编译:深潮TechFlow

背景介绍

金融领域中最缓慢的资产——贷款、建筑物、商品——正在被绑到历史上最快的市场之中。代币化承诺带来流动性,但实际上创造的只是一个幻象:一个流动性的外壳包裹着一个非流动性的核心。这种错配被称为“现实世界资产(RWA)流动性悖论”。

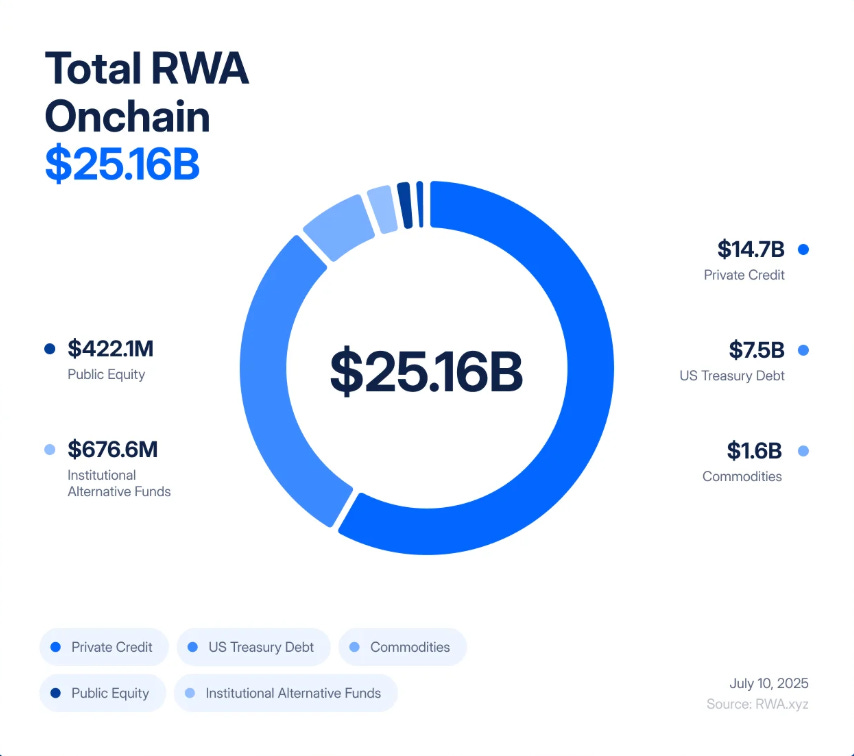

仅仅五年间,RWA 代币化已经从一个价值8500万美元的实验跃升为一个 250 亿美元的市场,在 2020 年至 2025 年间实现了“245 倍增长,这主要得益于机构对收益率、透明度以及资产负债表效率的需求”。

贝莱德(BlackRock)推出了代币化的国债,Figure Technologies已将数十亿美元的私人信贷上链,而从新泽西到迪拜的房地产交易正在被分割并在去中心化交易所进行交易。

分析师预测,未来可能会有数万亿美元的资产跟随这一趋势。在许多人看来,这似乎是传统金融(TradFi)与去中心化金融(DeFi)之间期待已久的桥梁——一个将现实世界收益的安全性与区块链的速度和透明性相结合的机会。

然而,在这股热情之下隐藏着一个结构性缺陷。代币化并没有改变办公室建筑、私人贷款或金条的基本属性。这些资产本质上是缓慢且缺乏流动性的——它们受合同、登记和法院的法律和操作约束。代币化所做的只是将这些资产包装在一个超流动的外壳中,使其可以即时交易、杠杆化和清算。结果是一个金融系统,将缓慢的信用和估值风险转化为高频率的波动性风险,其蔓延性不再以月为单位,而是以分钟为单位扩散。

如果这听起来似曾相识,那是因为它确实如此。2008年,华尔街经历了一个惨痛的教训,发现当非流动性资产被转化为“流动性”衍生品时会发生什么。次级抵押贷款缓慢崩溃;担保债务凭证(CDOs)和信用违约掉期(CDS)却迅速瓦解。现实世界违约与金融工程之间的错配引爆了全球系统。今天的危险在于我们正在重建这一架构——只是现在它运行在区块链的轨道上,危机的传播速度变成了代码的速度。

想象一下,一个与新泽西州伯根县的一处商业地产相关联的代币。从纸面上看,这座建筑似乎很稳固:租户支付租金,贷款按时偿还,产权清晰。但要转移这份产权的法律流程——产权检查、签字、向县书记员提交文件——需要数周时间。这就是房地产的运作方式:缓慢、有条不紊,由纸张和法院约束。

现在将同一房产上链。产权存储在一个特殊目的载体(SPV)中,该载体发行代表分割所有权的数字代币。突然间,这个曾经沉寂的资产可以全天候交易。在一个下午,这些代币可能在去中心化交易所中易手数百次,在借贷协议中作为稳定币的抵押品,或者被打包成结构性产品,承诺“安全的现实世界收益”。

问题在于:关于这栋建筑本身的任何东西都没有改变。如果主要租户违约、物业价值下滑,或者SPV的法律权益受到挑战,现实世界的影响可能需要数月甚至数年才能显现。但在链上,信心可能瞬间蒸发。一条推特上的谣言、一个延迟的预言机更新或一次突然的抛售,就足以触发自动清算的连锁反应。建筑物不会移动,但它的代币化表示可以在几分钟内崩溃——拖累抵押池、借贷协议、稳定币,一同陷入困境。

这就是 RWA 流动性悖论的本质:将非流动性资产绑到超流动市场上并不会使它们更安全,反而会让它们变得更加危险。

2008年的缓慢崩盘 vs. 2025年的实时崩盘

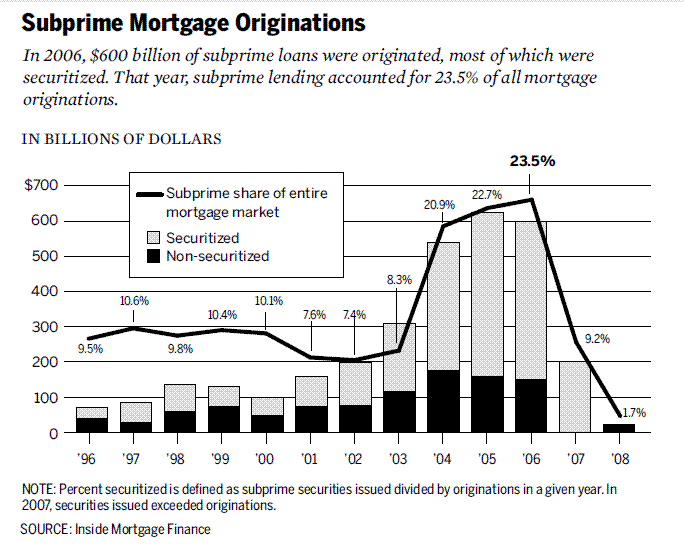

2000年代中期,华尔街将次级抵押贷款——流动性差、高风险贷款——转化为复杂的证券。

抵押贷款被集中到抵押贷款支持证券(MBS)中,然后被分割成不同档次的担保债务凭证(CDO)。为了对冲风险,银行层层叠加信用违约掉期(CDS)。理论上,这种“金融炼金术”将脆弱的次级贷款转化为“安全”的AAA级资产。但实际上,它却在摇摇欲坠的地基上筑起了一座杠杆和不透明的“高塔”。

这场危机爆发于缓慢蔓延的抵押贷款违约与快速发展的CDO和CDS市场发生碰撞时。房屋需要几个月才能完成止赎,但与之相关的衍生品却能在几秒内重新定价。这种错配并非导致崩溃的唯一原因,但它将局部违约放大为全球冲击。

RWA 的代币化正面临着重演这一错配风险——而速度更快。我们不再将次级抵押贷款分层,而是将私人信贷、房地产和国债分割成链上的代币。我们不再使用 CDS,而是会看到“RWA 加强版”衍生品:基于RWA代币的期权、合成资产和结构性产品。评级机构曾将垃圾资产标记为AAA,现在我们将估值外包给预言机和托管人——新的信任黑箱。

这种相似性并非表面现象,其逻辑完全相同:将流动性差、速度慢的资产包装在看似流动性强的结构中,然后让它们在比标的资产波动速度快几个数量级的市场中流通。2008年的系统崩溃用了几个月。而在 DeFi 中,危机会在几分钟内蔓延开来。

场景 1:信用违约连锁反应

一个私人信贷协议已将价值 50 亿美元的中小企业贷款代币化。从表面上看,收益率稳定在 8% 至 12% 之间。投资者将代币视为安全的抵押品,并在 Aave 和 Compound 上进行借贷。

然后,现实经济开始恶化。违约率上升。贷款账簿的真实价值下降,但提供链上价格的预言机每月仅更新一次。在链上,代币看起来仍然稳健。

谣言开始蔓延:一些大额借款人逾期未还。交易员们在预言机发现之前纷纷抛售。代币的市场价格跌破其“官方”价值,打破了与美元的挂钩。

这足以触发自动化机制。DeFi借贷协议检测到价格下跌,自动清算以该代币为抵押的贷款。清算机器人偿还债务,接管抵押品,并将其抛售到交易所——进一步压低价格。更多清算接踵而至。在几分钟内,一个缓慢的信贷问题变成了全面的链上崩盘。

场景 2:房地产闪崩

一家托管机构管理着价值20亿美元的代币化商业地产,但由于遭遇黑客攻击,其对这些地产的法律权益可能受到威胁。同时,一场飓风袭击了这些建筑物所在的城市。

资产的链下价值陷入不确定;链上的代币价格则立即崩盘。

在去中心化交易所中,惊慌失措的持有者争相退出。自动化做市商的流动性被抽干。代币价格暴跌。

在整个 DeFi 生态中,这些代币曾被用作抵押品。清算机制启动,但被接管的抵押品却变得毫无价值且流动性极差。借贷协议留下了无法收回的坏账。借贷协议最终陷入无法追回的坏账困境。原本宣传为“链上的机构级房地产”瞬间成为 DeFi 协议以及任何与之相关的传统金融基金的资产负债表上的巨大漏洞。

两个场景都展示了同样的动态:流动性外壳崩溃的速度远快于标的资产的反应速度。建筑仍然矗立,贷款依然存在,但链上的资产表示在几分钟内蒸发,拖累整个系统。

下一阶段:RWA-Squared

金融从未止步于第一层。一旦某个资产类别出现,华尔街(以及现在的 DeFi)就会在其之上构建衍生品。次级抵押贷款催生了抵押贷款支持证券 (MBS),然后是债务抵押债券 (CDO),再后来是信用违约掉期 (CDS)。每一层都承诺提供更好的风险管理;每一层都加剧了脆弱性。

RWA 的代币化也不会有所不同。第一波产品相对简单:分割化的信贷、国债和房地产。第二波则不可避免:RWA 加强版(RWA-Squared)。代币被打包成指数产品,分层为“安全”和“风险”部分,合成资产让交易者可以押注或对抗一篮子代币化贷款或物业。一个由新泽西房地产和新加坡中小企业贷款支持的代币可以被重新包装成一个单一的“收益产品”,并在 DeFi 中进行杠杆化。

讽刺的是,链上的衍生品看起来比 2008 年的 CDS 更安全,因为它们是完全抵押且透明的。但风险不会消失——它们会变异。智能合约漏洞取代了交易对手违约;预言机错误取代了评级欺诈;协议治理失败取代了 AIG 的问题。结果却相同:杠杆层级、隐藏的相关性,以及一个易受单点故障影响的系统。

多元化的承诺——将国债、信贷和房地产混合到一个代币化篮子中——忽略了一个现实:所有这些资产现在共享一个相关性向量——DeFi 的底层技术轨道。一旦主要的预言机、稳定币或借贷协议发生故障,所有基于其构建的 RWA 衍生品都会崩溃,无论其标的资产的多样性如何。

RWA 加强版产品将被宣传为走向成熟的桥梁,证明 DeFi 能够重建复杂的传统金融市场。但它们也可能成为催化剂,确保当第一波冲击来临时,系统不会缓冲——而是直接崩溃。

结论

RWA 的热潮被宣传为传统金融与去中心化金融之间的桥梁。通证化确实带来了效率、可组合性和新的收益获取途径。但它并没有改变资产本身的性质:即使贷款、建筑物和商品的数字资产以区块链速度交易,它们仍然流动性低且交易缓慢。

这就是流动性悖论。将非流动性资产捆绑到高流动性市场,我们增加了脆弱性和反身性。那些让市场更快、更透明的工具,也让它们更容易受到突发冲击的影响。

2008年,级抵押贷款的违约扩散为全球危机用了数月时间。而对于代币化的现实世界资产,一个类似的错配可能在几分钟内就蔓延开来。教训并不是要放弃代币化,而是要在设计中充分考虑其风险:更保守的预言机、更严格的抵押品标准以及更强的机制熔断。

我们并非注定要重蹈覆辙上次危机。但如果我们忽视这个悖论,最终可能会加速危机的到来。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。