Organized & Compiled by: Janna, ChainCatcher

Since the beginning of this year, digital asset treasury companies have rapidly gained momentum as typical representatives in the wave of coin-stock integration. However, while these treasury-type companies inject liquidity into mainstream assets like Bitcoin and Ethereum, they also expose certain vulnerabilities. This article is based on an analysis of the potential risks behind the prosperity of DATs by Anthony DeMartino, founder of Sentora and general partner at venture capital firm Istari. ChainCatcher has organized and compiled it without altering the original meaning for readers' reference, but it should be noted that this article does not constitute any investment advice.

The following is the original text:

In 2025, a new type of publicly listed company has attracted widespread attention from investors: Digital Asset Treasuries (DATs). These entities typically use cryptocurrencies like Bitcoin as core reserve assets, raising over $15 billion in funding this year alone, surpassing the scale of traditional venture capital in the crypto space. This trend has been spearheaded by companies like MicroStrategy and has gradually gained momentum, with more and more enterprises accumulating digital assets through the public market. Although this strategy has yielded substantial returns during bull markets, it also carries inherent risks that could lead to painful liquidation waves, further exacerbating volatility in both the stock and crypto markets.

(1) Operating Model of DATs

The establishment of DATs typically relies on innovative financing structures, including reverse mergers with NASDAQ-listed shell companies. This method allows private entities to go public quickly without undergoing the stringent scrutiny of a traditional initial public offering (IPO). For example, in May 2025, Asset Entities and Strive Asset Management formed a treasury-type company focused on Bitcoin through a reverse merger.

Other cases include Twenty One Capital, supported by SoftBank and Tether, which created a $3.6 billion Bitcoin investment vehicle through a reverse merger with Cantor Equity Partners. After going public, these companies raise funds through stock issuance and invest almost all of the raised capital into digital assets. Their core mission is clear: to buy and hold cryptocurrencies such as Bitcoin, Ethereum, SOL, XRP, and even TON.

This model achieves a cross-integration of traditional finance and cryptocurrencies, providing investors with an investment vehicle that offers "leveraged exposure" without the need to hold the assets directly.

(2) Stock Price Increases and Premium Trading

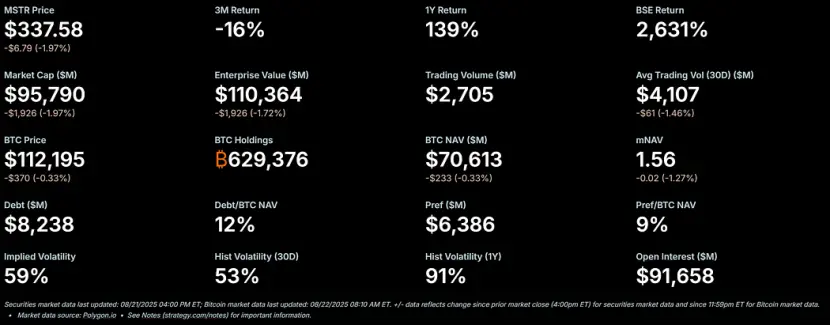

During crypto bull markets, the stocks of DATs often see significant increases, and there is a notable premium relative to their net asset value (NAV). As a benchmark company in this model, MicroStrategy's stock price has previously exceeded a 50% premium over its Bitcoin NAV, with its multiple NAV (mNAV) ratio recently reaching 1.56.

The formation of this premium stems from several factors: first, these companies can access low-cost public market funding; second, investors are enthusiastic about leveraged bets on cryptocurrencies; and third, the market views these companies as vehicles to amplify stock returns.

When the stock price is above NAV, the dilution effect of raising $1 for shareholders is less than the value increment brought by asset purchases, thus creating a virtuous cycle. In 2025, publicly listed companies and investors collectively acquired over 157,000 Bitcoins (worth over $16 billion), further propelling this momentum. Stocks of companies like Metaplanet, Bitmine, and SharpLink have all seen significant increases, often outpacing the price increases of their underlying cryptocurrencies.

(3) Leverage: Adding Fuel to the Fire

As premiums persist, DATs typically leverage to amplify returns. They issue convertible bonds or conduct secondary stock offerings to purchase more digital assets, essentially borrowing against future appreciation. For instance, MicroStrategy extensively uses convertible notes, with its debt accounting for 11% of its Bitcoin NAV.

This strategy amplifies returns in rising markets but exposes the company to significant risks during downturns. Leverage reduces a company's resilience to shocks, potentially triggering margin calls or forced liquidations. Its appeal is evident: in a rising market, leverage can turn moderate cryptocurrency gains into explosive stock performance. However, the inherent high volatility of digital assets can lead to rapid depreciation in asset value.

(4) Inevitable Decline: From Premium to Discount

The high volatility of the crypto market is well-known; when cryptocurrency prices fall, the stock prices of DATs may decline even more sharply. If the price drops too quickly or market confidence in these companies wanes, the premium of the stock price over NAV may swiftly turn into a discount. Leveraged positions can further exacerbate this issue: a decline in NAV may force companies to de-risk, creating a volatility trap where bets that originally amplified returns turn into greater losses for holders.

A discount in stock price relative to NAV indicates market skepticism about the company's asset management capabilities or its ability to cover operational costs during asset value declines. If no intervention is taken, a chain reaction may ensue: loss of investor confidence, rising borrowing costs, and potential liquidity crises.

(5) Choices in Crisis: Three Paths Forward

Assuming a DAT has sufficient cash reserves to cover operational costs, it primarily faces three choices when its stock is trading at a discount:

Maintain Status Quo: The company continues to hold assets, waiting for a market rebound. This approach preserves cryptocurrency holdings but may lead to long-term shareholder dissatisfaction, further exacerbating stock price declines. To date, Strategy has held onto its Bitcoin through multiple bear markets without selling.

Peer Acquisition: If the discount widens significantly, some speculative buyers (usually other DATs) may acquire the company at a low price, essentially purchasing its underlying tokens below market value. This could drive industry consolidation but also prematurely release demand, weakening new buying flows, which is one of the core drivers of the current upward trend.

Sell Assets to Repurchase Stock: The company's board may sell some digital assets to repurchase stock, aiming to narrow the discount and restore parity between stock price and NAV. This approach actively manages the dynamics of premiums and discounts but essentially involves selling cryptocurrencies during market weakness.

These three choices highlight the fragile balance between asset preservation and shareholder value.

(6) Selling Pressure: Motives and Impacts

Decision-makers at DATs typically receive stock as their primary form of compensation. While this aligns their interests with stock performance, it also leads them to favor short-term solutions. As personal wealth is directly tied to stock prices, when stock prices trade at a discount, the board faces immense pressure to opt for a strategy that combines asset sales and stock repurchases.

This incentive structure may lead companies to prioritize short-term NAV parity over a long-term holding strategy, resulting in hasty decisions that contradict the original logic of reserve assets. Critics argue that this mechanism resembles historical asset cycles of "boom to bust," where leveraged bets ultimately collapse in a brutal manner. If multiple companies simultaneously choose this strategy, it could trigger a chain reaction, leading to broader market turmoil.

(7) Widespread Impact on Cryptocurrency Prices

The process of DAT stock prices transitioning from premium to discount may have profound effects on the prices of underlying cryptocurrencies, often forming a negative feedback loop: when companies sell tokens to repurchase stock or cover leverage, they inject additional supply into an already declining market, further exacerbating price drops. For example, banking analysts warn that if Bitcoin prices fall more than 22% below the average purchase price of companies, it could trigger forced liquidations.

This could lead to systemic risks: the behavior of large holders can influence market dynamics, amplify volatility, and potentially result in cascading liquidations. However, some data suggest that corporate holdings have a relatively small direct impact on prices, and the market may overestimate the influence of digital asset treasury companies.

Nevertheless, in a high-leverage ecosystem, coordinated sell-offs could further depress asset values, hinder new players from entering the market, and prolong bear market cycles. As the DAT trend matures, its liquidation waves may test the resilience of the entire crypto market, transforming the current prosperity of reserve assets into future cautionary tales.

(8) Which Tokens Will Be Most Affected by the Transition to Discount?

Since the beginning of 2025, Ethereum-focused DATs have become significant players in the crypto ecosystem. They have accumulated substantial Ethereum (ETH) holdings through public market financing. While this has driven up Ethereum prices during bull markets, the model introduces additional risks during bear markets: when DAT stock prices transition from premium NAV to discount NAV, boards will face pressure to sell Ethereum to finance stock repurchases or cover operational costs, potentially further exacerbating Ethereum price declines. The following will analyze the potential price bottom for Ethereum in such scenarios, considering historical context, current holdings, and market dynamics.

(9) Historical Context: Price Trends Before and After the Announcement of the First Ethereum DAT

The first announcement of a DAT focused on Ethereum was made by BioNexus Gene Lab Corporation on March 5, 2025, marking the official transformation of this NASDAQ-listed company into an Ethereum asset strategy company. Prior to this, on March 4, 2025, Ethereum's closing price was approximately $2,170, reflecting the market's consolidation state amid widespread uncertainty following the 2024 bull market.

As of August 21, 2025, Ethereum's price was approximately $4,240, an increase of about 95% from the price before the announcement. In contrast, BTC's increase during the same period was only 28%. Additionally, the ETH/BTC exchange rate also reached a high point in 2025 (over 0.037), highlighting Ethereum's outperformance.

This surge in Ethereum was driven by multiple factors, including inflows into spot Ethereum ETFs (over $9.4 billion since June), rising institutional adoption, and corporate buying driven by the DAT trend itself. However, a significant portion of this increase stemmed from speculative inflows related to the DAT narrative, making it susceptible to corrections.

(10) Corporate Ethereum Holdings and Supply Proportion Since the Launch of the DAT Trend

Since BioNexus's announcement initiated the Ethereum DAT wave, publicly listed companies have actively accumulated Ethereum as a reserve asset. As of August 2025, approximately 69 entities hold over 4.1 million Ethereum, valued at around $17.6 billion. Major participants include BitMine Immersion Technologies (with holdings valued at $6.6 billion as of August 18, leading the industry), SharpLink (728,804 ETH), ETHZilla (approximately 82,186 ETH), Coinbase, and Bit Digital.

These companies hold over 3% of the total supply of Ethereum. The Ethereum DAT trend began in March 2025. Prior to this, very few publicly listed companies used Ethereum as a reserve asset; for example, Coinbase's Ethereum holdings were primarily for operational use rather than strategic reserves. This 3.4% holding is essentially all newly acquired since the launch of the DAT trend. When including institutional and ETF holdings, the institutional ownership of Ethereum is approximately 8.3% of the total supply, but the recent accumulation has primarily been driven by corporate purchases related to DATs.

(11) Predictions for Ethereum Price Decline When DATs Stock Prices Are Discounted

During bull markets, DATs stock prices typically trade at a premium to NAV; however, in bear markets, the previous premium may reverse into a discount of 20%-50%, triggering three response paths: maintaining the status quo, being acquired, or selling assets to repurchase stock. Since executive compensation is tied to stock performance, they are more inclined to reduce the discount by selling Ethereum, which would inject additional supply into the market. For Ethereum, such sell-offs could create a negative feedback loop, especially considering the concentrated holdings of a few companies.

- Baseline Scenario (Mild Discount, Partial Sell-off)

If Ethereum enters a correction phase due to macro factors (such as rising interest rates) and DATs stock prices fall to a 10%-20% discount, companies may sell 5%-10% of their Ethereum holdings (approximately 205,000 - 410,000 ETH, valued at $870 million - $1.74 billion at current prices) to raise funds for stock repurchases. Ethereum's average daily trading volume is about $15 billion - $20 billion, so this sell-off could exert 5%-10% downward pressure, bringing the price down to $3,600 - $3,800 (a 10%-15% drop from the current $4,240). This scenario assumes companies gradually sell through over-the-counter (OTC) transactions to minimize slippage.

- Severe Scenario (Deep Discount, Coordinated Sell-off)

If the crypto market enters a full bear market (with premiums completely disappearing and discounts widening to 30%-50%), multiple DATs may initiate liquidations simultaneously—especially when leveraged positions (such as convertible bonds) force them to de-risk. If 20%-30% of corporate Ethereum holdings (approximately 820,000 - 1.23 million ETH, valued at $3.5 billion - $5.2 billion) flood the market within weeks, it could exceed the market's liquidity capacity, leading to a price drop of 25%-40%. At that point, Ethereum prices could fall to $2,500 - $3,000, approaching levels seen before the launch of the DAT trend, but not completely reverting—thanks to ETF funding support and on-chain growth (for example, Ethereum's average daily trading volume reached 1.74 million transactions in early August). Referring to historical cases where institutional sell-offs amplified declines during the 2022 bear market, and considering the current 3.4% concentration of corporate holdings, Ethereum's volatility could further intensify.

- Worst-Case Scenario (Complete Liquidation)

If regulatory scrutiny increases (such as the U.S. SEC taking action against treasury-type companies) or a liquidity crisis erupts, forcing companies to sell Ethereum on a large scale (potentially selling over 50% of their holdings, or more than 2 million ETH), prices could plummet to $1,800 - $2,200, completely erasing the gains made since the launch of the DAT trend and testing the 2025 lows. However, the probability of this scenario occurring is low, as peer acquisitions could absorb some of the supply, and the 8% ETF holdings could provide a buffer.

The above predictions have taken into account improvements in Ethereum's fundamentals, such as the accumulation of 200,000 ETH by whales in the second quarter of 2025, but still highlight specific risks related to DATs. Ultimately, the extent of Ethereum's price decline will depend on the scale of sell-offs, market depth, and external catalysts. However, in scenarios driven by discounts leading to liquidations, a price retreat to the $2,500 - $3,500 range is reasonable, which also exposes the vulnerabilities of the DAT model.

Disclaimer

The content of this article does not represent the views of ChainCatcher. The opinions, data, and conclusions in the text reflect the personal positions of the original author or interviewees. The compiler maintains a neutral stance and does not endorse their accuracy. This does not constitute any professional advice or guidance; readers should exercise caution and use independent judgment. This compilation is for knowledge-sharing purposes only; readers are strictly advised to comply with the laws and regulations of their respective regions and not engage in any illegal financial activities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。