What Happened In Crypto Market Today: Trump Removes 39% Tariff on Gold

The global cryptocurrency market cap is $4.03 trillion, down by 0.8% in 24 hours. Daily trading volume reflects $189.43 billion, with Bitcoin dominance at 58.7% and Ethereum’s at 12.7%.

The total number of cryptocurrencies as of now is 18,052 being tracked. This shows the market is active. The largest gainers in the crypto industry are Polkadot and XRP Ledger Ecosystem.

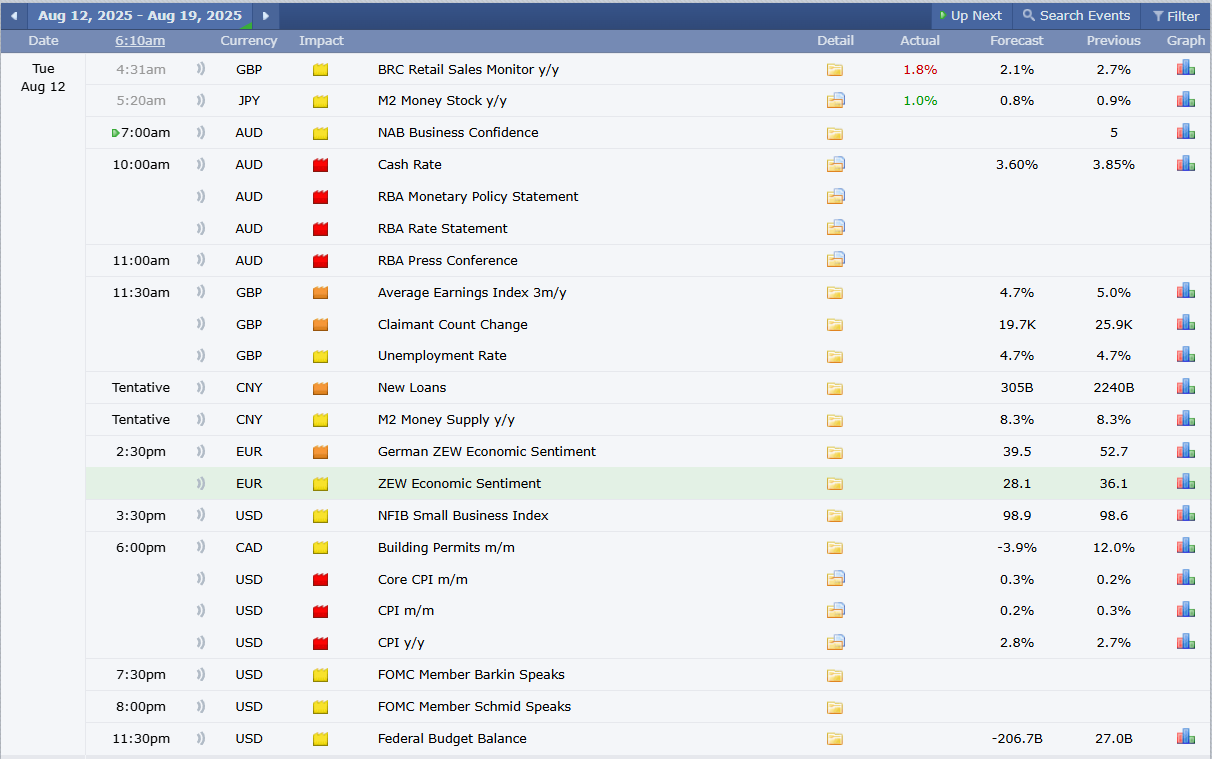

Major Crypto Events Today

Source: Forex Factory

Major Crypto Market Update of the Last 24 Hours

Bitcoin trades at $118892, with a slight decrease of 0.3% in the past 24 hours. With a massive $2.37 trillion market cap and $67.88 billion trading volume, BTC remains the dominant cryptocurrency with a 58.7% share of the global market.

The top 3 trending cryptocurrencies are ZORA, Fartcoin, Succinct, Aerodrome Finance, and Ethereum. Zora (ZORA) at $0.1204 with a trading volume (TV) of $405.63M fell by 2.8%. Fartcoin (FARTCOIN) at $0.8857 decreased by 17.5% with $322.19M TV. Succinct (PROVE) at $1.60 shows an increment of 9.7% with $668.65M TV.

Top gainer is RIZE at $0.07194 with a $4.39M trading volume, surging 115.3%. Codatta (XNY) follows, priced at $0.01535 with a $67.46M TV, rising 113.3%. Liora (LIORA) ranks third, trading at $0.1634 with a $63.13M TV, jumping 99.1% in the last 24 hours.

Top 3 losers are Uranus (URANUS) tops the losers’ list at $0.4307 with an $11.48M TV, dropping 25.9%. Revox (REX) is at $0.0207 with a $3.08M TV, falling 22.8%. Useless Coin (USELESS) trades at $0.2034 with a $52.98M TV, recording a 22.1% loss in the same period.

Stablecoins collectively hold a $279 billion market cap, reflecting a modest 0.2% change in the last 24 hours. Their trading volume reached $141.17 billion, showing continued dominance in providing liquidity and stability within the cryptocurrency ecosystem.

The DeFi market cap stands at $162.61 billion, marking a 1.7% decline in the past 24 hours. DeFi’s dominance over the global crypto market is 4%, with a 24-hour trading volume of $11.98 billion.

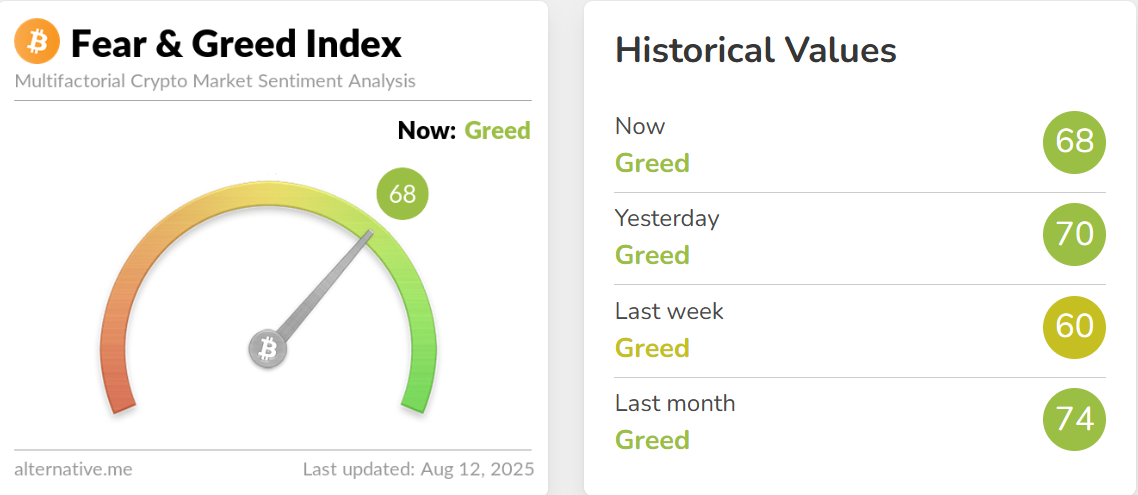

Fear and Greed Index Today

Source: Alternative me

The Crypto Fear and Greed Index is 68, showing greed. This is a bit lower than yesterday but higher than last week. However, all of them stayed on the greed meter, which indicates a continued bullish mood.

Major Crypto News of the Last 24 Hours

In 2022, the collapse of TerraUSD, an algorithmic stablecoin, wiped out $40 billion and shook the global industry, causing an estimated $300 billion ripple effect in decentralized finance. The collapse exposed the fact that these coins rely very much on the trust of the market and not on actual assets, and thus are susceptible and cast a very big question on their sustainability in the long term to traditional financial structures.

On August 11, 2025, President Trump gave the U.S.-China tariff truce another 90 days , postponing increased tariffs on Chinese goods until November 9. The deal came after negotiations in Stockholm, relaxing a ban on rare earth materials that are important to technology and the military. Although this step will provide temporary relief in the business industry, analysts caution that it is not a solution to the underlying trade problems.

The Finance Ministry of India identified more than 29,208 crore of undeclared foreign assets and 1,089 crore of undeclared crypto income in FY 2024- 25 through a voluntary disclosure scheme. This comes after international tax information exchange regulations that were adopted in 2017. The move, which comes amid tight crypto taxation since 2022, is part of a global policy change that has led India to explain its rules on digital assets.

President Trump unexpectedly declared on August 11, 2025, that there would be no tariffs on gold, overturning a recent U.S. decision that imposed a 39 percent tax on Swiss gold bars. The move came after price spikes, industry backlash, and fears of global trade disruptions similar to past tariff-related gold surges.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。