Blackrock Leads $1B Ether ETF Surge As Bitcoin ETFs Extend Gains

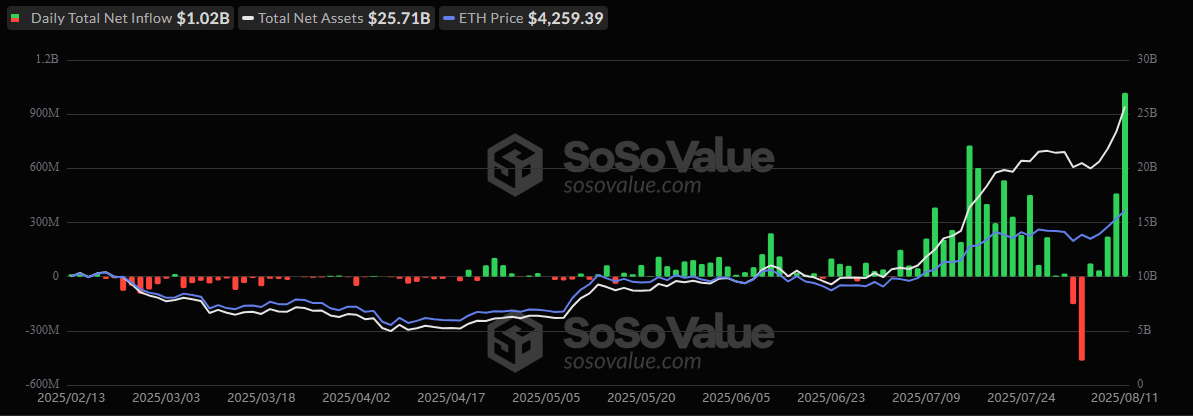

Crypto ETF flows lit up the market on Monday, August 11, with a performance that could make history books blush. Ether ETFs didn’t just have a good day; they shattered records with a staggering $1.02 billion in net inflows. Bitcoin ETFs, while not as headline-grabbing, kept the recovery rally alive with a solid $178.15 million gain.

Ether ETFs delivered the true spectacle. Blackrock’s ETHA alone absorbed $639.79 million, while Fidelity’s FETH wasn’t far behind at $276.90 million. Grayscale’s Ether Mini Trust drew in $66.57 million, and ETHE added $13.01 million.

Smaller but notable entries came from Vaneck’s ETHV ($9.42 million), Franklin’s EZET ($4.88 million), Bitwise’s ETHW ($4.30 million), and 21shares’ CETH ($3.86 million). Trading totaled $2.77 billion, pushing net assets to a record $25.71 billion.

Source: Sosovalue

Bitcoin ETFs also saw green across the board. Blackrock’s IBIT carried the bulk of the inflows at $138.25 million, while Grayscale’s Bitcoin Mini Trust and Fidelity’s FBTC added $14.24 million and $12.99 million, respectively.

Grayscale’s GBTC contributed $7.49 million, and Bitwise’s BITB closed the tally with $5.19 million. No outflows were recorded, with $3.66 billion traded and total net assets climbing to $154.42 billion.

The market takeaway? Institutional appetite for ether has shifted into overdrive, with bitcoin holding steady as the reliable counterpart. If flows like these continue, this week could set the tone for the rest of the quarter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。