Candy@TEDAO|Author

Introduction | Can the "Business Ledger" Behind Transactions Be Made Public?

In the DeFi world, every transaction is recorded on an immutable public ledger, allowing anyone to verify the records. We are accustomed to seeing every swap on decentralized exchanges like Uniswap, but the information often stops at the level of "this transaction occurred."

Where does this transaction come from? Was it recommended by a KOL, or did it come from a specific trading tool? For a long time, such attribution has relied on internal systems or centralized backend processing, known as the "growth black box": the transaction itself can be verified on-chain, but the sources of promotion are usually counted off-chain. This is not coincidental but rather a consideration of technology and cost—adding extra identifiers to each transaction on mainnets like Ethereum significantly increases gas fees and may pose security challenges. Therefore, many projects choose to store their "business ledger" off-chain.

Hyperliquid is a decentralized trading platform running on a self-developed underlying blockchain network (self-developed L1), where users can engage in perpetual contract trading. Unlike other platforms, it chooses to make key business data and trading logic public on-chain, achieving comprehensive transparency from financial transactions to growth attribution, allowing the exchange's "backend" to be intuitively presented as a traceable growth map.

I | The Public "Business Ledger": Understanding the Source of Growth

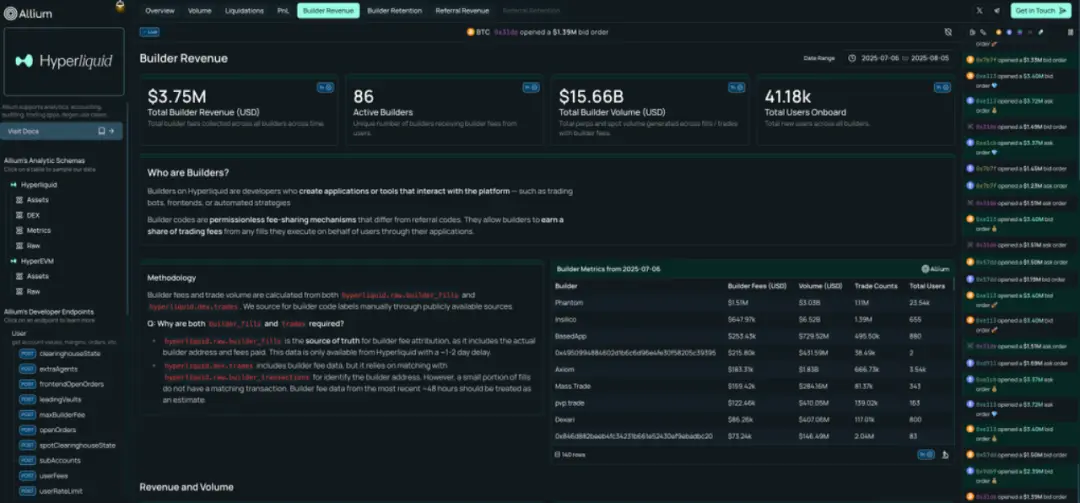

Hyperliquid's data dashboard (provided by the third-party data analysis platform Allium) resembles a real-time "war room." It not only shows macro trends but also reveals who (wallet address), what tools were used, and when market changes were driven. The approach is to structure the source information into the protocol path, clarifying two dimensions:

- Builder (Order Level): Records the tool used to place the order (e.g., builder field) in the order parameters. This allows for comparison of transaction volume, fees, and retention by tool, enabling source attribution.

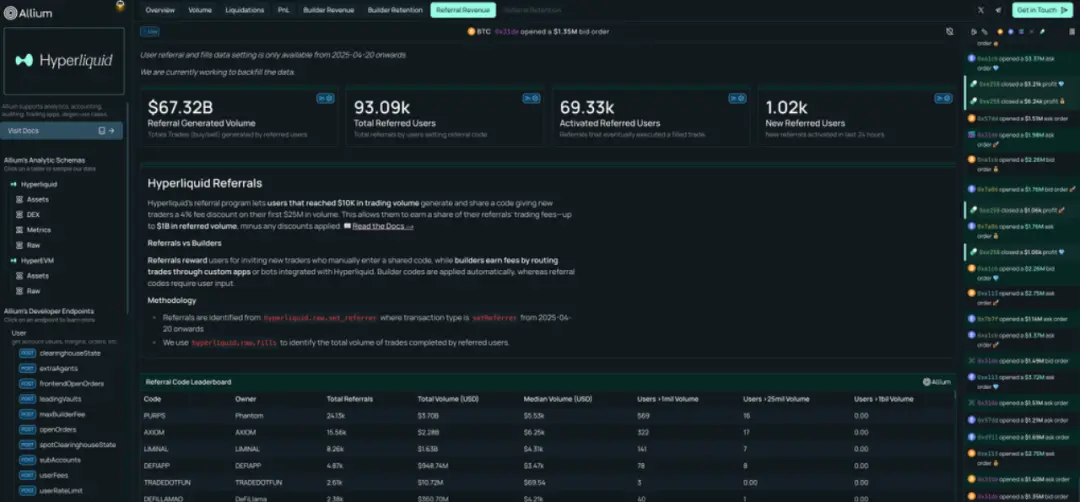

- Referral (Account Level): Binds "who referred you" on the account side, with discounts and commissions settled on-chain according to protocol rules. This allows for on-chain settlements to be verified against official/third-party dashboards for new promotions and transactions, facilitating budget and ROI assessments.

Figure 1: Overview of the Hyperliquid ecosystem provided by Allium. Data source: Allium: https://hyperliquid.allium.so/

Simple Example: How to Connect Transactions with Growth?

Scenario A (Builder | Order Level)

Trader Bob places an order using developer David's "TradePro" tool, with the order carrying David's address (builder parameter); the protocol automatically records this address and the corresponding fees on-chain, completing the revenue sharing according to the rules.

Scenario B (Referral | Account Level)

Trader Alice registers using KOL Emma's referral code, establishing a verifiable referral binding on-chain; thereafter, Alice enjoys fee discounts on every transaction, with the system automatically calculating discounts at the account level and allocating commissions to Emma.

Figures 2&3: Overview of income and user growth from different Builders and Referrals. Data source: Allium

II | When Growth Contribution Becomes Trustless

When "growth attribution" moves from off-chain to on-chain, the entire value chain changes—let's look at it from three dimensions: rules, settlement, and data:

1. Rules: From "Variable Interpretation" to "Protocol Layer Rules"

Key logic is solidified into contracts, executed collectively by the network; code constraints replace temporary interpretations, enhancing the neutrality and predictability of the rules.

2. Settlement: From "Manual Approval" to "Automated Clearing"

Taking Builder (Order Level) as an example: Users first set a "maximum fee authorization" (ApproveBuilderFee) for the developer's address, and subsequent orders carry the builder parameter, with the protocol completing revenue sharing settlements on-chain without any manual intervention.

3. Data: From "Promotional Reports" to "Traceable Ledgers"

All key actions—placing orders, canceling orders, clearing, applying discounts—are written on-chain, allowing anyone to independently verify in the public ledger without relying solely on promotions.

This brings direct impacts:

For Developers (Builder) and Promoters (Referral): Returning to Contribution Itself

Settlements are automatically made based on on-chain contributions, independent of relationships or off-chain statistics, making value creation visible. Excellent developers and promoters can "vote with code" rather than "persuade with PPT."

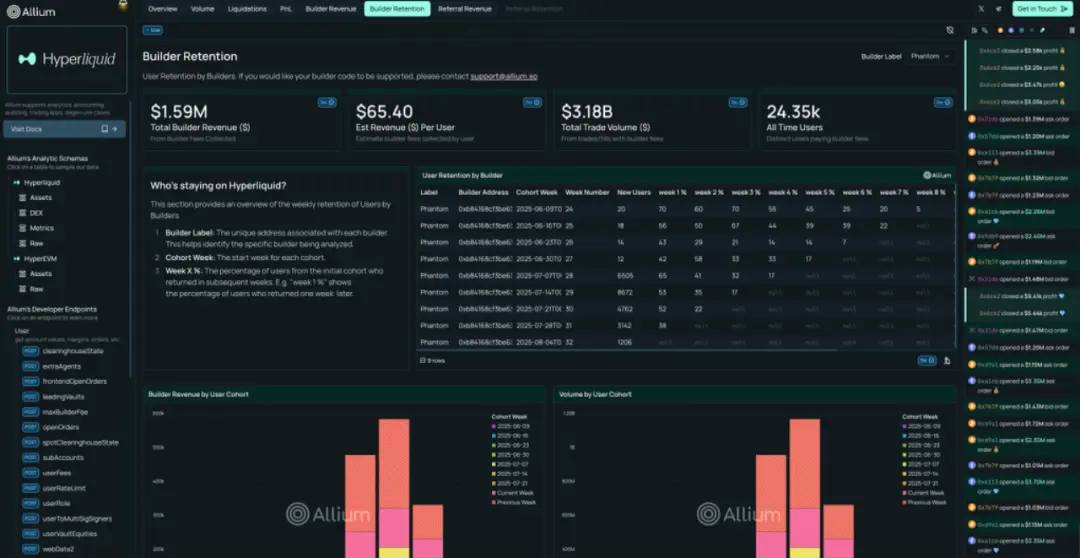

For Project Operations and DAO Governance: From Subjectivity to Data Consensus

Decisions are made around unified metrics (e.g., "promoter contribution × retention × ARPU"), leading to reduced discussion costs.

For example, the "Builder User Retention Rate" dashboard can reveal differences in user quality brought by different tools: some attract many new users but have high churn the following week; others attract fewer but have stable retention, clarifying incentive directions.

Figure 4: Builder user retention rate dashboard, tracking new customers and subsequent retention weekly. Data source: Allium

For Ordinary Traders: Cutting Through the Noise with Facts

They can independently identify "who is leading the trend and which tools are effective," reducing the impact of calls and opaque information.

III | The Cost of Transparency and the Boundaries of Privacy

However, any technological paradigm is a double-edged sword. When transparency is pushed to the extreme, new risks and challenges emerge:

Strategy Leakage and Alpha Decay: The Evaporation of Trade Secrets

For professional traders and developers, when their trading patterns and tool logic are clearly tracked, their profitable Alpha is exposed to the light, potentially being easily copied and imitated, leading to rapid strategy failure.

Precise Targeting and Market Manipulation: A Transparent Hunting Ground

The intentions of large traders become apparent, which may lead to malicious following or opponents using position information for precise strikes, increasing the risks of large capital operations.

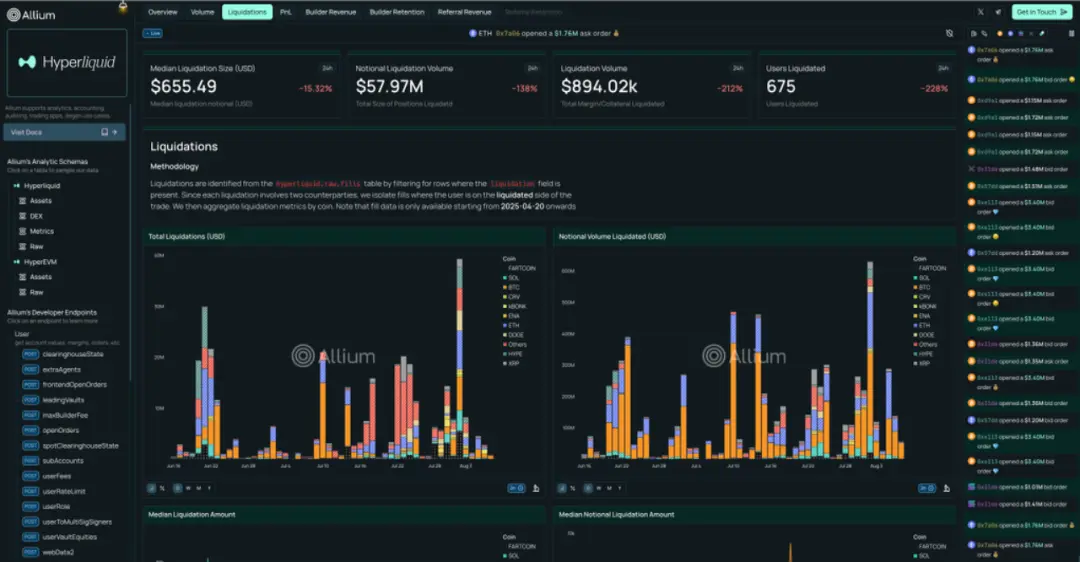

Financial Privacy Spillover: The Public "Naked Wealth"

Users' trading histories and profit and loss (PnL) statuses are fully public, for instance, ecological dashboards (like Allium) aggregate liquidation events to form rankings; this also exposes addresses and nominal losses, potentially attracting hackers, phishing, or even offline security threats.

Figure 5: Liquidation leaderboard, displaying addresses that were liquidated and the amounts lost. Data source: Allium

Solutions in Progress

To address these risks, the industry has turned its attention to verifiable privacy technologies represented by zero-knowledge proofs (ZKP). The core goal is to prove to the protocol that a certain contribution indeed came from a specific promoter or tool without disclosing the trader's identity or strategy details, thus completing on-chain settlements based on this proof.

This path provides a clear technical direction for achieving the ideal state of "verifiable yet protective." However, challenges in cost, latency, and anti-witch-hunt aspects still require significant engineering refinement.

Conclusion | Beyond Financial Transparency, It's a Reconstruction of Business

Hyperliquid's attempt extends the DeFi principle of "trustlessness" from the transaction level to the source level, demonstrating what protocol-native growth looks like: it places the closed loop of "user acquisition—transaction—revenue sharing" entirely on-chain, making it both traceable and verifiable, laying the foundation for a fairer incentive mechanism.

However, this design of moving growth attribution on-chain also raises a core challenge: how to better protect individual strategies and privacy without sacrificing verifiability. Only when the "traceable ledger" and "anonymity rights" coexist harmoniously can the growth mechanism be considered a complete migration from off-chain to on-chain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。