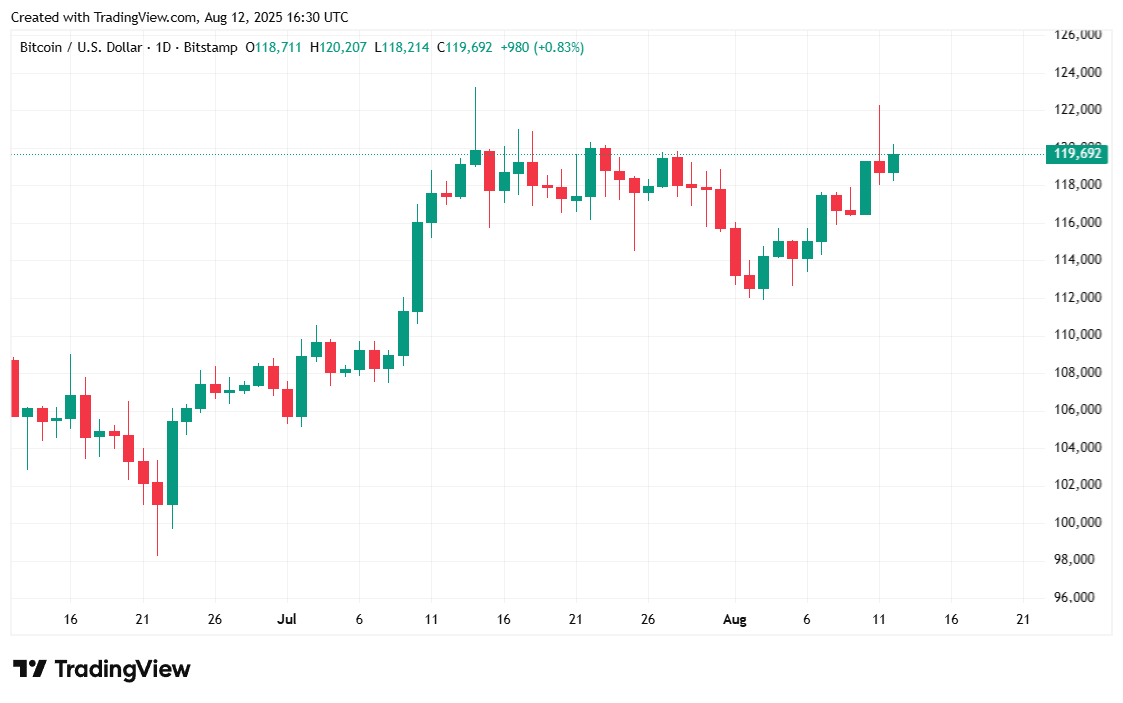

美国劳工统计局周二发布了7月份的消费者价格指数(CPI)数据,显示所有商品的通胀低于预期,但剔除食品和能源等价格波动较大的项目后,“核心”通胀攀升至两年来的最高点,这引发了交易者对市场走向的疑问。比特币在经历了一个周末的反弹后决定不动,徘徊在119,000美元,之前该加密货币曾飙升至122,000美元后回落。

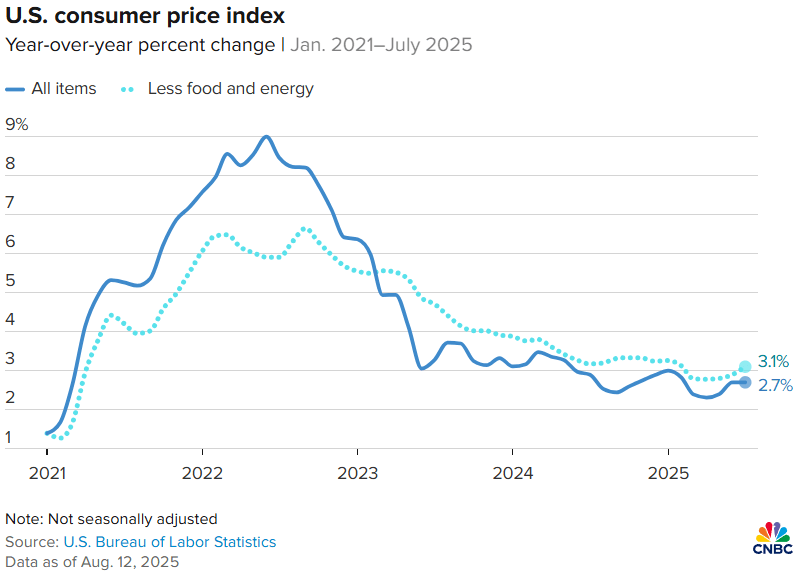

总体通胀在7月份按年计算为2.7%,低于许多经济学家预测的2.8%。剔除食品和能源价格后的核心通胀跃升至3.1%,高于大多数专家的预测,并且是自2023年以来的最高水平。

(7月份CPI数据显示年通胀率低于预期的2.7%,但“核心”通胀率为3.1%,高于预期 / CNBC和美国劳工统计局)

一些分析师将核心CPI的上升归因于特朗普政府有争议的关税政策,认为高核心数字是未来失控通胀的领先指标。但白宫经济顾问委员会主席、近期美联储理事提名人斯蒂芬·米兰在接受CNBC采访时表示不同意见。

“目前仍然没有任何证据表明存在关税引发的通胀,”米兰解释道。“一种商品或服务变得更贵,而另一种则变得更便宜。这种情况总是会发生。但从整体来看,当你全面审视通胀数据时,根本没有任何证据。”

根据Coinmarketcap的数据,比特币在撰写时的交易价格为119,898.64美元,在过去24小时内略微下跌0.46%,但本周仍上涨5.9%。该加密货币自昨天以来一直在118,159.03美元和120,193.39美元之间交易。

(比特币价格 / Trading View)

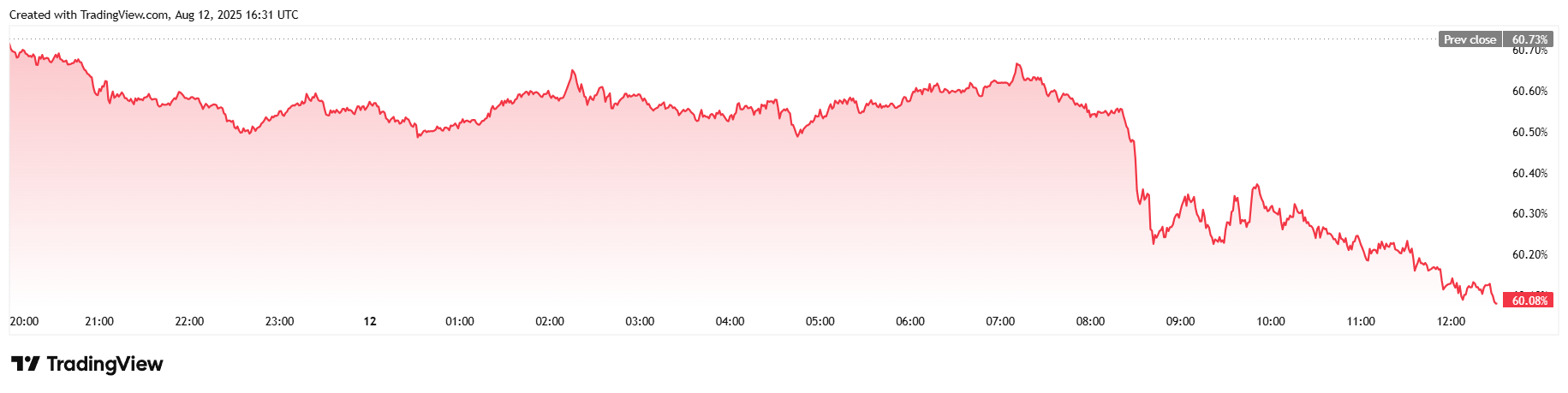

24小时交易量下降了15.82%,为739.8亿美元,市场总市值下降0.71%,至2.38万亿美元。比特币的市场主导地位降至60.08%,在过去24小时内下降了1.09%,这表明山寨币表现更强劲。

(比特币主导地位 / Trading View)

Coinglass上的比特币期货未平仓合约总数下降了2.09%,在报告时为808亿美元。比特币的清算总额达到了5633万美元,但与昨天不同,这一数字主要由多头头寸主导,损失了4383万美元,而空头则损失了较小的1250万美元。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。