9月2日,据 BlockBeats 报道,阿里巴巴创始人马云通过云锋金融间接持有该公司约11.15%股份,而云锋金融已在公开市场累计购入10,000枚ETH,共计投资成本约4400万美元。所购ETH被列为集团“投资资产” 。

这不是中国企业第一次公开购买加密货币。早在2021年香港上市科技企业 Meitu(美图公司)就通过其子公司首次布局数字资产,其投资组合中包括15,000枚ETH(约2,210万美元)及379枚 BTC(近1,790万美元),此后于2024年底至2025年初退出,成功实现翻倍净利。现在,一位中国科技界重量级人物再次间接持有加密资产纳入企业储备,折射出主流资本对于数字货币资产配置的新态度。

以太坊市场表现渐入佳境:突破高位行情有望继续

与此同时,以太坊在最近一段时间的市场表现亮眼,逐步走强中。根据CoinMarketCap 数据,截至2025年9月初,以太坊从年中低点至高点的累计涨幅高达25%,最高触及约4,956美元。目前交易价格回调至约4,430美元,市值达5,332亿美元。多家机构预计,受 ETF 流入、企业机构持仓加码及监管利好推动,年内ETH有望继续上行。

此外,虽然比特币短期走势偏弱,但大额资金正在从BTC向ETH流动,以太坊正迎来属于自己的“机构牛市”。而大多数人所期待的,大概是以太坊的“牛市”表现最终带来山寨币的普涨行情。

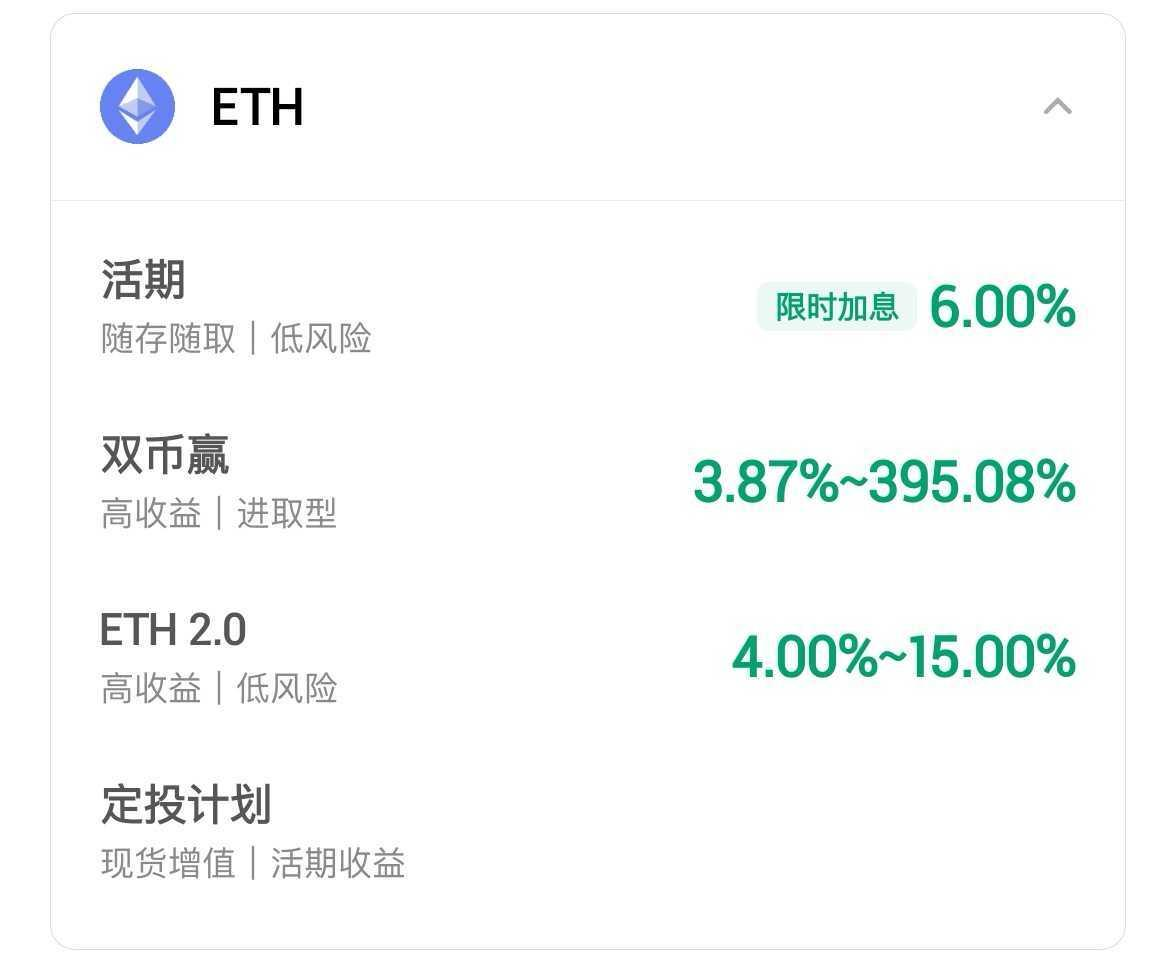

手握以太坊,参与火币赚币:全民狂欢赚币,ETH年化补贴最高至6%

作为全球领先的一站式加密资产交易平台,火币HTX 一直致力于构建多元化的收益产品体系。其 赚币板块向用户提供了“可随时存入取出+远高于传统收益”的双重优势产品,涵盖稳定币、主流加密资产简单赚币及高级金融结构产品,并且经常推出包括以太坊在内的赚币加息活动,年化收益更高。火币赚币是大众金融用户接触加密资产储蓄/增值服务的首选平台。

目前,火币HTX 12周年庆“全民狂欢赚币日” 活动已开启,全用户申购指定主流币即享空投加息券,最高可获赠12%加息券,ETH的年化收益补贴最高至6%。除此之外,火币HTX通过简单赚币、结构化产品或者ETH Staking(如 ETH2.0)链上赚币为以太坊持仓者提供稳健收益渠道,支持低门槛入场与灵活赎回,让ETH持有者能够参与权益质押并赚取年化回报。适合ETH长线持有者、短期参与者,兼顾收益和流动性。

同时,火币赚币近期为多个稳定币活期产品提供了加息补贴,收益率高达10–20%,远超传统银行储蓄或美债收益;USDT、USDC、USD1、USDD等均在此列,其中首次使用平台的新人还有机会获得100% APY的限时福利。

随着平台12周年生日的到来,正处于高速发展的火币HTX,致力于用更有竞争力的产品回馈全球用户。火币赚币的利息补贴,正是来源于平台的战略投入和集团资源支持,旨在不断提升用户体验和交易活跃度。目前火币HTX已连续35个月更新默克尔树资产储备金证明(PoR)数据,持续披露平台资产储备情况,资金透明度领先行业。凭借稳健的盈利能力和可靠的安全支持,火币HTX完全具备持续补贴的条件和信心。

买买买:马云到底是追高还是战略抄底?

这一次,从马云通过云锋金融购买ETH 的消息,到以太坊市场的强劲表现,可以看出以下几点趋势:

● 机构态度转向:关键人物与企业将一部分资产配置到以太坊,凸显其在多元资产中的战略地位;

● 价格阶段利好:以太坊近期涨势迅猛,并被多机构预期未来有进一步上升空间。

从马云到普通用户参与,以太坊正从机制探索走向财富配置常态。火币赚币为用户提供低门槛、灵活参与、高收益奖励的多元化加密投资组合,让中小投资者也能参与加密资产的增值。用户可随时关注火币HTX的平台动态,理性投资加密资产。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。