Author: Nancy, PANews

At a time when the concept of cryptocurrency stocks is being hyped, a tweet stating "millions of dollars frozen" has instantly put MyStonks in the spotlight. Keywords such as fund security, trading platform, and compliance risks quickly ignited investors' nerves, and panic spread rapidly within the community.

In response to doubts and speculation, MyStonks swiftly clarified that the freeze only concerns a single user and is to cooperate with a regulatory investigation. They have contacted the involved user to guide them in completing the necessary compliance information submission. This incident of fund freezing has sparked discussions about the safety and compliance qualifications of cryptocurrency stock platforms, and a commercial struggle seems to be unfolding. This article will review the events and MyStonks' response measures.

The Large Fund Freeze is to Cooperate with Regulatory Investigation; Ordinary Users' Deposits and Withdrawals Are Not Affected

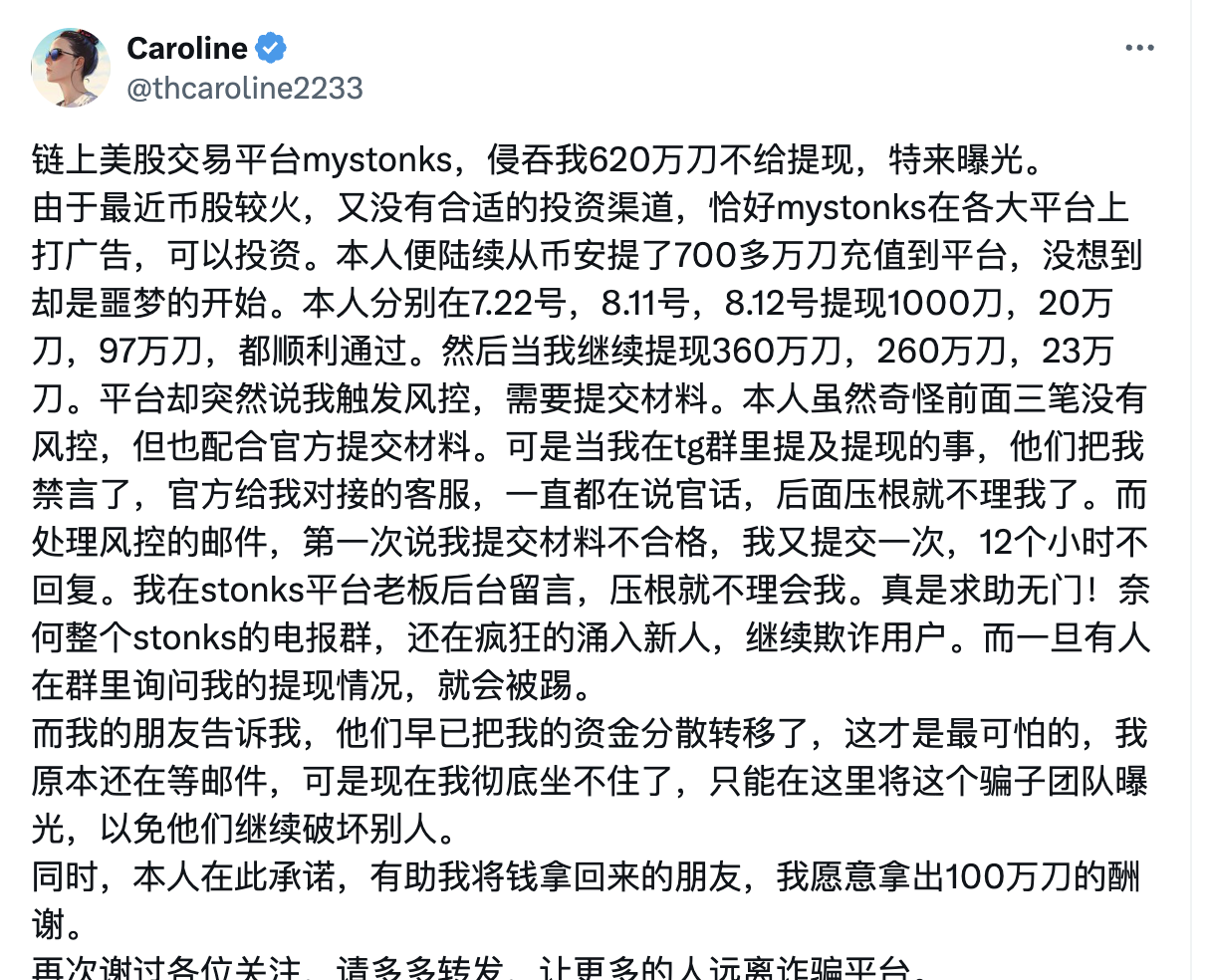

On August 13, a user posted on social platform X that they had deposited over $7 million from Binance into MyStonks, but approximately $6.2 million of that was frozen, and withdrawal channels were closed and funds dispersed because the platform required them to submit materials to complete a risk control review. This news quickly attracted attention and raised questions about MyStonks' safety, especially after being marked as a phishing site by OKX, further exacerbating the trust crisis.

In response to the incident, MyStonks officially stated that the platform recently received a regulatory enforcement request concerning a specific user. After receiving the request, the compliance team immediately contacted the relevant user through secure channels and provided detailed information submission procedures. All collected information will be securely stored and shared only within the legal requirements. This investigation only involves a single user and includes matters such as anti-money laundering, associations with criminal organizations or fraud groups, drug trafficking, evasion of sanctions, and suspicious activity reports. Ordinary users' deposit and withdrawal operations are not affected by this investigation and can proceed normally.

Meanwhile, MyStonks founder Bruce J also held a Space on platform X to provide a detailed explanation of the incident. According to Bruce J, the compliance team received an enforcement request concerning a single customer last week and has contacted the customer to assist in providing relevant proof materials, but at this stage, the information provided by the user is limited, and it is still unclear when the funds will be unfrozen.

Bruce J explained that under the constraints of the Bank Secrecy Act, stock trading may trigger a review of "single or multiple transactions exceeding $1 million." If abnormalities are found, a Suspicious Activity Report (SAR) must be submitted to FinCEN. Therefore, the targeted investigation and withdrawal suspension concerning this user are not actions taken autonomously by the platform; cooperating with regulatory investigations is a legal obligation for every exchange, and the investigation does not imply that there are issues with the customer's funds. He urged the public not to overinterpret the incident and stated that specific investigation information would be sent directly to the user to protect their privacy.

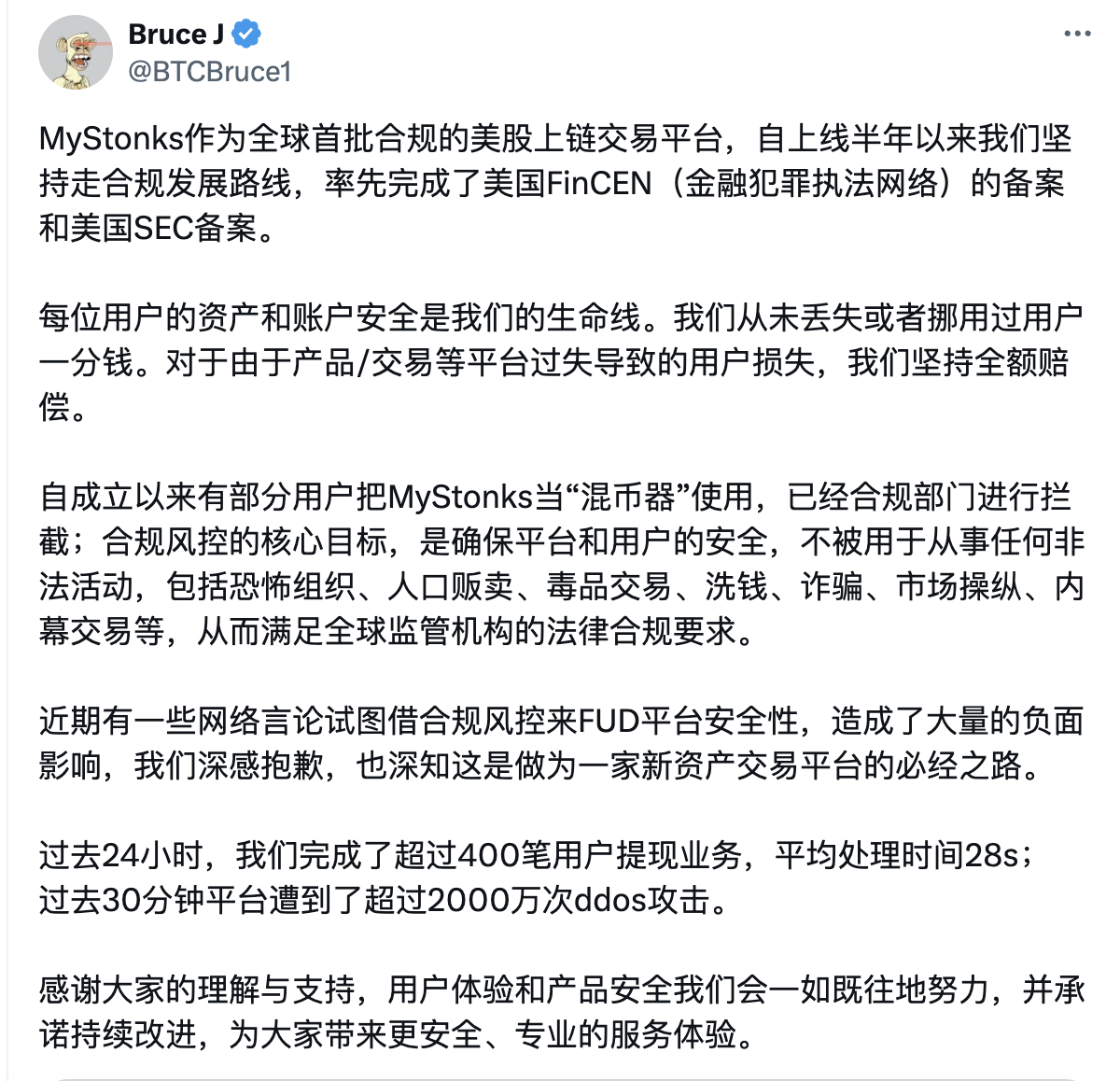

He further disclosed that since its establishment, the platform has registered over 20,000 users, processing approximately 500 to 800 deposits and withdrawals daily, with 99% having no issues. In the past 24 hours alone, MyStonks completed over 400 user withdrawal transactions, with an average processing time of 28 seconds.

"The safety of every user's assets and accounts is our lifeline. We have never lost or misappropriated a single cent of users' funds. For losses incurred by users due to platform negligence in products/trading, we insist on full compensation. Regarding malicious defamation online, such as 'running away' or 'fraud,' we urge everyone to obtain accurate information through formal legal channels and not to believe or spread rumors," Bruce J emphasized.

According to security agency Slow Mist's founder, Yu Xian, the frozen funds of the user mainly came from withdrawing from Binance, with DEX interactions involving STONKS and USDT exchanges. If MyStonks' cooperation with the enforcement request is valid, attention should be paid to the target user's fund transactions on Binance.

Responding to Compliance Qualifications and Operating Models, Emphasizing Compliance Risk Control as a Core Goal

The fund freeze incident on the MyStonks platform has attracted widespread attention and sparked discussions and doubts in the market regarding the platform's compliance qualifications and operating model.

Some users believe that the platform's excessive emphasis on its MSB license may obscure deficiencies in compliance with securities trading and mislead non-U.S. investors through information asymmetry; some users question that MyStonks is packaging private placement filings as comprehensive compliance licenses, using ordinary investors' unfamiliarity with U.S. securities regulations for marketing; others point out that the platform's practice of freezing funds rather than directly returning them differs from standard financial institution operating practices, which may reflect vulnerabilities in its compliance system.

In response to these doubts, MyStonks made the following statements.

The official emphasized that MyStonks is a fully compliant and regulated platform, holding a U.S. FinCEN Money Services Business (MSB) license and has completed the U.S. SEC's filing for Security Token Offerings (STO). The platform always adheres to the principles of legal and compliant operation, strictly following regulatory requirements and risk control policies.

Regarding compliance details, MyStonks pointed out that its submitted Form D is a federal filing required by the SEC, which must meet Rule 504/506 and other provisions, including investor qualification verification, information disclosure, and compliance with anti-fraud provisions, applicable to entities issuing securities under Regulation D exemptions. MyStonks strictly follows the requirements of Regulation D and Regulation S when submitting Form D. Regulation S explicitly allows the issuance of securities to non-U.S. investors outside the U.S., which is a legally recognized cross-border issuance path by the SEC.

MSB registration is managed by FinCEN under the U.S. Department of the Treasury, which is an important step into the U.S. compliance system. After registration, companies must comply with the Bank Secrecy Act and FinCEN's anti-money laundering regulations, including customer due diligence (KYC), anti-money laundering monitoring (AML), and suspicious transaction reporting (SAR). MyStonks submits AML reports annually as required and is subject to FinCEN's supervision and review. MSB registration is not only a confirmation of compliance identity but also the beginning of ongoing regulatory obligations.

At the same time, MyStonks emphasized that not all of its business falls under STO, so some assets are functional tokens or digital goods, which are not within the scope of securities regulation and are not subject to Regulation D investor restrictions.

It is worth noting that, according to MyStonks, since its establishment, some users have used MyStonks as a "mixing service," which has already been intercepted by the compliance department; the core goal of compliance risk control is to ensure the safety of the platform and users, preventing it from being used for any illegal activities, including terrorism, human trafficking, drug trafficking, money laundering, fraud, market manipulation, insider trading, etc., thus meeting the legal compliance requirements of global regulatory agencies.

From Website Attacks to Abnormal Fund Flows, Suspicion of Commercial Warfare Emerges

After the rights protection storm escalated, MyStonks revealed that its website had suffered a DDoS attack and received numerous complaints and reports. Meanwhile, the fund activities of rights protection users also attracted market attention. This series of events has sparked speculation about the possibility of commercial warfare.

For instance, according to KOL @OxMayyy's analysis, the funds of the rights protection user had almost no substantial trading, withdrawing funds within an hour after each deposit, and not returning to the original deposit address, which naturally triggered risk control; additionally, when a single or cumulative fund flow exceeds $1 million, it may be subject to regulatory review. At the same time, MyStonks recently also faced a DDoS attack, indicating that the platform's influence is expanding, making this dispute seem more like market pressure on a growing platform rather than a simple rights protection incident.

According to @CryptoPainter_X, the involved party had previously shared their trading experience in a group named Biyapay under the alias "Uncle," stating that their account had a large amount of funds and gave positive feedback on the platform experience. This screenshot was also shared by the official Biyapay account, and Biyapay and MyStonks are in direct competition in terms of business model. In his view, this seems like a premeditated commercial smear campaign, but there is currently no conclusive evidence.

Christine, co-founder of Infini, also stated that in the battlefield of commercial competition, some opponents always choose to use despicable means: first, they flood social platforms with negative information, then disrupt normal operations through technical attacks, and finally leverage panic messages to undermine user trust. For those who have experienced this, it is often a signal that your business has touched the core of the market. She believes that the real battle is not just for revenge but also to protect one's achievements and defend one's position.

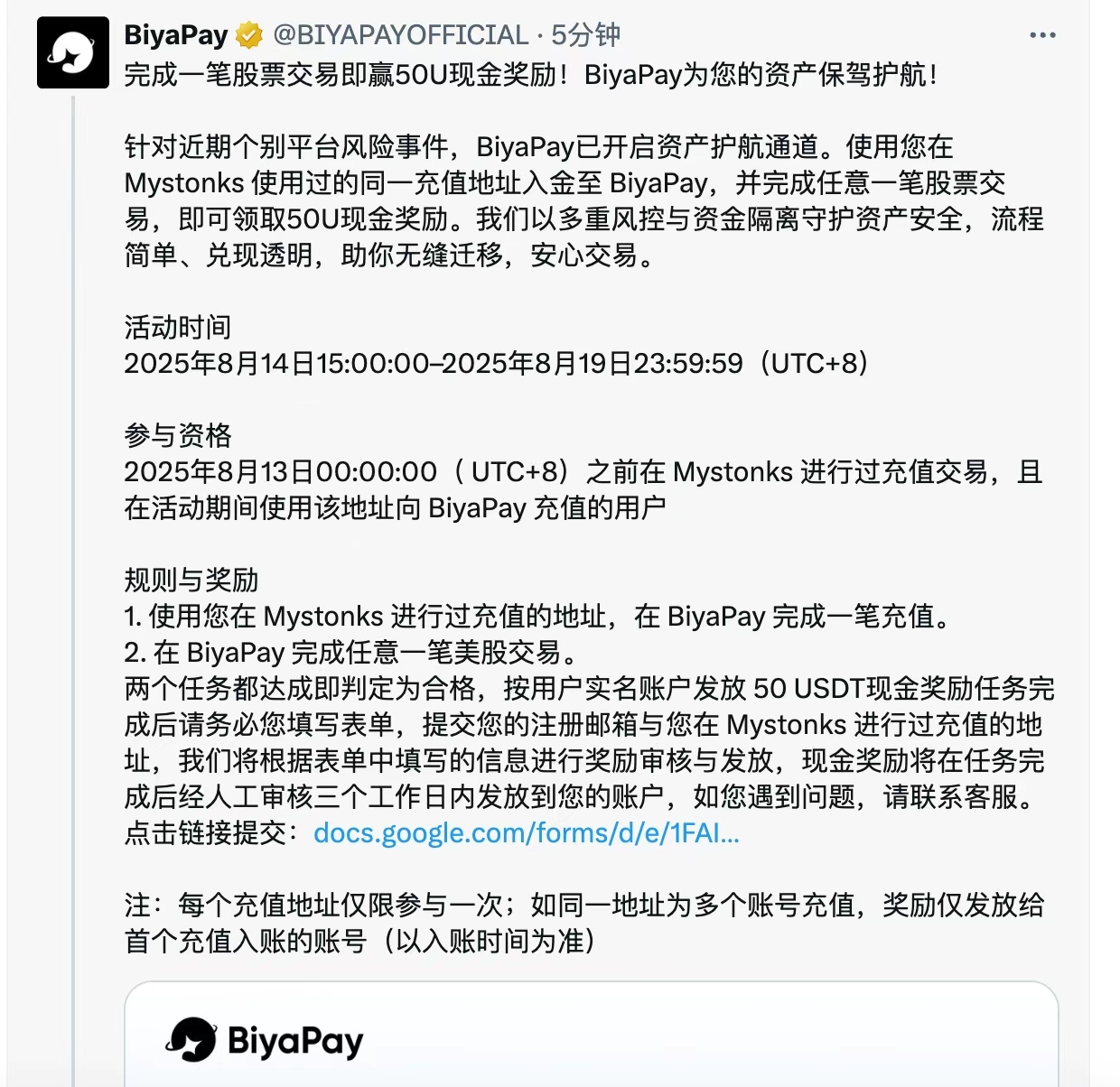

Interestingly, after the MyStonks freezing incident, Biyapay not only emphasized multiple risk control and fund isolation protection measures but also launched an asset migration reward program, where users can receive rewards for completing any transaction on Biyapay using MyStonks' deposit address. This move has been interpreted within the industry as both an incentive and protection for users, encouraging safe fund migration, and is also seen as a market strategy against competitors.

In response to the online public opinion storm, MyStonks stated that they deeply regret the recent attempts to smear the platform's safety under the guise of compliance risk control and spread negative information, and that this is a necessary path for a new asset trading platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。