文|Kaori、Sleepy.txt

编辑|Sleepy.txt

Meta(彼时还叫 Facebook)做稳定币这件事,从来不是为了给 Web3 添砖加瓦。

那是一个更像央行、更像 IMF 的设想,一开始就被写进了白皮书。2019 年,Libra 横空出世,这是一场由科技巨头主导、试图建立「数字美元替代品」的全球实验。Libra 协会总部设在瑞士,币种锚定一篮子法币,由一整套治理架构与储备模型支撑,白皮书里写满了 IMF 的味道。

监管还没来得及反应,国会就先给 Libra 敲响了警钟。

白皮书发布仅三天,众议院金融服务委员会主席麦克辛·沃特斯就发起公开听证,直指 Libra 有「绕开主权」的金融野心。

此后三年,扎克伯格四次被传唤作证;代币模型从多币种锚定改为单一美元,删去「普惠金融」等敏感字眼;合作银行从四处碰壁,到最终成功牵手 Silvergate,白皮书也从 1.0 改到 2.0,一步步向现实妥协。

Meta 一路退守,但越退,外界越清楚它想进的是哪里。

2022 年 1 月,Diem 的全部资产以 2 亿美元出售给 Silvergate,项目宣告死亡。从那之后,再没有哪家美国科技公司,敢在公开场合谈发行稳定币,Libra 成了一种「想得太多」的象征。

发币大戏收场并不仓促,反倒像是一份监管部门亲手写下的案例教材,专门用来给 Big Tech 们划清边界。

从国会的连番听证,到银行清算网络的全面封锁;从 SWIFT、Visa 等渠道的婉拒合作,到 PayPal、Stripe 等联盟成员相继退场;从钱包团队与 Libra 协会的内部分歧,再到《GENIUS Act》的正式落地,不仅立法明确禁止平台类企业发行锚定法币资产,更在法条中多次点名 Diem,作为「不能再发生的反例」。

Diem 被钉进了历史,也顺手在 Meta 心里钉下了一条教训。

三年后,Meta 换了剧本

2025 年的 Meta,看上去不再执念于自己发一个美元,但它的剧本从来没有离开稳定币赛道。

年初,一个曾在 Meta 历史中扮演关键角色的人重新出现在组织架构中——Ginger Baker 被任命为支付产品副总裁。这位曾在 Ripple、Plaid、Square 辗转多年、深谙合规路径的老兵,早在 2016 年就曾主导 Facebook 的支付系统搭建。

彼时 Libra 尚未公开,但团队已在搭建链上支付原型。从履历来看,她几乎踩遍了所有监管对接口的关键节点。她的回归被业内视作一个明确的信号,Meta 准备以另一种方式,重返稳定币赛道。

而这一次,它选择从一个小切口入手。它不再试图一次性重建货币体系,而是从最好控制、也最好放大的支付场景切入。

据《财富》杂志独家报道,Meta 正在与多家加密基础设施公司展开初步接触,探索将稳定币作为一种支付解决方案——尤其用于其旗下平台,包括 Facebook 和 WhatsApp 上的内容创作者收入结算。据称,Meta 有意支持包括 USDC 与 USDT 在内的多种稳定币,而非仅靠单一发行方。

在这一机制中,Meta 并不介入储备和清算环节,只负责内容与账户系统之间的付款路径调度。但在结构上它仍牢牢控制了三个金融系统最核心的入口:谁有权收款、资金从哪来、账怎么结。

很快,这一动向再次引起了监管的注意。

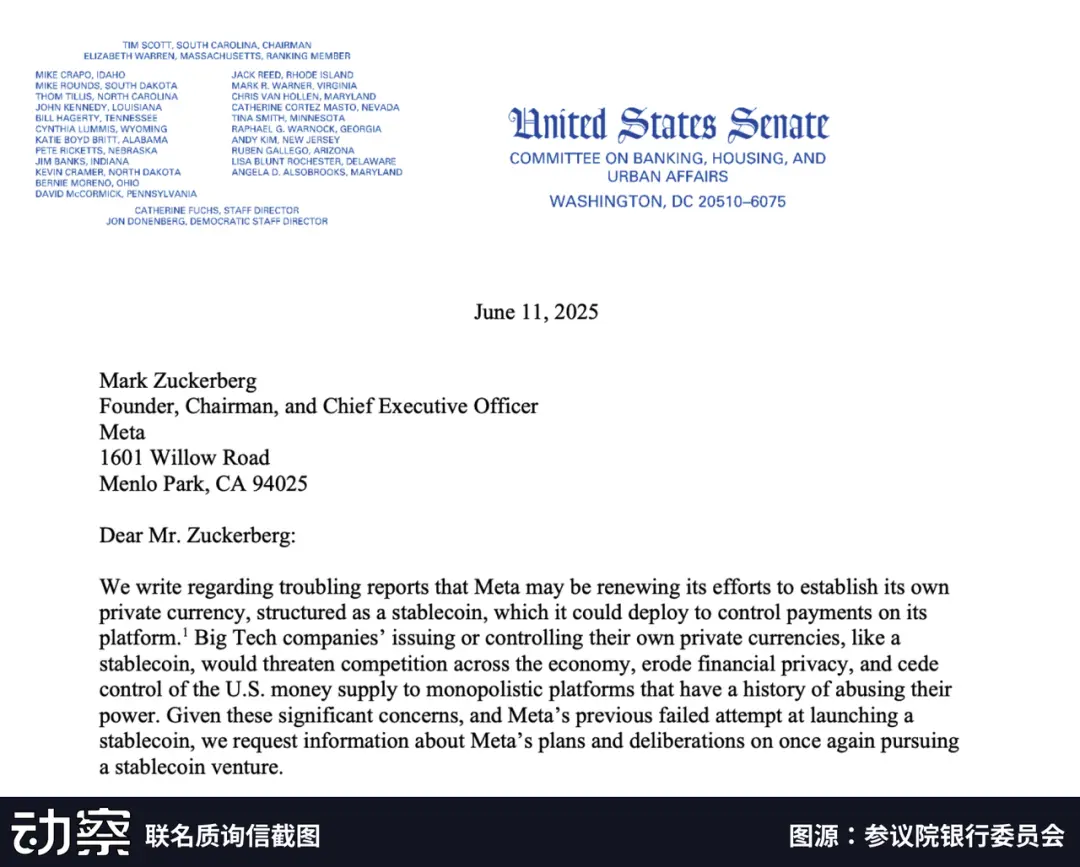

今年六月,美国参议员伊丽莎白·沃伦与理查德·布卢门撒尔向扎克伯格发出联名质询信,要求 Meta 明确是否在借合作名义绕道重启一套「私有货币网络」。信中点出了最关键的一点,即便不直接发行稳定币,只要仍控制账户与清算通路,其系统性风险就依然存在。

这一连串动作看似分散,但彼此之间的节奏几乎严丝合缝。从 Ginger Baker 的归位,到产品机制的试探,再到监管雷达的重新锁定,人、产品、政治,这三条看似无关的路径,最终在 Meta 身上交汇,构成它重新入局稳定币的路线图。

发不了稳定币的 Meta,或许想靠「分销」赚钱

Meta 的新路径,与 Diem 时代的最大分野,在于它不再执念于「自己发一个稳定币」,而是转向分销现成合规币种。

当年,Libra 的野心,是要构建一套从底层公链到前端钱包的完整闭环,把加密支付的每一环都握在手中。只是,这套结构还未真正上线,就在监管合围下黯然收场。

而如今的 Meta,把 USDC 作为现成的美元结算模块,嵌入平台已有的账户体系中,把清算与储备交由第三方,只保留流量聚合与账户系统这两块最熟悉的阵地。

在 Diem 时代,Meta 寄望通过自有稳定币锁定铸币权,收回铸币税,并在跨境支付规模化后,通过清算通道收取网络费用。

这套重模式在《GENIUS Act》落地后被彻底封堵——法案禁止大型平台直接发行稳定币,并要求发行方具备银行级资质与储备审计机制。

Circle 首席战略官 Dante Disparte 在一档播客节目中表示:「GENIUS 法案中有一项我愿意称之为‘Libra 条款’——以此载入史册。」该条款指的是任何非银行机构如果希望发行与美元挂钩的代币,必须设立一个「更像 Circle 而不像银行」的独立实体,通过反垄断审查,并接受由财政部设立且拥有否决权的专门委员会审批。

Disparte 认为这一架构甚至「比摩根大通等提出的存款代币模式更加保守」。

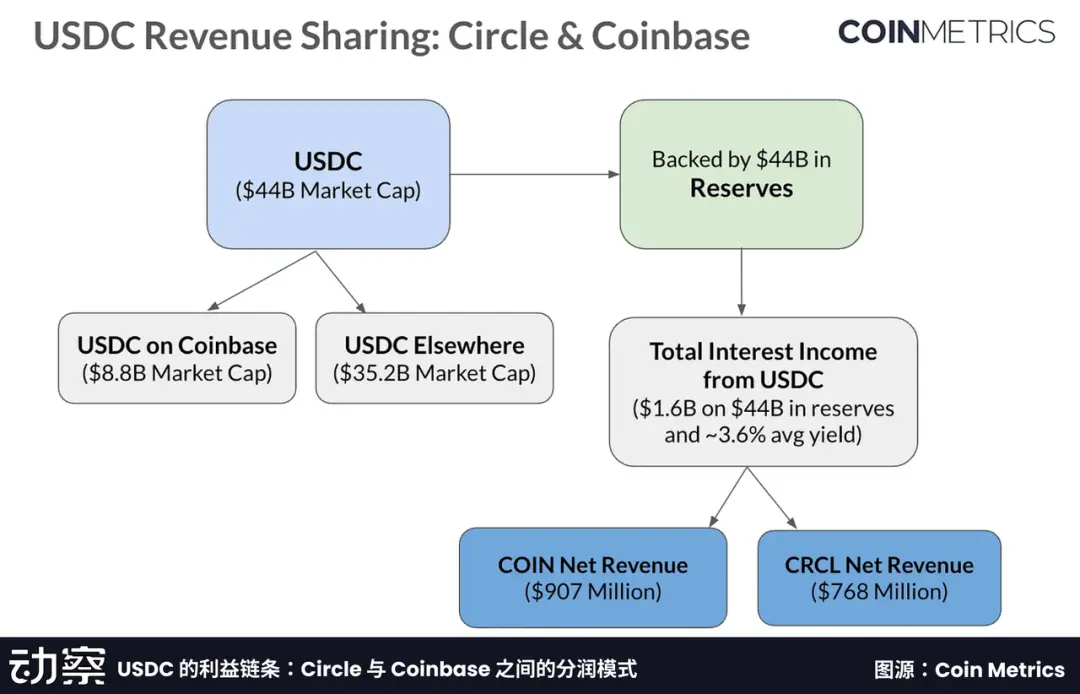

这把 Meta 从「发行方」推向了「分销商」,它转而与 Circle 合作,将 USDC 嵌入账户体系中,清算与储备由 Circle 托管。正如 Coinbase 凭借流量主导地位与 Circle 谈下利息分润一样,Meta 在未来也有机会将自身流量,变成一种新的金融议价筹码。

相比漫长且不确定的铸币收益,这种结算路径上的分润既合规、又可即时计入营收,显然更现实。

角色变化带来的是技术栈的减重。区块链层与储备管理全部由 USDC 的发行方负责,Meta 只保留与用户侧相关的模块,也就是账户系统、身份验证与付款路径的调度。

合规责任顺势交给了对方,监管压力也随之卸下。Meta 把注意力重新放在平台体系中更熟悉的部分——账户关系、社交链条,以及一次支付应有的顺滑感。

在收入模式上,Meta 也换了一个截然不同的逻辑。Diem 时代,它讲的是普惠金融的故事,希望先做大盘子,再从转账与汇兑差价中寻找盈利空间。

而现在它从创作者经济的微支付场景切入,有报告指出,这一路径能将结算周期从「月」压缩至「日」,大幅缓解跨境创作者的现金流摩擦。

而如果这条路径能够走通,Meta 不仅可以在通道费上与 Circle 谈条件,还能把交易数据沉淀为广告定向和金融增值服务。这种「轻投入、快结算、强沉淀」的路径,比起当年「自建央行」的重型方案,更贴合互联网平台的盈利逻辑。

但监管的警觉并未因此消散。

两位参议员在联名信中指出,即使 Meta 表面不再自发稳定币,一旦通过子公司结构绕过监管,其在账户、支付入口和数据三个关键环节的控制权,仍可能带来系统性金融风险与隐私隐患。

尽管 Meta 当前声称只是采用 USDC 作为结算工具,而非自行发行稳定币,但监管的关注点,已不再局限于「谁来发稳定币」,而是开始延伸至「谁控制账户、谁主导清算」。

在这一点上,Meta 与 Stripe、PayPal 正走在一条路径上。他们都试图将稳定币隐匿在 Web 2 的业务链条之下,让它以工具的方式融入体验,而非以资产的形态暴露在前端。

当货币开始像图片、语音一样流动在社交平台中,真正的竞争将不再是「谁发行稳定币」,而是谁掌控资金的流向与节奏。

稳定币,正退居后台

Meta 的角色转向并非孤例,而是一个更大结构转变中的一环。

《GENIUS Act》的通过,为稳定币发行划出了精细的边界。一方面,它为持牌发行方首次设立联邦级监管路径,将其纳入银行级审查与储备监管体系;另一方面,则划定红线,禁止大型平台直接或通过关联实体发行稳定币,彻底堵死了自建货币体系的「野路子」。

自此,稳定币的叙事主角开始更换。平台不再争夺「发行权」,而是围绕「流量端口」展开新一轮竞逐。

与此同时,稳定币的角色也在被重构,它不再是一种面向用户的资产,而变成了一套嵌入系统底层的清算模块。像 Stripe 与 Meta 这样的公司,开始将稳定币隐藏进 Web2 的支付流程之中,既不呈现在用户界面上,也无需用户知晓其存在。

对用户而言,稳定币正在退化为一个不可见的「结算 API」,即插即用、无需开户、可实现 T+0 清算。你无需理解它为何存在,就像你从未关心过 TCP/IP 协议,却依然会在每天刷视频、发消息。

而这也正是支付范式的重构起点。资金的流动方式,正从以银行为中心的封闭网络,转向平台主导的「接口 + 清算」组合网络。发行方和入口平台之间,开始形成一种全新的金融分工。

像 Circle、Paxos 这样的发行方,负责储备管理与链上清算,是监管对接与透明度的基础设施。而 Meta、Stripe、PayPal 等公司则扮演新一代渠道商,构建账户系统、支付场景与用户交互,成为资金流动的起点。

它们像是不掌握储备的卡组织,却控制交易路径、设定准入门槛、定义分润结构。在这种分工模式下,稳定币已不是某个平台的货币实验,而是一种可嵌入、可复用、可组合的通用美元模块。

真正的变化不是用户开始了解「Crypto」,而是他们在毫无察觉中完成了一次支付。

而当稳定币彻底成为无感基础设施,平台之间的竞争也将回到本质问题——谁能控制资金流的路径,谁就能攫取利润、设定规则,并决定下一代支付的接口标准与费率结构。

金融的定义,正在被谁重写?

如果说 Diem 是 Meta 想成为「央行」的失败尝试,那么转向 USDC,更像是它换了一个方式,继续靠近金融系统的核心。

这一次它没有再去争夺发行权,而是回到了自己熟悉的领地。但它掌握的恰恰是曾经由央行、清算机构和银行分工完成的那一套系统——身份验证、资金调度与支付路径。

金融的底层逻辑,正在被平台一点点重写。

《GENIUS Act》划出了清晰的边界,稳定币可以发,但不能由你来发。但它并没有回答另一个问题,如果一个平台不发稳定币,却掌控了资金的流向、账户的建立和数据的沉淀,它到底是工具提供者,还是新一代的清算组织?

Meta 不是唯一的答案。Stripe、PayPal 等平台,也在将稳定币嵌入 Web2 的业务流程中。它们将链上清算压缩为后台服务,把「Crypto」的存在感降到最低,只留下一个更顺畅的结算体验。

当稳定币真正成为平台级的基础设施,公众的关注点也随之转移。从「应不应该发行」,变成了「谁在定义支付」。谁控制了资金进出的路径,谁就有能力重构费率结构、设定准入门槛,乃至于重新定义一笔交易的发生方式。

而新的问题也因此浮现。比如,Circle 会不会给 Meta 开出类似 Coinbase 的分润模式?参议员的质疑,是否会触发新一轮听证?而当稳定币真正隐入 Web2 的肌理之中,监管是否还找得到它的落点?

Diem 的故事已经落幕,而 Meta 的新一轮尝试,正在以另一种方式重新展开。关于平台与金融边界的讨论,也许才刚刚开始。

-END-

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。