The characteristics of this round of price increase are the parallelism of institutionalization and fundamental drivers, differing from previous trends dominated by retail speculation. The overall capital structure is more robust compared to the last bull market, and the market's willingness to allocate mainstream assets for the medium to long term has significantly increased.

1. Why has the "coin-stock" concept suddenly become popular?

1.1 Overall liquidity in the crypto market has worsened

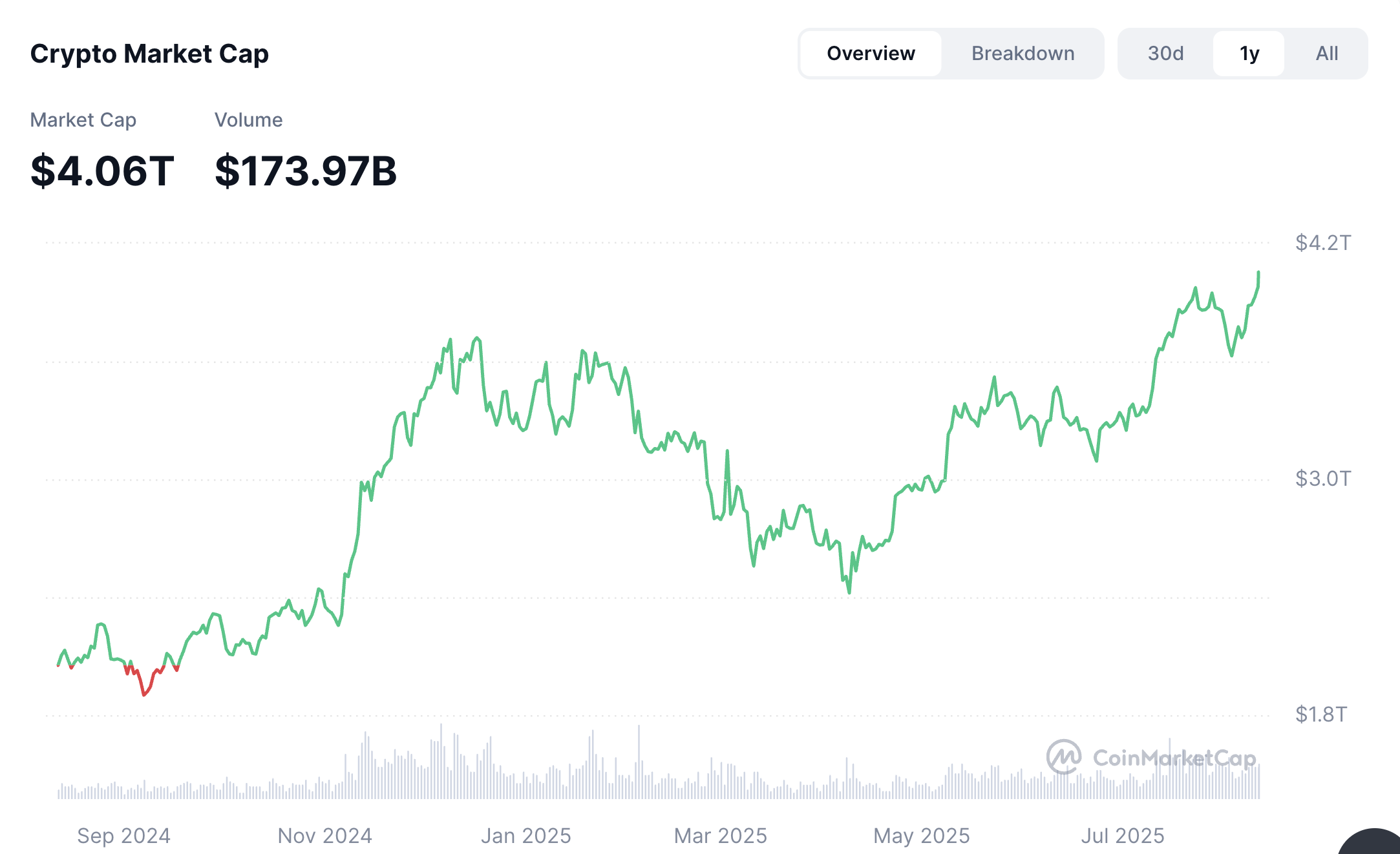

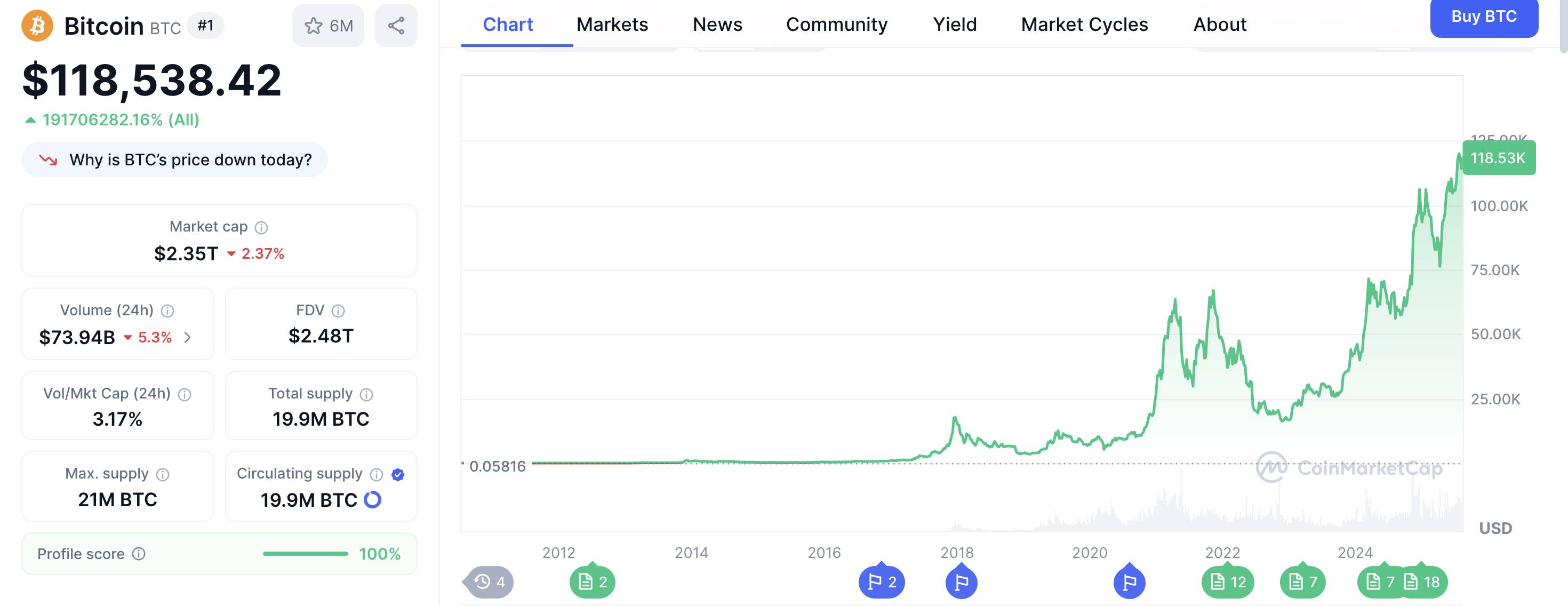

According to CoinMarketCap data, from November to December 2024, the crypto asset market entered a significant upward cycle. The total market capitalization rose from $2.26 trillion to $3.72 trillion, with an average daily trading volume maintained at around $250 billion, significantly increasing market activity and exhibiting typical "bull market" characteristics.

However, starting from late January 2025, due to multiple overlapping factors, market sentiment began to shift:

Macroeconomic factors: Uncertainty from U.S. tariff policies suppressed risk appetite;

Capital diversion: Celebrity tokens such as "Trump Coin," "Melania Meme," and the Argentine presidential-themed token Libra attracted significant capital and trading attention in a short period;

Liquidity consumption and risk events: Subsequently, these tokens experienced severe price volatility and even crashes (Libra), leading to some capital fleeing and weakening market confidence in emerging projects.

Against this backdrop, on-chain activity and market sentiment gradually cooled, and the crypto market entered an adjustment phase, with both total market capitalization and trading volume declining.

By May 2025, market sentiment reached a turning point. On one hand, U.S. inflation data had been below expectations for two consecutive months, increasing the market's pricing of the probability of the Federal Reserve cutting interest rates within the year; on the other hand, the negative impact of tariff policies that had raised market concerns at the beginning of the year gradually faded, with some trade and macro expectations recovering, leading to a warming of risk appetite. Additionally, several compliant channels (including ETFs, pension plans, and compliant custody platforms) gradually opened up mainstream crypto asset allocation permissions, driving incremental capital inflow. During this phase, "coin-stock" assets (such as ETH and some tokens with on-chain cash flow) became key targets for capital allocation, with average daily trading volume significantly rebounding.

By August 2025, the total market capitalization of the crypto market surpassed $4.0 trillion, reaching a historic high. The characteristics of this round of price increase are the parallelism of institutionalization and fundamental drivers, differing from previous trends dominated by retail speculation. The overall capital structure is more robust compared to the last bull market, and the market's willingness to allocate mainstream assets for the medium to long term has significantly increased.

VC funding slows down, crypto projects must seek alternative paths, highlighting the limitations of traditional financing methods

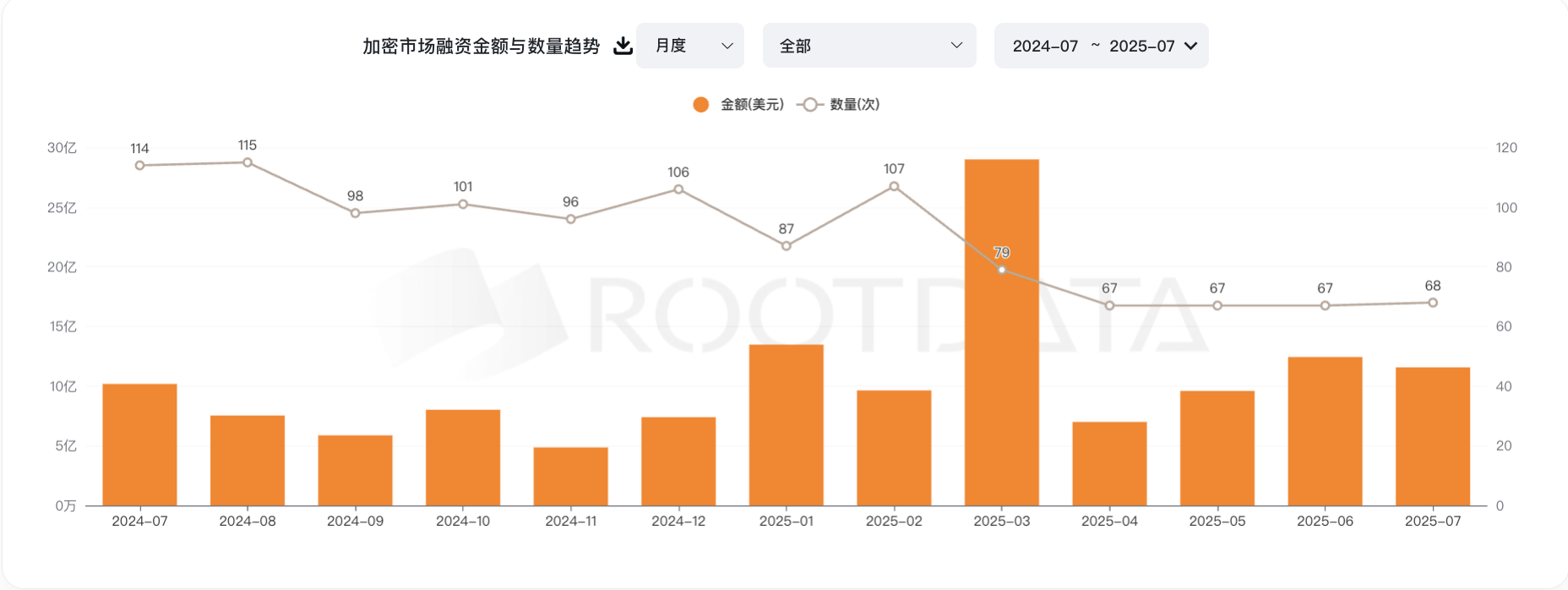

From July 2024 to July 2025, financing activities in the crypto market noticeably cooled. According to RootData, the number of project financing deals decreased from 114 in July 2024 to a low of 67 in April 2025, indicating a continued contraction in venture capital (VC) investment willingness for new projects.

In the context of slowing financing, some projects opted to quickly obtain funds by launching tokens first and then gradually releasing chips, a strategy known as the "VC coin" model. A typical operation is to launch on Binance Alpha, attracting users through airdrops to achieve rapid entry into large exchanges. However, this model has exposed significant drawbacks in the current market environment. For example, projects like PRAI and XTER, despite receiving support from well-known institutions, saw their tokens quickly fall below the cost price for investors after listing. The fundamental reason lies in the high fully diluted valuation (FDV) and low circulation ratio, leading to artificially inflated initial prices, while the release of tokens during the unlocking period and insufficient liquidity put downward pressure on prices.

This phenomenon not only weakened VC confidence in crypto projects but also had a negative impact on retail investor psychology. For institutions, projects showed paper losses immediately upon listing; for retail investors, "VC coins" became synonymous with "unlocking means selling," leading to a decrease in willingness to take over, creating a vicious cycle. From the chart data, the number of financing deals dropped sharply from 107 to 67 between February and April 2025, coinciding with a concentrated outbreak of "VC coin" price crashes during that period.

In summary, the slowdown in VC funding and the phenomenon of "VC coin" price crashes are different manifestations of the same structural market issue. On one hand, a sluggish macro environment and market sentiment prompt institutional funds to be more cautious; on the other hand, the token issuance model characterized by high valuations, low circulation, and short-term cashing out loses its appeal when the market cools. If future financing and token issuance mechanisms do not innovate and break through, the price performance of "VC coins" is unlikely to improve, continuing to constrain the recovery of market confidence.

Therefore, in the face of tightening financing environments and price volatility of tokens, many VCs, in pursuit of more stable and sustainable returns, have begun to establish companies through methods such as "reverse mergers" in regions with relatively loose market regulations, directly purchasing and holding cryptocurrencies as asset reserves. This model not only avoids the price volatility risks associated with traditional token issuance but also provides institutions with compliant and long-term investment channels. This is the background and source of the emergence of "coin-stock companies."

1.2 "Compliance"

The re-election of U.S. President Donald Trump in 2024 marked the beginning of a new phase in the regulatory environment for crypto assets in the U.S. After taking office in early 2025, the new chairman of the U.S. Securities and Exchange Commission (SEC), Paul S. Atkins, quickly implemented a series of crypto-friendly policies, clearly distinguishing that most crypto assets do not fall under the category of securities and promoting the establishment of a dedicated regulatory framework for digital assets. This shift greatly boosted market confidence and facilitated the compliance process in the crypto industry.

Against this backdrop, in July 2025, Congress passed and President Trump signed the GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act), the first federal legislation in the U.S. targeting payment stablecoins, establishing a clear regulatory system for the issuance and operation of stablecoins. The act stipulates:

• Reserve assets must strictly maintain a 1:1 ratio, and stablecoin issuers must hold U.S. dollars or highly liquid U.S. Treasury bonds as reserves to ensure the redemption capability and stability of stablecoins.

• Transparency and audit requirements are strengthened, requiring issuers to regularly disclose their financial status to regulatory agencies and undergo independent audits to ensure the authenticity and adequacy of fund reserves.

• Anti-money laundering and sanctions compliance responsibilities are clarified, requiring stablecoin issuing institutions to establish comprehensive anti-money laundering (AML) and customer identification (KYC) mechanisms to prevent illegal fund flows.

Additionally, the U.S. Treasury has recognized Bitcoin (BTC) as a national strategic reserve asset, allowing federal agencies to include Bitcoin in their foreign exchange reserve portfolios, which not only highlights Bitcoin's status as digital gold but also provides authoritative endorsement for the entire digital asset market.

The clarity and looseness of the regulatory environment have led more traditional financial institutions to actively engage in the crypto asset field, willing to hold and trade digital currencies through compliant channels, avoiding the high risks previously associated with regulatory uncertainty. This policy direction is driving crypto assets from the marginal "gray area" toward becoming a mainstream financial asset class, becoming an important component of institutional investors' asset allocation.

1.3 Circle's IPO and Coinbase's inclusion in the S&P 500 have led more financial institutions to correctly "view" the investment attributes of cryptocurrencies

Driven by this compliance environment, in June 2025, Circle successfully completed its initial public offering (IPO), raising over $1.1 billion, with its stock price soaring 168% on the first day of trading, reaching a market capitalization close to $20 billion, making it one of the largest IPOs in the digital asset space in recent years. This not only reflects the market's high recognition of compliant stablecoin issuers but also demonstrates investors' confidence in the long-term value of crypto assets as an emerging asset class. Circle's successful IPO broke the barriers for the crypto industry to enter traditional capital markets, becoming a key milestone for the industry to move toward the mainstream financial system, validating the feasibility of the compliance path and the sustainability of the business model.

At the same time, Coinbase officially became the first crypto-native company to be included in the S&P 500 index in May 2025. This historic breakthrough not only won broad legitimacy for the entire crypto industry but also significantly enhanced institutional investors' recognition of crypto assets. With Coinbase's inclusion in mainstream indices, more pension funds, insurance companies, and asset management institutions began to incorporate crypto assets into their standard investment portfolios, promoting diversification and stability in capital structures.

This not only brought significant scale effects but also prompted more crypto companies to strengthen compliance efforts, improve governance standards and transparency to meet the strict requirements of institutional investors, driving the standardized development of the entire industry.

From the perspective of capital flow, the success of Circle and Coinbase has triggered a new wave of institutional capital inflow. Data shows that in the second quarter of 2025, institutional investors' allocation in compliant crypto assets grew by over 40% year-on-year. In particular, the demand for holding digital assets through publicly listed companies or regulated entities has significantly increased, effectively reducing traditional investors' concerns about price volatility and regulatory risks.

Moreover, the compliant holding model helps institutions avoid the common price volatility risks associated with token issuance, achieving stable asset appreciation and enhancing overall market liquidity and resilience.

Overall, the success of Circle and Coinbase not only brought recognition from the capital markets to the crypto industry but, more importantly, set a benchmark for compliant development in the industry, inspiring broad imagination and firm confidence in the future of digital assets.

2. Financing channels for "coin-stocks"

1. PIPE (Private Investment in Public Equity)

Operational Logic

○ Public companies issue stocks or convertible bonds to specific institutional investors at a discount price, quickly raising funds to buy large amounts of cryptocurrencies.

○ PIPE funds are injected quickly, allowing the company to rapidly build positions and create a signal of "institutional entry," driving up stock prices.

○ Investment institutions enjoy discounted prices and priority, while retail investors follow in at higher price levels.

Advantages

○ Fast financing speed, high flexibility.

○ Institutional endorsement increases market confidence, narrative marketing drives stock price increases.

○ Simple structure, suitable for rapid momentum building.

2. SPAC (Special Purpose Acquisition Company)

Operational Logic

○ Establish a shell company, raise funds, and then purchase crypto projects, quickly going public while bypassing traditional IPO processes.

○ Use SPAC along with PIPE, convertible bonds, and other tools to raise funds for purchasing cryptocurrencies, creating a "coin-based" balance sheet.

○ Leverage the public company status to attract institutional buying from ETFs, hedge funds, etc., enhancing liquidity.

Advantages

○ Fast listing speed (4-6 months), diverse financing channels.

○ Founding teams retain more control and equity.

○ Stocks are more easily accepted by mainstream trading platforms, enhancing legitimacy and investor confidence.

3. ATM (At-the-Market Offering)

Operational Logic

○ The company sells shares periodically and in phases based on market prices, raising cash to purchase cryptocurrencies.

○ There is no fixed price or time point, and issuance can occur at any time.

○ Provides flexible cash flow support for the company, allowing for quick accumulation or replenishment of funds.

Advantages

○ High flexibility, low financing threshold.

○ Does not rely on specific institutions, can respond to market dynamics in real-time.

○ Facilitates the continuous construction of a coin-based balance sheet.

4. Convertible Bonds

Operational Logic

○ Companies issue bonds that come with the right to convert into stocks.

○ Investors enjoy fixed interest on the bonds and can convert to equity for profit when stock prices rise.

○ Companies can raise funds to buy coins at a lower financing cost while delaying dilution.

○ When the stock price reaches the conversion price, the bonds convert into stocks, releasing selling pressure.

Advantages

○ Low financing cost, reduces immediate dilution.

○ Attracts institutional investors due to debt protection and equity potential.

○ Supports companies in quickly expanding their cryptocurrency holdings.

2.1 Driving Forces Behind the Surge of Coin-Stock Companies

The rapid increase in the number of coin-stock companies is primarily driven by the following factors:

• Stabilization of regulations and improvement of compliance frameworks: Crypto assets are gradually gaining policy recognition, with clear legal definitions, leading institutions to enter the market through compliant channels, making the coin-stock company model a mainstream choice.

• Tightening of market financing channels: Traditional token issuance and VC financing have cooled, prompting projects to seek more robust and compliant funding methods, with reverse mergers and direct reserves becoming alternatives.

• Changes in investor demand: Institutions and high-net-worth investors prefer to hold crypto assets through publicly listed companies to avoid regulatory and market volatility risks associated with direct holdings.

• Demonstration effect of successful cases: The successful experiences of pioneers like MicroStrategy, Circle, and Coinbase encourage more companies to adopt the coin-stock model, driving rapid industry development.

In summary, coin-stock companies are becoming an important development trend in the industry, serving as a bridge between traditional capital markets and the crypto asset market, leveraging advantages such as legality, compliance, efficient financing, and diversified asset allocation.

3. Introduction to "Coin-Stock" Cases

3.1 The Most Successful Case — MSTR

1. Background and Strategic Choice

The pandemic in 2020 triggered a global liquidity crisis, and monetary easing policies in various countries exacerbated inflation risks. Michael Saylor believed Bitcoin was the best alternative store of value to fiat currency, prompting MicroStrategy (MSTR) to shift its company funds and financing capabilities towards large-scale Bitcoin purchases. Unlike traditional ETFs/ETPs that only track prices, MSTR directly holds coins, bearing the risk of price volatility while enjoying the benefits of price increases.

2. Sources of Funds and Coin Purchase Journey

MSTR's four major financing methods for purchasing coins:

- Own Funds

In the initial investments, MicroStrategy used idle funds on its balance sheet for purchases.

○ In August 2020, MicroStrategy spent $250 million to buy 21,400 Bitcoins.

○ In September, it invested $175 million to purchase 16,796 Bitcoins.

○ In December, it invested $50 million to buy 2,574 Bitcoins.

○ Subsequently, from 2022 to 2024, it occasionally used its own funds to buy coins.

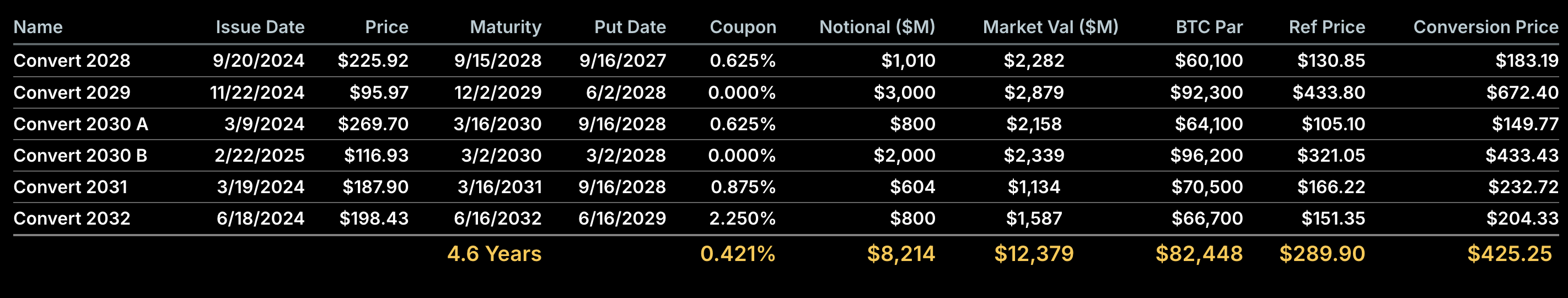

- Convertible Preferred Bonds (low interest or even zero interest, betting on MSTR's stock price increase)

Convertible preferred bonds are a financial instrument that allows investors to convert bonds into company stock under specific conditions.

These bonds typically have low or even zero interest rates, with a conversion price set above the current stock price. Investors are willing to purchase such bonds mainly because they provide downside protection (i.e., the principal and interest can be recovered at maturity) and potential gains when stock prices rise.

The interest rates on several issues of convertible bonds issued by MicroStrategy ranged from 0% to 0.75%, indicating that investors are confident in MSTR's stock price increase, hoping to convert the bonds into stocks for greater returns.

- Secured Preferred Bonds (collateralized, fixed income, prepaid)

In addition to convertible preferred bonds, MicroStrategy also issued a $489 million secured preferred bond with a 6.125% interest rate maturing in 2028.

Secured preferred bonds are collateralized bonds with lower risk than convertible preferred bonds, but they only offer fixed interest income. The batch of secured preferred bonds issued by MicroStrategy has already chosen to be prepaid.

- At-the-Market Stock Issuance (ATM) (flexible, no debt pressure, but dilutes equity)

MicroStrategy has signed public market sales agreements with agents such as Jefferies, Cowen and Company LLC, and BTIG LLC. According to these agreements, MicroStrategy can periodically issue and sell Class A common stock through these agents.

At-the-market stock issuance is more flexible, allowing MicroStrategy to choose the timing of new stock sales based on secondary market conditions. While issuing stock dilutes existing shareholders' equity, the correlation with Bitcoin prices and the increase in the amount of Bitcoin per share of MSTR lead to complex market reactions, resulting in a relatively high volatility in MSTR's stock price.

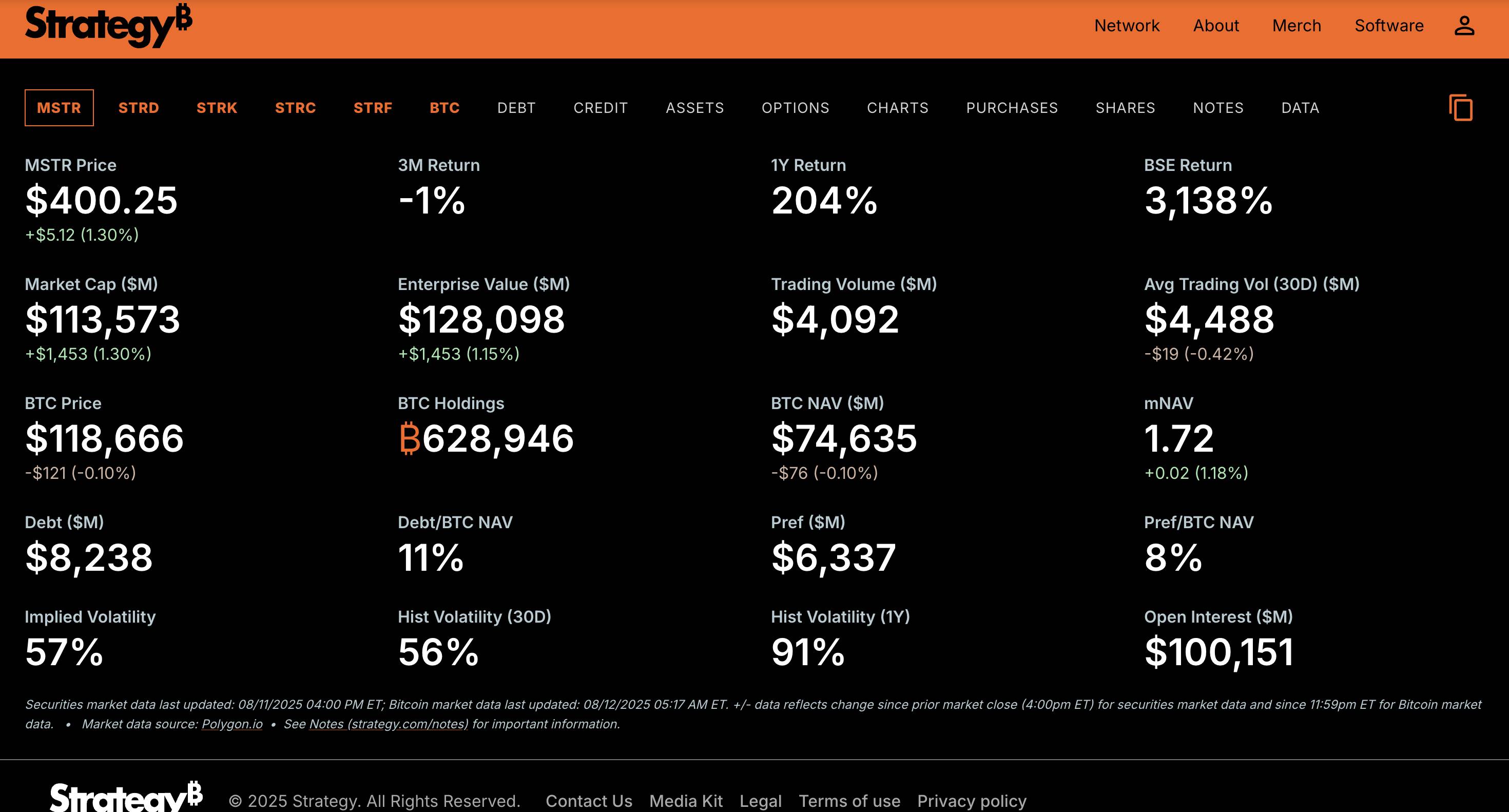

By August 2025, MSTR had cumulatively purchased 628,946 Bitcoins through the above four methods, with a total market value of $74.635 billion at current prices.

3. Stock Price Performance and Resilience (Core Advantage)

- Amplified Upside

○ During the period from 2024 to 2025, when BTC prices rose approximately 166% (from $45,000 to $120,000), MSTR's stock price increased over 471% (from $70 to $400).

○ Reason: The market not only valued it based on BTC prices but also paid a premium for its financing capabilities and expectations of additional coin purchases.

- Strong Resilience

○ During the phase when BTC adjusted by 28% (from $106,000 on January 22, 2025, to $76,000 on April 9, 2025), MSTR's stock price fell by 15% (from $353 to $300), mainly because:

▪ Some shareholders held shares for their equity attributes and would not immediately sell due to short-term BTC fluctuations.

▪ The market expected MSTR to continue buying at lower prices, forming "buying support during declines."

- Historical Advantage

○ As the first company to use publicly listed company funds to purchase BTC on a large scale, MSTR has established a first-mover brand in terms of media exposure and investor recognition. Although ETFs/ETPs have low fees, they lack the dual drivers of "operational expectations + asset appreciation."

3.2 Core Buyers Driving the Recent Ethereum Surge — BMNR, SBET

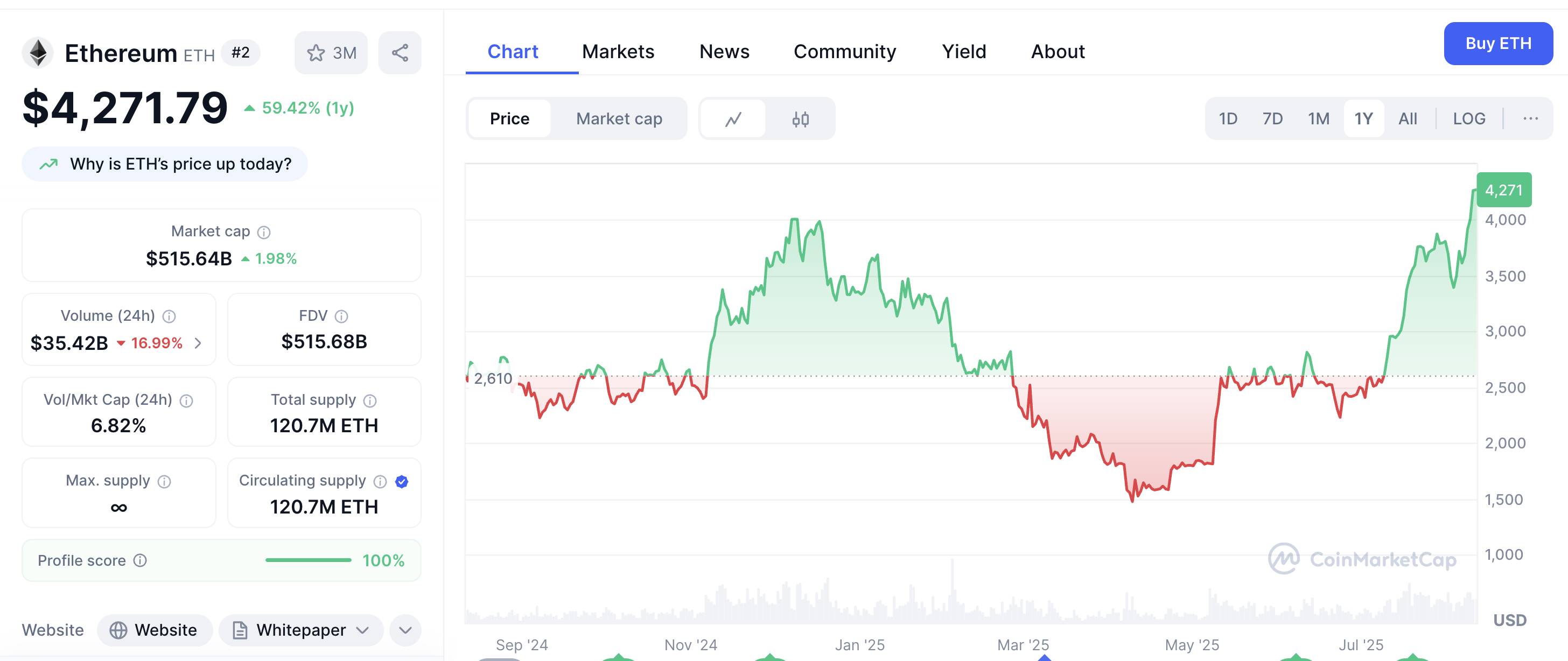

In this cycle, the strongest performing asset is undoubtedly Ethereum. As of August 11, the price of Ethereum has soared from a low of $1,472 in April to $4,271, an increase of nearly 190%. Unlike previous cycles driven by retail sentiment, the dominant force in this round comes from concentrated accumulation by financial institutions such as Wall Street.

First, since May, there has been a continuous net inflow of funds into U.S. Ethereum spot ETFs, and the scale is constantly increasing.

Second, a number of publicly listed companies have begun to include Ethereum in their strategic treasury reserves, purchasing ETH through equity financing and leveraging the appreciation effect of crypto assets to boost company valuations, forming a positive cycle of "stock price — financing capability — holding amount." These "coin-stocks" not only directly participate in on-chain value capture but also enjoy a broader investor base and compliance advantages in the secondary market, becoming one of the core narratives of the new round of crypto capital stories.

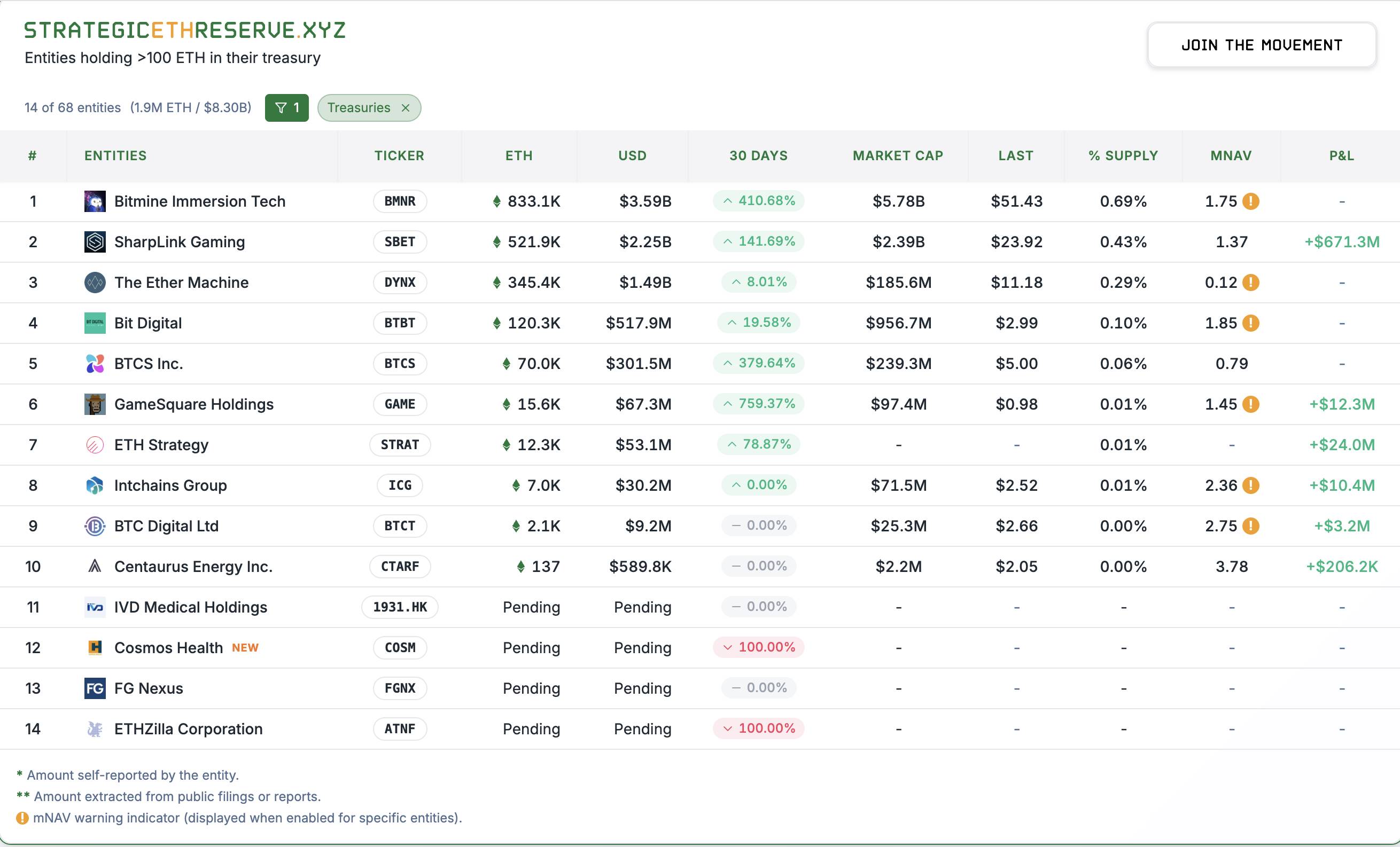

According to data from the Strategic ETH Reserve website, more than 10 publicly listed companies have currently announced their Ethereum strategic reserves, with a total purchase amount exceeding 1.928 million coins. Based on the current price of Ethereum, the total holding scale exceeds $8.2 billion, accounting for 1.6% of Ethereum's circulating supply. Among them, two companies that require special attention are Bitmine (BMNR) and SharpLink (SBET).

BMNR:

- Former Name and Renaming

The company was originally named Sandy Springs Holdings, Inc. It changed its name and trading code to BMNR in March 2022 to reflect its focus on "immersive cooling" technology for mining machine hosting and mining business.

- Main Business

– Hosting Services: Provides third-party mining companies with proprietary immersive cooling-based data center hosting, power supply, racking, thermal management, and security services;

– Self-Mining: Utilizes hosted mining machines for self-operated Bitcoin mining;

– Equipment Sales and Software: Sells mining equipment and provides infrastructure management and custom firmware software.

- Key Figure: TOM Lee

Known as the "Wall Street Oracle," he has gained widespread attention for his accurate market predictions and deep insights into technology stocks, Bitcoin, and other assets. As the founder of the analysis firm Fundstrat, he is a well-known analyst in traditional markets and a staunch supporter of digital assets like Bitcoin and Ethereum.

Lee was appointed as the chairman of the board of the mining company Bitmine and participated in the company's launch of a $250 million Ethereum treasury strategy, which has attracted significant market attention. In a recent external interview, Tom Lee boldly predicted that Ethereum would rise to $10,000 in the current market cycle.

- Financing History and Methods

Click the image to view the complete electronic spreadsheet

PIPE Private Placement Financing

○ June 30, 2025: BMNR successfully completed a PIPE private placement, issuing 55.6 million shares of common stock (priced at approximately $4.50/share), raising about $250 million. The official disclosure stated that these funds would be used to initiate the ETH treasury strategy.

ATM "At The Market" Issuance Plan Launched

○ Early July 2025: The company announced the launch of the ATM stock issuance plan, with an initial target to raise up to $2 billion, gradually issuing stock at market price in the public market through Cantor Fitzgerald and ThinkEquity as sales agents.

ATM Limit Increased to $4.5 Billion

○ July 24, 2025: BMNR submitted a supplemental filing to the SEC, raising the ATM issuance limit from the original $2 billion to $4.5 billion.

Institutional Investor Participation: ARK Invest

○ July 22, 2025: BMNR announced that ARK Invest had participated in its existing ATM plan, purchasing company stock through block trades totaling $182 million. The announcement indicated that 100% of ARK's net proceeds would be used to continue buying ETH. PR Newswire Stock Titan

ETH Reserve Progress

○ August 4, 2025: The company disclosed that it had held over 833,137 ETH as of that date, valued at approximately $2.9 billion, making it one of the largest publicly listed companies by cryptocurrency holdings.

- Investors

- Current ETH Holdings and Stock Price Performance

According to the latest official disclosure data, BMNR currently holds a total of 1.15 million ETH, with a total value of $5.29 billion at current prices, and the company's current market capitalization is $6.444 billion.

BMNR's stock price, which had dropped to a relative low of $30 on August 1, has risen to $62 in just two weeks, achieving a doubling.

SBET:

- Company Background and Transformation Reasons

• SharpLink was originally established in 1995 as MER Telemanagement Solutions, focusing on traditional telecommunications. In 2019, it shifted to sports betting, but faced a significant revenue decline and delisting risks in 2024.

• In May 2025, it announced a $425 million PIPE financing, with Ethereum (ETH) as the primary treasury reserve asset, completing its transformation.

- Timeline and Actions of the ETH Treasury Strategy

• On May 20, SharpLink conducted a round of stock issuance, raising $4.5 million at a price of $2.94 per share. The official statement indicated that these funds would be used to "restore compliance with Nasdaq's minimum shareholder equity requirements." This round of funding was solely invested by Consensys, indicating the latter's long-term layout for Ethereum reserve companies.

• On May 27, SharpLink Gaming announced its Ethereum treasury reserve strategy, planning to raise $425 million to increase its Ethereum holdings.

• Subsequently, SBET conducted multiple ATM (public market issuance) rounds, raising approximately $1 billion in cash for ETH purchases.

• On July 24, SharpLink held a shareholder meeting to issue additional stock to raise $5 billion for ETH purchases.

- Key Figure: Joseph Lubin

Co-founder of Ethereum and a leading figure in the blockchain industry, he is also the founder and CEO of the blockchain development company ConsenSys. Lubin graduated from Princeton University with a degree in Electrical Engineering and Computer Science and has worked at institutions like Goldman Sachs, possessing a strong technical and financial background. He has long been committed to promoting decentralized applications and blockchain infrastructure development, being one of the key founders of the Ethereum ecosystem.

Currently serving as the CEO of SharpLink Gaming, he leads SBET in raising funds through stock issuance to purchase and stake ETH, and has proposed a vision to "tokenize" the company's stock on-chain in the future, aiming to enhance the integration of capital markets and the blockchain world.

- Financing History and Methods

SharpLink's initial $425 million fundraising was conducted through PIPE (private placement), followed by multiple ATM rounds to sell stock for fundraising. According to Lubin's latest interview, there may be considerations for issuing convertible bonds for future fundraising.

- Investors

In the PIPE financing, Consensys Software Inc. served as the lead investor for this issuance. Participating institutions also include several well-known crypto venture capital and infrastructure firms, such as:

• ParaFi Capital

• Electric Capital

• Pantera Capital

• Arrington Capital

• Galaxy Digital

• Ondo

• White Star Capital

• GSR

• Hivemind Capital

• Hypersphere

• Primitive Ventures

• Republic Digital

- Current ETH Holdings and Stock Price Performance

According to the latest official disclosure data, SBET currently holds 600,000 ETH, with a total value of $2.76 billion at current prices, and the company's current market capitalization is $3.13 billion.

After experiencing a sell-off triggered by "ATM dilution," SBET's stock price has risen from a low of $17 on August 1 to the current $24, an increase of over 40%.

3.3 Reserves of Small-Cap Companies

ENA — StablecoinX

- Listing Background and Transformation

○ StablecoinX began with $230 million raised through an IPO by the Nasdaq SPAC company TLGY Acquisition Corp. (TLGYF), originally planned to merge with Verde Bioresins, which did not materialize.

○ In June 2024, it was taken over by the Carnegie Park Capital team, shifting its focus to the Ethena ecosystem.

- Core Team

○ Jin-Goon Kim (Chairman of TLGYF), a financial and public company transformation expert.

○ Young Cho (CEO of StablecoinX), experienced in crypto and SPAC mergers.

○ Edward Chen (Founder of CPC), a senior SPAC investment strategy expert.

- PIPE Financing Structure

○ Total scale of approximately $360 million, primarily used for strategic accumulation of ENA tokens.

○ $260 million in cash to purchase 1.23 billion ENA tokens at approximately $0.21/ENA (locked).

○ Approximately $100 million in discounted ENA tokens (including $60 million from the Ethena Foundation).

○ Lead investors: Dragonfly, Ribbit Capital, Blockchain.com, Pantera, Haun Ventures, Polychain, Galaxy Digital, and others.

- Lock-up and Unlocking Arrangements

○ ENA tokens have a 48-month lock-up period.

○ 25% will be unlocked after 12 months, with the remaining 75% unlocked in equal monthly installments over 36 months.

- Equity and Governance Structure

○ PIPE investors receive Class A non-voting shares, priced at $10 per share.

○ The Ethena Foundation holds voting Class B shares, which will constitute a majority after the closing.

- de-SPAC Transaction Structure

○ TLGYF merges with its subsidiary SPAC Merger Sub, which then merges with the operating entity StablecoinX Assets Inc., ultimately forming the publicly listed entity StablecoinX Inc.

- Valuation and Market Indicators

○ PIPE issuance price is $10, with the number of shares fluctuating based on ENA token prices.

○ An estimated issuance of 101 million shares, with total share capital of approximately 104 million shares after closing.

○ Fully diluted market capitalization of approximately $1.43 billion, corresponding to the value of holding 1.7 billion ENA tokens (mNAV approximately 1×).

○ Valuation is at a discount compared to MicroStrategy (1.5×) and BitMine Immersion (1.9×).

- ENA Token Price Performance

Since July 22, the Ethena Foundation's subsidiary has repurchased 83 million ENA tokens in the public market through a third-party market maker.

Since then, the ENA token price has risen from a low of $0.25 at the end of June to the current $0.78, an increase of 212%.

ATA Creativity Global (Nasdaq: AACG)

Transaction Structure and Funding Scale

○ Signing Date: August 2, 2025

○ Investor: Baby BTC Strategic Capital (Babylon Foundation as the main LP)

○ Investment Method:

▪ New Share Subscription: $30 million

▪ Warrants: $70 million

▪ Total Investment Scale: $100 million

○ Result: Baby Capital gains control of ATA and appoints 3 directors to the board.

- Strategic Goals and Differentiation

○ Different from MSTR (accumulating BTC) and SBET (focusing on the ETH ecosystem) models.

○ Core Competitiveness:

i. Activating the BTC Ecosystem

• Deep collaboration with the Babylon project.

• Introducing Bitcoin staking into DeFi.

ii. Large-Scale Acquisition of Baby Tokens

• Baby token circulating market cap is approximately $100 million.

• ATA plans to acquire with an equivalent amount of funds, equivalent to a 100% reinvestment of the market cap, expected to significantly boost token value.

- Babylon Project Background

○ Bitcoin Layer 2 (L2) network, focusing on trustless BTC staking.

○ Founders: David Tse (Stanford Professor), Fisher Yu (former Senior Engineer at Dolby Labs).

○ Financing: Cumulative $96 million (Paradigm, Polychain, OKX Ventures, Binance Labs, etc.).

○ Mainnet: Launching in August 2024.

○ Total Staked Value: Over $5 billion as of July 2025.

○ Baby tokens are listed on major exchanges such as Binance, OKX, Bybit, KuCoin, etc.

- Future Plans for the Public Company

○ Treasury Strategy:

▪ Most funds invested in Baby tokens.

▪ A small portion of funds invested in BTC.

○ Sources of Funds:

▪ PIPE (private placement).

▪ ATM (at-the-market issuance).

▪ Convertible bonds.

○ Acquisition Strategy: Continuous market acquisition of Baby tokens & BTC.

○ Expected Effects:

▪ Drive asset value growth.

▪ Promote market capitalization increase.

▪ Build a positive feedback loop for asset appreciation and market cap enhancement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。