Most people know that the most profitable business in the crypto space is contracts.

But can you imagine a low-key dark horse, Perp DEX, which has only been operating for a year, surpassing top public chains like Ethereum and Base in 24-hour revenue? When you extend the timeframe to 7 days, it has trampled over DeFi veterans like Uniswap, Jupiter, AAVE, and Lido. It is not only one of the few projects in the top 15 daily revenue list that has not issued a token, but it also has the best liquidity depth for buying BTC and ETH within a 0.01% price range among perp DEXs.

This new revenue curve "monster" is called edgeX.

Why is the revenue curve so fierce?

Unlike the Hyperliquid we are familiar with, edgeX is a ZK-structured perp DEX. The team is incubated by Amber, and its core members come from a background of high-frequency trading experience at firms like Goldman Sachs and Jump Trading. In terms of product form, edgeX resembles a "full-stack on-chain financial base": in addition to the perp DEX, it also has two other product lines, eStrategy (vault) and the edgeX chain.

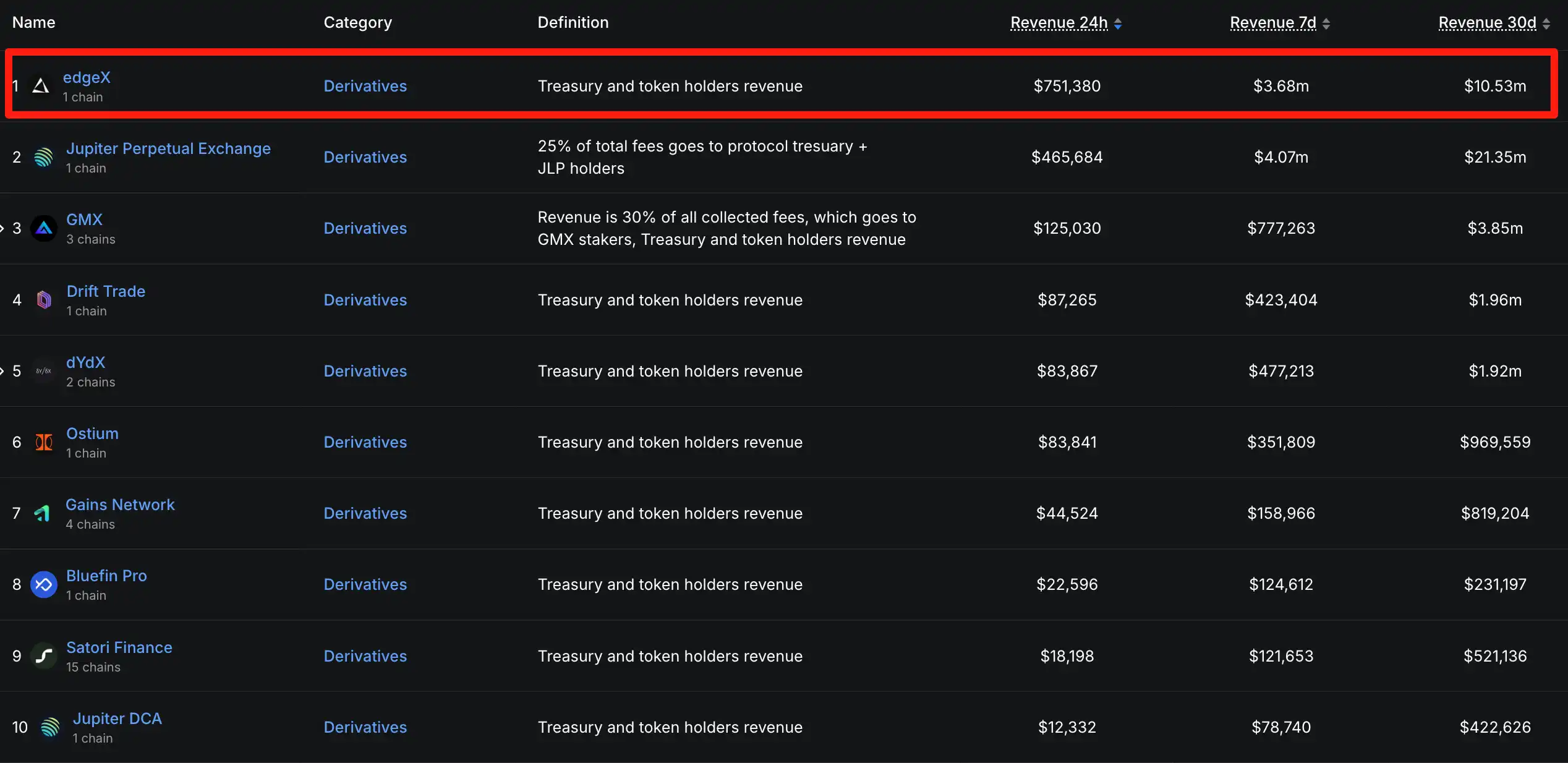

As mentioned at the beginning of the article, the quality of the product is directly reflected in the revenue, so comparing the revenue within the perp DEX track can more directly show edgeX's ferocity.

As a perp DEX that has only been operating for a year, edgeX's fee revenue in the past 30 days is $10.53M, far exceeding the $3.85M of veteran GMX and the $1.92M of dYdX. In other words, edgeX's revenue is almost more than twice that of GMX and more than five times that of dYdX.

Data source: DefiLlama

So, how did edgeX break into the top tier of perp DEXs through its revenue curve? The answer may lie in trading depth and fees, the two most important and intuitive metrics for traders.

In terms of liquidity depth, edgeX currently ranks second among all Perp DEXs. Taking the core BTC/USDT pair as an example, within a 0.01% price range, edgeX's order book can support an order volume of up to $6M for BTC, surpassing hyperliquid ($5M), Aster ($4M), and Lighter ($1M). Although the overall depth is still slightly inferior to hyperliquid, edgeX has the best depth among Perp DEXs for most cryptocurrencies, aside from hyperliquid. For more in-depth content on this point, you can refer to the latest article by Dan, the head of research at edgeX, titled "Understanding DEX Liquidity: A Comparative Look at Trading Efficiency," which discusses this in greater detail.

Additionally, edgeX offers highly competitive rates for both Makers and Takers: Maker fees are only 0.015%, and Taker fees are 0.038%, significantly lower than Hyperliquid's 0.045%. Furthermore, users can unlock VIP1 status by registering through ambassador referral links, allowing Taker fees to drop to 0.036%, and ambassadors can enjoy up to 35% in fee rebates—saving on trading costs while continuously accumulating airdrop points.

With such advantages in trading depth and fees, edgeX's moat has naturally formed, driving the growth of its revenue curve. Even without issuing a token yet, it proves that edgeX has the ability for continuous "token buybacks" and to generate funds for ecological development.

Interestingly, when we look at the overall revenue leaderboard: among the top 15 protocols (excluding the issuers of stablecoins USDT and USDC), only four have made it to the forefront without issuing tokens, and edgeX is one of them.

Data source: DefiLlama

Many friends in the Chinese community may not have heard of this dark horse because this perp DEX rarely engages in narrative packaging, with its community audience primarily in South Korea and North America.

In other words, this is a clear case of high revenue, low valuation, and still in the token window period—a rare Alpha.

Currently, edgeX uses edgeX Points to measure contributions, distributing them weekly, with 2.4M already distributed. The ways to earn include trading volume, positions, vault participation, and invitations, and the edgeX Messenger ambassador program is currently underway.

Trading volume can be manipulated, but profit revenue is hard to fake. Whether in traditional finance or the web3 industry, only the genuine "user willingness to pay" in terms of real money is the most direct validation of "product sustainability."

In less than a year, edgeX has achieved cash flow in the industry's top 15, representing a highly certain growth trajectory, and perhaps a very strong alpha. What FDV will it launch with in the next phase, and what returns will it provide to early participants? We can look forward to that.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。