🎣 The fishing platform sees opportunities, while whales see prey.

Author: K2 Kai

The massive liquidation of XPL on HyperLiquid is not an accident; it mirrors the previous JELLYJELLY incident. It is not just a simple market fluctuation but a blatant "liquidity hunting," precisely exploiting the weaknesses of mechanisms, human nature, and market structure.

According to on-chain data monitoring, the core process of this event is as follows:

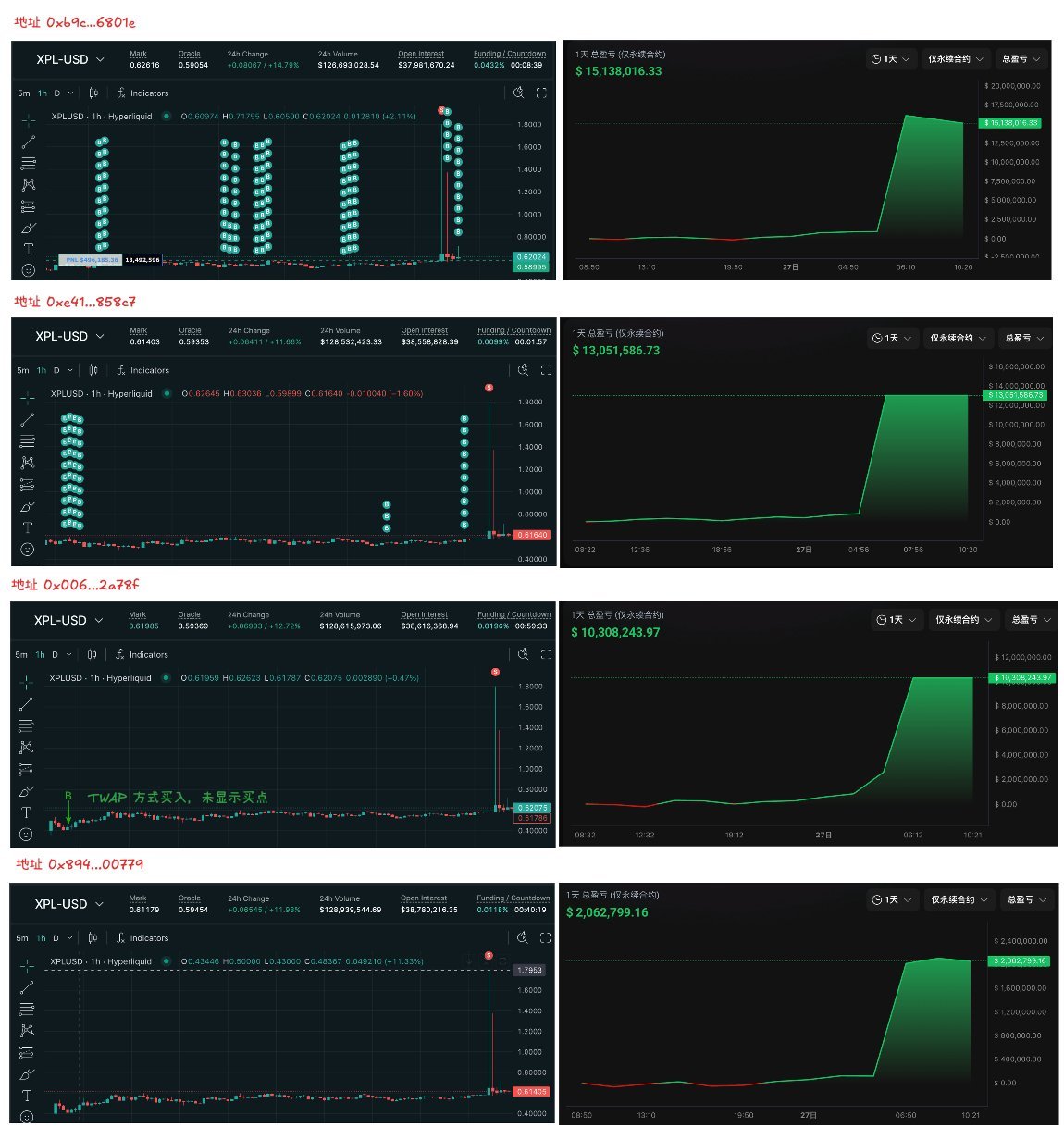

05:35 AM: A whale address 0xb9c…6801e suddenly injected a large amount of USDC into HyperLiquid and opened a long position on XPL tokens with 3x leverage. Its fierce buying momentum instantly cleared the entire order book, causing the XPL price to start soaring vertically.

05:36 – 05:37: Driven by this whale's strong pull, the XPL price skyrocketed from nearly $0.6 to a peak of about $1.80 in just about 2 minutes, an increase of over 200%. The sharp price rise triggered a massive liquidation of short positions, with address 0xC2Cb losing about $4.59 million and 0x64a4 losing about $2 million.

Quick profit-taking: When the price peaked, the whale quickly closed its position, locking in about $16 million in profit in just one minute. Meanwhile, two other cooperating whale addresses also took profits at the high. In the end, these three addresses collectively profited nearly $38 million.

Post-event holdings

It is worth noting that after completing the main profit-taking operation, the whale still held a long position of up to 15.2 million XPL, valued at over $10.2 million, indicating that it may wish to continue influencing the subsequent market trend.

A total of 4 main addresses participated in the $XPL hedging attack, accumulating profits of $46.1 million (Source: @ai_9684xtp)

Let’s take a look at how this targeted attack was executed?

Exploiting liquidity disadvantages: The process was clearly divided, and the methods were skilled. On-chain data shows that at least 4 whale addresses participated in this attack, taking away $46.1 million:

Exploiting liquidity disadvantages: Why XPL? Because it is a pre-market contract with few participants, and the liquidity pool is as shallow as a small puddle. In this environment, price control almost entirely depends on the amount of capital. The whale used 3x leverage to directly clear the hanging orders, leveraging this structural asymmetry to move the entire market with relatively small costs.

Creating a liquidation chain reaction: The price surge from $0.6 to $1.8 was not achieved through real money buying; the whales only used initial capital, and the real fuel was all the short sellers.

Let me explain this "death spiral": The whale raises the price with large orders -> your short position gets liquidated -> the system forces you to buy to close -> your buy order further pushes up the price -> the next short's liquidation line is reached…

When the snowball reaches its maximum size, the whales calmly sell their chips at high prices to these passive buyers, completing the harvest.

Highly coordinated operations: On-chain capital flow clearly reveals that this was not a solo operation. At least four addresses coordinated in terms of capital sources, position building rhythm, price pulling actions, and exit timing as if they came from the same training institution.

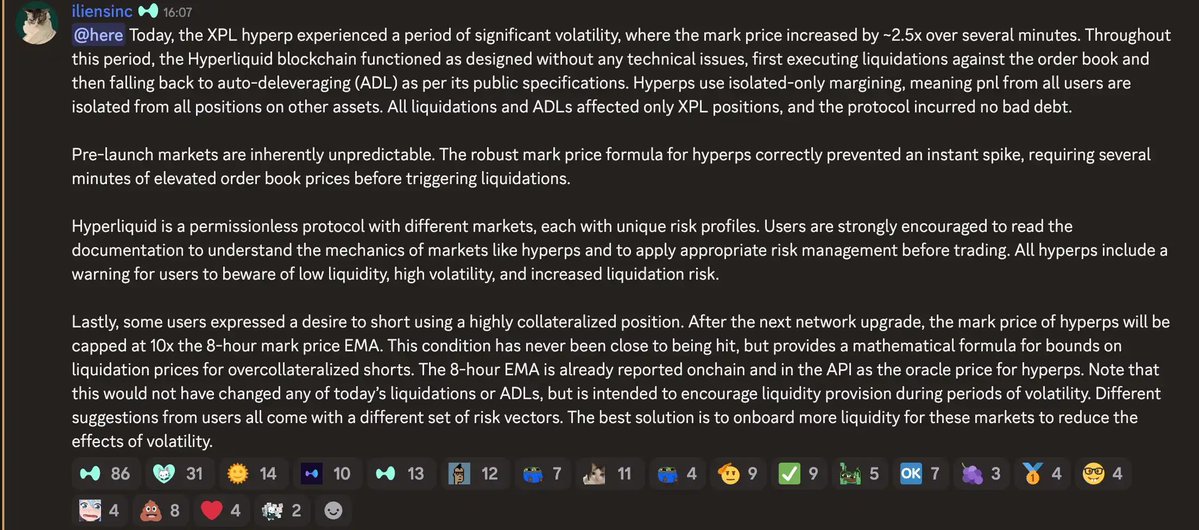

Amplified platform design flaws: HyperLiquid's internal pricing mechanism does not connect to external oracles, meaning that here, the price is entirely determined by the people in the market. The whales took advantage of this to "do as they please" in this shallow water. Ironically, the JELLYJELLY incident from a few months ago had the same formula and flavor.

Review of the JELLYJELLY incident

The XPL incident is not an isolated case. On March 26 of this year, HyperLiquid experienced a similar price manipulation incident involving the JELLYJELLY token. At that time, a whale address first sold off JELLYJELLY heavily, causing the price to plummet and forcing the platform's liquidity pool (HLP) to passively short. The address then quickly bought back, raising the price, leading to a loss of nearly $12 million for the HLP treasury. Afterward, HyperLiquid had to delist the trading pair and compensate affected users.

Although the platform updated its leverage and liquidation mechanisms after the JELLYJELLY incident, the occurrence of the XPL incident indicates that its system still has significant vulnerabilities when facing attacks from whales exploiting capital and mechanism loopholes.

If you don't want to become the next "meal," consider the following points

The XPL incident once again verifies a harsh reality: in a market with insufficient liquidity, retail investors are the natural "counterparty" and "fuel" for whales. To avoid becoming the next victim of hunting, the following points are crucial:

- ### Don't play with sharks in a "small pond"

Avoid participating in pre-market contracts, new coins, or small tokens with leveraged trading. The water is shallow, the fish are few, and it's easy to take advantage of. If you must participate, treat it as high-risk speculation, invest funds that can be zeroed out at any time, and do not harbor the illusion of "catching a big trend."

- ### Leverage is the rope that hangs you

In such a market, there is no difference between 2x leverage and 20x leverage; both can lead to instant liquidation. Always keep your position within a range you can calmly accept losses, such as 5% of your total capital. Surviving is more important than anything else.

- ### Be wary of abnormal order books and capital flows

When you see a coin inexplicably soaring vertically, and the sell orders are being torn apart like paper, don’t FOMO, run! That’s not an opportunity to get rich; it’s the beginning of a slaughter. Capable traders can monitor on-chain data (refer to on-chain data platforms like Onchain Lens, Lookonchain, etc.), as large amounts of capital flowing into specific platforms before an attack is a common danger signal.

Before betting in a casino with opaque rules, take five minutes to check if the platform has oracles and sufficient trading depth.

A good platform will find ways to protect you, rather than letting the rules become a weapon for others to attack you.

After the incident, HyperLiquid released an official statement, which consisted of only one sentence: "It has nothing to do with us; reflect on yourself."

- ### Don’t gamble your life savings on a fantasy

Whales make money from information asymmetry and rule loopholes, while many people lose money chasing fantasies of getting rich. Stop chasing opportunities that don’t belong to you, and focus your energy on risk control; that is far more important.

Finally, remember this: in this jungle, the most dangerous thing is not the rise and fall of prices, but those who hide behind the rules and treat you as prey. Don’t be prey.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。