作者:Kai Schultz,彭博社

编译:Luffy,Foresight News

新广告提示音接踵而至。想要假币?洗钱服务?黑客技术?只要你懂中文、懂黑话——「料主」 指持有赃款或银行信息的人,「狗推」 指诈骗园区员工——所有这些,甚至更多的东西,都在这个世界上最大的非法商品交易市场的角落里出售。

找到它并不难。相关信息主要发布在汇旺集团(Huione Group)运营的公共聊天室里。这家柬埔寨企业集团在当地华语社区家喻户晓,以销售保险、货币兑换和金融服务闻名。它的线上银行部门 「汇旺支付」(Huione Pay)自称 「柬埔寨的支付宝」。餐馆和街角小店随处可见印着汇旺二维码的红色贴纸,人们可以用它扫码支付。

但汇旺旗下公司提供的全套服务实际上阴暗得多。尽管汇旺关联企业多次否认参与任何犯罪活动,但美国财政部称,汇旺为诈骗和加密货币盗窃所得洗钱至少 40 亿美元。

本文基于对政府官员、公司内部人士、据称的受害者的 20 多次采访,以及内部文件,详细揭示了汇旺如何助力亚洲网络诈骗行业膨胀为价值数十亿美元的庞然大物。

「汇旺就像罪犯的亚马逊,」 网络威胁调查员、前黑客 Ngo Minh Hieu 如此评价,他正研究这家企业集团的网络足迹。「他们的业务组织方式和产品范围,让我震惊。」Ngo 的结论与一些监管机构的看法不谋而合。

不断变形的运作模式

汇旺的企业历史极度不透明。存档网页显示其 2014 年在柬埔寨成立,但香港记录显示其 2018 年才在当地注册。它似乎从未公开财务披露,也没有员工或办公场所。本质上,它只是一个关联企业网络的空壳。这些分支机构的董事经常重叠,但各部门之间的关系模糊不清。

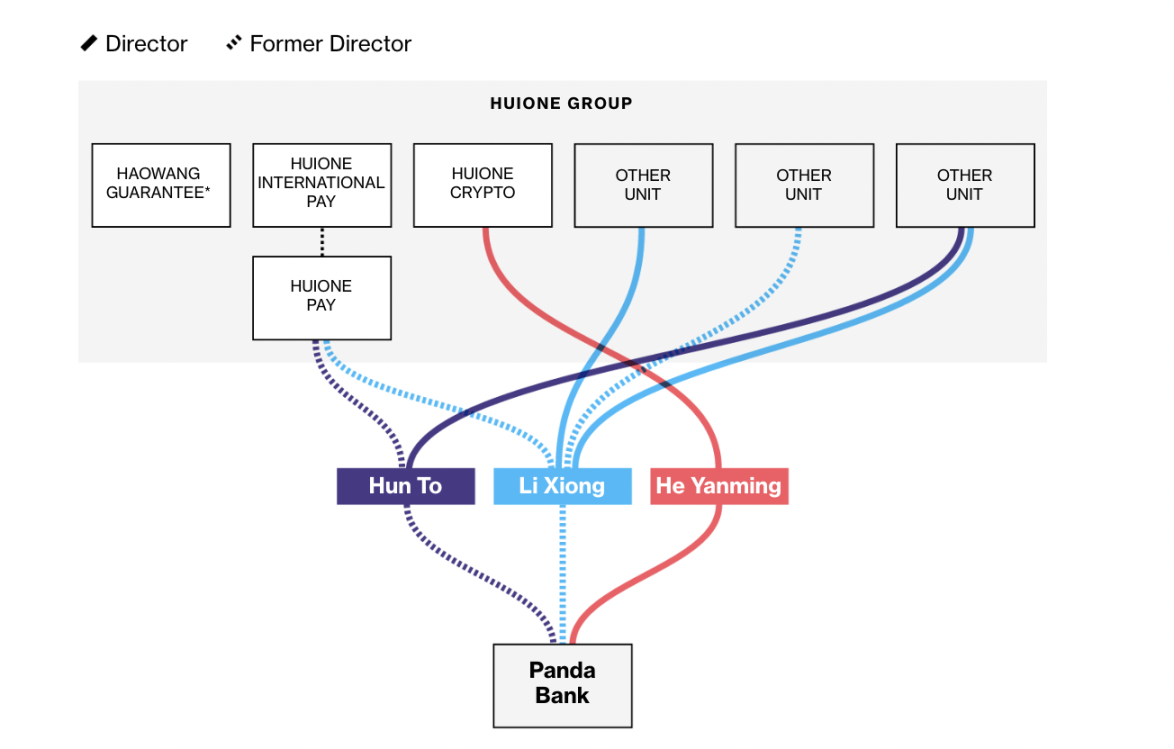

美国财政部特别点名三个实体,称它们在帮助犯罪集团转移非法资金中发挥了作用:汇旺支付(Huione Pay)、加密货币交易所 Huione Crypto,以及在线交易平台运营商 「好旺担保」(Haowang Guarantee,前身为汇旺担保)。财政部称,这三家实体与母公司 「实质上是一回事」。今年 5 月,美国财政部宣布计划将汇旺完全排除在美国金融体系之外,同时指出汇旺的客户包括跨国犯罪组织和朝鲜黑客 「 Lazarus 集团」。财政部称,「由于缺乏有效的反洗钱 / 客户身份识别(AML/KYC)政策和程序」,汇旺与非法行为者及交易的关联所带来的风险 「进一步加剧」。

其他国家也在加强遏制。与柬埔寨接壤的泰国 6 月宣布,正调查汇旺集团涉嫌处理非法赌博和诈骗所得资金。商业领域,即时通讯应用 Telegram 已关闭数十个汇旺相关的聊天群。稳定币发行商 Tether 发言人表示,已冻结与好旺担保相关的钱包中近 3000 万美元的 USDT,并补充称,若执法部门标记更多与好旺担保相关的钱包,公司将立即采取行动。

这些举措已产生一些公开影响。据柬埔寨央行称,好旺担保和 Huione Crypto 均已宣布关闭,汇旺支付也于 6 月清算。柬埔寨国家银行在给彭博社的一份声明中表示,汇旺支付因 「严重违反适用法规」 被吊销执照,已被勒令关闭 办公室并停止所有业务,且该过程已于 6 月 19 日全部完成。然而,在看似终止运营三周后,汇旺支付却在给彭博社的电子邮件声明中称,正 「致力于与美国官员及其他当局建设性接触」,以促进金融体系的安全与透明。在对美国财政部的公开回应中,汇旺支付表示 「正全力解决合规问题并采取补救措施」。

尽管历史上这些实体曾宣称彼此存在直接关联(汇旺支付旧版网站称其 「源自汇旺集团」;去年年底,好旺担保在社交媒体帖子中称汇旺集团是其 「战略合作伙伴和股东」 之一),但目前没有任何独立实体公开承认与汇旺集团有关联。

但网络活动和两名熟悉业务运作的人士表示,这三个部门似乎仍在以某种形式继续运营,通过更改名称或将客户引导至关联企业来规避中断和监管压力。

例如,在好旺担保宣布关闭后的几周内,区块链分析公司 Chainalysis 识别出的与汇旺实体相关的加密货币交易量实际上有所增加。Telegram 上一个大型好旺担保群组仍可公开访问且表现活跃,同时管理员还将客户引向 「土豆担保」(Tudou Guarantee)。根据两家公司的声明,好旺担保近期收购了该平台 30% 的股份。

土豆担保没有公开电子邮件或电话号码。其 Telegram 上的客服人员称,无人能回应媒体问题。好旺担保拒绝了采访请求,称其已停止运营,且与任何汇旺实体无关。该公司此前否认在协助网络犯罪中扮演任何角色。Telegram 发言人表示,「我们会逐案评估举报,坚决反对一刀切禁令」,并补充称该应用致力于保护用户隐私和财务自主权。

在 Huione Crypto 的网站上,一个聊天机器人会引导客户注册一家名为 Kex 的新服务提供商。Kex 注册于英属维京群岛,无法联系到。一位不愿透露姓名(出于安全考虑)的知情人士称,Kex 由曾任职 Huione Crypto 的员工运营。Ngo 补充说,Kex 的定制网站模板与 Huione Crypto 相同。彭博社发送至 Huione Crypto 和 Kex 官方邮箱的邮件均被退回。

汇旺企业集团的持续存在,凸显了关闭去中心化市场的难度,也体现了汇旺架构的韧性,以及该集团善于寻找变通方案的能力。内部文件显示,其所谓的 「钱骡」(负责洗钱的人)已将目标锁定至少 12 个国家的受害者。企业文件显示,汇旺部分部门在波兰、加拿大和日本设有分支机构。

「当复杂的犯罪金融网络真正扎根后,公开关闭往往只是表面文章,」Chainalysis 国家安全分析主管 Andrew Fierman 表示。美国财政部借鉴了该公司的研究,得出汇旺是 「洗钱者重要渠道」 的结论。「真正的基础设施(他们的洗钱管道)仍在表面之下运作,畅通无阻地处理数十亿美元资金。」

隐秘的核心

汇旺内部,这一基础设施的就位于一个神秘的部门 「汇旺国际支付」(Huione International Pay)。据两位不愿透露姓名(出于安全考虑)的知情人士称,该部门是日常协助诈骗业务的主要运作地。彭博社看到的公司文件和这两位人士均表示,除了在 Telegram 等即时通讯应用上管理在线犯罪市场外,员工还直接为诈骗者与钱骡牵线搭桥并收取费用。

据称,汇旺国际支付的员工曾在金边汇旺支付总部二楼办公,他们内部使用化名,还协助建立洗钱者网络之间的联系。彭博社看到的文件包含数千名受害者的详细会计记录,这些受害者是不同团伙利用 Huione International Pay 服务实施诈骗的。虽然几乎不可能核实每一起事件,但彭博社已将一些细节和身份信息与美国法院正在审理的案件进行比对。

汇旺支付称,其与汇旺国际支付无任何关联,也不知道该名称所指的实体或个人。美国金融犯罪执法网络在 5 月的报告中称,汇旺国际支付是 「汇旺支付的一部分」,并为好旺担保促成 「与洗钱活动相关的交易」。

行业爆发式增长

早在个人电脑普及之前,网络犯罪就已存在,可以说自 19 世纪 30 年代就有了:当时一对法国兄弟利用光学电报系统,抢先获取巴黎的股市数据。但 2010 年代,网络勒索行为才真正爆发,其中许多活动源自东南亚国家(如柬埔寨、缅甸、老挝)新出现的诈骗园区,这些园区开始欺诈全球受害者。

许多园区由华人主导的犯罪集团运营,工作人员是被贩卖的人员,他们被迫诈骗美国、德国和日本等国的受害者。在许多情况下,目标对象被哄骗参与虚假的加密货币投资计划或虚假的恋情,即所谓的「杀猪盘」。

电诈行业增长迅猛。Chainalysis 数据显示,2024 年 「杀猪盘」 诈骗收入较前一年激增近 40%。随着行业扩张,全球执法官员的疑问也越来越多:犯罪头目是如何获取工具(如假护照、恶意软件、人脸识别软件、钱骡)以实现如此快速的增长?答案是一批新的在线交易市场。与 「丝绸之路」等用户需突破技术障碍才能访问的西方同类平台不同,这些新平台就在明面上运作。

汇旺管理的 Telegram 群组(多达数千个)中,许多看似无伤大雅,其功能大致相当于货币兑换或房地产买卖的分类信息页。但据追踪该平台的联合国毒品和犯罪问题办公室分析师称,在缅甸一个名为 「全光担保」(Fully Light Guarantee,与任何汇旺无已知关联)的地下市场被关闭后,汇旺担保上的氛围变得阴暗起来。匿名用户开始在帖子中使用更多暗示非法交易的黑话,而用户广告也不再刻意掩饰非法意图。大多数广告用中文撰写,表明主要客户并非柬埔寨人。

中国外交部虽未直接评论汇旺,但表示中国与包括柬埔寨在内的周边国家积极开展执法安全合作,并将继续深化国际执法合作,打击网络诈骗等跨境犯罪活动。

彭博社查阅的一则 2023 年广告,兜售能通过验钞机的假人民币。其他广告则推销走私 iPhone、被黑电脑,或提供解冻银行账户的服务。有几则广告直接兜售与诈骗行业相关的商品:使用 「杀猪」 等中文词汇,出售伪造加密货币投资网站的服务,宣传使用电棍和催泪瓦斯来控制「逃亡的狗」,这显然是指虐待被贩卖的员工。大多数广告要求用加密货币支付。

「全光担保的倒闭成为其他交易平台的主要催化剂,」 前联合国毒品和犯罪问题办公室威胁分析师 John Wojcik 表示,「汇旺担保几乎一夜之间从几千用户增长到数万、数十万用户,」 因为全光担保的前用户在寻找替代平台。

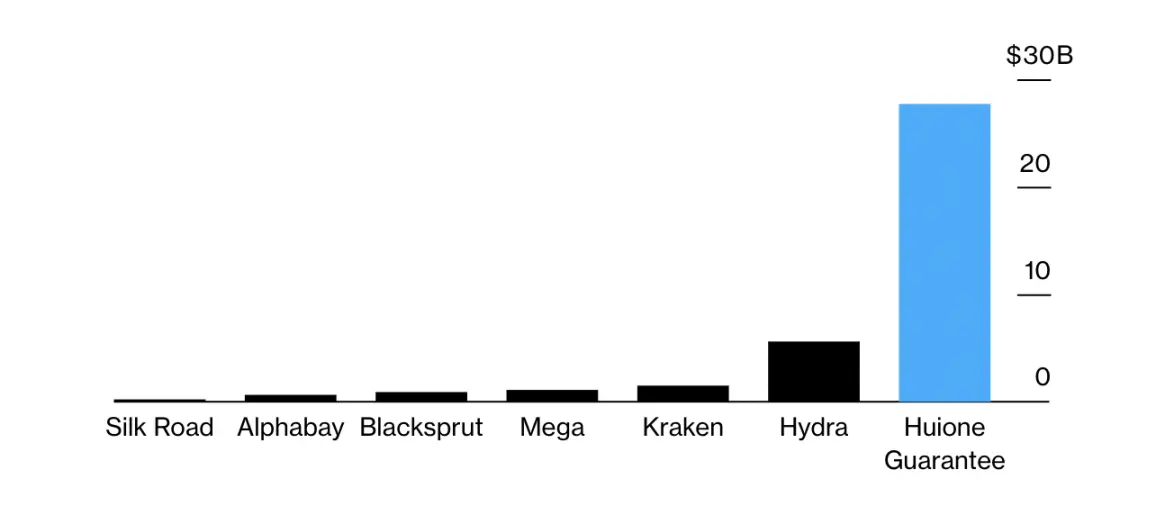

随着汇旺担保的影响力扩大,区块链调查人员开始深入挖掘,试图估算其真实规模。最大的调查公司之一 Elliptic 1 月发布研究报告,结论是至少 240 亿美元流经汇旺担保及其商户使用的加密货币钱包。区块链情报公司 TRM Labs 的估计更高,达 810 亿美元。无论哪种估计,都意味着汇旺担保的规模远超其最大的前身 —— 被美国和德国官员关闭的俄罗斯运营的 「九头蛇市场」(Hydra Market)。

数据来源:Elliptic

「它们比任何同类平台都大几倍,」Elliptic 首席科学家 Tom Robinson 说。

好旺担保在 2 月的声明中否认在协助网络犯罪中扮演任何角色,并表示其 Telegram 群组中的所有业务均由第三方提供。

复杂的运作

彭博社查阅了汇旺国际支付 2022 至 2023 年部分内部文件,这些文件主要以中文书写,记录了数千名受害者和数千万美元的交易。文件显示,员工直接参与监控交易和处理纠纷,且平台定期从交易中抽取佣金。文件还显示,汇旺国际支付深度参与运营,甚至向表现优异的洗钱团队提供大额信贷额度。

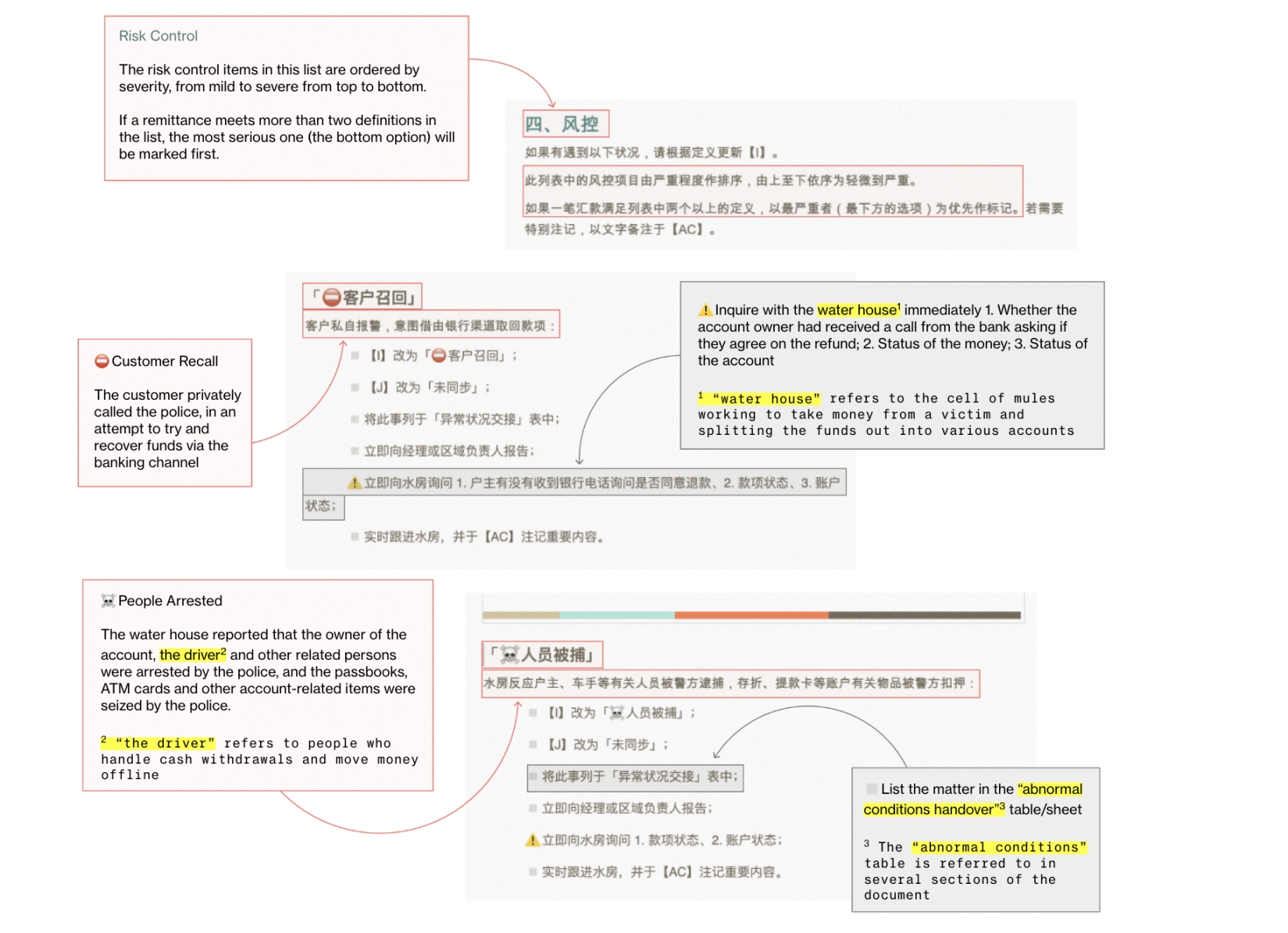

其中一份文件是汇旺国际支付交易部门编写的多页手册,列出了为美国、欧洲和澳大利亚 「客户」(即受害者)填写日志的规则。这份 2022 年的报告描述了如何处理 「从轻微到严重」 的风险,包括当受害者报警或钱骡被当局拘留时 的情况。手册称,在日志中把某一栏改为 「人员被捕」,并 「立即向经理或区域负责人报告」。

汇旺国际支付交易部门编写的文件截图,显示为受害者(称为 「客户」)填写日志的规则

这些文件使用编码系统跟踪钱骡和诈骗者,显示出其覆盖范围和复杂性。洗钱者以 「X」 为前缀加数字编号分类。诈骗者大致按目标地区分组:EZ3 指专注于欧洲受害者的团伙;US26 指针对美国的团伙。汇旺国际支付还记录受害者信息,有时甚至存储他们的银行账户详情。针对台湾地区的操作记录极为详细,包括诈骗者为电汇编造的理由备注。例如,某案例中写的是 「批量订购宠物食品」。台湾专门负责网络犯罪调查的检察官 Harris Chen 表示,他能将文件中的细节与台湾至少两起洗钱定罪案件匹配。

彭博社将文件中多名人员的详细信息与美国联邦调查局和特勤局(负责金融犯罪管辖及总统保护)主导的调查中的信息匹配。

其中包括李达伦(Daren Li,拥有中国和圣基茨和尼维斯双重国籍)的案件,他在美国承认通过加密货币投资诈骗洗钱逾 7300 万美元。美国官员查获了他的手机,称他在 Telegram 上以 「KG71777」 为昵称与同伙沟通。汇旺国际支付的文件中不仅有该用户名的记录,还有他的 WhatsApp 账号。文件显示,李从中赚取约 9% 的佣金。(汇旺未出现在该案公开法庭文件中。)

日志中出现的一位受害者是美国居民 Shashi Iyer。美国法庭文件显示,2022 年末,Iyer 手机收到一条奇怪的提醒:你已被自动加入一个 Telegram 群组。当他询问管理员原因时,对方称该群组供对波士顿某金融服务公司的加密货币交易对期权合约感兴趣的投资者使用。Iyer 经常在 Telegram 群组中寻找投资机会,在 50% 至 95% 的盈利承诺的诱惑下,他决定尝试一下。

「那是个蜜糖陷阱,」 他在采访中说。

在资金几乎翻倍并顺利提现后,Iyer 被邀请加入一个仅限高额度投资者的小型 Telegram 群组,他投入了约 4 万美元。当他试图套现时,才发现那家投资公司根本不存在,于是向美国政府报案。美国特勤局去年在田纳西州为包括 Iyer 在内的受害者提起民事诉讼(汇旺未被提及),法庭最终下令返还部分资金。

法庭文件显示,受害者总共向孟菲斯 Evolve 银行信托公司的空壳公司账户转账数百万美元。Evolve 银行信托公司发言人拒绝对此案置评,但强调该机构 「全力致力于维持最高标准的合规监管、财务诚信和反洗钱控制」。

汇旺国际支付的日志中,记录了 Iyer 和另外两名田纳西州受害者的信息,精确到电汇时间戳、银行账号,以及负责他们的洗钱团伙编号:X3。

规避审查

汇旺在柬埔寨的业务(包括汇旺支付和好旺担保)的有限记录显示,这些业务由中国管理人员和当地权势人物共同领导,这在柬埔寨是一种常见的共生关系。近年来,大量中国资本涌入该国,改变了这个国家。如今驾车穿过金边,许多建筑工地都挂着中文招牌。据一位前员工称,在汇旺支付办公室内,听到普通话的频率高于柬埔寨主要语言高棉语。

Hun To 曾在柬埔寨商业登记处被列为现已解散的汇旺支付的董事,他是柬埔寨首相洪玛奈(Hun Manet)的表亲。Hun To 在金边的家像座堡垒,围着厚厚的水泥墙,地面上方挂着网,可能是为了防止一群外来的犀鸟逃跑。据当地媒体报道,多年前在澳大利亚 「伊利潘戈行动」 调查中,官员曾怀疑他利用木材运输走私毒品。他否认了指控,最终未被起诉。澳大利亚犯罪情报委员会表示无法协助提供相关查询。

记者通过 Hun To 担任董事的三家公司的关联邮箱联系他,但未获回应。柬埔寨首相领导的内阁办公厅也未回应置评请求。Hun To 始终否认其业务参与网络诈骗,且没有迹象表明他知晓汇旺国际支付的运作。

汇旺的关联企业,来源:美国财政部、公司文件及彭博社报道

Huione Crypto 在波兰登记的所有者何艳明(He Yanming),在柬埔寨商业登记处被列为该国主要金融机构熊猫商业银行(Panda Commercial Bank Plc)的董事。Hun To 和曾担任汇旺至少四家企业董事的李雄(Li Xiong),在去年 10 月辞职前一直是该银行的董事会成员。

记者通过李雄和何艳明担任董事的其他公司的关联邮箱请求置评,但未获回应。没有迹象表明两人此前知晓该企业集团内所谓的非法活动。熊猫银行也未回应置评请求。

据了解该企业集团的外国官员称,汇旺的业务在柬埔寨境内并未受到过多审查。然而,去年 9 月,柬埔寨央行吊销了汇旺支付的执照。几个月后,消息公开时,客户纷纷涌向该公司在金边的主要办公室提款,汇旺支付随后将所有 USDT 存款的利率从 2% 临时上调至 7.3%。

但这场恐慌只是小插曲。该公司很快在一个社交媒体账号上宣布,将把支付和区块链服务转移到日本和加拿大,汇旺旗下单位此前在这两个国家持有营业执照。

日本金融监管机构拒绝对汇旺任何分支机构是否接受调查置评,但表示该企业集团没有有效的支付服务许可证。加拿大金融监管机构发言人 Erica Constant 称,汇旺支付在加拿大的货币服务提供商注册已于 2023 年底到期。她拒绝对执法部门是否已向其机构分享有关该公司的情报置评。近期,记者前往 Huione Crypto 在波兰的办公地址 —— 华沙一个绿树成荫的居民区的一栋四层公寓楼,对讲机那头的人说这里是 「虚拟办公室」。当记者表明身份后,对方挂断了电话。波兰虚拟货币监管机构未回应置评请求。

据两位知情人士称,在柬埔寨央行采取行动后,汇旺支付以 「HPay」 的名义继续运营。根据柬埔寨商业登记处信息,HPay 于去年 10 月在该国注册,其官网显示总部与熊猫银行的一家分行位于同一栋楼。HPay 未回应置评请求。

即便美国财政部试图将汇旺排除在美国金融体系之外,其威胁可能也没有看上去那么大。一般来说,网络诈骗不需要物理距离,而洗钱者擅长通过钱骡账户转移资金。

汇旺还有另一层保护:自己的货币。

历史上,许多交易以 USDT 进行。但当 Tether 开始冻结使用汇旺的可疑钱包后,Huione Crypto 去年推出了自己的稳定币 USDH。

汇旺官网存档声明称,USDH 「不受传统监管约束」,并 「确保用户资产不会被任意冻结」。

台湾研究网络犯罪的学者陈燕玉在柬埔寨花了数月时间,与据称的洗钱者、诈骗者及其头目交谈。她说,这个相互关联的利益网络已熟练掌握各种变通方法,无论是利用柬埔寨金融体系的漏洞,还是借助其他国家的有利法规。

「网络犯罪已深度嵌入全球资本主义运作中,从世界各地掠夺资源,」 陈燕玉说,「它不可能被轻易瓦解。」

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。