编译:深潮TechFlow

我们对数字资产财库公司(Digital Asset Treasury,简称 DATs)的投资理论基于一个简单的假设:

DATs 能通过产生收益来增加每股净资产价值,从而随着时间推移积累更多的代币持有量,而不仅仅是持仓现货。

因此,相较于直接持有代币或通过交易所交易基金(ETF)持有代币,投资 DATs 有可能带来更高的回报潜力。

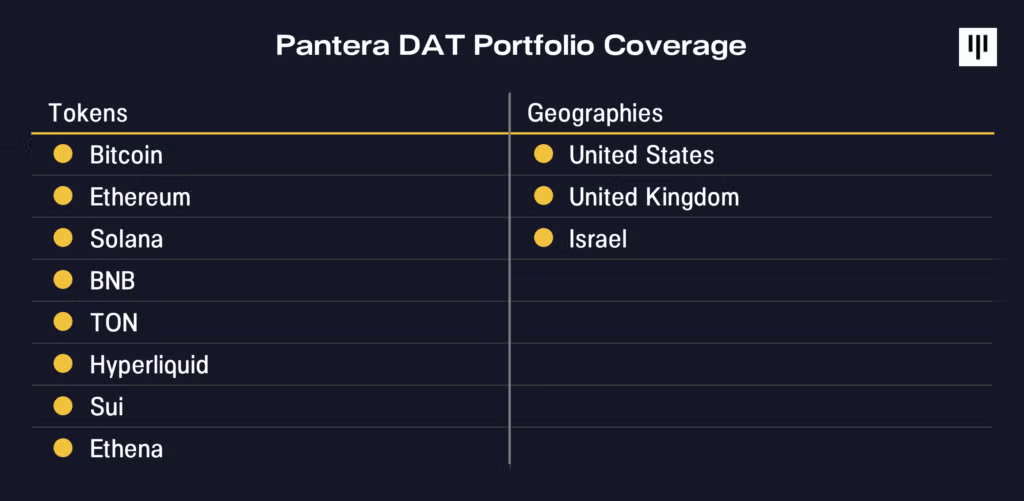

Pantera 已在不同代币和地区的数字资产财库(DATs)中投入超过 3 亿美元。这些 DATs 利用其独特优势,通过策略性操作以每股增值的方式扩大其数字资产持有量。以下是我们 DAT 投资组合覆盖的简要概览。

BitMine Immersion (BMNR) 是 Pantera DAT Fund 的首笔投资,展现了一个拥有清晰战略规划并具备执行力的公司典范。Fundstrat 的董事长 Tom Lee 阐述了 BitMine 的长期愿景——获取总 ETH 供应量的 5%,这一目标被称为“5% 的炼金术”。我们认为,通过 BMNR 的案例来解读一个高效运作的数字资产财库(DAT)如何创造价值是非常有意义的。

BitMine(BMNR)案例研究

自 BitMine 推出其资金管理策略以来,他们已成为全球最大的 ETH 资金管理机构和第三大 DAT(仅次于 Strategy 和 XXI),截至 2025 年 8 月 10 日,BMNR 持有总计 1,150,263 枚 ETH,价值达 49 亿美元。此外,BMNR 还是美国流动性排名第 25 位的股票,日均交易额达到 22 亿美元(基于截至 2025 年 8 月 8 日的五日平均交易额)。

以太坊案例

DAT 成功的最重要因素在于其基础代币的长期投资价值。BitMine 的 DAT 战略基于一个核心论点:随着华尔街向链上转移,以太坊将成为未来十年最大的宏观趋势之一。正如我们在上个月的文中所写,“伟大的链上迁移”(The Great Onchain Migration)正在进行,代币化创新和稳定币的重要性日益凸显。

目前已有 250 亿美元的现实世界资产存在于公共区块链之上——此外,还有 2600 亿美元的稳定币,这些稳定币合计已成为美国国债的第 17 大持有者。

“稳定币已经成为加密领域的 ChatGPT 故事。”

– Tom Lee,BitMine 董事长,Pantera DAT Call,2025 年 7 月 2 日

大部分这些活动都发生在以太坊(Ethereum)上,这使得 ETH 有望从不断增长的区块空间需求中受益。随着金融机构越来越多地依赖以太坊的安全性来支持其运营,它们将被激励参与以太坊的权益证明(Proof-of-Stake)网络——进一步推动对 ETH 的增持需求。

每股 ETH 数量增长(“EPS”)

在确立基础代币的投资价值后,数字资产财库(DAT)的商业模式核心在于最大化每股代币数量增长。以下是提每股代币数量增长的主要方法:

-

以代币每股净资产价值(“NAV”)溢价发行股票。

-

发行可转换债券及其他与股权挂钩的证券,以利用股票和基础代币的波动性进行变现。

-

通过质押奖励、DeFi收益及其他运营收入获取更多代币。需要注意的是,这是 ETH 和其他智能合约代币财库所独有的额外优势,早期的比特币财库(如 Strategy)并不具备这一点。

-

收购接近或低于净资产价值(NAV)交易的其他数字资产财库。

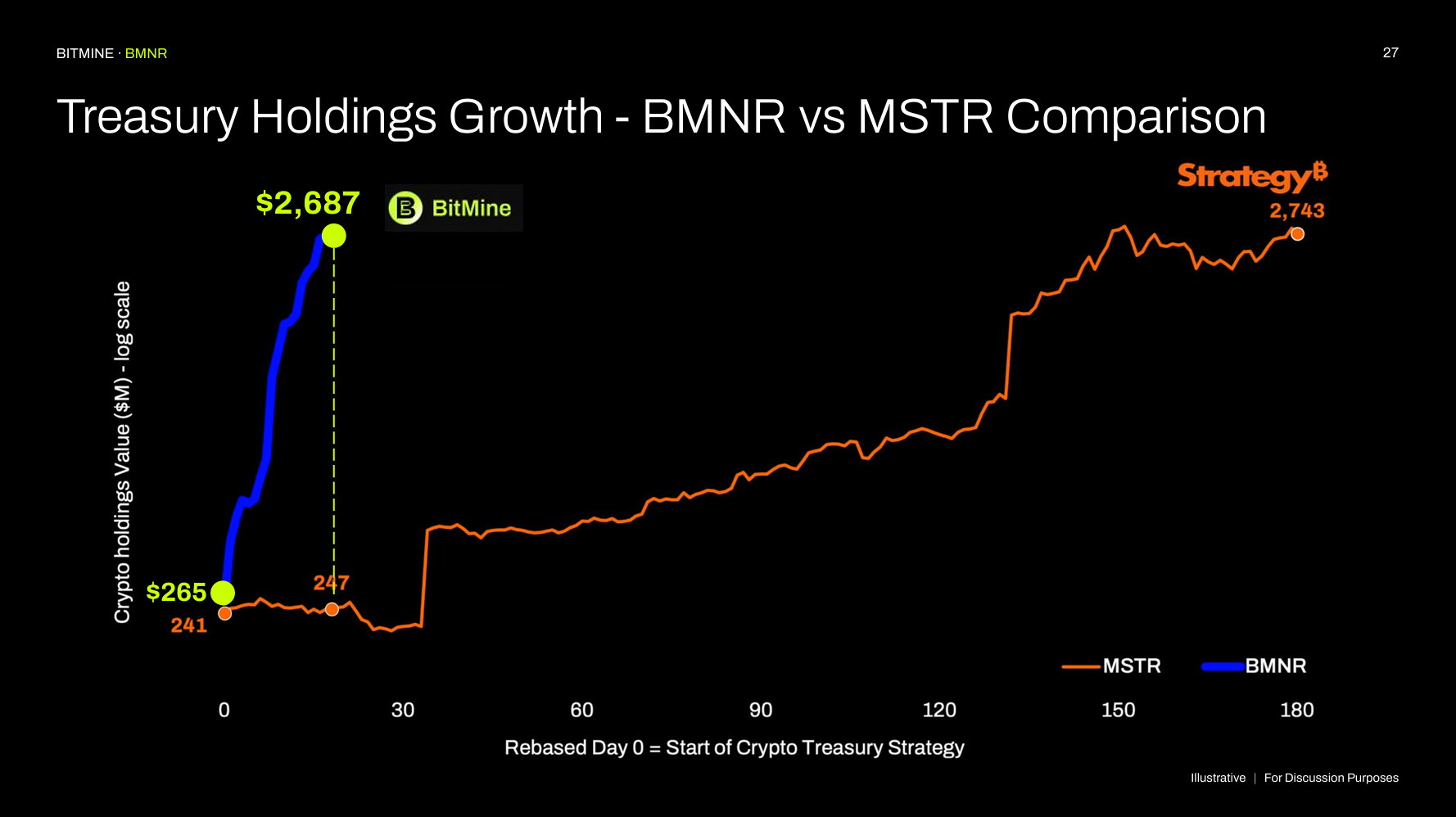

在这一方面,BitMine 自推出 ETH 财库战略以来的第一个月内,以令人瞩目的速度增长了每股 ETH 收益(巧合地是也称“EPS”。

深潮注:Earnings Per Share, EPS,指每一股普通股所获得的净利润),远超其他数字资产财库(DAT)。相比之下,BitMine 在首月积累的 ETH 数量已超过 Strategy(原 MicroStrategy)在执行类似战略的前六个月所积累的总量。

BitMine 主要通过发行股票和生成质押奖励来增加每股数量,我们预计 BitMine 很可能会在不久的将来扩展其工具菜单,发行可转换债务及其他金融工具。

来源:BitMine 公司展示,2025年7月27日

价值创造行动

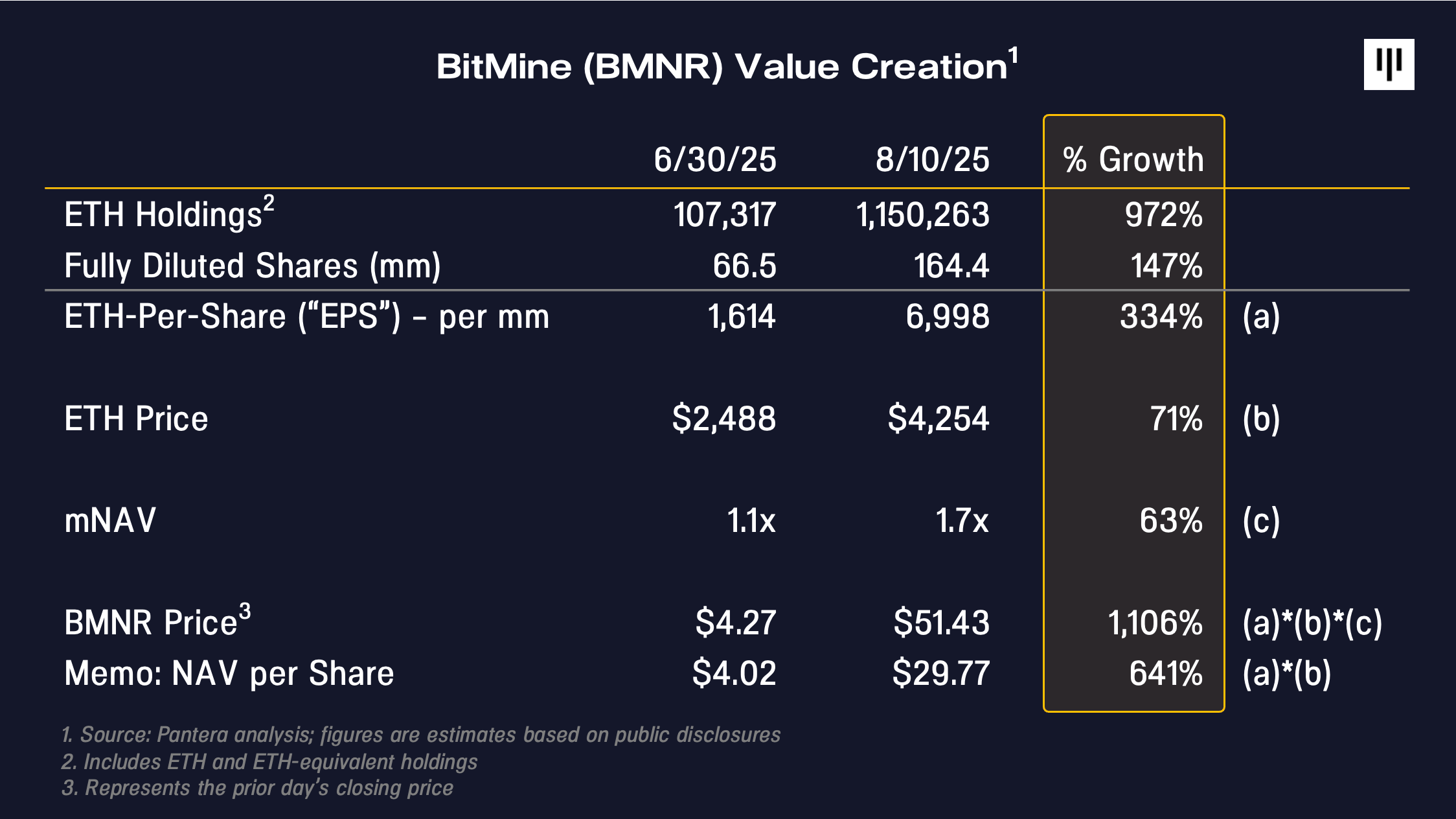

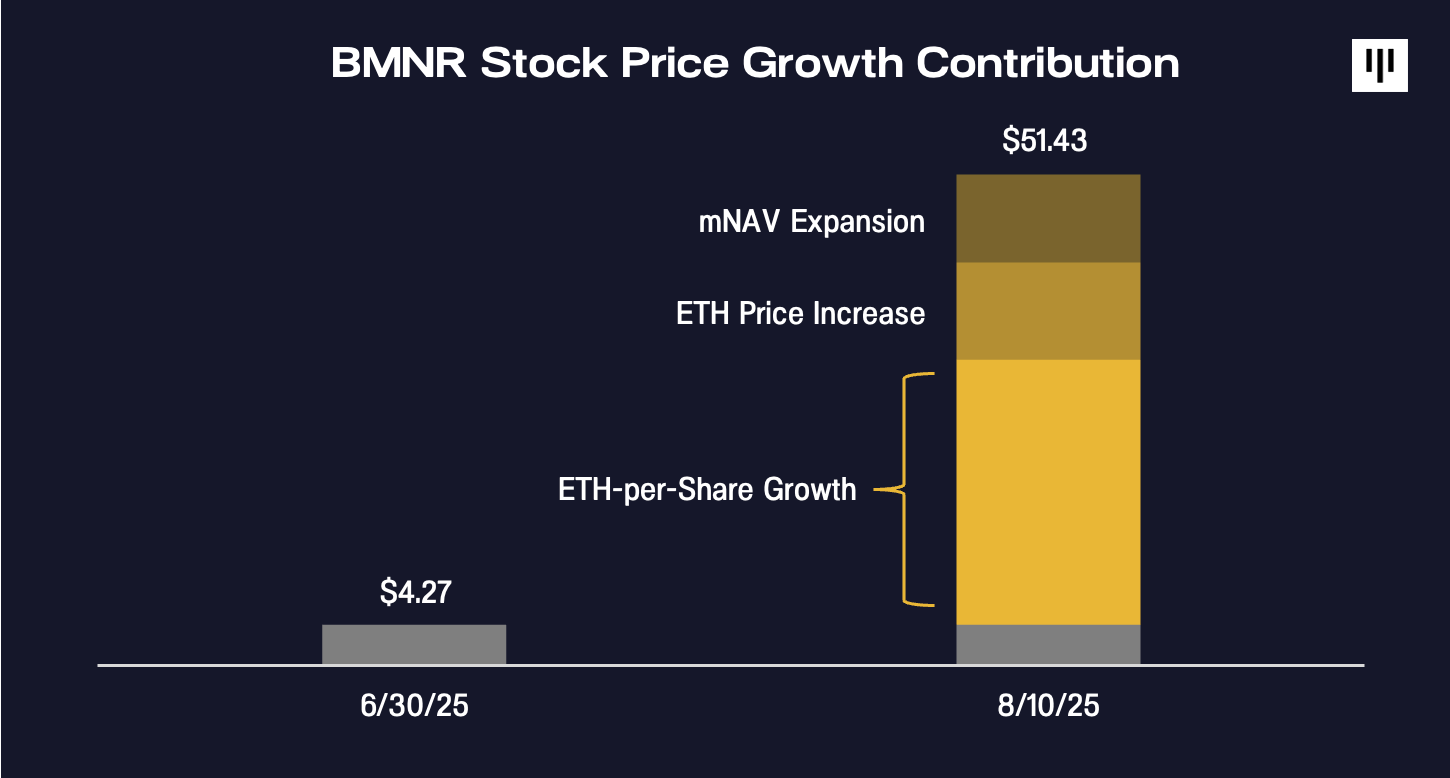

数字资产财库(DAT)的价格可以分解为以下三部分的乘积:(a)每股代币数量,(b)基础代币价格,以及(c) 净资产价值倍数(“mNAV”)。

截至 6 月底,BMNR 的股价为每股 4.27 美元,大约是其初始 DAT 融资后每股净资产价值(NAV)4 美元的 1.1 倍。仅仅一个多月后,该股收盘价达到 51 美元,约为其估算每股净资产价值(NAV)30 美元的 1.7 倍。

这意味着股价在一个多月内上涨了 1,100%,其中:(a) 每股代币数量(EPS)增长约 330%,贡献了约 60% 的涨幅;(b) ETH 价格从 2,500 美元上涨至 4,300 美元,贡献了约 20% 的涨幅;(c) mNAV 扩展至 1.7 倍,贡献了约 20% 的涨幅。

这意味着,BMNR 股价的大幅上涨主要由其每股 ETH 数量(EPS)的增长推动。这是管理层可控的核心驱动因素,也是数字资产财库(DAT)与单纯持有现货的根本区别所在。

我们尚未深入探讨的第三个因素是净资产价值倍数(mNAV)。自然,有人可能会问:为什么有人会以溢价购买数字资产财库(DAT)的净资产价值(NAV)?

在这里,可以将其类比为基于资产负债表的金融业务,包括银行。银行通过资产生成收益,而投资者会给予那些能够持续创造超过资本成本收益的银行估值溢价。例如,质量最高的银行通常以高于净资产价值(NAV)或账面价值的溢价交易,比如摩根大通(JPM)超过 2 倍的估值。

同样地,如果投资者相信某个 DAT 能够持续增长每股净资产价值(NAV),他们可能会愿意以溢价估值该 DAT。我们认为,BMNR 每股净资产价值(NAV)月度增长约 640% 足以证明其 mNAV 溢价的合理性。

BitMine 能否持续执行其战略将在时间中得到验证,并且在此过程中不可避免地会面临挑战。BitMine 的管理团队及其迄今为止的表现已吸引了传统金融领域的重量级支持者,包括Stan Druckenmiller、Bill Miller 以及 ARK Invest。我们预计,最高质量 DAT 的增长故事将像 Strategy 一样,受到更多机构投资者的青睐。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。