Experts Say Ethereum Treasury Companies Offer Higher ROI Than ETFs

Is Ethereum Treasury Companies a Better Investment Than ETH ETFs

Treasury firms have started acquiring ETH, the second-largest digital currency in terms of market value. Geoffrey Kendrick, global head of digital assets research at Standard Chartered, says Ethereum treasury companies are now "very investable." Organisation which are buying token for their digital assets reserve are much better options rather than buy ETH spot exchange traded funds.

The Ethereum reserve investments are attracting not just for their holdings but for its financial structure which is now gaining every investor's attention. The Layer-1 token is transforming into a global financial infrastructure, with Tom Lee predicting a $330K milestone. Cosmos Health is deploying a $300M in treasury, and Robinhood, JPMorgan, and BlackRock are building on it.

Experts Advice on Ethereum Treasury Companies or Trading in ETF which is Better

Standard Chartered’s global head of digital assets research Geoffrey Kendrick stated that “I see no reason for the NAV multiple to go below 1.0 because I see these firms as providing regulatory arbitrage opportunities for investors,”. He also explained that:

-

The market cap of ETH ETFs, divided by their token holding value, is expected to normalize and remain above 1, making them a better investment option.

-

Ether reserve companies provide better access to ether price appreciation, staking rewards, and ETH-per-share growth compared to U.S. spot ETH ETFs, which cannot participate in decentralized finance.

The conclusion to the statements is, if you are buying and holding digital assets for a long term growth you will definitely gain the maximum profit rather than trading in ETFs. High return gained by token can be used in stacking or sell off to get net profit.

Do Ethereum Treasury Companies play a major role in coin’s Price Surge?

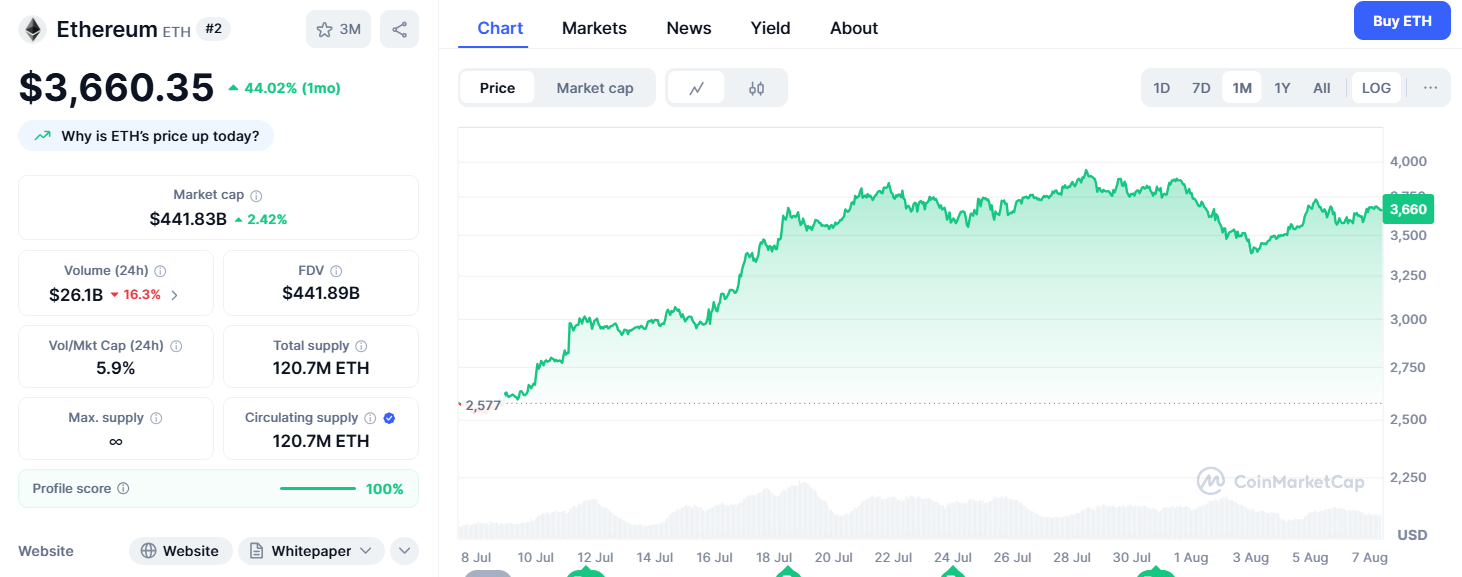

Source: CoinMarketCap

The token dominates 11.6% of the total global crypto market. At the time of writing, the coin is trading at $3660 with a market capital of $441.83B. The layer-1 token has seen a 44% increment in the past month. Analysts are predicting the coin to surge above $5k ending this year. Majorly the firms started purchasing and holding tokens from the last 4 -5 months aggressively.

Last month the coin's price went from $2577 to $3915, nearly $4k. The timing is when Sharplink Gaming and Blackrock were storing the coin aggressively. This massive surge shows how confident big financial institutes are in buying and holding tokens in their treasuries.

The consistent increment in the token is giving a boost to traders, investors, and giant institutions to make a bet on it. Investors are waiting for Sharplink’s Q2 earnings report due on August 15, which will offer further insight into this growing asset class.

Kendric’s advice on Ethereum Treasury Companies Boosting Confidence to Build more Cryptocurrency Reserves

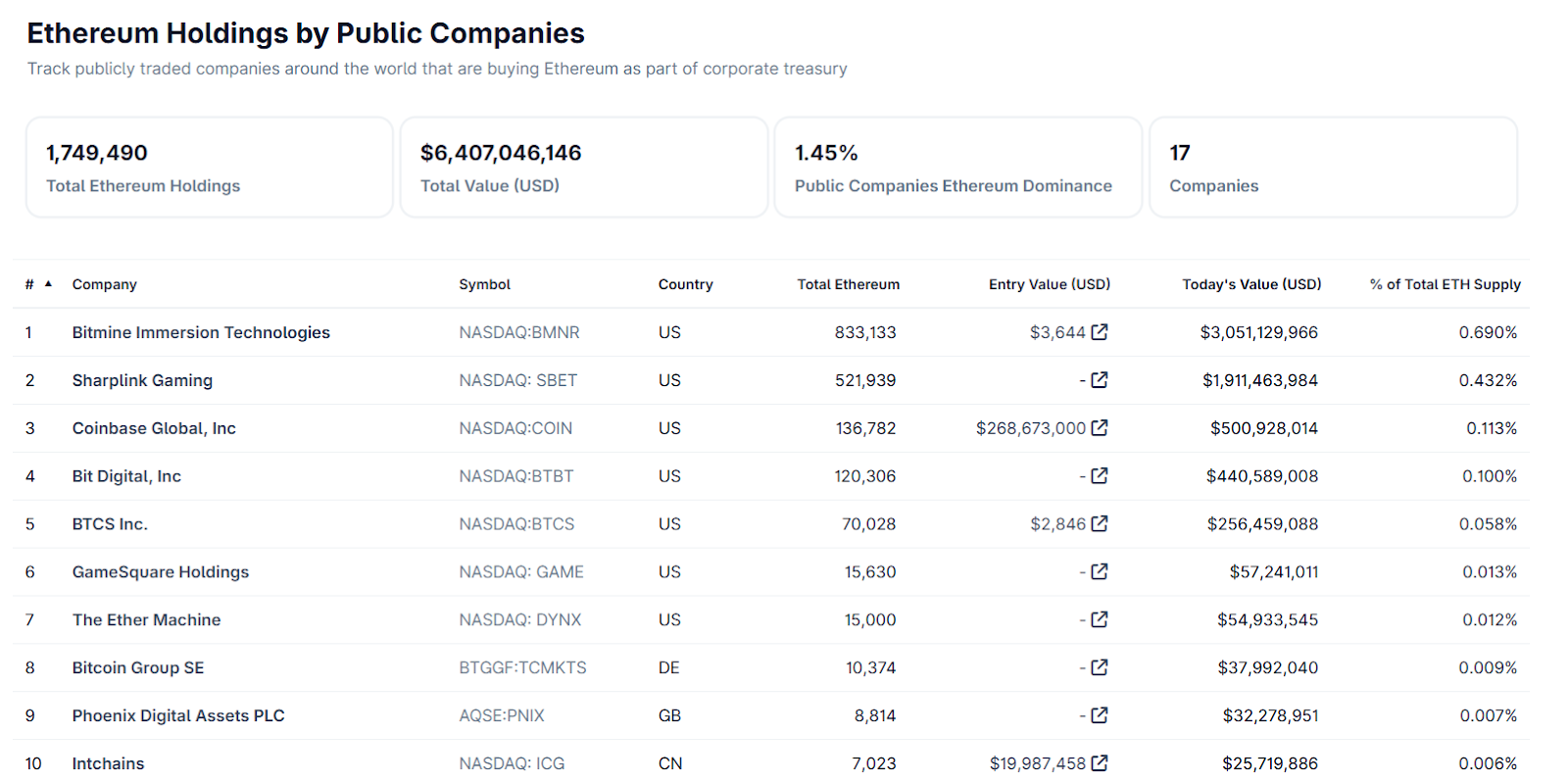

Source: Coingecko

As per the data top 10 companies hold over 1M Ether in their reserves. Bitmine topped the list followed by Sharplink Gaming, Coinbase and Big Digital. Kendric’s advice highlights a shifting dynamic in institutional Ethereum investment. With NAV multiples stabilizing and staking benefits accruing, Ether reserve firms are positioning themselves as high-efficiency alternatives to ETFs.

Also read: Trump Latest Tariffs on India, Japan, Pharma and Semiconductors免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。