作者:KarenZ,Foresight News

本文最早发布于 7 月 29 日

原文标题:《Etherex 能否打响 Linea 发币前的第一枪?》

随着 Linea 于 7 月底公布 LINEA 代币经济学和治理细节,其生态内的 DEX Nile 也迎来重要升级。

Linea 主网始终缺乏一个能够承载全链流动性、又把价值回馈给社区的交易层。NILE 的升级版本——Etherex 致力于填补 Linea 生态在退出机制、高效流动性聚合、激励机制设计上的空白。

Etherex 采用了全新的 x(3,3) 模型,比 ve (3,3) 更灵活,并且去除了锁仓要求,通过动态激励和退出惩罚机制,确保协议的价值流向最活跃的参与者。

本文将解析 Etherex 的核心机制、代币经济学及其创新之处。

从 Nile 到 Etherex

Etherex 是 Linea、ConsenSys 和 NILE 合作推出的去中心化交易所,于 2025 年 7 月 29 日正式上线。合作伙伴包括 Astera、Foxy、eFrogs、MYX、MetaMask、Alchemix、Frax、Zerolend 和 Turtle。

根据 Etherex 团队,早在 2014 年,以太坊主网尚未推出之时,Vitalik Buterin 和 Joseph Lubin 等以太坊构建者就怀揣着一个去中心化交易所的愿景,希望打造一个真正无需信任、安全可靠的去中心化交易平台,让用户能够无需依赖中心化实体,在链上自由交易。EtherEX 正是基于这一愿景诞生,虽然后来这个构想未能实现,但如今的 Etherex 正是向这一早期愿景致敬,并在此基础上进行革新。在 Etherex 看来,Etherex 不是新瓶装旧酒的 DEX,而是对 2014 年 EtherEX 愿景的「终极交付」。

从现实层面看,Etherex 是 Nile 在 Linea 上的升级版。作为 Linea 原生的流动性枢纽,Etherex 承担着三大核心功能:定向激励分配、LINEA 代币流动性承载,以及将有价值的代币增发引导至对整个生态健康有益的交易池。

Etherex 是什么?

Etherex 的核心在于其创新的 x (3,3) 模型,这是对传统 metaDEX 模型的进化,解决了此前激励机制对齐的难题。

传统 metaDEX 验证了大规模应用和可持续收益的可能性,但始终依赖「强制锁仓」等人工限制维持用户参与 —— 用户必须将代币锁定数年才能公平参与生态,形成了以「义务」而非「价值」驱动的参与模式。

x (3,3) 模型则改变了这一逻辑:它不依赖强制锁仓,而是通过有机激励让用户主动留在生态中 —— 系统奖励积极参与者,并将价值自然集中到贡献最大的用户手中。用户无需锁仓即可参与,退出机制的设计确保只有真正认同协议价值的参与者才会留下,形成一个自我筛选的活跃社区。

Etherex 如何运行?

如前所述,Etherex 的突破在于将「强制参与」转为「主动留存和贡献」,核心目标是为 Linea 提供原生深度流动性,优化激励,以及实现无缝用户体验。

三代币系统如何实现激励对齐?

在探索 Etherex 的运行机制前有必要先了解 Etherex 的三代币系统。

Etherex 采用创新的三代币系统,设计初衷是在保持灵活性的同时,实现激励机制的精准对齐,具体细节虽未完全公布,但核心逻辑已清晰可见:

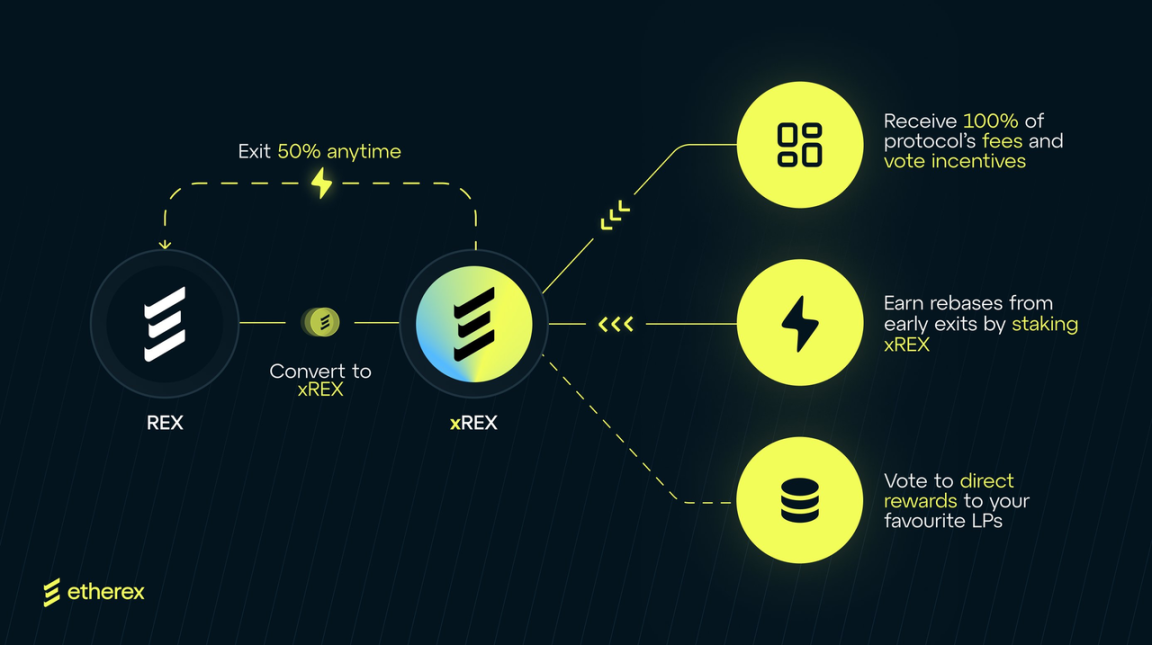

- xREX:治理代币,xREX 主动质押者拥有投票权,可决定流动性池的增发分配,同时可以获得 100% 的交易手续费、退出 Rebase(Exit Rebase)奖励以及协议提供的额外奖励。

- REX33:xREX 的流动性质押代币,具备自动投票、收益复利功能。它解决了治理代币的流动性难题,REX33:xREX 的比例初始为 1:1,随着手续费、投票激励和 Rebase 等奖励的累积,比例将朝着有利于 REX33 的方向增长。除此之外,Etherex 会通过套利机制会确保 REX33 不低于 xREX 的赎回底价,为用户提供了低摩擦的参与方式。

- REX:协议基础代币,通过增发分配给流动性池,是激励流动性提供者的核心工具。其增发量由 xREX 持有者投票决定,确保资源流向最具价值的流动性池。

Etherex 的运行机制

1、退出机制的正向循环

用户退出 xREX 有两种方式:一是直接赎回(Exit Rebase),需承担 50% 惩罚,惩罚代币全部分给现有 xREX 持有者;二是通过 REX33(xREX 的流动性质押版本)在公开市场交易。这样既解决了代币稀释问题,又激励用户长期参与,形成「优胜劣汰」的生态系统。

2、每周 Epoch: xREX 持有者投票决定下一周 REX 增发量流向哪些流动性池

每个周四 08:00,xREX 持有者投票决定下一周 REX 增发量流向哪些流动性池。投票权重取决于 xREX 持有量和参与度,得票越高的池获得的 emission 越多。

3、动态费用与收益分配

Etherex 根据市场波动性和交易量自动调整手续费(0.05%-5%),并将 100% 协议费用分配给 xREX 持有者。交易对产生费用,吸引更多投票和代币释放,进而带来更深流动性,推动产生更高的交易量和费用,形成正向飞轮。

4、集中流动性(CL)优化

- LP 可自定义价格区间提供流动性,最大化资本效率。

- 通过竞争性挖矿(Competitive Farming),激励 LP 优化流动性范围,提升交易执行质量。

5、MEV 防护与价值回流

内置 MEV 捕获模块(如 REX33 AMO),将套利收益分配给投票者。

Etherex 代币经济学

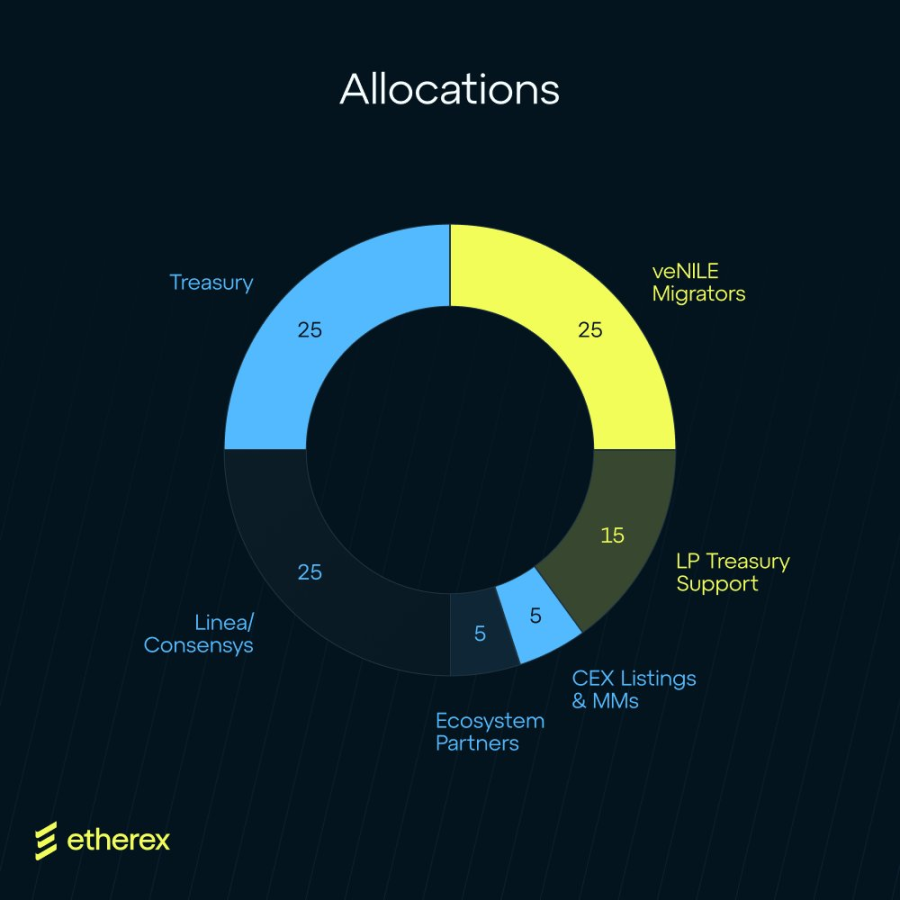

Etherex 将于 8 月 6 日上线代币 REX。REX 初始总供应量为 3.5 亿枚,最大供应量上限为 10 亿枚代币。具体分配如下:

- 25% 分配给 Linea/Consensys(80% xREX,20% 为 REX。原有 veNILE 持有者可迁移至 xREX,但需满足:最低 100 veNILE,4 年锁定期。快照时间:北京时间 7 月 26 日 11:59)。

- 25% 分配给 veNILE 迁移者(100% 为 xREX)。

- 25% 分配给协议金库。

- 15% 用于 LP 财库支持。

- 5% 用于中心化交易所和做市商。

- 5% 分配给生态系统合作伙伴。

除了分配给 LP 财库支持和 CEX 上线 / 做市商的代币为 REX 之外,大多数代币分配形式为 xREX。

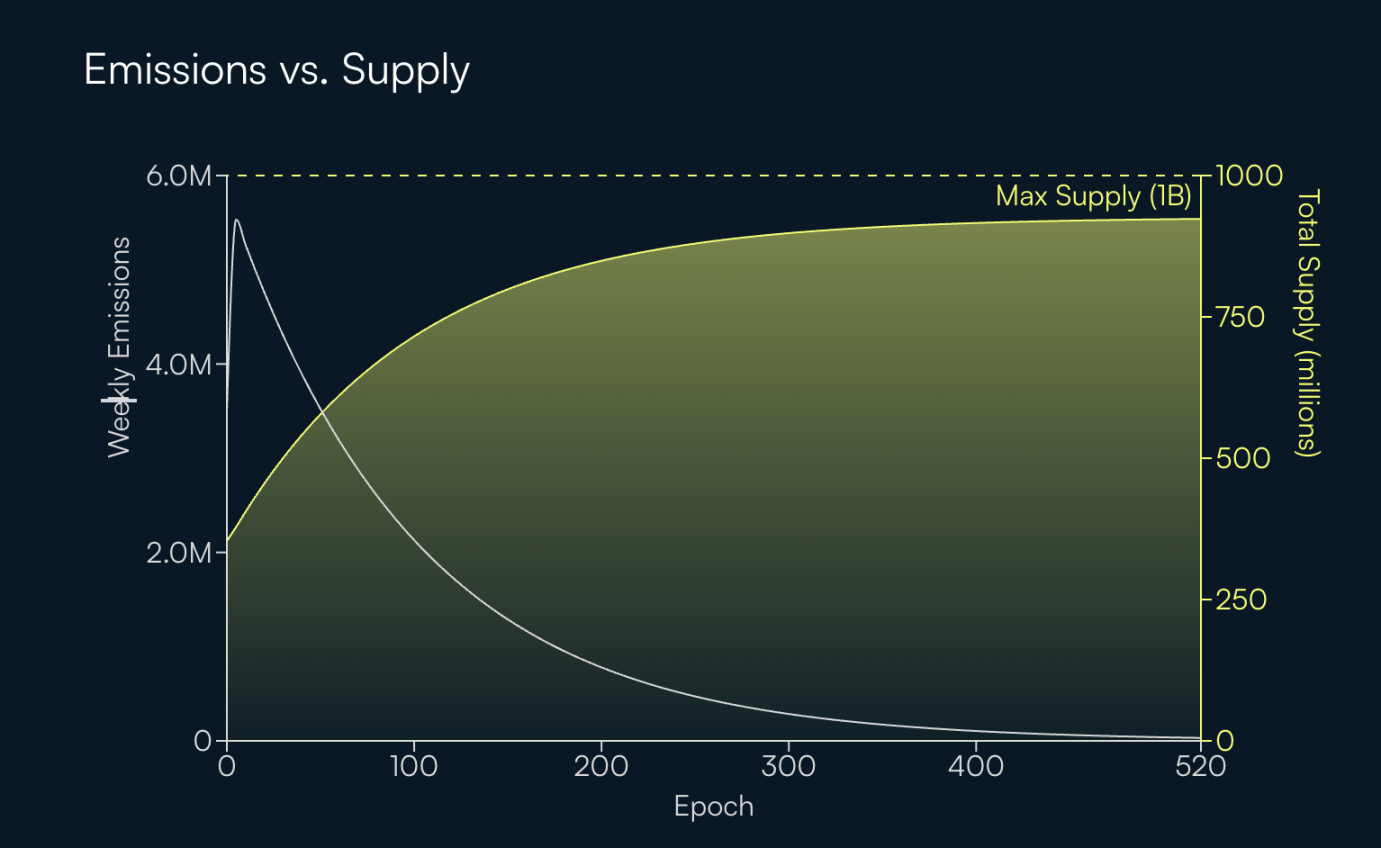

如前所述,xREX 持有者投票决定下一周 REX 增发量流向哪些流动性池。以下是 Etherex 每周排放量(下图白色曲线)与前 500 个 Epoch (约 10 年) 总供应量(下图黄色曲线)的近似值。Epoch 0 期间释放 350 万枚代币,Epoch 1 到 4 期间,每个 Epoch 先增加 20%,后增加 10%,Epoch 5 之后,每个 Epoch 衰减 1%。

Etherex 为何是 Linea 生态的关键拼图?

Etherex 的出现,为 Linea 生态带来了几大大核心价值:

首先,它通过 x (3,3) 模型解决了流动性激励的根本性问题 —— 将「强制参与」转为「价值驱动参与」,让流动性自然流向最具效率的领域,同时通过退出 Rebase 机制保护长期参与者的利益。

其次,Etherex 通过与 MetaMask 的深度集成和无锁仓设计,极大降低了用户和流动性提供者的参与门槛,为 Linea 生态注入了更广泛的用户基础。

另外,作为 Linea 原生的流动性枢纽,Etherex 实现了与以太坊生态的价值协同 —— 其激励机制设计不仅服务于 Linea 的短期增长,更着眼于以太坊成为经济关键组成部分的长期目标。

同样值得强调的是,以太坊财库公司 SharpLink 目前持有超 36 万枚 ETH,以太坊联合创始人、Consensys 首席执行官 Joseph Lubin 担任 SharpLink Gaming 董事会主席。社区用户猜测 SharpLink 会将其部分 ETH 持仓放置于 Etherex 中。

Etherex 凭借其创新的 x (3,3) 模型、协调一致的代币经济学和无缝的用户体验,能否成为推动 Linea 生态爆发的核心引擎,还有待时间的检验。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。