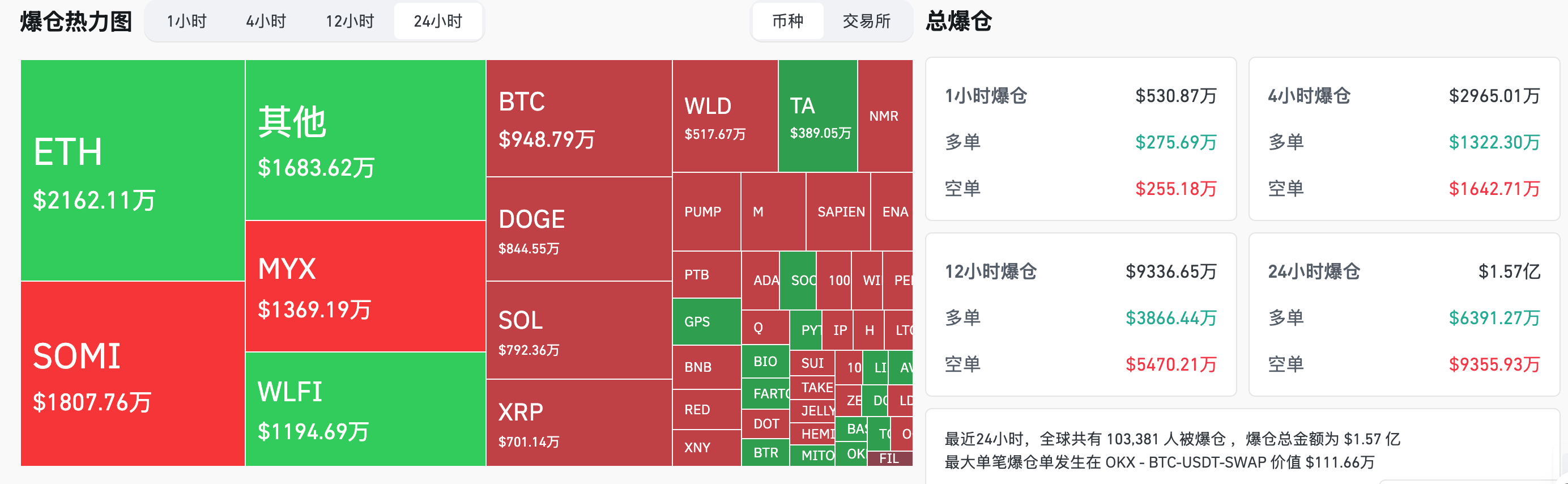

24小时爆仓数据:全球共103381人被爆仓 ,爆仓总金额为1.57亿美元,其BTC爆仓948.79万美元、ETH爆仓2162万美元、SOMI爆仓1807万美元

BTC中长线趋势通道:通道上沿线(112257.62美元),下沿线(110034.70美元)

ETH中长线趋势通道:通道上沿线(4395.86美元),下沿线(4308.81美元)

*注:当价格高于上沿和下沿时则为中长期看多趋势,反之则为看空趋势,当价格在区间内或短期反复通过成本区间则为筑底或筑顶状态。

3.ETF流向(截至9月5日)

比特币ETF:-1.6亿美元

以太坊ETF:-4.47亿美元,持续5日净流出

4. 今日前瞻

美国2025年非农就业基准变动初值(万人):前值-59.8(9月9日22:00)

Sonic(S)将于9月9日上午8点解锁约1.5亿枚代币,与现流通量的比例为5.02%,价值约4540万美元;

Movement(MOVE)将于9月9日晚上8点解锁约5000万枚代币,与现流通量的比例为1.89%,价值约590万美元;

今日市值前100币种最大涨幅:Worldcoin涨24%,HEX涨14.5%,SPX6900涨11.2%,Dogecoin涨6.8%,Bonk涨6.4%。

5. 热点新闻

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。