撰文:Leo Schwartz,财富杂志

编译:Luffy,Foresight News

Dan Morehead,Pantera Capital 创始人

2016 年,Dan Morehead 开启了一场全球之旅,宣扬比特币的 「福音」。这位前高盛与老虎管理公司交易员,几年前就被比特币 「彻底征服」,坚信它将重塑全球经济。他对这种货币的信仰如此强烈,甚至从半退休状态复出,将自己的对冲基金 Pantera Capital 改造成全球首批比特币基金之一。

这项新业务于 2013 年启动,初期势头迅猛,得到了两位普林斯顿校友 Pete Briger 和 Mike Novogratz 的支持,两人均来自私募巨头堡垒投资集团。三人欣喜地看着 Pantera 以 65 美元初始价购入的比特币,在年底就飙升至 1000 多美元。但随后灾难降临,黑客洗劫了新兴加密货币行业的主要交易所 Mt. Gox,比特币价格暴跌了 85%。「人们会说,『你不是做那个已经凉了的比特币吗?』」 Morehead 回忆道。「它还活着!」 他总会这样回应。

2016 年那场比特币宣讲之旅中,Morehead 安排了 170 场会面。每次走进潜在投资者的办公室,他都要花一小时论证这种新资产为何是最诱人的机会。结果是:他只为濒临困境的基金筹集到 100 万美元。更糟的是,Morehead 自己的出场费总计约 1.7 万美元。「我每场会面挣 100 美元,就为了说服人们买比特币,」 他告诉《财富》杂志。

不到十年后,当比特币价格逼近 12 万美元,Morehead 早年那段艰难岁月已成为创始人神话的一部分 —— 堪比苹果公司史蒂夫・乔布斯和史蒂夫・沃兹尼亚克在乔布斯父母车库里捣鼓发明,或是沃伦・巴菲特与查理・芒格在奥马哈晚宴上交流炒股心得的故事。

如今,Pantera 旗下各类加密基金管理着逾 40 亿美元资产,持仓包括比特币、以太坊等数字资产,以及对 Circle(6 月上市)、Bitstamp(今年初被 Robinhood 以 2 亿美元收购)等项目的投资。但在竞争激烈的加密风投领域,这家公司的独特之处在于其 「先行者」 地位:它是保守的传统金融界与曾经叛逆的加密行业之间一座声名远扬的桥梁。而核心人物 Morehead,在这个充斥着传奇人物的行业里,是一位低调的实干家。

「我很固执,而且完全相信(比特币)会改变世界,」 Morehead 告诉《财富》,「所以我一直坚持下来。」

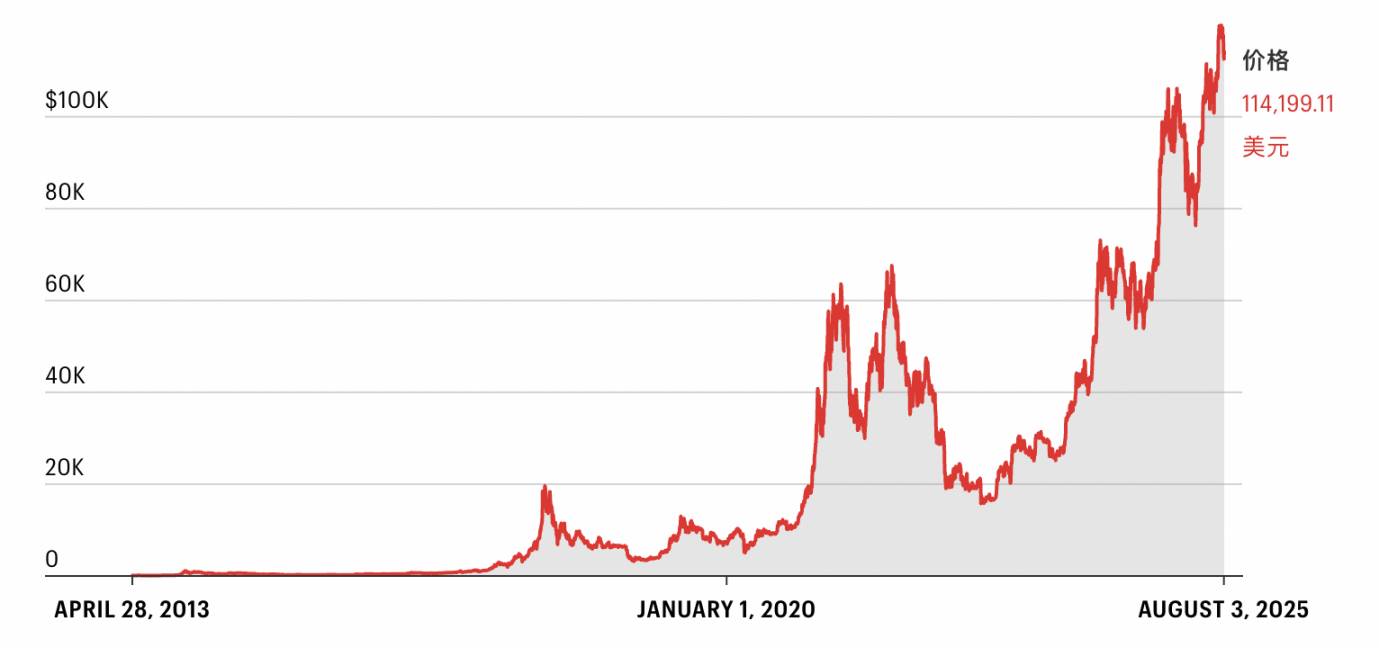

比特币的狂野之旅

2013 年以来,比特币的价格走势。数据来源:CoinGecko

普林斯顿 「黑帮」

在华尔街尚未渗透区块链行业的年代,Morehead 在早期加密货币的混沌世界里显得格格不入。他曾是普林斯顿大学的双栖运动员(橄榄球和重量级赛艇),如今仍保留着年轻时宽阔的肩膀和方正的下颌线。这与那些瘦骨嶙峋、特立独行、整天泡在网络论坛上的人截然不同。相反,Morehead 来自传统金融界,他至今习惯于穿着西装外套。

在接触比特币之前,Morehead 已拥有漫长的交易生涯。在高盛和老虎基金任职后,他创办了自己的对冲基金 Pantera,却在 2008 年金融危机期间倒闭。大约就在那时,一个名叫中本聪的神秘人物在网上发布白皮书,将比特币引入世界。

2011 年,Morehead 从弟弟那里第一次听说比特币,还隐约知道普林斯顿的同学 Gavin Andresen 运营着一个网站,用户只要破解验证码就能获得 5 枚比特币(目前市价约合 57.5 万美元)。但他没太在意,直到几年后,另一位同学 Briger 邀请他到堡垒投资集团旧金山办公室喝咖啡聊加密货币,Novogratz 也远程加入。「从那以后,我就被比特币迷住了,」 Morehead 说。

科技界以所谓的 「黑帮」 闻名,比如 PayPal 黑帮后来主导了下一代初创企业。在加密领域,「黑帮」 并非来自某家公司,而是一所大学:普林斯顿孕育了该行业一些最具影响力的项目。Briger 和 Novogratz 都是 Pantera 的关键支持者,Morehead 甚至搬进了堡垒投资旧金山办公室的闲置空间。Briger 至今仍在加密领域保持着幕后影响力,最近加入了 Michael Saylor 市值 1000 亿美元的比特币持有公司 Strategy 的董事会。Novogratz 则创办了 Galaxy,成为最大的加密企业集团之一。另一位同学 Joe Lubin,后来成了以太坊的联合创始人。

但在 2013 年,常春藤盟校毕业生、活跃在私募股权和宏观交易等高端领域的人会对比特币感兴趣,这听起来仍很离谱。Briger 告诉《财富》杂志,他最初是从阿根廷企业家、早期加密货币爱好者 Wences Casares 那里听说比特币的,当时两人在圣胡安群岛的青年总裁组织聚会上同住一个房间。Briger 很快看到了颠覆全球支付系统的潜力,他至今仍坚持这一点,尽管他认为比特币还处于起步阶段。他说,比特币的前景堪比互联网,后者促成了信息传播的新形式。「资金流动方式没有跟上,这实在令人遗憾,」 他说。

在与 Novogratz 分享这个想法后,他们认为有外汇市场经验的 Morehead 是合适的掌舵人。当 Morehead 决定将余生的金融事业投入加密领域时,他将 Pantera 重新定位为比特币基金,向外部投资者开放。Briger 和 Novogratz 都以有限合伙人身份加入,堡垒投资、风投公司 Benchmark 和 Ribbit 则以普通合伙人股(后来退出)。他在老虎基金的导师、传奇投资者 Julian Robertson,也投资了后来的一支基金。

Pantera 的重生

在加密货币喧嚣的早期,企业家们必须面对剧烈的市场波动,相比之下,如今的波动性简直是小打小闹。但 Novogratz 回忆,最大的麻烦不是价格过山车,而是根本买不到比特币。

他曾去找当时才成立一年的 Coinbase,想买 3 万枚比特币,当时价值约 200 万美元。结果弹出一个窗口,提示他的限额为 50 美元。在与 Coinbase 的首位员工、后来成为加密货币界知名人物的 Olaf Carlson-Wee 商量后,Coinbase 同意将他的限额提高到 300 美元。

然而,Morehead 最令人钦佩的成就,或许是在 2013 到 2016 年的低迷期坚持了下来。那段时间比特币价格低迷,除了封闭的区块链圈子,没人在意它。「在加密货币毫无动静的那些年,Dan 一直在外面奔波,」 Novogratz 告诉《财富》。

那个时代也有高光时刻,包括 Morehead 在太浩湖家中举办的三次年度会议。其中一次,交易所 Kraken 创始人 Jesse Powell 没有乘坐 Morehead 包租的私人飞机,而是选择自驾。「当时比特币社区有不少人在飞机上,他担心如果飞机坠毁,比特币也会完蛋,」 Morehead 回忆道。

与许多同行不同,Morehead 从不把自己定位为 「比特币最大主义者」(即主张不应存在其他加密货币的人)。在买下全球 2% 的比特币供应后,Pantera 成为 Ripple Labs 的早期投资者,该公司发行了数字货币 XRP。「我的想法是,比特币显然是最重要的,」 Morehead 说,「但互联网公司也不止一家。」

据 Morehead 称,Pantera 86% 的风投项目都实现了盈利。考虑到绝大多数风投支持的初创公司都会失败,这个数字令人震惊。加密领域或许更宽容,许多项目都持有加密货币,这意味着即便初创公司的产品无果而终,投资价值往往仍能存续。

Morehead 现在每年有一半时间在波多黎各度过,那里已成为加密热土。当时 Pantera 的合伙人、如今在 Peter Thiel 旗下 Founders Fund 任职的 Joey Krug 已搬到那里,Morehead 也决定搬到那里。他估计岛上有 1000 名区块链创业者,不过他们因推高房地产价格而受到审查。Morehead 曾遭参议院财政委员会调查,被质疑是否通过移居该岛、从 Pantera 获取逾 8.5 亿美元资本利得而违反联邦税法。他今年初告诉《纽约时报》,自己相信 「在税收方面行为得当」,但拒绝向《财富》进一步置评。

比特币的未来

Morehead 承认,加密行业充斥着赌博行为,Pantera 不像许多风投公司那样涉足 Meme 币。但他认为,这不应该掩盖区块链重塑全球金融的远大目标。「因为一点旁门左道就想搞垮区块链行业,这很荒谬,」 他说,「GameStop 事件并不意味着整个美国股市都有问题。」

Pantera 持续扩张,包括募集第五支风投基金,目标 10 亿美元。Morehead 称,将在今年晚些时候完成第四支基金的投资后关闭募资。Pantera 还进军了炙手可热的数字资产财库领域,即上市公司将加密货币纳入资产负债表。

但比特币仍是 Pantera 战略的核心。去年年底,其比特币基金回报率达到 1000 倍,累积回报率逾 130,000%。当被问及比特币的未来价格时,Morehead 的答案始终如一:一年内翻倍。这个简单的模型大体奏效,尽管他承认增长的势头可能正在放缓。他认为比特币仍会再涨一个数量级,接近 100 万美元,不过这将是最后一次 10 倍增长。

如果比特币永远无法达到那个里程碑,Morehead 也甘愿承受批评。毕竟在 2016 年,他还在为 500 美元的比特币苦苦辩护。而不到十年后的今天,他才刚刚开始。「我相信,绝大多数机构对比特币的信念才刚刚开始,」 他告诉《财富》杂志,「我们还有几十年的路要走。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。