今天加密货币市场发生了什么:特朗普关税影响印度,税务通知来袭

全球加密货币市场总市值为3.95万亿美元,24小时内增长了3.1%。总交易量达到1424.4亿美元。比特币以59%的市场主导地位领先,其次是以太坊,市场占有率为11.9%。目前跟踪的加密货币数量为17,959种。在此期间,波卡和XRP分类账生态系统是表现最好的领域。

主要加密事件

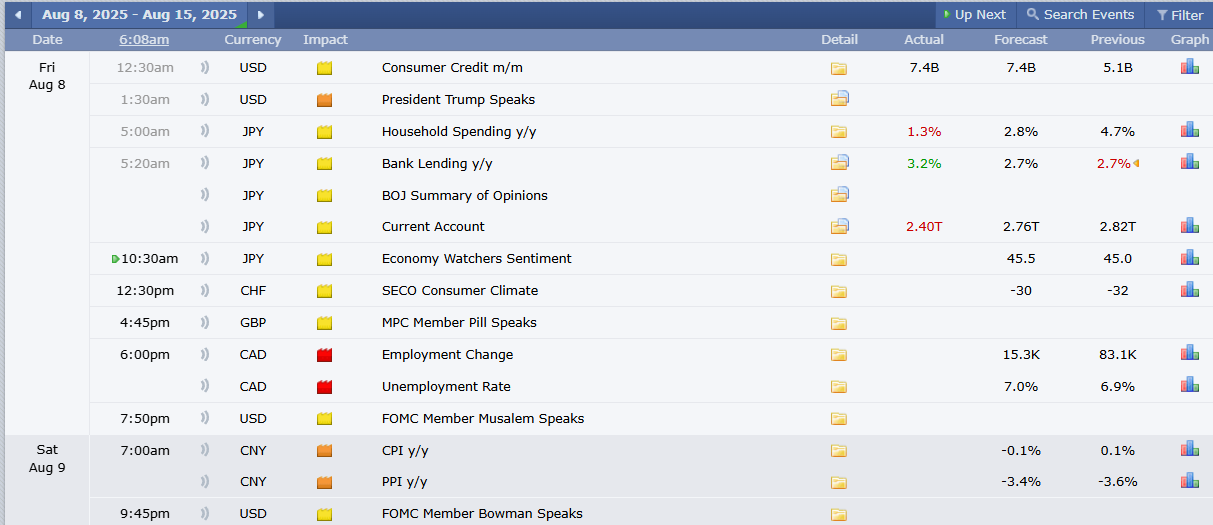

来源: Forex Factory

过去24小时主要加密货币市场更新

比特币(BTC) 价格为117,102美元,24小时内上涨1.9%。其市值为2.33万亿美元,交易量为415.2亿美元。比特币保持59%的最高主导地位,继续作为全球所有交易所和平台上交易和市值最高的数字资产。

前5大热门币:

当前热门的加密货币包括XRP、Pendle和以太坊。XRP上涨10.8%,至3.31美元,交易量为84.8亿美元。Pendle飙升25.1%,至4.98美元,交易量为2.6149亿美元。以太坊上涨6.7%,达到3,899.19美元,交易量为308.5亿美元。比特币和Pump.Fun也在榜单上。它们的高可见性反映了投资者的强烈兴趣、社交媒体的热议以及显著的交易量。

前3大加密货币涨幅:

Arena-Z(A2Z)飙升93.9%,现价为0.009821美元,交易量为1.3153亿美元。Yala(YALA)上涨84.1%,至0.3677美元,交易量为8067万美元。TOKABU上涨63.2%,现价为0.04151美元,交易量为1209万美元。这些山寨币因投资者的活跃兴趣和高交易量激增而出现强劲的上涨势头。

前3大加密货币跌幅:

GXChain(GXC)下跌56.8%,至1.00美元,交易量为267万美元。DOWGE(DJI6930)下跌21.7%,至0.03783美元,交易量为249万美元。Mamo(MAMO) 下跌17.3%,至0.1735美元,交易量为1543万美元。这些代币因可能的抛售或情绪减弱而在过去24小时内出现了剧烈的调整。

稳定币 市场总市值达到2758.7亿美元,24小时内小幅上涨0.2%。总交易量为1055.2亿美元,突显了它们在提供流动性、实现套利和降低波动性方面的重要作用。稳定币在交易对和去中心化应用(dApps)中仍然是不可或缺的。

去中心化金融(DeFi) 市场总市值为87.3亿美元,锁定的总价值(TVL)为1526.1亿美元。该领域在24小时内上涨6.4%,市场主导地位为3.8%。受欢迎的DeFi协议继续吸引用户进行借贷、质押和交换,巩固了它们在去中心化生态系统中的地位。

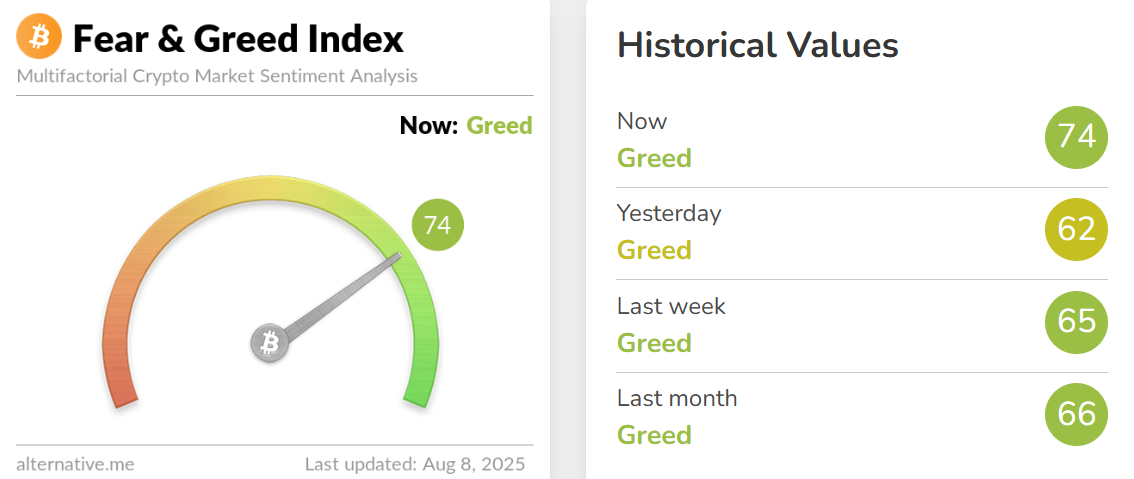

今日恐惧与贪婪指数

截至2025年8月8日,加密货币恐惧与贪婪指数为74,意味着市场情绪高度贪婪。这比前一天的62、前一周的65和上个月的66有所改善。趋势积极向上,表明投资者信心和行业的看涨情绪正在增长。

加密市场24小时回顾

$2亿 收购Ripple的Rail,这是一个稳定币支付平台,旨在增加跨境支付并与USDC的主导地位竞争。该交易将使RLUSD更加虚拟化和自动化,符合新的美国加密法律。这使Ripple成为合规国际支付的领导者,并可能对XRP的未来效用产生积极影响。

印度收入 税务部门已向超过44,000名加密 交易者 发出了通知,这些交易者未在其所得税申报中报告交易,并发现630亿印度卢比的未披露收入。有关部门正在利用区块链追踪和数字取证加强打击,这表明对加密收益的30%税和1% TDS将严格执行。

特朗普总统对印度施加了新的关税:将印度进口的关税翻倍至50%,对日本进口增加15%,并对半导体(苹果和英伟达除外)征收100%的关税。制药产品的关税可能增加到250%。如此激进的举措妨碍了贸易关系,使全球企业面临不确定性,尤其是科技和制药行业的企业。

Chainlink发行了100万美元的LINK代币储备,锁定代币以减少流通供应并帮助企业使用。该储备由服务产生的实际收入资助,增加了对代币的需求,从而导致LINK的价格和交易量上升。这一举措表明机构采用正在上升,并可能因供应问题导致价格爆炸。

免责声明:Coingabbar提供有关加密货币、NFT和其他去中心化资产的信息内容。这不是财务建议。用户请自行研究,了解风险,并在投资前咨询财务专业人士。CoinGabbar对任何财务损失不承担责任。加密货币和NFT高度波动——明智投资。

另请阅读: SEC与Ripple案件即将结束,分析师预测XRP价格将上涨40%

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。