Written by: KarenZ, Foresight News

Financial technology giant Stripe is accelerating its layout in the stablecoin and payment sectors.

A now-removed job posting revealed its secret collaboration with crypto venture capital firm Paradigm — the two are jointly building a high-performance payment-specific blockchain called Tempo.

This move is a key step in Stripe's ongoing strategy in the stablecoin space, reflecting its ambition to reshape the global payment system and even the financial landscape.

Tempo: A Layer1 Blockchain Focused on Payments

According to a recently archived product marketing job posting on the website of Fortune magazine and the cryptocurrency lobbying group Blockchain Association (now removed), Tempo is positioned as a "high-performance, payment-focused Layer1 blockchain" and is currently in a confidential phase. The team currently consists of 5 members and is recruiting its first product marketing personnel.

The position requires candidates to be familiar with the fintech/payment or cryptocurrency sectors, and "must have marketing experience targeting Fortune 500 companies," indicating that its target customer base is large enterprises.

According to Fortune, citing four informed sources, Tempo is a Layer1 blockchain that uses a programming language compatible with Ethereum.

This technical choice ensures independence while leveraging the mature developer resources of the Ethereum ecosystem to lower application barriers.

Notably, Matt Huang, co-founder of Paradigm, is a member of Stripe's board and was involved in the early investment in the crypto wallet company Privy, which Stripe acquired. Paradigm led Privy's $18 million Series A funding round in November 2023, at which time Matt Huang also joined Privy's board. In March 2025, Privy announced the completion of a $15 million funding round led by Ribbit Capital, with participation from Sequoia Capital, Paradigm, and Coinbase. This deep binding laid the foundation for the collaboration between Paradigm and Stripe.

In fact, in February of this year, Matt Huang stated that Paradigm was in discussions with some of the world's largest companies to help them formulate stablecoin strategies, such as faster global expansion or easier fund custody.

From Acquisitions and Collaborations to In-House Development: Stripe's Evolving Stablecoin Strategy

The development of Tempo is a continuation of Stripe's stablecoin strategy. From acquiring infrastructure to developing underlying technology, its layout logic is clear and progressive.

Step One: Securing the Core of Stablecoin Infrastructure — Bridge

In October 2024, Stripe acquired the stablecoin infrastructure company Bridge for $1.1 billion, marking its largest acquisition to date.

Bridge allows businesses and developers to seamlessly integrate stablecoin payments and supports the convenient transfer of fiat and stablecoins.

Bridge has attracted numerous clients, including SpaceX. For example, SpaceX uses Bridge to repatriate sales funds from Starlink in Argentina, Nigeria, and other markets. The new Mexican bank DollarApp uses Bridge to help individuals receive dollar payments from payroll service providers like Deel. Artim uses Bridge to pay employees across Latin America.

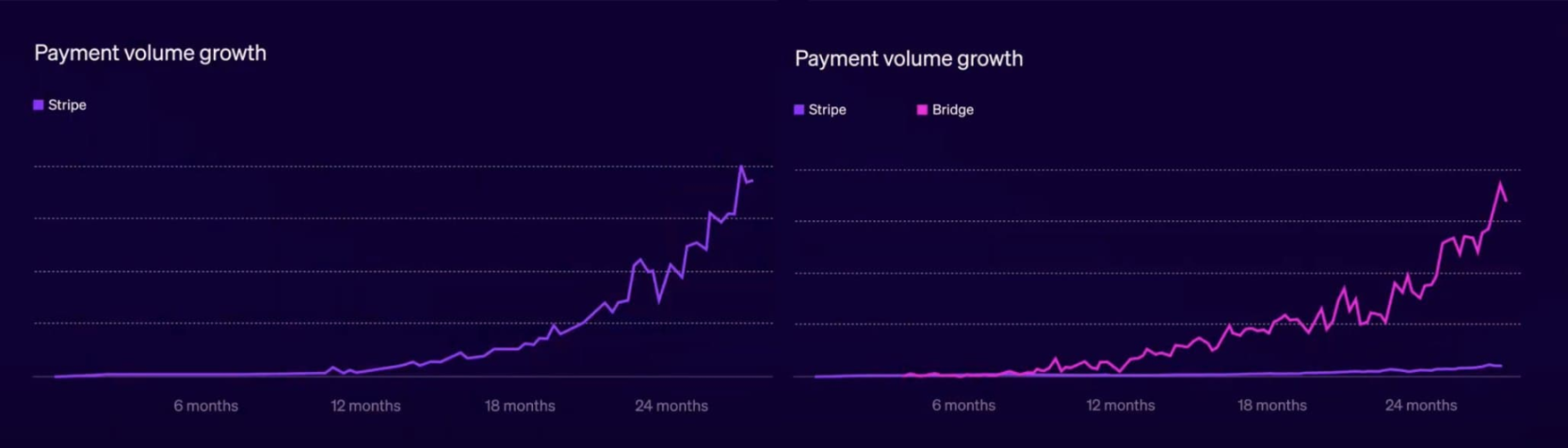

As Stripe co-founder John Collison stated at Stripe Sessions 2025 in May this year, "Stablecoins can truly enable borderless finance. By comparing the payment transaction growth in the first two years of Stripe's establishment with that of Bridge, we can see that Bridge exhibits a more significant exponential growth trend, which indirectly confirms the immense potential of stablecoins."

Step Two: Connecting Offline Payment Scenarios and Launching Stablecoin Financial Accounts

Additionally, on April 30, Stripe's Bridge partnered with Visa to launch a stablecoin issuance product, allowing developers using Bridge to programmatically issue Visa cards related to stablecoins in multiple countries/regions through a single API.

Businesses and individuals can use their stablecoin balances for everyday shopping anywhere Visa is accepted. When cardholders make purchases, Bridge deducts funds from their stablecoin balance and converts them to fiat currency, while merchants continue to receive payments in local currency.

After acquiring Bridge, Stripe officially announced the launch of stablecoin financial accounts on May 8, aimed at providing global enterprises with more efficient and convenient cross-border payment and fund management solutions.

According to Stripe's official documentation, stablecoin financial accounts allow users to hold USDC and USDB stablecoin balances and send and receive funds through stablecoins and traditional financial channels (such as ACH, SEPA, and wire transfers), meaning that funds from the stablecoin balance can be transferred to external bank accounts or crypto wallets. If the recipient is an external bank account, the received amount will be automatically converted based on the current exchange rate, greatly enhancing the convenience and flexibility of fund circulation. This service's technical support also comes from the Bridge platform acquired by Stripe.

Step Three: Completing the User Entry Point — Privy

In June 2025, Stripe also brought embedded crypto wallet developer Privy under its wing.

Privy's authentication and wallet infrastructure allow developers, project teams, or companies to register wallets for users, initiate self-custody wallets, and securely sign transactions through application security. Privy simplifies the use of cryptocurrency by embedding wallets within applications.

At its core, Privy combines Trusted Execution Environments (TEE) with distributed key sharding to provide seamless, secure, and scalable wallets.

In June of this year, data released by Privy showed that it has over 75 million accounts in more than 180 countries/regions, with a monthly transaction volume exceeding 85 million, totaling over 500 million RPC calls. Privy's clients include mainstream crypto projects such as Hyperliquid, Farcaster, Jupiter, Zora, pump.fun, and Blackbird.

Step Four: In-House Development of the Underlying Blockchain — Tempo Closed Loop

Now, the development of Tempo is an important piece of the puzzle in Stripe's stablecoin layout.

By developing its own Layer1 blockchain, Stripe can control the core processing of stablecoin transactions, forming a complete closed loop with its previous layout: Bridge focuses on stablecoin infrastructure construction and enterprise integration, responsible for enterprise stablecoin integration and issuance; Privy provides user wallet entry; stablecoin financial accounts and Visa cards connect fund circulation scenarios; Tempo handles the underlying transaction processing.

Stripe's ultimate goal is to fully control the entire process of stablecoin payments through the Tempo blockchain.

Stripe's Deep Ambition

Stripe's vast customer network provides a natural landing scenario for its stablecoin ecosystem.

According to Stripe CEO Patrick Collison and co-founder John Collison in their 2024 annual letter released in February this year, in 2024, the total payment volume on the Stripe platform reached $14 trillion, a year-on-year increase of 38%, equivalent to 1.3% of global GDP. Stripe firmly believes that technologies such as stablecoins and artificial intelligence will inevitably reshape the economic landscape. The Stripe ecosystem encompasses every dimension of the economic map, from industry giants (half of the Fortune 100 are using Stripe) to high-growth companies (80% of the Forbes Cloud 100 and 78% of the Forbes AI 50 are Stripe customers), to emerging startups (one in every six newly registered Delaware companies is registered through Stripe Atlas).

Stripe has previously stated that it is becoming the preferred platform for building stablecoin applications and is already in discussions with several top global companies to assist them in formulating stablecoin strategies, such as accelerating global expansion or simplifying fund custody.

If Stripe's stablecoin ecosystem fully takes shape, it could become a key hub for the integration of Web2 and Web3 finance, further consolidating its position in the trillion-dollar payment empire.

Stripe's ambitions extend beyond just improving payment efficiency. In its 2024 annual letter, it mentioned that stablecoins could become an "upgraded version of the Eurodollar" — just as the Eurodollar system provides offshore dollar services for non-U.S. companies, stablecoins enable global dollar circulation with lower barriers. Additionally, stablecoin issuers may also become significant buyers of U.S. Treasury bonds, further promoting the dollar's strong position.

Click to learn about job openings at ChainCatcher

Recommended Reading:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。