DeFi and RWA Protocols Repositioning as Layer 1s Pursue High Valuations, but Changing Labels Won't Help if the Product is Lacking.

Author: Alexandra Levis

Translation: Deep Tide TechFlow

DeFi and RWA protocols are repositioning themselves as Layer 1s to achieve valuations similar to infrastructure. However, Avtar Sehra states that most DeFi and RWA protocols remain confined to narrow application areas, lacking sustainable economic benefits—the market is starting to see through this.

In financial markets, startups have long tried to package themselves as "tech companies," hoping investors would value them at tech multiples. This strategy often works—at least in the short term.

Traditional institutions have paid the price for this. Throughout the 2010s, many companies rushed to rebrand themselves as tech companies. Banks, payment processors, and retailers began calling themselves fintech or data companies. Yet, few managed to achieve true tech company valuation multiples—because their fundamentals often failed to match the narrative.

WeWork is one of the most representative cases: a real estate company disguised as a tech platform that ultimately collapsed under the weight of its own illusion. In the financial services sector, Goldman Sachs launched Marcus in 2016, a digital-first platform aimed at competing with consumer fintech companies. Despite some early progress, the project was scaled back in 2023 due to long-term profitability issues.

JPMorgan has loudly proclaimed itself a "tech company with a banking license," while BBVA and Wells Fargo have invested heavily in digital transformation. However, these efforts rarely achieve platform-level economic benefits. Today, the tech delusions of such companies lie in ruins—clearly reminding us that no matter how a brand is packaged, it cannot transcend the structural limitations of capital-intensive or regulated business models.

The crypto industry is now facing a similar identity crisis. DeFi protocols aspire to achieve valuations akin to Layer 1s. RWA decentralized applications are trying to shape themselves as sovereign networks. Everyone is chasing the "tech premium" of Layer 1.

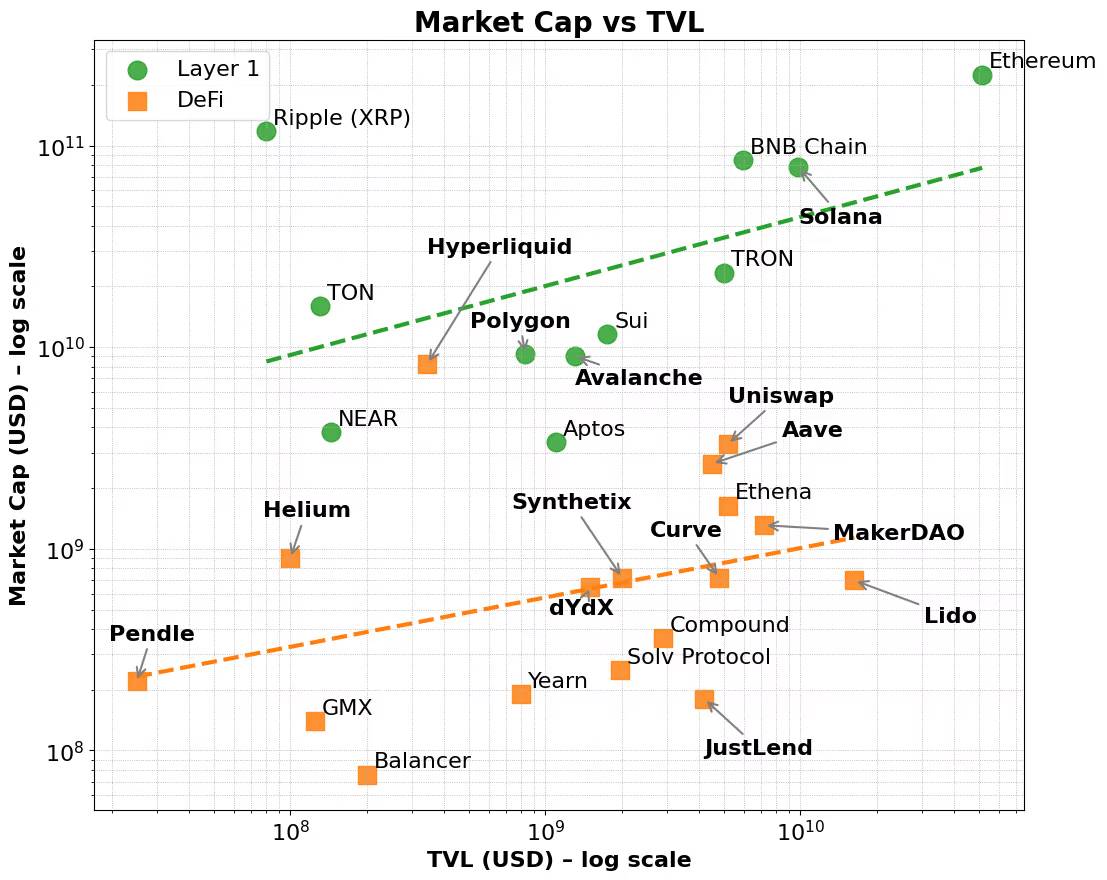

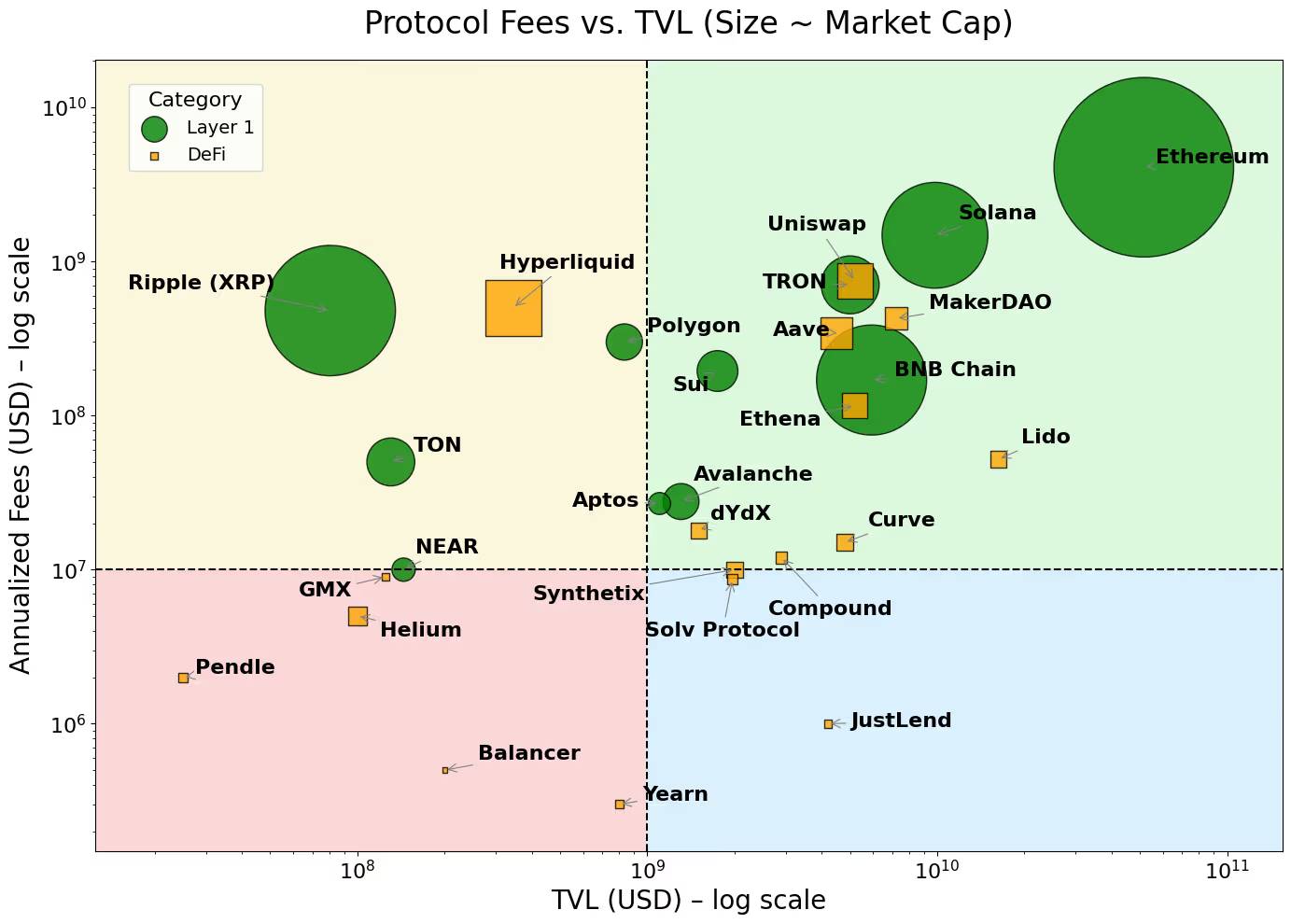

Fairly speaking, this premium does exist. Layer 1 networks like Ethereum, Solana, and BNB have consistently enjoyed higher valuation multiples compared to metrics like Total Value Locked (TVL) and fee generation. These networks benefit from a broader market narrative—a narrative that leans more towards infrastructure rather than applications, and more towards platforms rather than products.

Even when controlling for fundamental factors, this premium persists. Many DeFi protocols exhibit strong TVL or fee generation capabilities but still struggle to reach market capitalizations comparable to Layer 1s. In contrast, Layer 1s attract early users through validator incentives and native token economics, subsequently expanding into developer ecosystems and composable application domains.

Ultimately, this premium reflects the broad native token utility, ecosystem coordination, and long-term scalability of Layer 1s. Moreover, as fee scales grow, the market capitalization of these networks often shows disproportionate growth—indicating that investors consider not only current usage but also future potential and compound network effects.

This layered flywheel mechanism—from infrastructure adoption to ecosystem growth—explains why Layer 1 valuations consistently exceed those of decentralized applications (dApps), even when the underlying performance metrics of both seem similar.

This is akin to how the stock market distinguishes between platforms and products. Infrastructure companies like AWS, Microsoft Azure, Apple's App Store, or Meta's developer ecosystem are not merely service providers; they are ecosystems. These platforms enable thousands of developers and businesses to build, scale, and collaborate. Investors assign these companies higher valuation multiples not just for current revenue but to support the potential for emerging use cases, network effects, and economies of scale in the future. In contrast, even highly profitable software-as-a-service (SaaS) tools or niche services struggle to achieve the same valuation premium—because their growth is constrained by limited API composability and narrow utility.

Today, this model is also playing out among large language model (LLM) providers. Most vendors are rushing to position themselves as the infrastructure for AI applications rather than simple chatbots. Everyone wants to be AWS, not Mailchimp.

Layer 1s in the crypto space follow a similar logic. They are not just blockchains; they are coordination layers for decentralized computing and state synchronization. They support a wide range of composable applications and assets, with their native tokens accumulating value through underlying activities: such as gas fees, staking, MEV, etc. More importantly, these tokens also serve as mechanisms to incentivize developers and users. Layer 1s benefit from a self-reinforcing loop—creating interactions between users, developers, liquidity, and token demand while supporting vertical and horizontal scaling across industries.

In contrast, most protocols are not infrastructure but single-function products. Therefore, increasing the validator set does not make them Layer 1s—it merely seeks justification for higher valuations by draping the product in the guise of infrastructure.

This is the backdrop against which the appchain trend has emerged. Appchains integrate applications, protocol logic, and settlement layers into a vertically integrated tech stack, promising better fee capture, user experience, and "sovereignty." In a few cases—like Hyperliquid—these promises have been fulfilled. By controlling the entire tech stack, Hyperliquid achieves fast execution, excellent user experience, and significant fee generation—without relying on token incentives. Developers can even deploy dApps on its underlying Layer 1, leveraging the infrastructure of its high-performance decentralized exchange. Although its scope remains narrow, it demonstrates a certain degree of broader scaling potential.

However, most appchains are merely trying to change their identity by repackaging protocols; they lack actual usage and deep ecosystem support. These projects often find themselves in a dilemma: trying to build infrastructure while also wanting to create products, but often lacking sufficient capital or teams to excel at either. The end result is a vague hybrid—neither a high-performance Layer 1 nor a category-defining decentralized application.

We have seen this situation before. A robo-advisor with a cool user interface is still essentially a wealth management service; a bank with open APIs remains a balance sheet-centric business; a co-working company with a polished application is ultimately still leasing office space. Eventually, as market enthusiasm wanes, capital will reassess the value of these projects.

RWA protocols are now falling into the same trap. Many protocols attempt to position themselves as the infrastructure for tokenized finance but lack substantial differentiation from existing Layer 1s and sustainable user adoption. At best, they are merely vertically integrated products, lacking a true need for an independent settlement layer. Worse still, most protocols have yet to achieve product-market fit in their core use cases. They merely add infrastructure features and rely on exaggerated narratives, hoping to support high valuations that their economic models cannot sustain.

So, what is the way forward?

The answer is not to disguise as infrastructure but to clearly define oneself as a product or service and excel at it. If your protocol can solve real problems and drive significant total locked value growth, that is a solid foundation. But relying solely on TVL is not enough to make you a successful appchain.

What truly matters is actual economic activity: the ability to drive sustainable fee generation, user retention, and clear value accumulation for the native token. Furthermore, if developers choose to build on your protocol because it is genuinely useful, rather than because it claims to be infrastructure, the market will naturally reward that. Platform status is earned through merit, not self-proclamation.

Some DeFi protocols—like Maker/Sky and Uniswap—are moving along this path. They are evolving towards an appchain model to enhance scalability and cross-network accessibility. But they are doing so based on their strengths: mature ecosystems, clear profit models, and product-market fit.

In contrast, the emerging RWA space has yet to demonstrate lasting appeal. Almost every RWA protocol or centralized service is rushing to launch appchains—often supported by fragile or untested economic models. Just as leading DeFi protocols transition to appchain models, the best development path for RWA protocols is to first leverage existing Layer 1 ecosystems, accumulate user and developer appeal, drive TVL growth, and demonstrate sustainable fee generation capabilities before evolving into appchain infrastructure models with clear goals and strategies.

Therefore, for appchains, the practicality and economic model of underlying applications must be prioritized for validation. Only after these foundations are proven does transitioning to an independent Layer 1 become feasible. This sharply contrasts with the growth trajectory of general-purpose Layer 1s, which can prioritize building validator and trader ecosystems early on. Initial fee generation primarily relies on native token trading, and over time, cross-market expansion will broaden the network to developers and end-users, ultimately driving TVL growth and creating diversified fee sources.

As the crypto industry matures, the fog of narratives is dissipating, and investors are becoming more discerning. Buzzwords like "appchain" and "Layer 1" no longer attract attention solely on their own. Without a clear value proposition, sustainable token economics, and a defined strategic path, protocols will lack the necessary foundation to transition to true infrastructure.

What the crypto industry—especially the RWA space—needs is not more Layer 1s, but better products. Projects focused on building high-quality products will truly earn market rewards.

Figure 1. Market Capitalization of DeFi and Layer 1 vs. TVL

Figure 2. Layer 1s concentrate in high-fee areas, while dApps concentrate in low-fee areas.

Note: The views expressed in this column are those of the author and do not necessarily reflect the views of CoinDesk, Inc. or its owners and affiliates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。