Buterin对ETH国库的看法引发了对企业加密策略的质疑

Vitalik Buterin对ETH国库的看法:机会还是风险?

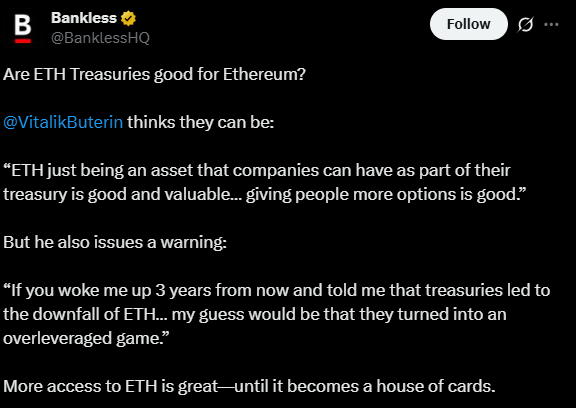

以太坊联合创始人Vitalik Buterin对公司在其国库中持有以太币的想法发表了平衡的看法。他在谈到这个话题时表示,以太币是一种为企业储备提供价值和灵活性的资产,但他也警告说,管理不善可能会使其变成一种危险的“过度杠杆游戏”。

来源:X

作为储备资产的价值

根据Buterin对ETH国库的看法,允许公司将以太币作为其储备的一部分是有用且重要的,因为这为人们提供了更多选择。

像特斯拉、MicroStrategy和Square这样的公司已经将加密货币视为资本资产,持有比特币。如果以太坊也被视为同样的资产,未来几年公司持有的金额可能会达到数十亿美元。

除了积极的一面,Buterin对ETH国库也提出了警告。担忧在于公司可能会利用其数字资产借贷过多或交易过多的高风险衍生品。如果价格突然下跌,可能会引发连锁反应,就像2022年过度杠杆的加密贷方崩溃并被迫迅速出售所有资产一样。

对货币价格的潜在影响

价格的影响取决于规模:

小规模采用:可能会将货币稳定在$3,000 - $4,000的范围内。

大规模采用:可能会推动币价达到新的历史高点。

过度杠杆采用:如果公司在市场压力下被迫出售,可能会导致价格急剧下跌。

顶级以太坊国库的主导玩家

尽管Buterin对ETH国库的尖锐言辞引发了担忧,但大型投资者仍在不断将虚拟货币添加到其储备中。排名第一的是BitMine Immersion Technology,持有833,100个币(价值32亿美元),其次是SharpLink Gaming(20亿美元)和Ether Machine(13.4亿美元)。

目前,超过1%的资产总供应量由加密资本公司持有,专家预计未来几年这一比例将激增至10%。

以太币2025年价格反弹

与此同时,这种货币在今年经历了一段非常戏剧性的旅程。它在1月份以$3,300开始,在4月9日达到了年内最低点$1,385,而在8月时写作时达到了$3,967,较上个月的低点上涨了185%。

这一反弹与资本需求的增加相吻合,暗示企业购买以太币与市场复苏之间可能存在联系。

结论

更多企业接触以太坊可能会成为其采用的变革性力量,就像比特币一样。然而,Buterin对ETH国库的警告突显了健康增长与危险投机之间的微妙界限。未来几年将考验以太币储备是否成为加密经济稳定的基础,还是一座纸牌屋。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。