1. Market Observation

Trump's announcement yesterday to dismiss Federal Reserve Governor Lisa Cook, claiming that he will soon have a "majority" on the board supporting significant interest rate cuts, has sparked widespread legal and political controversy. Cook's lawyer has stated that they will challenge this "illegal act" through litigation, while the Federal Reserve has expressed its commitment to comply with court rulings, emphasizing that the long terms of governors and protection against arbitrary dismissal are crucial for ensuring the independence of monetary policy. Meanwhile, the regulatory landscape in the U.S. is also changing, with CFTC Commissioner Kristin Johnson announcing her impending departure, leaving only one leader in the committee. Currently, investors are generally waiting for Nvidia's earnings report scheduled for August 28.

Regarding Bitcoin, most analysts are cautious. Among the long-term bearish voices, asset management firm Diaman Partners predicts that the bottom of this cycle may occur in 2026, ranging between $60,000 and $80,000; economist Peter Schiff is even more pessimistic, noting that Bitcoin has dropped 13% from its peak to below $109,000, predicting it could fall to around $75,000 at its lowest. On a more immediate support level, CryptoQuant analyst Axel Adler Jr. believes that if it breaks below the strong support range of $100,000 to $107,000 (where the actual price for short-term holders intersects with the 200-day simple moving average), the market may find deeper support around $92,000 to $93,000. Currently, the market's focus is on key support and resistance areas. Analyst Murphy emphasizes that the cost basis for short-term holders (STH-RP) at $108,800 is an emotional "bull-bear dividing line," and if the daily closing price effectively falls below this level, it could trigger market panic and require a long time to recover. To confirm an upward trend, several analysts, including AlphaBTC and Altcoin Sherpa, point out that the price must close above $112,000 on the four-hour or daily chart; otherwise, it may retreat to around $105,000. However, Breakout founder Mayne believes Bitcoin may rebound and consolidate in the $110,000 to $120,000 range, while CrypNuevo notes that the CME gap around $117,000 could become a potential upward target.

On the Ethereum front, analysts generally exhibit a more optimistic outlook, especially following its strong performance relative to Bitcoin. Although there is short-term profit-taking pressure in the market, the overall bullish trend is widely believed to remain intact. In terms of price support, analyst Amr Taha points out that if it cannot hold above $4,700, the price may oscillate between $4,350 and $4,700, or even fall back to $4,000. However, Liquid Capital founder Yi Lihua believes that the current pullback to around $4,100 and $4,300 may be the best buying opportunity. BitMine board chairman Tom Lee also shared his analyst Mark Newton's view, expecting Ethereum to bottom out around $4,300. Looking ahead, breaking through key levels will open up new upward space. Amr Taha believes that an effective breakout above $4,700 will pave the way to $5,000. Mark Newton's prediction is even more aggressive, suggesting that after a rebound, it will hit new highs, with a target price set between $5,100 and $5,450. Tom Lee himself is the most optimistic, predicting that Ethereum will rise to $5,500 in the coming weeks and reach $10,000 to $12,000 by the end of the year, citing Ethereum's increasing preference among Wall Street institutions as the source of his confidence.

In broader market dynamics, the price of the token XPL on Hyperliquid skyrocketed 200% within five minutes before rapidly crashing, leading to a liquidation amount of $17.1 million for XPL in the past 24 hours, with two whale addresses collectively profiting $27.5 million. Additionally, Trump Media & Technology Group announced a strategic partnership with Crypto.com, planning to use the CRO token as a utility token for its reward system on its social platform, and intends to establish a publicly listed CRO reserve company through SPAC with an expected funding scale of up to $6.42 billion, causing CRO to rise nearly 40%. On another front, hedge fund Numerai announced it has secured an investment commitment of up to $500 million from JPMorgan's asset management division, causing its native token NMR to surge over 120% at one point.

2. Key Data (as of August 27, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $111,650 (Year-to-date +19.16%), daily spot trading volume $39.888 billion

Ethereum: $4,633.55 (Year-to-date +38.54%), daily spot trading volume $40.139 billion

Fear and Greed Index: 52 (Neutral)

Average GAS: BTC: 1 sat/vB, ETH: 0.22 Gwei

Market share: BTC 57.2%, ETH 14.4%

Upbit 24-hour trading volume ranking: ETH, XRP, BTC, SOL, CRO

24-hour BTC long-short ratio: 49.34%/50.66%

Sector performance: Meme sector up 4.87%, AI sector up 4.23%

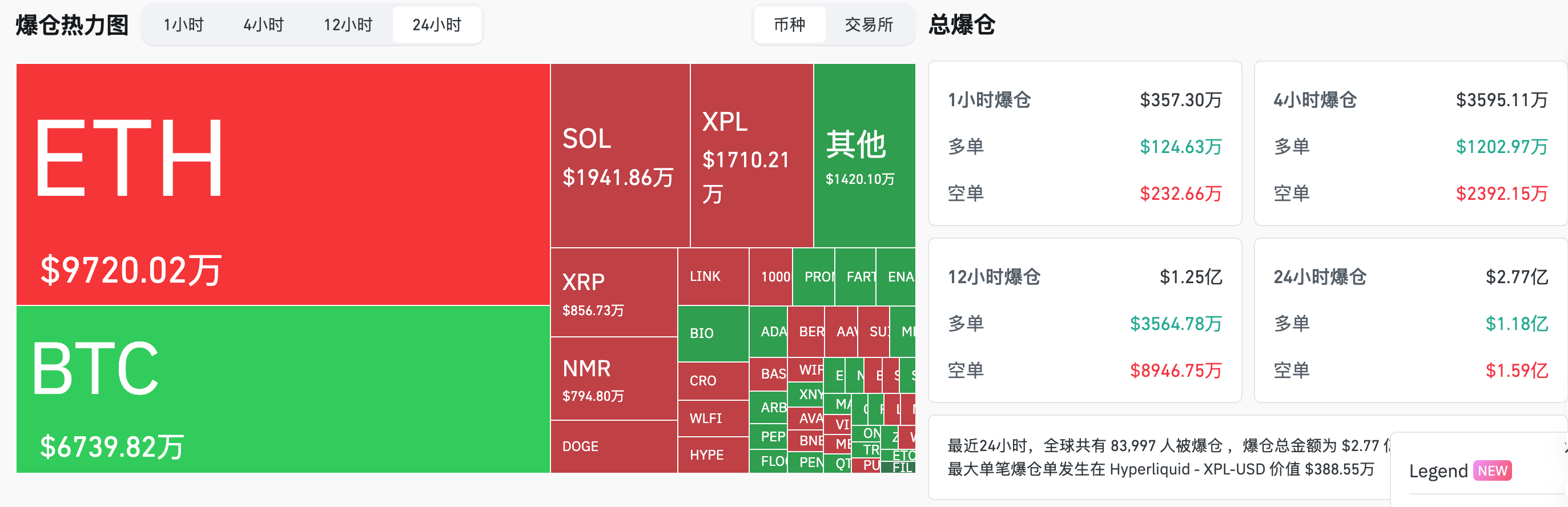

24-hour liquidation data: A total of 83,997 people were liquidated globally, with a total liquidation amount of $277 million, including $67.398 million for BTC, $97.2 million for ETH, and $19.4186 million for SOL.

BTC medium to long-term trend channel: Upper line ($115,277.81), lower line ($112,995.08)

ETH medium to long-term trend channel: Upper line ($4,514.58), lower line ($4,425.18)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of August 26)

Bitcoin ETF: +$88.2049 million

Ethereum ETF: +$455 million, continuing four days of net inflow

4. Today's Outlook

Binance Alpha and Binance Futures will launch Bitlayer (BTR) on August 27, airdrop starts today and lasts for 30 days

Binance Alpha and Binance Futures will launch Mitosis (MITO) on August 28

Nvidia will announce its Q2 fiscal year 2026 earnings after U.S. stock market close on August 28.

Jupiter (JUP) will unlock approximately 53.47 million tokens at 10 PM on August 28, accounting for 1.78% of the current circulating supply, valued at approximately $27.1 million;

Sophon (SOPH) will unlock approximately 267 million tokens at 9 PM on August 28, accounting for 12.94% of the current circulating supply, valued at approximately $8.9 million;

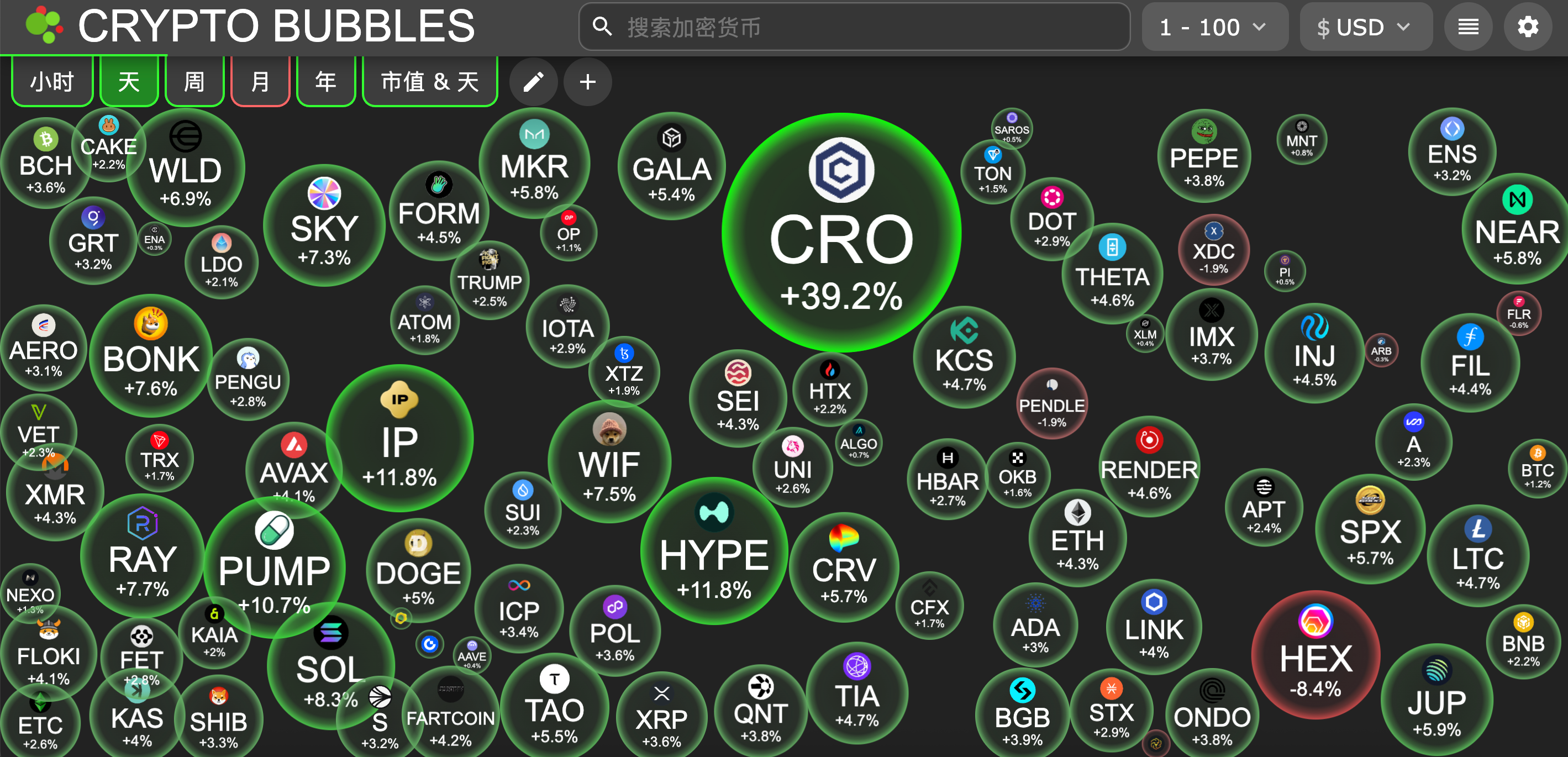

Top gainers in the top 100 market cap today: Cronos up 39.2%, Hyperliquid up 11.8%, Story up 11.8%, Pump.fun up 10.7%, Solana up 8.3%.

5. Hot News

Public company Kindly MD applies for $5 billion financing to advance Bitcoin reserve strategy

Google Cloud launches L1 blockchain GCUL, currently in private testnet phase

Hedge fund Numerai secures a $500 million investment commitment from JPMorgan

Coinbase International will launch GMT, Omni Network, and Synthetix perpetual contracts

Union announces U token economics: community incentives account for 12%

Donald Trump's venture capital fund has invested in the prediction market Polymarket

Trump Media signs a $155 million strategic agreement withCrypto.com.

YZi Labs announces investment in yield-generating synthetic dollar protocolUSD.AI.

Bitwise has submitted a Bitwise Chainlink ETF application to the SEC

Bitlayer announces BTR token economics: 40% for ecosystem incentives, 7.75% for node incentives

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。