以太坊再次超越万事达卡市值

在一个重要的里程碑中,以太坊再次超越万事达卡的市值,现已成为第22大资产。这一显著成就凸显了该资产在加密领域日益增长的影响力。

以太坊第二次超越万事达卡

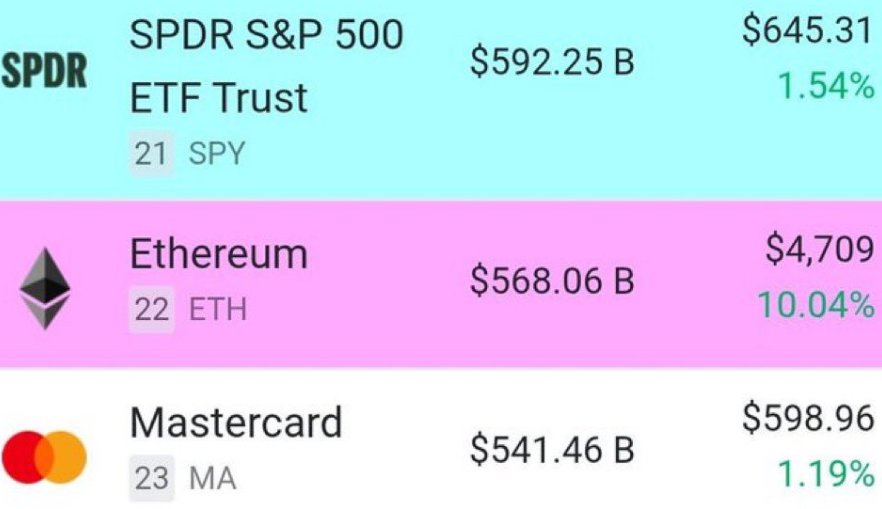

据报道,以太坊再次超越 万事达卡的市值,达到了5680.6亿美元。这一成就使得加密货币成为全球第22大资产。万事达卡以5414.6亿美元的市值紧随其后,位列第23位。

在24小时内,市值实现了12.99%的显著增长。在过去七天中,它也增长了8%。该代币的价值在一周内飙升了21%,使其市值超过5200亿美元,领先于Netflix和万事达卡等企业巨头。

值得注意的是,这一增长是由于机构投资的增加以及对以太坊ETF 的大量流入。例如,最近关于贝莱德的ETHA和富达的FETH的正向流入引起了特别关注。

显著的是,这些流入抵消了前四个交易日的重大流出。这一举动使以太坊交易所交易基金的净流入超过120亿美元,总资产约为270亿美元。九个ETF持有的以太坊在8月19日达到了606.9万的历史高点,较7月8日记录的415万有了显著增加。

ETH国库增长

以太坊市值超过万事达卡的增长与企业对该资产的日益采用相吻合。行业巨头如BitMine积极积累ETH,选择以太坊而非比特币。BitMine的负责人汤姆·李表示,

“仅在一周内,BitMine将其ETH持有量增加了17亿美元,达到了66亿美元(从115万枚增加到152万枚,增加了超过373,000枚代币),因为机构投资者对我们追求‘5%炼金术’表示了兴趣和支持……正如我们一直所说,我们在提高每股加密资产净值的速度和我们股票的高交易流动性方面领先于加密国库同行。”

有趣的是,像Sharplink Gaming和Ether Machine这样的平台也在加大对以太坊的投资。正如Coin Gabbar最近报道的,Ether Machine购买了 15,000 ETH,价值5690万美元,每枚价格为3809.97美元。

另请阅读: Xenea钱包测验答案2025年8月24日:玩游戏赚取$Gems

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。