撰文:Joakim Book

编译:AididiaoJP,Foresight News

今天的比特币世界,一切似乎都颠倒了;市场充斥着看涨声音、比特币不久前创下新高,以及那些搜刮世界的比特币国库公司,但比特币价格持续下跌。这种不协调的状况在最近于香港结束的 Bitcoin Asia 上达到了顶峰。

西装革履的人来了,比特币玩家成了金融市场的新宠。

这几乎是今年大部分时间发生的故事,并在 2025 年 Bitcoin Asia 期间比特币价格的暴跌中达到了惊人的高潮。比特币,这个对法币货币体系最直言不讳的不信任攻击,现在正一头扎回传统金融。

密码朋克已经演变成「西装币者」,并最终找到了他们作为「股票币者」的终极形态。

叛逆的青少年忏悔了他们的罪过,迷失的投资者已经归来,带着炫目、贪婪的荣耀。

我们这些曾经一心一意要建立一个崭新且更美好世界的书呆子,已经变成了受监管、需许可的证券啦啦队,这些证券经过巧妙杠杆化和金融工程,以实现每股比特币最大化。金融法则被粗暴地推到台前,即使是最坚定的密码学信仰者也放弃了他们的大部分原则,因为华尔街现在愿意为一美元的比特币支付 2 美元、3 美元或 5 美元。

而在香港的 Bitcoin Asia 上,其他一切也都是颠倒的。人们发声不是为了自我托管或密码朋克式的比特币讨论,而是为了政治大人物和金融工程。

欧洲最大国债公司的首席执行官 Alexandre Laizet 在台上说,资产负债表正在变成损益表。他不仅仅是在说国债公司现在成了银行,利用它们的资产负债表成为利润来源;他的意思是对比特币国债公司来说,唯一重要的就是资产负债表本身。当你拥有每股无限可印股票对应的比特币时,利润就无关紧要了。

「作为市场上的理性参与者,你就应该这样做。」

大约 200 家公司,以 Strategy 和 Metaplanet 为这场运动最直言不讳的代表,正在搜刮资本市场的廉价法币并用来购买比特币。到处都在破纪录:观众和观看人数、参会者和销售额。任何在比特币世界待过的人都能感受到这种能量、这种建设、这种永无止境的运输和建设的工厂车间。理解比特币从未如此容易,我们也从未拥有过这么多的比特币信仰者。

然而价格却持续曲折下行,从高点 125,000 美元跌至 Nakamoto6.79 亿美元购买的入场点 118,204 美元,在会议期间跌至 111,000 美元左右,然后暴跌至 108,000 美元以下,与台上看涨的演讲者完全同步。

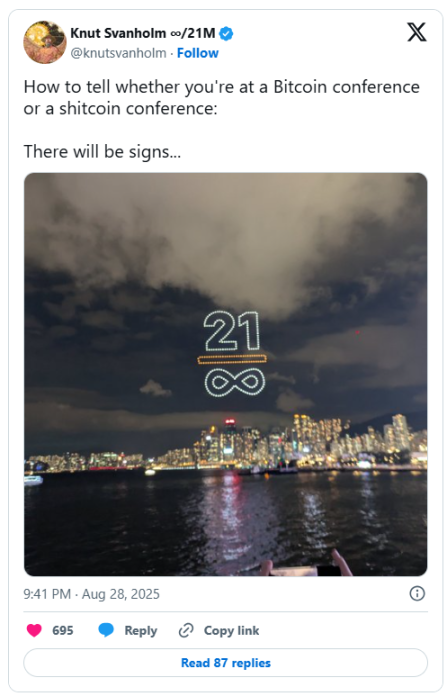

周四的无人机表演,以令人惊叹的比特币图形点亮了香港的夜空,再没有比这更能象征这一切是如何颠倒的了。它展示了一个强大的「21 除以无穷大」的符号,它是 Knut Svanholm 著名的「一切除以 2100 万」主张的直接倒置版本:

我们所有与参会的 20,000 多人,在连日观看 Nakamoto Stage 上看涨的声明被其身后大字体价格图表反驳和削弱后,急需比特币价格的上涨来恢复信心。

在香港的 Nakamoto 舞台上,David Bailey 自信满满地坐着,充满庆祝意味,为我们作为比特币玩家的巨大努力和成功鼓掌,而观众则盯着他身后屏幕上由 SALT 赞助的比特币价格持续暴跌,每一次向下的跳动都抹去了巨额财富。

台上所说的看涨言论、 现场的十几家国债公司所传达令人印象深刻且听起来合理可信的福音,与价格不断下跌的严酷现实之间的不协调,再没有比这更强烈的了。

这几乎就像是 David Bailey 等人谈论和鼓吹他们的比特币收购工具股票越多,我们的市场就变得越糟,价格也跌得越低。

也许 Bailey 先生只是比我胆量大得多,但如果我刚刚烧掉了投资者约 6000 万美元的资金而毫无成果可言时,我会更加谦卑和紧张不安,垂头丧气和怀疑。

价格是客观存在的,而且这确实不是一个好吃的蛋糕。

这同样具有象征意义,在香港我们见证了金融化的国债公司正在逐步取代密码朋克。

我们来到比特币节日巡演的最近一站,震惊地看到所有曾经神圣的事物如何被亵渎:一切都是颠倒的。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。