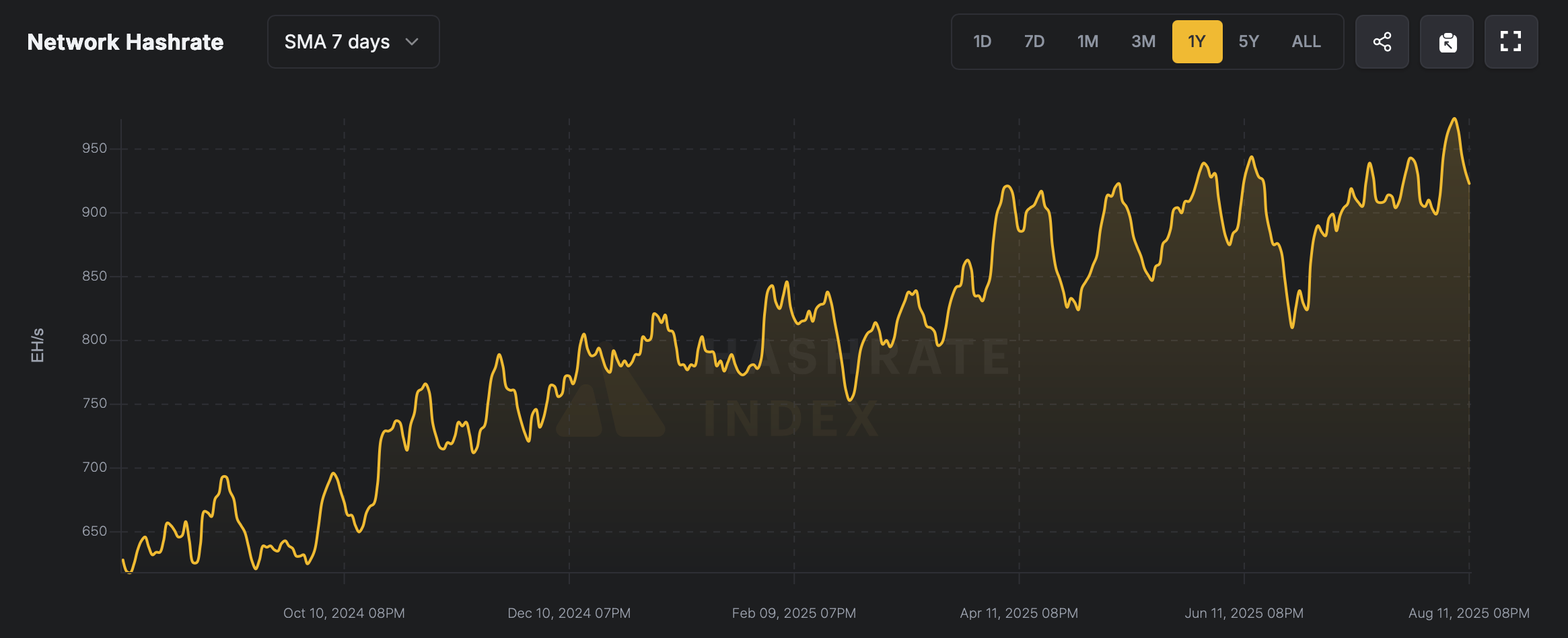

On Aug. 8, 2025, the network’s computing power reached a whopping 976 EH/s based on the seven-day simple moving average (SMA). As of today, the hashrate sits near 900 EH/s—down 76 EH/s over four days—coinciding with a 1.42% difficulty increase at block height 909216. Notably, the estimated revenue for 1 petahash per second (PH/s) of SHA256 output is higher.

Bitcoin total hashrate using the seven-day SMA and one-year timeframe via hashrateindex.com stats.

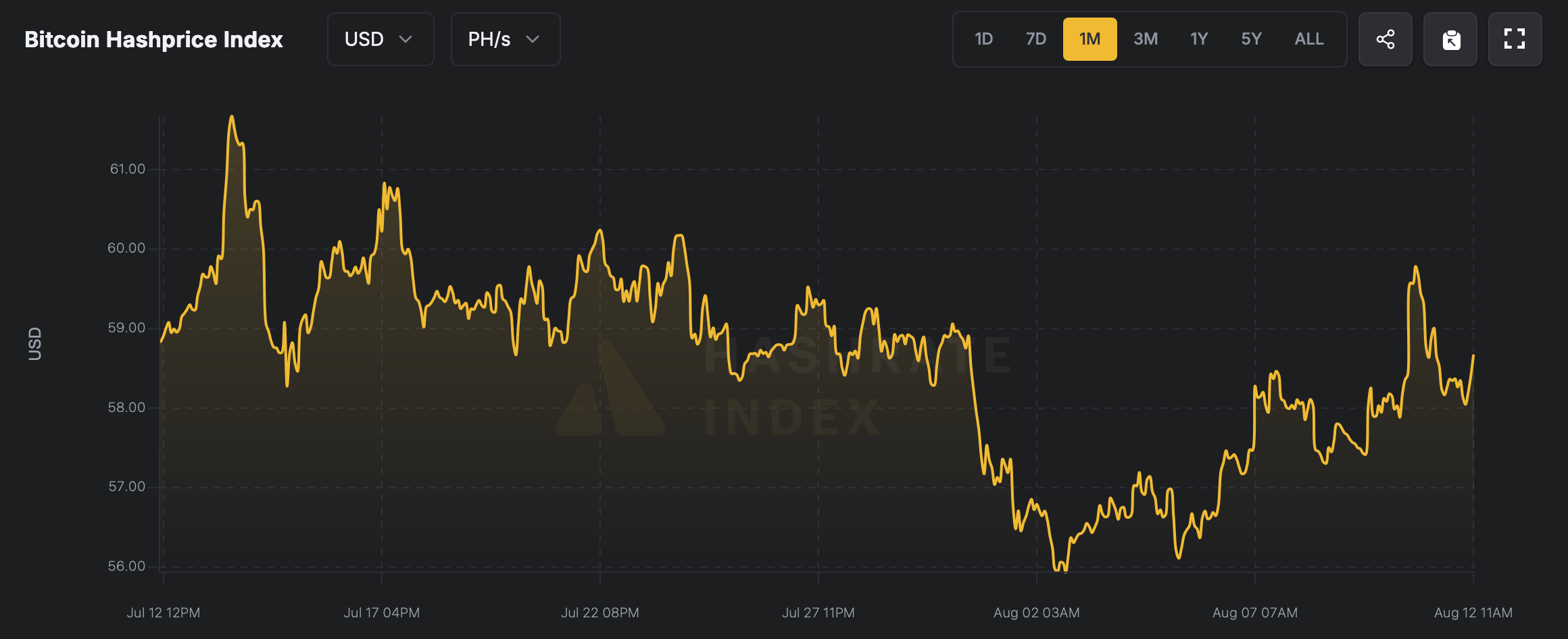

At that time, the estimated hashprice was $57.30 per PH/s, and today it’s 2.55% higher at $58.76, according to hashrateindex.com stats. Yesterday, as BTC pushed past the $120,000 range, the hashprice climbed to $59.78 per petahash. The current revenue remains 4.72% below its July 14 mark, when the hashprice reached $61.67. The increase in network difficulty appears to be the culprit pushing the hashrate lower.

Bitcoin hashprice over the last 30 days via hashrateindex.com.

With a lower hashrate, block intervals are running slower than the 10-minute target. As of 1:20 p.m. Eastern on Tuesday afternoon, the average block time is 11 minutes, 4 seconds. Slower intervals could set up a downward adjustment at the next difficulty retarget on Aug. 24, 2025. With more than 1,500 blocks left and projections subject to change, an estimated 9.64% cut to mining difficulty is on the table, at least for now.

A softer difficulty setting would ease pressure and could entice sidelined rigs back online, stabilizing block cadence. If price momentum holds, rising unit revenue could offset weaker output and steady participation; if it fades, consolidation among operators may quicken. Currently, the five leading mining pools by blocks mined are Foundry, Antpool, Viabtc, F2pool, and Spider Pool. Combined, the collection of entities control 78.39% of the total hashrate.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。