Stablecoin Yield Protocol Cap: Do You Want Points or Returns?

Written by: KarenZ, Foresight News

The popularity of stablecoins remains unabated, while the industry continues to face two core questions: How can we strengthen the asset security defense line while allowing users to flexibly participate and earn more attractive returns? How can we achieve precise alignment of incentives among the various roles in the protocol—stablecoin holders, operators, and risk bearers?

Today, we introduce a stablecoin protocol called Cap, built on Ethereum. As early as the end of April this year, I analyzed its operational model in the article “Gold Mining Handbook | How Can CAP Allow Stablecoin Users to Earn Institutional-Level Returns?.”

Now, Cap has officially launched on the Ethereum mainnet and simultaneously introduced the Frontier program, incentivizing early ecosystem contributors through the Caps points mechanism.

What is CAP?

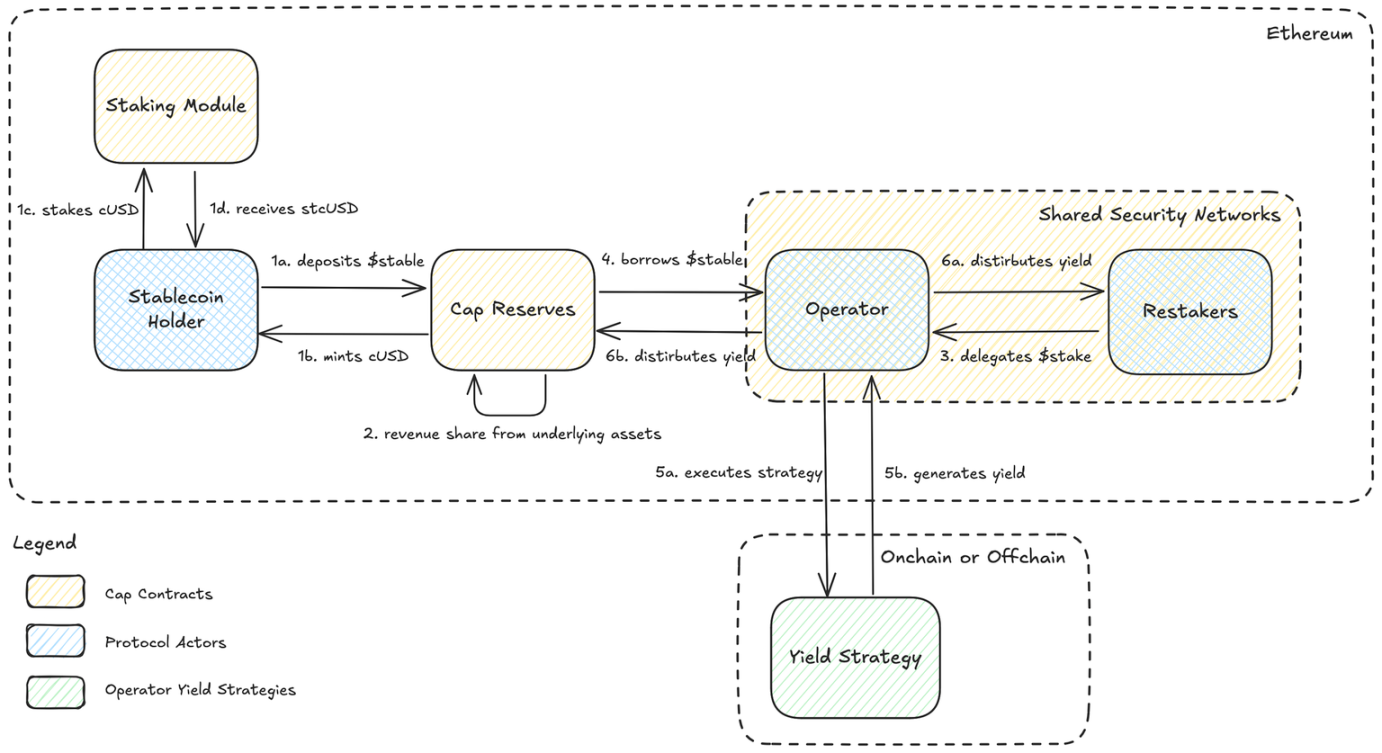

Cap's core product is built around decentralized stablecoins and yield enhancement strategies, while introducing a multi-role collaboration mechanism involving operators (who generate returns) and re-staking delegators (who provide economic security for stablecoin depositors), ensuring system security and efficient operation. If you're interested in the specific operational mechanisms, you can check the link at the beginning of the article.

From a financing perspective, in October 2024, CAP Labs completed a $1.9 million Pre-Seed round of financing, with angel investors including Kraken Ventures, Robot Ventures, ANAGRAM, ABCDE Labs, SCB Limited, and Synthetix founder Kain Warwick participating. In early April 2025, CAP secured another $11 million in funding, with traditional asset management giants like Franklin Templeton and Triton Capital participating, confirming traditional finance's recognition of its model.

Although Cap was selected for the MegaETH flagship accelerator program "Mega Mafia," it chose to launch its core protocol on the Ethereum mainnet.

Cap Core Products

1. cUSD: A stablecoin backed by the US dollar, redeemable at any time.

Acquisition Method: Users deposit whitelisted assets (such as mainstream stablecoins like USDC and money market funds) into the collateral pool to mint cUSD based on the value from Chainlink oracles (the minting fee is 0.10% to compensate for potential deviations in collateral prices not accounted for by oracle prices).

Reward Mechanism: Users holding cUSD will receive Caps points as rewards, with early participants (in the first two weeks) enjoying higher incentives, which will decrease thereafter.

cUSD Utility: cUSD holders can use cUSD on any network.

2. stcUSD: Yield-bearing stablecoin

Acquisition Method: Stake cUSD to obtain stcUSD (currently, USDC can also be exchanged for it on its DApp).

Source of Returns: Regardless of market conditions and scale, stcUSD holders can earn returns. stcUSD holders can earn from the underlying strategy of cUSD collateralized assets and from the allocation of returns to institutional yield operators by Cap, with returns redeemable at any time.

Who Generates Returns: Returns come from the underlying strategy and from over-collateralized loans to financial institutions.

In other words, if operators discover a higher yield opportunity (exceeding the current minimum yield rate of the protocol), they can execute proprietary strategies by borrowing reserve funds to generate returns. To qualify for borrowing, operators need to obtain delegation from re-staking delegators. Re-staking delegators lock assets for operators through the "Shared Security Network," underwriting the risk borne by operators and thus receiving fee returns (paid in blue-chip assets like ETH, USD, etc.), with the ability to set risk premiums for different operators. This mechanism helps protect cUSD holders from default risk.

The borrowing interest rate that operators need to pay includes the re-staking rate (negotiated with re-stakers) and the minimum yield rate for stcUSD holders (which varies dynamically).

The first batch of whitelisted operators announced by Cap includes Amber Group, Auros, Caladan, Concrete, Edge, Fasanara, Flow Traders, Flowdesk, Gauntlet, GSR, IMC Trading, Keyrock, Portofino, Re7, RockawayX, and Susquehanna Crypto.

Re-staking delegators include Ether fi, Gauntlet, Stakestone, Kelp, MEV Capital, Puffer, Re7, and Renzo. This means that all loans provided to operators from Cap's reserves are over-collateralized through ETH and BTC derivatives via EigenLayer and Symbiotic.

Cap Points System

With the mainnet launch, Cap also introduced the Caps points system. This program, also known as the Frontier program, commemorates the initial version of the Ethereum network and will last for up to 5 months or until internal metrics are met.

The Frontier program is divided into multiple Epochs, with early Epoch participants receiving more Caps than those who join later.

Epoch 1 focuses on minting and holding cUSD, with enhanced rewards in the first two weeks, providing higher returns for early depositors. Holding cUSD will continue to earn incentives, but rewards will diminish as the program progresses.

Epoch 2 will be announced on August 25, involving the use of cUSD assets (stcUSD, cUSD, and their derivatives) in partner protocols.

How to Participate?

Use USDC on cap.app to mint cUSD and earn Gaps points, with early participants able to earn more points.

Use USDC or cUSD to exchange for stcUSD and earn institutional returns (points acquisition is currently not supported).

Points or Returns? If the core goal is to earn points and aim for future airdrops, cUSD is the only choice. Currently, Cap does not support points acquisition for stcUSD holders, so stcUSD is only suitable for long-term holders or income-oriented investors.

It is worth noting that since it is the first day of the mainnet launch, the previously announced 16 operators, including Amber Group, and 8 re-staking delegators, including Ether.fi, have not yet fully commenced operations, and the initial yield rate for stcUSD is temporarily low. However, as more institutions gradually enter the market, yields are expected to steadily increase. As of now, Cap's total locked value (TVL) has surpassed $10 million.

Additionally, although Cap has completed five audits before launch, security in the DeFi space remains a top priority. Users should be aware of potential risks, including code vulnerabilities, protocol mechanism risks, counterparty risks, and cUSD decoupling risks, and it is recommended to fully understand the rules before participating.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。